Ever since I started following the miles community more closely, there have been regular proclamations about how this hobby is dead, points are worthless, yadda yadda yadda. Oh, and that greedy bloggers are ruining all the best deals. It usually happens when there is a massive devaluation on a particular route or some “sweet spot” redemption finally dies. Naturally, years after it’s discovered and written about everywhere.

Recently we saw a few notable stealth devaluations. One had to do with the gutting of ANA first-class award costs via Virgin Atlantic. The other was the sudden increase of mileage rates on JAL via Alaska Mileage Plan (on certain routes). Neither program gave any advance notice. People woke up and got the bad news from the blogs.

Loyalty programs are not your friends

Their goal is to sell miles and points for as high of a rate as they can get away with. They do it via arrangements with the banks, by baking it into the price of a revenue ticket and of course, by selling you miles directly. We are the source of profit for them, nothing more. In turn, they want us to get as little value as possible, though just enough to keep us coming back for more.

There is no question that what Alaska Mileage Plan did is super shady. Yes, they did say they are moving away from fixed award charts. Still, the executives made a promise to give advance notice of any major changes. They lied. If you’ve just bought Alaska miles with the idea of redeeming them on JAL upper class from the East coast to Japan, I personally would do a chargeback on my credit card. I think you have an excellent case. It’s certainly worth a shot.

But what if you’ve acquired Alaska miles via credit card bonus with the sole idea of redeeming them on JAL? While this change is unpleasant, unfortunately, it is what it is. Of course, it wouldn’t hurt to tag Alaska airlines on Twitter with the idea of shaming them (deservedly). That said, it’s important to remember that you have “bought” these miles at an extremely low cost.

Always factor in your opportunity cost

There are two different lines of thinking when it comes to applying for mileage bonuses tied to one program. Some say that unless you can use it immediately (well, within a few months), you shouldn’t apply for it. I tend to view it a bit differently. It really depends on what other bonuses are accessible to me at the moment. I can’t get approved for most flexible points offers, and not for the lack of trying.

Let me give you an example. Let’s say I’m looking to apply for a Bank of America credit card. There are two offers that caught my eye. One is BoA Premium Rewards card (bonus is worth $400, $500 if you can take advantage of the travel credit). The other is Bank of America’s Alaska Airlines card (non-affiliate link) that currently has a 72,000-mile bonus and a $95 annual fee. If you make a dummy booking on Alaska Airlines website, an offer should pop up for a 70k bonus that also includes a $100 statement credit, effectively wiping out the first year’s annual fee.

So, assuming you are diligent enough, we are looking at $500 vs. 70k Alaska miles in profit. There is one problem. I’m not sure I will be able to utilize Alaska miles within the next two years. Still, I value them at more than $500. Now it doesn’t mean I would pay that much speculatively because, and that’s important, miles don’t actually belong to members. A program can choose to “fire” you and keep your stash at any point. On the other hand, if you put your $400 in a FDIC-insured account, you are protected.

Still, I expect to get at least $700 from my 70k Alaska miles at some point in the future, and hopefully a bit more. Sure, it may take four years or so, but still. Even with high interest rates, my $500 is unlikely to become $700 in the same period of time. I’ve applied for Amex Delta offers when I had no clear plan to use those miles. But the price was right, so to speak. With my SIL moving to Detroit (Delta hub) soon, I’m finally planning to put them to good use in a few months.

However, it’s important to keep in mind that I don’t currently have a ton of miles. I’m constantly burning what I have towards trips. I don’t collect them just so they can sit and do nothing. Of course, sometimes life happens, and occasionally I bet on the wrong horse. In 2019 my husband and I applied for Cathay Pacific credit cards with the idea of using miles towards a trip to Japan.

I had it all figured out, but then Covid-19 pandemic hit and scrapped my plans. I couldn’t find a good use for these miles and even had to pay a penalty of 12k miles per ticket to cancel our awards. I recently had to burn them on a flight from Orlando to DC because otherwise they would expire. Be very careful with miles that have a hard expiration policy, especially if you are an occasional traveler.

My SIL also bought some Avianca miles for the same trip in 2020, and I transferred some of my Amex MR points. I still have this stash sitting doing nothing, waiting to be used up. I will burn it eventually, but it is a bit of a nuisance. So, why do I feel a sense of urgency when it comes to Lifemiles and not Alaska stash?

Well, because we’ve shelled out quite a bit of real money on the former. Also, because Lifemiles program depends on United releasing low-level awards, which are scarce these days. Well, when it comes to domestic routes, which is the bulk of our travel.

At least with Alaska program you can burn miles on all of the routes where Alaska operates. It may not be at an attractive rate, but I know I can liquidate the stash if absolutely necessary. For example, we may need to fly from San Francisco to Orlando next year. I don’t know what the rate will be by the time I get ready to pull the trigger, but right now I’m seeing 20k Alaska miles pricing per person one-way on some days in the summer. We should have some flexibility, so I can shop around.

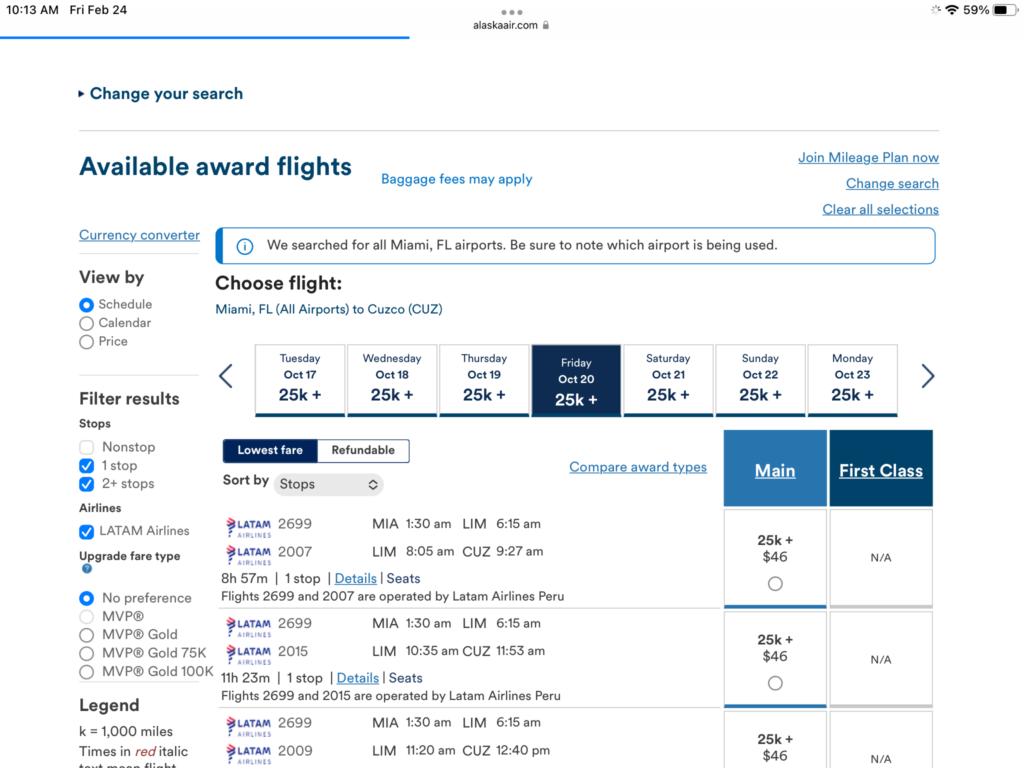

I’ve written about possibly going with my husband to Peru on a couple’s getaway in 2024. I’ve actually managed to convince him, so we’ll see what happens. The goal is to use the miles on LATAM before Delta forces them to terminate their partnership with Alaska.

Roundtrip revenue flights from Miami to Cuzco usually run at $700-$800, so using 50k miles+$110 in taxes is a no-brainer to me. No mile is speculatively worth 2 cents as far as I concerned. Plus, with Alaska miles I’m getting a fully refundable ticket.

Neither plan may materialize. But my point is, I have several possible scenarios where my Alaska miles may come in handy. It might take a few years to finally find a decent redemption, but as long as I get at least 1 cpm, it’s good enough.

It’s important to have Plan B, C and D. That’s a recipe for avoiding disappointment in the miles and points hobby. As the saying goes, the best laid plans of mice and men…

If you have a ton of miles, choose cash instead

Going back to my example above, if you are short on cash but have plenty of miles, then applying for BoA Premium card is a no-brainer. You can always apply for Alaska offer later on. It’s not going anywhere. In fact, there is a non-zero chance that it will be increased at some point. That’s the thing people tend to ignore. While the mileage rates have gone up, so did the bonus offers. It was almost unheard of to see 72k miles offer on Alaska card even a few years ago, yet here we are.

It’s impossible to predict what the future will bring, but I choose to believe that easy opportunities to collect miles will still exist. The key is to have reasonable expectations and pay as little for them as possible. Applying for credit card bonuses certainly falls in that category. Sure, it stinks to now pay 80k instead of 60k Alaska miles for a flight from New York to Tokyo in business class. But let’s be real, it’s still a heck of a deal. Again, I’m not defending Alaska executives, but here we have a case of too many miles chasing too few award seats. Especially if you factor in fuel surcharges that you have to pay for the same flights via BA and Asia Miles programs.

It may sound crazy, but if someone asked me if they should invest in AA miles or Alaska currency with the idea of redeeming them on JAL upper class 6-12 months from now, I would be inclined to recommend the latter. Yes, the rates via AAdvantage are lower right now. But we all know, a mother of all devaluations is likely coming when the awards go fully dynamic. I think? At least with Alaska you know what you are dealing with, and my guess is they won’t dare to gut these awards further anytime soon. But of course, I don’t have a crystal bowl, comrades.

And no, frequent flyer miles are not worthless. Not yet.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Привет Лина, have not read your articles in a while. Thank you for your hard work. Any good current cc offers you would mention here? Kinda hard for a churner out there. Thanks again.

Привет,Борис!

I try to post at least once a week, sometimes more, depending on circumstances. It is definitely hard for churners out there. But I still get approvals here and there. In my experience, BoA is easier to work with than other banks. So if you haven’t yet applied, look into Alaska offer or Premium Rewards card mentioned in the post. There are other obscure deals that are worth a look, like 80k points offer on Best Western rewards card (Google it). There are some very nice properties in Europe and near US National parks. I just keep trying until someone approves me. It’s not a very complicated strategy, but it works.

This thought-provoking article explores the question of whether frequent flyer miles are becoming worthless. With the pandemic changing the travel landscape and airlines adjusting their loyalty programs, it’s important to consider the long-term value of collecting miles. The author provides a balanced perspective and raises important points for travelers to keep in mind when evaluating their points and miles strategies. check out our blog at- https://www.mileagespot.com/ for more insights

Hi Leana —

I just found your blog and this interesting article.

Do you have any information about a “rumored” March 19 Chase Sapphire Preferred credit card offer “in branch” for 80K Ultimate Rewards after spending $4,000 in 3 months?

Thanks for any information.

Regards,

Larry Mehl

@Larry I believe that offer is live, but call your nearest branch to make sure. And it’s actually 90k points if you spend $6k or something like that.

I have Delta Sky Miles and have used them on numerous trips. In 2016, it was only 50,000 miles per person to fly to London and home from Manchester. The amount was raised to 70,000 in 2020, but that trip got postponed (and postponed again in 2021) Delta refunded all my points and taxes both times and eventually we went in 2022 for the same # of points. Then I go to book for a round trip flight to Manchester in 2023 and the amount is 152,000 points for ONE person!! Later it went down to 145,000 points. Still ridiculous, so I just bought a Main Cabin ticket so I could pick my seats. Cost $1792. Last I checked it was $100 more! (all these flights are for end of August) In 2022 it was over $1600. As a Sky Miles member, Delta also gives me $100 e-credits about twice a year! I used one for a trip I’m taking with my mom to see my cousin in Pittsburgh in May. My ticket was $198.80 and mom’s was the full price of $298.80 but I charged her $50 less when she paid me back for her half of plane ticket, car rental and hotel.

@ NJ Riley That’s a really crazy price to Manchester via miles! Delta can be all over the place on mileage pricing. In general, I find it most useful for economy tickets in US, which is how I usually burn my SkyPesos. There are occasional deals on international business class, but those are like unicorns.

I’ve been in the points game for over a decade and witnessed many changes over the years. We’ve enjoyed some incredible travel experiences that we otherwise would have missed out on. While it’s become much more challenging to find the deals that once were plentiful, it’s still a fun, rewarding hobby. But, a cache of points in several different program currencies is a big plus!

@BT Agree 100%! I’m still having fun and appreciate every opportunity to save real money while indulging in my favorite hobby: travel. And yes, having various currencies at your disposal (without going overboard) helps to find the flights you need when you need them.

just used 40000 AA miles for a

$600 car rental at DCA, I am happy with that

@BloggerGeorge That’s an excellent deal! As amazing as it seems, AAdvantage program has actually improved compared to what it was a few years ago. But will the trend hold? I’m guessing no, but I hope I’m wrong.

Just dropped 150k AA miles on 7 roundtrip tickets CLT-MKE for a family trip this summer. Total cash price would have been $3,200. Big win in my book!

@Nick That’s fantastic! I would be excited too. AA miles can be incredible. I’m looking forward to replenishing my stash if I can get approved for AA card in June.

Hi Leana,

I just received my new Alaska Airlines cc from BoA: 70k/$3k spend/3months. Our granddaughters are joining us in Barbados next Feb. so down payment on the house will take care of the required spend and 70k bonus will help fund two Icelandic Airways biz tickets ORD – HEL and on to Tallin for Christmas markets tour ending up in Berlin with our granddaughters for Christmas. Icelandic is releasing “biz” tickets at 55k a pop OW, so I thought it was a good trade with the rent down payment funding the required spend. Worked out this time. Points are worth what you get for them, it’s getting harder to find value, but worth the effort. That said, I no longer even LOOK at Delta’s website.

@Russ That’s incredible! Definitely a good trade. Redeeming Alaska miles on Icelandair business class is a unique opportunity, for sure. I hope you enjoy it.

I totally agree with you. Unicorn mileage deals are hard to find these days, but not impossible. It’s certainly an easier game for retirees and digital nomads, but even families like mine can snag a business class deal now and again.

I hear you on Delta. If you insist on only using miles to fly upfront ( nothing wrong with that), it’s a terrible program 99% of the time.

But I’m quite happy with it so far. I recently redeemed 17k miles per person on nonstop Sea-Mco flight, and consider it a decent deal. I strongly prefer nonstop flights, which is why I’m happy to have a small Delta stash for our upcoming trip to Detroit. In short, in the world of miles and points one man’s trash is another man’s treasure. 😉

Great post ! “Ben” has been gutting Alaska’s FF’ers. As a MM with them it’s just not the airline since he took over. He raced to make a deal with AA / OW which has turned out to be a train wreck. Loyalty is essentially out the window, they’re more worried about gender neutral uniforms than providing real service that AS was known for. It’s sad really sad. Will be interesting to see which airline takes AS over because thats where their headed.

@Ghostrider5408 It does look like Alaska miles are steadily losing value. I’ve noticed that mileage cost for flights from Florida to Hawaii has gone up substantially compared to what it was even a few years ago. Deals still exist (and JAL is one such example despite recent devaluation), but they are much harder to find. I still feel pretty confident that I’ll get at least 1CPM from my stash years from now, so I’m not worried. The beauty of low expectations!

“Devaluation” is mostly nonsense. Without a measure of how easily miles and points are acquired, pooled, and stacked offer value judging the infrequent redemption cost increases to be problematic is a red herring. When someone develops a formula to measure both incoming volume and outgoing cost, then we can address whether or not devaluation exists or not. Also, folks who purchase miles / points vs. earning them through leveraged strategic methods are already on the razor edge of a loosing approach.

@DJG Yes, I agree with you. You have to look at an overall cost of acquiring miles. However, it’s also important to factor in opportunity cost. Any time you “buy” miles, even indirectly, you forego cash back. If you are still sitting on millions of miles acquired a decade ago (while constantly earning more), I would argue that it’s a losing strategy. It’s time to switch to cash back and use up the stash. It’s good to have a buffer, but certainly not in the millions of miles. Well, not for an average person with three weeks of vacations each year.

Opportunities come and go, but I’m still able to acquire miles on the cheap via sign-up bonuses. Since I love to travel, I’m ok foregoing cash back offers most of the time. But I don’t delude myself that those miles are free. I could invest cash in the stock market and would come out ahead after a decade or so.

I recently booked a really good one way redemption back home to Greece, 70k aeroplan miles on UA and TK in biz class. The good redemptions are still there, one just needs to be even more flexible now. Which is hard nowadays since people have returned to actual offices for work. Fixed holidays are now back in full swing, so supply and demand will always play a factor. Most people want the premium cabins (rightfully so), however economy ticket redemptions are really good at the moment in most cases. Again, flexibility is key.

@Alex H Congrats on snagging a great award! It’s such a good feeling when you find those exceptional deals via miles.

I hear you on flexibility. My kids are in school, so we have no choice but to travel during popular times. That’s another reason why I value miles so conservatively. It’s also why I almost always burn miles on economy seats.

Good blog post topic. Loyalty miles and points are always going to go down in value. They are a poor long term investment much like gift cards. Earn and burn is the way.

Not a valid universal declaration, IMHO of course. Using points/miles, we have not paid for airfare or branded hotel lodging for nearly 30 years, mostly business class seats international and prime main cabin for domestic, while maintaining a growing balance that has net annual inflow of 750k and outflow of 500k. Ability to increase inflow growing far faster than cost of redemptions. Cash cost inflation has fully outpaced all of our points and miles value.

@DaninMCI @DJG I think you both make valid points. That said, I’m firmly in the “earn and burn” camp. While there are exceptions, overall, miles lose value over time. It’s more pronounced for those who only redeem on business class, but even economy flyers get shafted with constant award “enhancements”. Of course, it’s important to remember that revenue tickets go up in price as well.