See our Advertiser Disclosure and Editorial Note here.

You’ve probably seen the news that the sign-up offer on Chase World of Hyatt Visa now includes an extra incentive, aka easier pathway to Globalist status. Here is the copy of terms update: “Apply by 9/30/21 and receive 2 Tier-Qualifying Night credits for each night you stay from 8/16/21 to 12/31/21.” In addition, through the end of 2021, you can earn Globalist status if you have 30 qualifying nights.

All of this has prompted some folks in the hobby to consider applying for Chase Hyatt card now in order to lock in this highly sought-after status. After all, it will give you guaranteed “free” suite upgrades plus breakfast for up to 2 adults+2 children. So, in theory, it sounds like a great deal for families, right? Not to me it doesn’t.

First of all, the bonus on the card isn’t that compelling. It’s currently only 30k points, with the possibility of getting 2 extra points per dollar on up to $15k. Yawn. Second of all, with all the uncertainty in travel due to the ongoing pandemic, nobody can be sure that the juice will truly be worth the squeeze once you acquire this status. Also, some Hyatt properties have club lounges and I, for one, don’t feel comfortable eating in one just yet.

Don’t get me wrong, there are some very nice Hyatt resorts, and I just burned 64k UR points on a 2-night stay in one of them. I’m sure it won’t be the last splurge either. That said, if you have a family and are mostly looking for extra room when you travel, applying for Wyndham card may be your best bet. Here is why.

An all-time high Wyndham offer, plus 10% rebate

Back in the olden days, I applied for Wyndham card because it offered 45k points as a sign-up bonus. In fact I still have it since it gives me 15k points each year upon renewal. The current offer on Earner+ and Earner Business is a whopping 90k points. If you qualify, I would pick the latter since it gives 15k points upon renewal. But both are well worth it, IMO. Here is a non-affiliate application link

Since it doesn’t pay us any incentive unlike Hyatt offer, you know you can trust this recommendation 100%. In fact, I think it’s currently the best deal among hotel cards, hands down. This is a limited time offer, and the highest ever bonus on this bank product.

As to what makes this bonus so special, I have one word for you: Vacasa. Vacasa is a vacation rental management company that recently started partnering with Wyndham. I wrote about my experience redeeming points here.

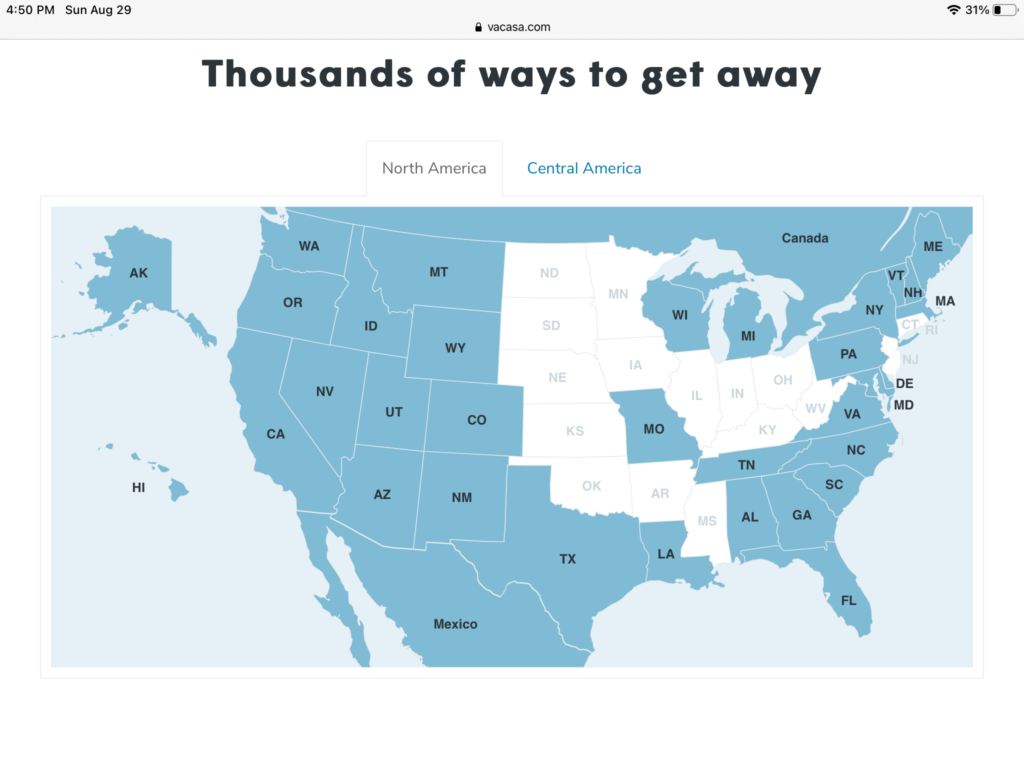

Here is the the map of locations where you can find Vacasa properties:

Many are standalone homes, which I consider a huge advantage during the pandemic. It was a bit of a nuisance having to call in but thankfully, I found out about a workaround from this excellent post on Travel With Grant blog. It gives instructions on how you can make an award reservation via email. I tried it and it worked.

Keep in mind that since the post went live, there have been many reports that Vacasa will black out availability for any rental that costs over $350 per night. So, you may not be able to replicate the author’s experience with booking super expensive condos on Kauai. But it certainly doesn’t hurt to try.

Even with $350 cap, you should be able to find a nice rental, unless you are going to Aspen during ski season et cetera. So, your bonus from the card will potentially cover 7 nights in a one-bedroom rental. Not bad.

Keep in mind that many units are listed as one-bedroom, but may have a loft with additional beds, plus an extra bathroom. Nick from Frequent Miler has recently redeemed his points on this amazing cabin in the mountains, and I’m impressed.

I have been mostly burning my Wyndham points in Florida, and can’t really say I got anything close to that in value. Still, so far I was able to reserve a few properties, all of them on the beach or within a few feet from one:

1) An oceanfront condo on New Smyrna Beach

2) A vacation unit in a small oceanfront motel in St. Pete beach

3) A condo in Siesta Key, 150 feet from the beach

I’m trying to avoid staying in traditional hotels for the next few months due to the fact that my son is still unvaccinated. So, Wyndham points are ideal in this respect. I’m especially excited about the rental in Siesta Key, which is one of the most beautiful beaches I’ve ever seen anywhere, not just Florida.

But I feel like all three bookings represent a solid value, especially considering the fact that I paid 15k points per night. There are a ton of nice oceanfront options in Florida Panhandle, though it’s a bit far from us. I’m hoping to use my remaining Wyndham points for a stay in Kauai in 2023, but that may be tough to pull off with $350 per night cap. If that doesn’t work, perhaps I can burn them in Grand Tetons area during the summer.

If you get approved for Earner + or Earner Business card, you will also get a 10% rebate, which will make the deal even sweeter. At this price, who needs a Hyatt Globalist status, right? I’m kidding, I know it’s an “apples to oranges” type comparison. Still, it’s tough to argue with value here, comrades.

Caveats to keep in mind

First and foremost caveat is the fact that you will potentially be foregoing other Barclays offers by choosing this particular card. And of course, if you qualify for Chase Sapphire Preferred or Citi Premier, you absolutely should prioritize those.

Also, don’t forget that Wyndham program isn’t very trustworthy. They have killed most of their outsized award deals, some without notice. I feel like this Vacasa partnership will eventually meet the same fate. Then again, it’s a niche redemption that does require some work, so perhaps it will last awhile.

The biggest issue and a deal breaker for some is the fact that you have to cancel your redemption 30 days in advance or lose all of your points. Obviously, that’s a huge negative, but that’s the tradeoff for paying dirt cheap amount via points. This policy is the main reason I’ve burned Wyndham points in my home state of Florida so far.

Last and not least, since you are booking a specific rental, you may be in for a nasty surprise when you arrive if something doesn’t quite fit the description. Read all the reviews carefully. You won’t be able to switch rooms, like you would in a hotel. It’s my understanding that Vacasa does provide customer service support and will send someone to fix a major issue, so that’s good.

All in all, I still think this card is a hot deal for most families and a worthy tool in your hobby toolbox.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Hi, prior to reading this I applied for the business earner, on/about 8/24 and was approved on 9/1. I do not recall reading about a rebate benefit, “Earner Business card, you will also get a 10% rebate, which will make the deal even sweeter.” Appreciate if you explain more about that, what is the rebate on and how calculated; and some guesswork on whether or not that benefit was in place for applications on/about 8/24. Thank you!

@Dgodesky I’m almost positive the benefit was there when you applied for it. Barclays has increased the points offer, that’s about it. The rebate is on points redemptions. So if you redeem 15000 points on a room or condo, you will get 1500 points back. So your true cost will be 13500 points.

Not directly related to this post but I thought I would add a data point about citi premier applications: my husband and I both applied for the premier yesterday and we were both denied for having too many credit inquiries on our credit reports. We both have one credit card application in the last 2 years. Plus an installment loan application last year and 3 mortgage refinance attempts (it finally worked out this summer) within the last two years. Excellent credit. Anyway it looks like citi cares if you have any credit checks (not just CCs) in the last few years. Which is kind of lame imho but there you have it. I guess very few people will be getting approved if that’s the case!

I did get approved for 100k Chase SP (husband is pending), and we both got approved for Barclays aviator for 60k miles (no AF!), Capital One 60k (through your link!), and Amex Platinum for 125k MR. Quite the haul!

@Tammie That’s quite a haul indeed! Congrats, well done. And thanks for supporting the site.

I’m quite happy with my haul this year as well, and should do a post on it at some point. There have been many terrific offers lately, CSP being the crown jewel.

I’m sorry about Premier. That is quite strange that you guys didn’t get approved. But it does line up with the reports we’ve been hearing lately. Aside from Capital One cards, getting Citi Premier is probably tougher than just any other product.

How many points for redemption? Is there a chart?

@Hilde Wyndham redemptions start at 7500 points per night ( usually basic motels ). The partnership with Vacasa lets you redeem 15000 points for one bedroom condo rental or house, 30000 for two-bedroom and so on.

Thanks for sharing !

@Nathalie It’s my pleasure!

Great article, thank you for linking to my Vacasa article. Have a great day 🙂

@Grant Thanks for the great post! It has helped me out tremendously, and saved me the frustration of calling Wyndham. I’m happy that you got such a great value in Kauai.