This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

As I mentioned in a previous post a few weeks ago, I was disappointed that I was rejected on my application for a business credit card I thought would bypass 5/24 in my Chase “Just For You” section of my online account. I am happy to report that since then, I was approved for a different Chase credit card. It’s my first new credit card in 11 months!

Another Offer

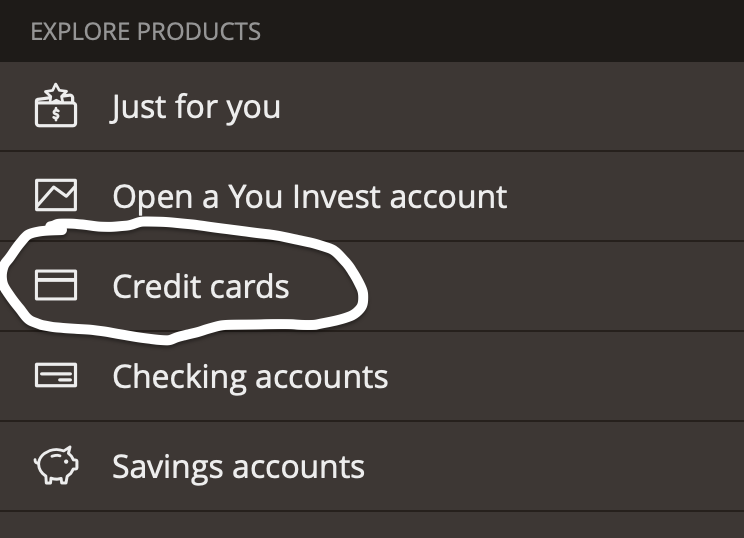

While none of my “Just For You” offers had static interest rates in the fine print (that’s the sign the offer will bypass 5/24), one offer in my “Credit Cards” section did.

The Chase United MileagePlus Explorer Card was one of my offers. The current offer (subject to change) is 40,000 miles after spending $2000 in the first three months. There is also a limited-time offer of an additional 25,000 miles after spending a total of $10,000 in the first six months. The annual fee is waived the first year. Perks of the card include priority boarding, free baggage for the card holder and a guest and two United Club passes per year.

While I really would have preferred to apply for the Chase Ink Business Preferred card due to the flexible points, I do have a use for United miles. I’m tentatively planning a family trip to Europe or Asia in the summer of 2021. Getting the card would set me back just one month on my 5/24 eligibility, which will be this summer.

I decided to apply, and I was approved instantly. Yay! I do plan to switch my monthly spending to this card to earn the extra 25k miles for a total of 65k bonus miles (75k with the spending included).

You Snooze, You Lose

My husband also had the same offer for the Chaes United MilagePlus Explorer Card. We were hemming and hawing about the decision for him to apply. Our first choice for him would have been one of the Southwest cards, since we still travel domestically a few times a year.

We thought about it for too long. The next time we looked, his offer was gone. Well, the card offer was there, but the static interest rate turned into a variable interest rate, which means he would not bypass 5/24 for the offer.

That’s ok. He will be out of 5/24 restrictions in just three months. Yippee!

Bottom Line

Between Chase’s 5/24 limitations and Amex’s Pop-up boxes, this has been a very slow year for me with new credit card bonuses. I’m excited to be back to earning miles and points to help pay for my family’s travel.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

Get a United paper application from the airport, better bonus of 50k. If you apply online make sure you enter the promo code from the paper app, and make darn sure you take a screenshot!

@Doc Unfortunately, I am over 5/24 and Chase won’t approve me for any applications unless I apply through my online profile with a static interest rate offer in the “Just For You” or “Credit Cards” section.

Terrible decision. Constantly devalued points I no longer see any true sweet spot in their award table. Shocked any pro would waste An application on this card.

@RM I disagree. Based on the cards I’ve already had, the cards I’m eligible to have, my family size and our travel goals, this card is the right card. All the major miles and points programs have had devaluations. United has decent award availability to Europe, which is one of my travel goals.