See our Advertiser Disclosure here.

This November my in-laws are hoping to take a cruise around South America, depending on what the entry requirements will be at the time. My family won’t be able to go for several reasons. First, the kids won’t be vaccinated by fall, so that’s that.

But even if they were, my husband would have to take off more than two weeks, and that’s a deal breaker at the company he works for. I mean, it’s possible to do it under extenuating circumstances, but unfortunately wanting to take a cruise isn’t one of them.

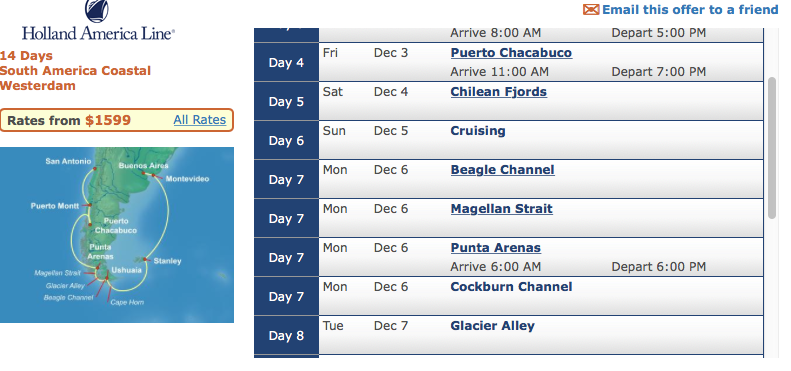

And what a neat itinerary it is, plus the price isn’t that crazy considering the fact that you get to sail for two weeks around Cape Horn with a stop in Falklands:

Sure, balcony cabins cost $2499 per person, but I still think it’s a relative bargain. Of course, while you are in Chile, might as well add an extension to an Easter Island. How can you not, right? Alas, we won’t be able to do this type of a trip for several decades. Or will we?

It has planted an idea in my mind that maybe if we save enough, my husband can retire in 10 years or so. The truth is, while dreaming of this cruise has sealed the deal, it’s something I’ve been pondering for awhile. My husband has a nice boss, and the company he works for has always been fair to us. That said, an IT job is full of stress, late nights and working on weekends. In addition, my husband’s health has been steadily deteriorating, and I can’t help but think his daily schedule has something to do with it.

On the other hand, we are a middle-class family and will not be getting an inheritance (not that it’s expected). We’ve been regularly putting away money for retirement since we got married at 19, but the amount we have so far is not anything to brag about. Still, it’s a solid foundation, and with some changes, I believe retiring in 10 years is within our grasp.

My love/hate relationship with FIRE movement

The FIRE (stands for “financial independence, retire early”) movement became all the rage about a decade ago. Several popular blogs and communities have sprung up all over the internets. At least on paper, there is a lot me and these folks have in common.

I don’t like the US culture of overconsumption. Part of it is because of the way I grew up. We were quite poor, and it was instilled in me to make use of what I got for as long as possible. We didn’t set out to be frugal, it’s the way life worked out. After I moved to US and got access to a lot more money, I kept the same mindset.

Unfortunately, at times FIRE community can take things a bit too far. Do you like to use A/C in the summer? According to many of them, you are a loser. You should get used to warm temperature and save money on power bills. Enjoy eating out? You are a sucker, should always cook food at home because it’s cheaper. Do you spend money on travel? You are a sheep, just go pitch a tent by the river and enjoy glorious outdoors for free.

Well, I must be a loser/sucker/sheep. I sleep much better when it’s 73 degrees at night, and even early retirement isn’t enough of a motivator to raise the temperature. I also really enjoy eating out, or takeout at the moment. I love brick-oven pizza made by a local restaurant, and look forward to having it every week. Yes, I can make one cheaper at home, but it won’t taste the same. I don’t have a brick oven.

I absolutely hate camping. Sleeping in a tent by the local river that’s full of alligators doesn’t sound like a vacation to me. I like decent hotels with preferably nice amenities to entertain my kids. Because if the kids aren’t happy… and you know the rest.

My point is, FIRE movement can be an “all or nothing” deal, at least according to most “believers.” It often doesn’t make allowances for various strong preferences one might have, where giving them up will have an extremely negative effect on life enjoyment right now. It also doesn’t take into consideration the fact that one spouse might not be as committed as the other.

For example, I’ve always felt that you should buy a used car and drive it until the wheels fall off. Unfortunately, my husband feels differently. Before we had kids, I forced him to drive an old, beat up Toyota Corolla. Keep in mind, my husband is a big guy and that car is tiny. Anyway, one time he made a remark that he would like something better, and that despite making the most money in the department, he has the most embarrassing-looking vehicle.

I told him that’s something to be proud of, but he wasn’t amused. That month I started putting away money, and two years later we bought him a gently used Ford Mustang for $15k cash all-in. In 2016 we actually took out a loan (at 0% interest) to buy him a brand new Mustang for a bit more than $15k. Was it what I wanted? Nope. Was it a financially smart decision? Not even a little. But it’s what my husband wanted, and marriage is about give and take. You can make the smartest financial decisions in the world, and end up with the spouse who resents you. To me it’s just not worth it.

Being married to him has been the best antidote to my cheapness. I’ve learned that it’s ok to splurge and treat yourself now and again. Like that time I’ve paid an extra $140 per night in Bora Bora just so we could have this view:

Totally worth it

So, what’s the plan anyway?

Warning! Lots of numbers ahead, but I wanted to share the specifics of how my husband can quit his job in 10 years without us having to eat cat food for the rest of our lives. Keep in mind, he is almost 42 now, so would be 52 at that point. By then, our youngest will hopefully graduate from local community college and will be expected to get a job.

Let’s get the main number out of the way first, shall we? I would feel comfortable with my husband quitting his job if we had around $600k in retirement accounts. A couple of assumptions: we won’t have Weimar republic type hyperinflation over the next 10 years, and Obamacare won’t be repealed. I’m also assuming spending $33k per year, give or take.

Generally, the experts recommend having 25-30 times your annual living expenses saved up, way above my number. But I think it depends on your age. If you retire at 30, sure, you will be walking towards lots of unknowns.

However, at 52, you are only 10 years away from collecting early Social Security. If your income was substantial up to that point, you can count on a decent payout which just might cover most of your expenses going forward. A spouse would be entitled to half of her husband’s benefits.

Yes, Social Security may evaporate in two decades, but I doubt it. And in the worst case scenario, there is always a reverse mortgage. I don’t expect anything from my parents, and don’t feel under pressure to leave anything for my kids either. Except for happy memories, of course.

According to this handy calculator, at 62 my husband would be entitled to around $1700 per month in inflation-adjusted dollars. That means I would get $850. Assuming we are both alive, that means we would be getting around $2550 per month, a small fortune!

Obamacare subsidies kick in if you stay under a certain income threshold, but you can’t make too little either. Fortunately, distributions from a Traditional IRA count for this purpose, so it’s currently possible to pick up a health insurance policy in Florida for under $150 per month for two 52-year old retirees.

But what about early distribution penalties? It’s a valid concern, but there is a trick to (mostly) avoid them. Let’s say we will have $600k I’ve mentioned earlier. We’ll assume that:

1) My husband has $400k from his 401(k) that we’ll roll over to Traditional Vanguard IRA.

2) I have a $125k Traditional IRA in my name, as well as $75k Roth IRA (with $45k being the original contributions).

Here is the main thing to remember. You want to draw from your Traditional IRA up until you reach your standard deduction. The reason is, you don’t pay federal taxes on that amount and if you live in Florida, no other taxes either. Right now that standard deduction for a married couple is close to $25k. In 10 years it will be around $28k if they don’t change laws.

Unless you qualify for exceptions (like large medical bills, college etc), you will pay a 10% penalty on all traditional IRA distributions if you are under 59 1/2 at the time. You pay it even if your income is wiped out by standard deduction. But there is one trick to avoid it and it’s called a 72(t) rule

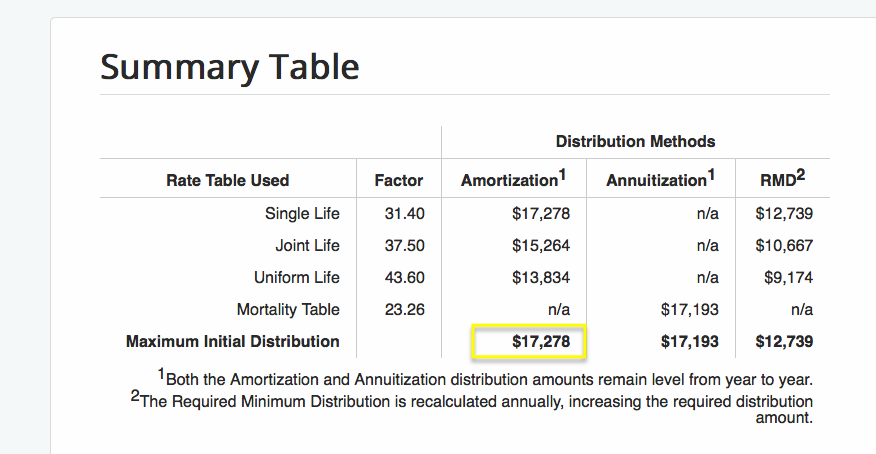

I’ll let you read an article that explains it in detail, but the gist of it is that as long as you draw substantially equal periodic payments, you don’t owe the penalty. There are several methods that calculate your payments, and you can run various scenarios via this handy calculator

Right now would be a very bad time to take advantage of 72(t) provision since the mid-term rate is so darn low (0.53%). But last year has been somewhat of an outlier. Let’s be optimistic and assume that in ten years the rate will be 2%, which is still fairly modest. Here is how the math would break down if we started drawing money from my husband’s $400k Traditional IRA:

Update in 2024: minimum interest rate you can use is now 5%, which is a game changer. That means a 51-year old with a $500k IRA can withdraw around $30k per year via 72(t) rule.

So, we could have access to $17,278 per year penalty-free. We would have to draw that exact amount for five years or until we are 59 1/2, whichever comes later. That’s OK, but not enough to live on. But remember, we still have access to $200k. On top of it, my husband has a small pension from his previous job that he can start drawing at 52 via reduced payout. It would be only $2400 per year in inflation-adjusted dollars, but it won’t be subject to early distribution penalty since it’s considered an annuity.

Anyway, if we add those two amounts, we are already up to almost $20k. As I’ve mentioned earlier, we would want to take advantage of standard deduction, so we draw $8k per year from my traditional IRA next. Unfortunately, we would be stuck with $800 penalty, but that’t not a deal breaker. Keep in mind, when I put that money away, we saved 12-15% in taxes, so we are still coming out ahead.

Plus, that’s assuming neither one of us would have any part-time jobs. Between two people, it shouldn’t be that hard to make $8k per year via Ebay or taking advantage of bank account bonuses. But let’s assume we make zero.

Anyway, we need $33k per year, and for that remaining $5k I would dip into my Roth IRA. Well, technically it would be close to $6k because we need to cover that $800 penalty, but you get the point. Any original Roth contributions can be withdrawn without penalty or taxes at any time. Only earnings are subject to tax and penalty when you are under 59 1/2. We would need to hang on for only 7 years.

Borrowing unforeseen occurrence, I think $600k would be more than sufficient to take the plunge, especially if the kids are grown and have their own jobs. Yes, the market may tank, and this or that might happen. I didn’t say there is zero risk.

So, to summarize, if you are a middle-class family and plan to live on a modest income in early retirement, you would want to put a bulk of your retirement savings in a Traditional IRA or 401(k). However, it’s prudent to have some money in a Roth IRA to give more room to your budget.

There are other tricks, like maximizing your HSA contributions while you work, and delaying getting reimbursement for medical bills until you actually retire. But we won’t go into that here. Google is your friend.

But how do we save $600k?

With what we contribute to retirement now, we will not be able to reach that goal. Period. So, after playing with this compounding interest calculator, I found out we need to increase my husband’s 401(k) contribution from 6% to 15%.

Update in 2024: we have further increased it to 22%.

I’ve always advocated contributing to 401(k) only up to employer’s match, and dumping the rest in Vanguard. However, I’ve changed my mind. There is something to be said about “out of sight, out of mind”. If the money is automatically deducted out of your paycheck, you are less likely to miss it. Plus, his employer plan offers several Vanguard funds as an investment option.

That’s a substantial jump, but there is no other way around it. Having him work more is out of the question. I wish I could give you some weird trick on how to retire early, but it essentially amounts to saving more and/or spending less. There is no magic involved.

It took a minute to put in a request online, and we are off. Our current allocation is 50% stocks/25% bonds/25% inflation-protected securities. The stock portion is invested in Vanguard Equity Income fund (VEIRX). This isn’t advice, I’m simply sharing what works for us.

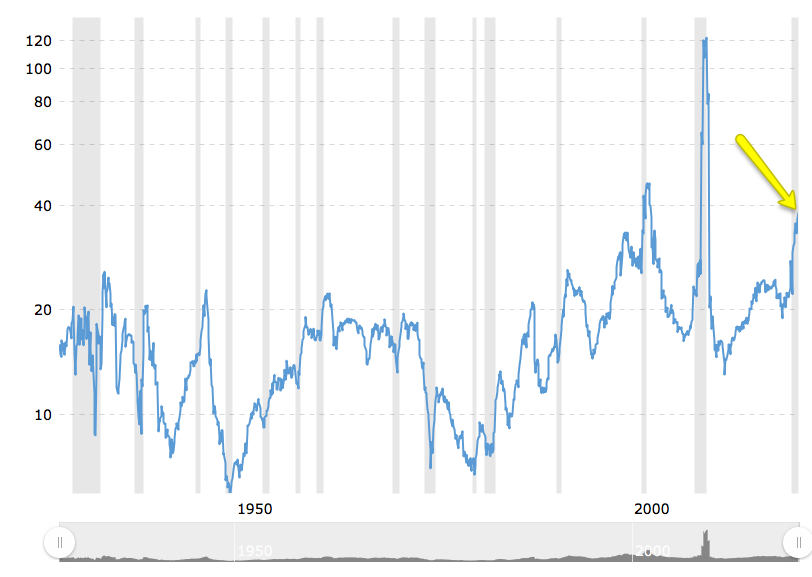

I’m assuming interest rate of 5% going forward because I fully anticipate a market crash in the next year or two. The bull cycle has lasted way too long as is, and P/E (price to earnings) ratio indicates that stocks are currently overpriced. A fair historical number is 16-17, yet here we are at 38 and climbing:

So, why invest in stocks at all? Simply put, I don’t see any better alternative with current measly interest rates on bonds. I’m not a fan of gold funds due to their volatile nature. Plus, it’s a non-income producing asset. Bitcoin is useful for those who live in authoritarian regime countries with long history of inflation (like Belarus where I grew up). Otherwise, I just don’t see the point.

I don’t buy individual stocks. Well, I did the other day because I’ve discovered that I have a $385 IRA at Etrade I totally forgot about. So, I’ve decided to run an experiment and buy some beaten down stocks. That’s the extent of my willingness to “gamble” on individual companies. I’ve been able to successfully time the market a few times in the past, but I don’t attribute it to a special skill. I simply got lucky. I’m not willing to bet my husband’s early retirement on luck.

Update in 2024: My beaten down stocks are now worth $550.

What we have to cut back on now/then

In normal non-Covid time, travel expenses comprise a decent chunk of our budget. I’m not willing to give that up, no way. Who knows what our health will be like in 10 years. Fortunately, we may not have to. We are almost done paying off my husband’s Mustang, so the freed up amount will simply be used to increase his 401(k) contributions.

My husband wanted to get a loan for a brand new Ford Mustang Mach-E, but that’s no longer an option. Instead, we will buy one that’s 3-4 years old with cash. Since it will technically be my car, he didn’t mind. Fortunately, electric vehicles (except for Tesla) tend to depreciate like crazy in the first few years of ownership.

It goes without saying that annual $33k budget assumes having no car payments or loans of any kind. We will simply keep that Mach-E until we are 59 1/2. I have a van that’s currently 12 years old and has 164k miles. I plan to drive it for another 3-4 years, so this isn’t anything out of the ordinary.

As far as retirement travel goes, that’s where our hobby would come in really handy. I believe that we could accumulate enough to have several trips per year covered entirely with miles and points. Just maximizing two credit cards: Chase Freedom Flex and Amex Everyday Preferred (personal referral link) would give us around 60K flexible points per year, when used strategically. And that’s assuming we would be prevented from signing up for any new cards, which I doubt will be the case.

Wrapping it up

If my plan works out, great. If not, that’s OK too. The important thing is, we have a plan, and that’s half the battle right there. I don’t have any illusions that my husband’s early retirement is an end all be all. I know having more time would give us extra opportunities to volunteer and do other things that are important to our family. And of course, it would reduce my husband’s stress and hopefully have a positive effect on his health. It’s a goal worth sacrificing for.

But you can’t put off life and happiness until some specific age or how much you have in your IRA nest egg. As they say, life is what happens when you are making other plans.

I know I’ll be sailing around Cape Horn someday regardless.

Readers, are you contemplating an early retirement? Any tricks you are willing to share?

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Chelsea That’s so funny! You do sound like us from 3.5 years ago. I honestly can’t believe it’s been so long, seems like I wrote this post last year. Lots of ups and downs in the market since, but my husband’s 401(k) is steadily growing so far. We are on track to get to our target number in hopefully 5-6 years. Of course, there is so much uncertainty, I try not to get too focused on the end result.

I hear you on some retirement “dilemmas” that make me scream at my computer. If we had 2 million dollars, my husband would quit his job today. Like right now. What is there to debate?!

On slow travel: probably won’t be an option for us, as my elderly MIL lives across the street from us. As long as she is alive, we will have to look after her. But who knows what the future holds.

I really enjoyed this article and how real you kept it! It was a breath of fresh air from all the “I have $2M saved, can I retire?” youtube videos and Bay area IT people making $300k a year and how they save money for retirement. Ugh, just disheartening.

When I started reading this article I thought you were writing about me and my husband for a second! We are in the same spot as you were – planning early retirement, husband is 42 and works in IT, and will continue until last child is graduating college which is 10 years away. Everything you said was spot on. It’s a fine balance between saving as much as possible and still doing the things you love.

Lastly, have you considered the slow travel lifestyle? We plan to kill 2 birds with one stone – save money by traveling to lower cost countries for a month or longer at a time while getting to enjoy each location longer than we have been able to due to work/kids. Renting out our home base in Texas while gone will cover the home base’s costs. Will probably do 3 – 6 months abroad each year.

We can do this!

In addition to the 72t rules, there is another way to access traditional IRAs and 401ks before age 59.5 without paying a 10% penalty, that is the Roth IRA Conversion Ladder.

This fellow FIRE blogger detailed the information –

https://rootofgood.com/roth-ira-conversion-ladder-early-retirement/

Enjoy!

@Andy F Good point, and I was aware of it. There are two main issues, however. First, you have to pay taxes in the year of conversion. This isn’t a huge problem, but may exceed the 10% penalty that I’ve mentioned earlier. The idea is to utilize standard deduction to your advantage.

Second, Roth IRA withdrawals don’t count for ACA subsidies. This is a big one, since it can potentially mess up your eligibility for health insurance. That said, a lot can change in 10 years. I will definitely take a look at the time and decide which path to follow. Thank you so much for the comment.

Thanks for the reply, Leana. I was curious about what you mentioned ‘Roth IRA withdrawals don’t count for ACA subsidies.’ Could you talk a little bit more on that?

@Andy F I tried to find an in-depth article on this, but couldn’t. So, in short, non-taxable Roth IRA distributions aren’t counted as income for purpose of calculating health insurance subsidy. See this page https://www.healthcare.gov/income-and-household-information/income/

To be clear, every state has its own requirements. For example, here in Florida we don’t have Medicaid for adults. And you have to make a certain amount before you qualify for health insurance subsidy. So, withdrawing from a Traditional IRA via 72(t) rule could be advantageous. Also something to keep in mind is that conversion from Traditional to Roth also counts as income in the year it’s made, even though you technically don’t have access to that money. So, you can potentially increase your AGI income so you don’t qualify for subsidies.That’s why Roth IRA conversion ladder may not be the best approach for someone like me. Early retirement requires a nuanced strategy, and paying a small penalty could very well be advantageous, as crazy as that sounds. Hope that makes sense. Of course, as I’ve said earlier, things may change drastically over the next decade. But for us, access to an affordable healthcare is a must to even consider early retirement. I suspect most folks with health issues are in the same boat.

Leana, I think I got what you’re talking about. To qualify for ACA subsidies, one do need to have some sort of incomes, otherwise it will be Medicaid. And Withdrawings from a Roth IRA account do not count for taxable events. That makes sense to me. Thank you again for the reply!

@Andy F Sure thing! This whole topic is beyond the scope of this blog, and honestly not my area of expertise. I’m much more comfortable giving miles and points advice. 🙂

I absolutely encourage everyone to do their own research. From what I’ve gleaned, you have to be very careful on how you structure your IRA distributions, depending on where you live. My strategy for the next 10 years is to funnel more contributions into Roth IRA. That way I won’t have to worry about Roth IRA conversion ladder or potential implications on ACA subsidies. Well, assuming the law doesn’t change between now and then!

Your blog is very well written and we like this post very much, we liked reading thank you

Family Travel

I thought you could access your Roth IRA distributions at anytime without penalty.

Part time work or career changes can do wonders for the soul if it’s meaningful and low stress. Plus it passes the time and can help people feel useful and productive .

You can also plan to invest any “windfalls” such as pay raises, bonuses, gifts, reimbursements, etc.

Good luck with the plan! My husband is having a midlife crisis at 43. He’s also in IT and wants out! We’re addicted to that nice paycheck and stock payouts so I’m not sure what to do 😉

Sorry not distributions…I meant contributions!

@Tammie Yes, you are correct, the original contributions to Roth IRA can be accessed without penalty. The earnings, however, have to remain in the account until you are 59 1/2. That’s why I plan to contribute only to Roth IRA in my name going forward. I put $2-3k each year now. Not a huge amount, but still.

I haven’t met a lot of folks who worked in IT for several decades and didn’t want out. My BIL went to college and got medical training at 35. He absolutely loves it, and makes really good money. He ended up in IT at 18, not because he enjoyed it, but because my husband helped to get him a job at his old company. It’s a tough field to be in, but as you know, there are perks too. We enjoy a decent income in a depressed area of Florida.

If my husband got out, I know he would have plenty to do. Right now he has a lot of responsibilities in our congregation, and it’s tough to find time to take care of everything after working 60+ hour weeks. Our religion is extremely important to us, so extra time would be shifted to increase volunteer work. We would not get bored. But yeah, it is important to have a plan. Many folks quit their jobs and end up disappointed.

@Christian Thank you so much! I’m very glad that you found the info to be useful. I was actually a little hesitant to lay out specific numbers on the internet, but decided to just go for it. I didn’t want to share yet another article on how you can skip daily latte at work, and retire 20 years earlier. That’s vague, not to mention unrealistic. In the end, for us it comes down to drastically increasing 401(k) contributions. And even that may not be enough if market has a severe crash or if we have another “lost” decade like the period from 1999-2009. In fact, I think it’s somewhat likely considering how good the stocks have been performing over the last ten years. But, if we don’t at least try, then my husband will be working until he dies. Not a comforting thought.

Hmm, I tried AARP calculator and it worked for me, even though I don’t have a membership. Try this one on Social Security website https://www.ssa.gov/OACT/quickcalc/

Good point on life insurance. Extremely important, and something I’ve mentioned on this blog several times in the past. My husband has a $250k term insurance that’s guaranteed until he turns 62. He also has one through work, but I always recommend buying one separately as well.

Thanks for laying out all of your information. It couldn’t have been easy to do that for a bunch of strangers but I for one certainly do appreciate it. Given the depth of your dive here, you’ve got me thinking more intently about retirement for my wife and I. The links you left help, although I can’t get the AARP Social Security calculator to work. Maybe it’s only for members. The compounding interest calculator is very handy as well. I’m with @Nancy about my main retirement fear being health care costs. Also, whether you write about it or not, look into life insurance. My family has learned a couple of times just how a sudden demise can turn your plan upside down. Great work and if you’d be inclined, maybe keep interested readers up on your progress.

So inspiring! Brian and I are a few years older, but we’ve also been contemplating an early retirement. We haven’t put any numbers to the plan, though. Health insurance expenses scare me.

@Nancy Thanks! Hope it works out for you guys. I agree, Healthcare is the biggest variable piece of this puzzle. Before Obamacare subsidies, it was downright impossible for a person to afford non-group health insurance, especially with pre-existing conditions. Right now, if someone would draw $28k from a traditional IRA, they would be considered low-income, and a decent policy would cost around $150 per month for two people. You still have to worry about co-pays, but it’s something within the grasp for most folks. Of course, a lot can change in 10 years.

We did this South America cruise itinerary in 2008, but sailed on the Star Princess and in reverse (Buenos Aires to Santiago). It was our last trip before having kids, actually a “babymoon” but not originally planned that way. It was a great time and we added extra days on the beginning and end to spend adequate time exploring Buenos Aires and Santiago. Besides the sights of South America, seeing wild penguin colonies in the Falklands and Punta Arenas was a highlight (plus it was cool to add the Falklands to our travel map!). We were necessarily more thrifty back then and booked an inside cabin for $799pp through SmartCruiser with something like $200 onboard credit, which I thought was a fantastic deal.

Some tips:

1) Brush up on your Spanish. It was frequently difficult to communicate in English, even at places like the front desk at the Hilton. Makes sense, because the whole continent speaks Spanish and Portuguese so speaking fluent English is less of a priority. If you have a decent grasp of first year/second year Spanish, it will seriously help you understand each other better.

2) Know that Stanley and Ushuaia can be difficult for big ships to visit at that time of the year, even via tendering, due to the sea conditions (per our captain). We were lucky enough to visit Stanley but had to skip the port of Ushuaia.

3) This trip was different than some previous cruises we’ve taken in that the itinerary had many “at sea” days where there is nothing to see except open water. Plan accordingly for activities that you might do during that down time. Although there was plenty of viewing/lounging space available in the common areas, if I did this cruise again I would definitely upgrade to a balcony cabin.

4) Pre-trip, I would suggest joining a rollcall forum on Cruise Critic specific to your cruise and attend a meet-up, either the night before the cruise or on embarkation day. It’s a great way to meet people and definitely can make tip #3 more enjoyable. We attended a tango dinner show at El Querandi and had a deck party area when leaving port.

5) Random bits: a) The Ritz Carlton in Santiago was (still is?) the least expensive in the world. It was very luxurious and a great place to spend a couple nights after the cruise. I believe I paid around $150/night with breakfast included. b) bring plenty of US dollars for Argentina, they are in demand and you don’t want to leave with a bunch of AR pesos. c) don’t wear valuables or dress flashy in Buenos Aires, do the Rick Steves’ thing and wear a money belt. Although we did not have problems ourselves, we met several people on the ship who were pickpocketed and one person who was held up at gunpoint for his watch (the joke was on the criminal – it was a fake Rolex – but still an unnerving incident).

@Erik That sounds really cool, and I can’t wait to do it one day. You know, my one regret is not taking advantage of three weeks off my husband had between his last job and starting his current one. Now that would have been the time to sail around South America!

My problem is that I tend to hesitate and second guess myself. But we didn’t have kids at the time, and should have just gone. Now it’s basically impossible due to time commitment and kids’ school schedule. But that’s ok, something to look forward to in the future.

Timely article. Following your data analyses and applying comps to my own situation. You mentioned “But remember, we still have access to $200k.” ….not sure where the 200k number was previously mentioned. Did I miss something?

Ahhh,125K + 75K. Got it.

@gussomer No worries. Glad the article was helpful. Obviously, as they say YMMV

Every situation is unique, and I don’t pretend to be a financial expert. I do think that with some advance planning, many folks may be able to get off the hamster wheel a decade earlier than most. For me personally, my husband’s declining health has been a real kick in the pants lately. I want badly for him to have less stress, and willing to have a budget lifestyle if that’s what it takes.

Great stuff! I’ve actually been reading up on inflation (in fact I’m currently reading “When Money Dies” about the Weimar hyperinflation) and while I don’t think we’re headed for hyperinflation I do think conditions are in place for some nasty 1970s-style inflation. Moreover, inflation works to the advantage of the federal government since it reduces the value of the debt, so I think it’s going to happen.

Good luck investing in stocks, I think they’re overvalued too so I’ve been buying energy equities as many of those are coming off many years of underperformance and energy prices are shooting up right now.

@Nick I totally agree with you that runaway inflation in a near future is a definite possibility. Too much stimulus is being doled out for that not to happen. I’ve lived through hyperinflation as a child after the fall of Soviet Union, and it can hit rather quickly. Many folks have lost their lifetime savings, with even gold being stolen from the banks. Some crazy stuff. That’s why I don’t get too attached to money because I’ve seen how quickly the purchasing power can evaporate.

It’s so funny that you’ve mentioned energy equities. I was this close to buying some commodity mutual funds (30% energy), but changed my mind. Too volatile, but I agree that there is some definite potential in that particular sector. I’ll have to think about it some more because stock market is really making me uncomfortable at these levels. Of course, the Vanguard fund we have invests in mostly well known companies. However, when the market falls, they all tend to go down.