Like many of you, I’ve been following recent reports of Amex shutdowns on Reddit as well as Flyertalk. Frequent Miler blog also has a post with a good summary of what’s happening. In a nutshell, it appears that self-referrals are the culprit and the trigger for the shutdowns. But there is more to the story.

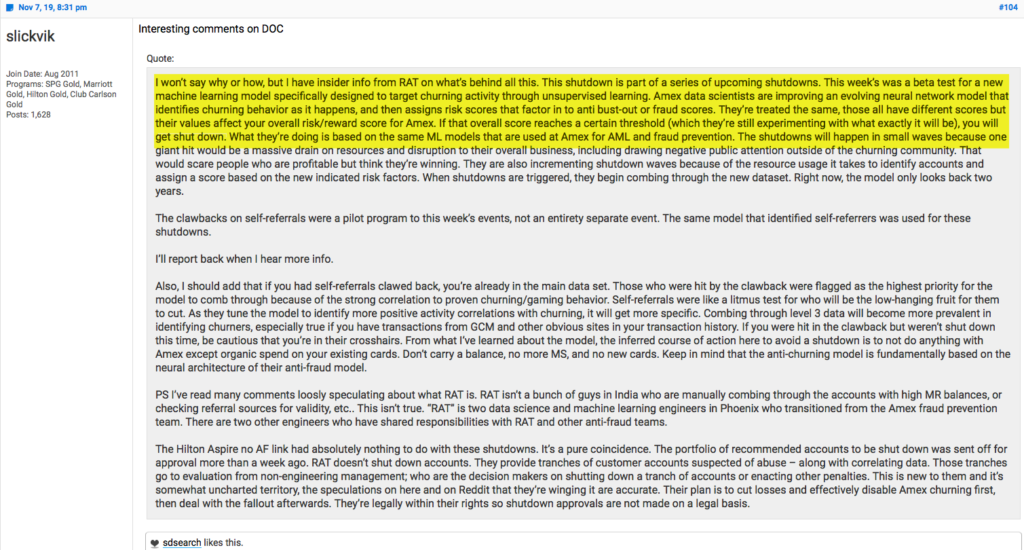

A comment on Flyertalk caught my eye, and I wanted to share it with you in case you haven’t seen it already:

Obviously, it’s possible that this is simply a case of sophisticated trolling. It’s internet after all, where people love getting attention and feeling of importance. Why do you think I started blogging? 🙂

That said, it’s hard to argue that the story rings true. Of course Amex would want to get rid of unprofitable customers. Why wouldn’t they? And let’s face it, our brethren makes up 99% of the customers they would like to dump. The other 1%? It’s folks who max out their credit cards and flee the country to enjoy life in Bali.

When I saw that comment, I immediately knew that I needed to transfer at least a portion of my MR stash to a mileage program. At the time I had about 65k points, not a huge amount, but enough to shed a tear or two in the case of a shutdown. I wish I had a time machine that would allow me to take advantage of 40% bonus on transfers to Avios. Alas…

To be clear, compared to most folks in the community, I’m pretty tame. I don’t do manufactured spending and haven’t done any self-referrals. So why the freak out? Because I hate uncertainty. I know for a fact that I’m an unprofitable customer. I’ve collected a fair share of sign-up bonuses courtesy of American Express, and do very little spending on their cards.

Will I fall through the cracks if the above prophecy comes true? Probably. But it makes me uncomfortable enough to not want to take that chance. Doing so would mean that I’m smarter than Amex engineers who get paid the big bucks for weeding out the deadbeats.

To be clear, I’m NOT telling you to transfer your MR points and give up the flexibility that comes with them. Everyone will have to measure the risk vs. reward and decide for themselves. But I’m out. Well, not completely, since I’ve decided to leave 25k MR points in the account, just in case.

It will stink to lose them, but it won’t be the end of the world. Reportedly, even after the account is closed, some people have been able to call in and transfer the points within the first 24 hours (ability to do so is locked online immediately after the closure). But I’m not betting on it and you shouldn’t either.

Where to transfer my points?

This is the most difficult question, isn’t it? I’ve touched on a similar topic in 2017, see my post Reader question: to which program should I speculatively transfer my Membership Rewards points?

I recommended asking three things:

1) Do I live near a hub served by this particular airline?

People love to hate on Delta, but if you mostly fly domestic economy and live near Delta hub, this is a terrific program for you. Very often Delta program will price short-haul tickets at 5,000 miles one-way. That’s only 5,000 MR points transferred on 1:1 basis. Ignore the haters, and do your own research.

The same principle applies to when you live near American, Alaska Air or United hubs. Since all traditional American-based programs offer “standard” level redemption at a higher cost, you can be sure that you will be able to use up miles as long as you fly occasionally. Will you get better than 1 CPM return? You may not, but you should come pretty close.

2) If I’m transferring to a foreign program, is it trustworthy?

I’ve been burned by foreign programs before, so tend to be leery when it comes to speculatively accumulating miles in them. (Just to clarify, I don’t think American-based programs are morally superior to foreign ones, it’s just that there is more accountability since all of them sell miles to banks.)

There are a few exceptions, like British Airways Avios and Virgin Atlantic Flying Club. I consider them to be fairly stable overall. Plus, the latter is owned by Richard Branson, aka the coolest dude in the world. I’m kidding, of course, you should never transfer your miles based on charismatic personality of airline’s CEO.

Also, British Airways and Virgin Atlantic usually announce devaluations well in advance. Obviously, past actions don’t guarantee what happens in the future but still, reputation matters.

3) Do I have Plan B and C in mind?

I recommend you don’t fixate on one specific redemption because it may not be there in the future. Airline programs change rates constantly, and that “sweet spot” may go poof next year. What will you do with your miles if that happens? It’s good to find other possible uses as a back-up plan. Remember, you can’t transfer your miles back to MR points, so you will be at the mercy of that particular program. Think of it as selling your mutual funds and buying stock in one specific company instead.

Based on the above criteria, I’ve narrowed down my options to Delta and Jet Blue

Both programs earn miles/points that don’t expire, a huge plus. Delta would normally win because there is ability to redeem miles on flights to Europe where most of my family is based. Jet Blue is supposed to start flying to London, but that’s several years away.

Delta has a much better US coverage compared to Jet Blue. However, since we live in Florida, Jet Blue is far superior when it comes to flights to Caribbean and Central America via its Fort Lauderdale hub. It also has interesting direct routes like Orlando-Salt Lake City, and Fort Myers-Washington DC. We can even fly from Florida to Lima, Peru! In the past, I’ve been able to get 1.4 cents per point on Jet Blue flights, which is good enough for me.

What sealed the deal is the current bonus on transfers to Jet Blue. Normally, 250 MR=200 Jet Blue points, but right now the ratio is 1:1. To be fair, it’s nothing to brag about since transfer ratio from Chase and Citi is 1:1 every day of the week.

Still, in a point-to-mile comparison, I felt like I would get more value and flexibility from Jet Blue compared to Delta. I actually prefer revenue-based frequent flyer programs for domestic economy flights.

Plan A

When speculatively transferring points to miles, I recommend at least having some idea on what you will do with them. It may not materialize, but at least you’ve tried. I’ve mentioned planning a trip to Washington DC in 2021, with the idea of viewing cherry blossoms. I’ve looked into doing it for a few years now, but things just never lined up.

As it turns out, I am currently sitting on $120 Travel Bank credit in Jet Blue program after canceling my trip to Costa Rica. I have to use it by the end of August of 2020, but the flight can be at a later date.

If spring 2021 schedule is posted by August (it should), I will probably use the credit towards one of the tickets and book the rest with Jet Blue points. I like Fort Myers airport because it’s more convenient to us than Tampa or Orlando. Normally, I avoid it because most routes require a connection. Having Jet Blue points+travel credit will give me an opportunity to reduce the stress of a relatively short trip.

Plan B

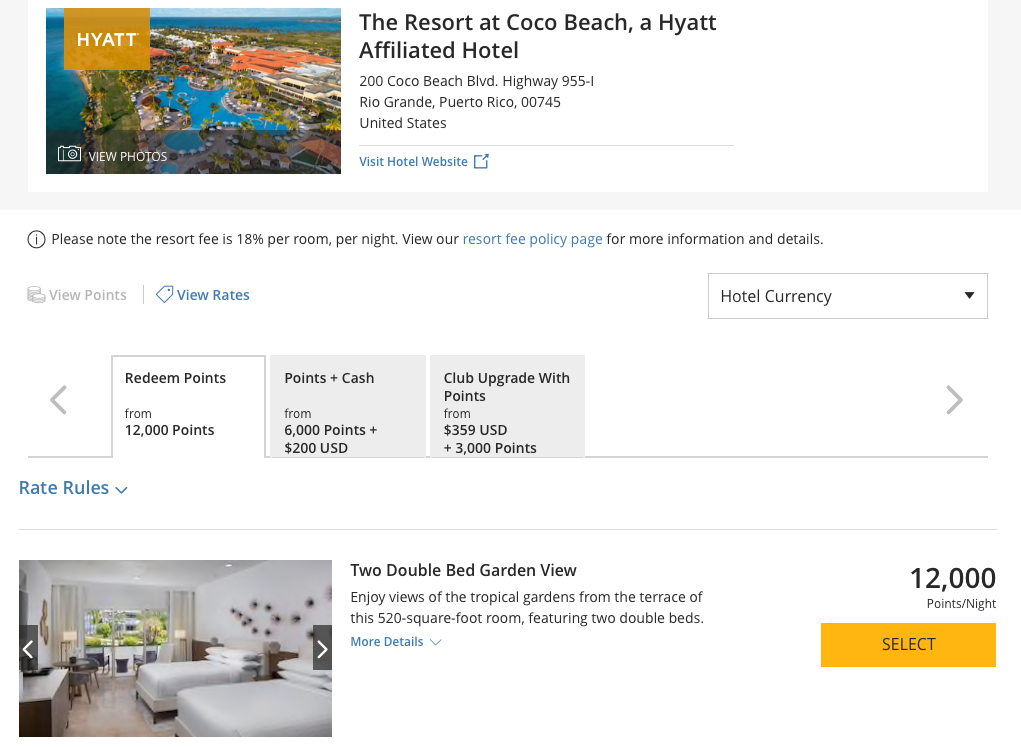

A new Hyatt property in Puerto Rico recently caught my eye: The Resort at Coco Beach, a Hyatt Affiliated Hotel. I’ve been to Puerto Rico once and I can tell you, IMO the island is highly underrated.

There is interesting history, beautiful mountains and of course, beaches. The best part? It’s part of the US, which means relatively good infrastructure and $5 taxes on award tickets. It’s a great spring-break destination for families as long as you have access to affordable flights. I love my state of Florida, but Puerto Rico seems way more exciting and exotic.

But back to this hotel. I was surprised that the rate per night is a relatively low 12,000 Hyatt points per night:

That means it’s eligible for annual certificates on Chase Hyatt Visa.

If you are looking to apply for Chase World of Hyatt credit card, I hope you consider using my personal referral link You will get 50k points after spending $6k in 6 months ($95 annual fee). It’s a card I personally have and recommend to others as well. The card is subject to 5/24 restriction.

No certificates or Hyatt points? You can transfer your UR points on 1:1 basis. Compared to rates of $380+tax during spring months, it’s a pretty good deal as long as you actually want to go to Puerto Rico. If you have a Club Access certificate, you can attach it to the points reservation.

Jet Blue flies to Puerto Rico from Tampa and Orlando. If we do go, we will definitely take the kids. Even though sharing one room (with two double beds) isn’t ideal, the pool complex looks amazing. We would probably bring an air mattress, and attaching Club Access cert will also cut food costs significantly.

This is my Plan B for now, but I’m really tempted to book a 3-night getaway to Puerto Rico. Anybody else feeling the same way after seeing this new Hyatt option?

Bottom line

I want to stress again that liquidating your MR points in light of these recent events vs. staying put is a personal choice. In no way am I saying that everyone should speculatively transfer them. Once you do, there is no going back. But I personally didn’t want to leave more than 25k points, though may reconsider depending on how the events will play out in the upcoming months.

I also plan to convert my Amex Everyday card to Amex Everyday Preferred in order to earn 4.5 MR points on groceries and 3 MR points on gas. See related post. So I’m not giving up on Membership Rewards, not at all. I just don’t want to leave a big stash of points and risk losing it.

A few months ago, I wrote a post with a warning when it comes to doing MS and other sketchy practices via American Express cards. Here is one of the comments:

Hmm.

CLICK HERE TO VIEW VARIOUS CREDIT CARDS AND AVAILABLE SIGN-UP BONUSES

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thanks for the post. I hadn’t seem the issue before. Because we mainly fly Delta and JetBlue and because I have no interest in being below 5/24 and have had fantastic success with AMEX, we put almost all our regular spend on various AMEX cards. Between us my wife and I currently have about 315k MR points. Of course this means that, in addition to the 3 or 4 cards we have in our regular rotation (and have had for years), we also sign up when possible for new cards – for example I recently got the 45k bonus on the Green card and my wife got 60k for the Platinum card (with no lifetime language) after having had it several years ago and cancelled it after a year. That being said, we never don’t do any MS and always keep the cards open for a full year before cancelling. Since we are strong, long-term customers and have such a large stash of points, I am thinking we will mostly sit tight. I may transfer some points to JetBlue because of the promotion, but other than that I’ll just keep my fingers crossed I guess. Thanks again for the helpful and timely post!

@Doug I’m glad you found the post helpful! Like I said, I’m most definitely not trying to spread panic. I honestly believe that majority of folks ( including myself) will be fine. Judging by what you’ve told me, I think that the shutdowns most likely won’t affect you.

I’m a little paranoid, I guess! To me, having flexible points is similar to opening a savings account in a bank and agreeing that they can confiscate the money if they feel like it. 🙂

I really didn’t pay attention to the shutdowns because I use my AMEX every week on non-bonus purchases. I’m leaving them there for now as I’m trying to build my stash, and I hope it’s not a mistake.

@Stephanie I really don’t think an average consumer like you (who mainly uses Amex cards for everyday spending) has anything to worry about. I also don’t think buying small 3rd party gift cards is likely to raise red flags. But who knows?

In my case, I’ve opened and closed quite a few Amex cards over the last few years. I use them occasionally, but there is no way Amex has made money on me. I’m 100% unprofitable customer, though don’t do anything nefarious either. Amex plainly states in the terms that MR points belong to them, and they can confiscate them for any reason. That just doesn’t sit well with me.

I still plan to earn MR points, but will probably transfer them out when there is a bonus. I’m kicking myself for passing on recent Avios deal.

And don’t forget no expiration date on Delta miles!

@Talchinksy Yep, mentioned it in the post!

Thank you for the post. Good point about the Hub locations. I had collected Alaska miles because I read they were so great. When they dropped Delta as a partner they lost a lot of value for me since I live 2 hours from Chicago. Unless I want to fly on Alaska to Seattle…. If they drop AA partner I might never get them used up. I have been holding them for 3 years, finally was able to use some for a flight next summer to EWR.

I have been thinking about transferring my MR points as well. I spend a small amount on Amex, so I am probably not a profitable customer to them as well. I think it sucks that it is legal for them to be able to take away all the points we have worked so hard to earn. You are right about great deals can disappear overnight. I was saving IHG points for a redemption that was 25k a night 2 years ago and now I think it is 50k to 60k a night! And I was heartbroken when the IHG annual night cert was capped. I had gotten some incredible value from that. Thank you again for the good ideas!

@Clyn6 Thanks for reading! Yeah, unfortunately, things in this hobby can change overnight. What was once a great redemption can become mediocre in a flash. IHG program is case in point. It has really deteriorated in the last few years, though I still get good value from my credit card renewal certs. Beyond that, I don’t really go out of my way to collect IHG points anymore. There are some exceptions, and I’ve written about one not long ago https://milesforfamily.com/2019/10/29/great-deal-on-points-holiday-inn-club-vacations-sunset-cove-resort/

And it’s true that airline miles can also become less valuable with loss of a partner or route. The value in this hobby is highly specific, and depends on your personal unique circumstances.

I don’t really think you are in danger of an Amex shutdown. In fact, I doubt that I am either. But recent events make me sufficiently uncomfortable that I’ve decided to dump a good chunk of my points to Jet Blue. I’m pretty sure I will put them to good use within a year or so.

I do think many folks in the hobby have a false sense of security, thinking a shutdown will never happen to them.

Also, don’t forget taxes on domestic airlines redemption

@Chris That’s very true, though the amount isn’t a huge swaying factor for me. I paid $23 fee( I think?) to transfer 40k MR points to Jet Blue.

It is an annoyance, for sure. I really wish I did take advantage of Avios transfer bonus. Oh well.

You forgot to mention one thing to do:

Check for points expiration policy as certain programs have a non flexible policy (i.e. ANA 3 years and no way to extend)

@Marc Yep, I did actually mention it in the post and gave examples of KrisFlyer and Asia Miles. Thanks for the reminder on ANA.

That’s a dealbreaker for me. I won’t speculatively transfer to any program that has hard expiration, regardless of my upcoming plans.