Update: Terps program has just massively devalued cash redemption options (see this post on DoC blog). I’m sure the same will happen to flights soon, though it’s not the case as of yet. I no longer recommend applying for this card.

A few days ago, I had a chance to finally redeem Terps rewards points from mine and my husband’s credit cards. For those who have no clue on what I’m talking about, see this post. Speaking of, it looks like the sign-up bonus on Terps Visa has been reduced to 30,000 points (non-affiliate link). I suggest you wait and see if 50,000 points offer returns, but it’s up to you.

Anyway, I’m beyond excited to finally put our points to excellent use, aka my parents’ airline tickets from Belarus to Florida. I’m sure we’ll drive each crazy, but that’s part of being a family, right?

Here are a few things you should be aware of:

1. The Terps website isn’t that great, but it works… usually.

I’ve played with it over the last few months, and often rewards section returns an error. Rather than calling, I suggest trying it later in the day, unless you need to book your airline tickets ASAP.

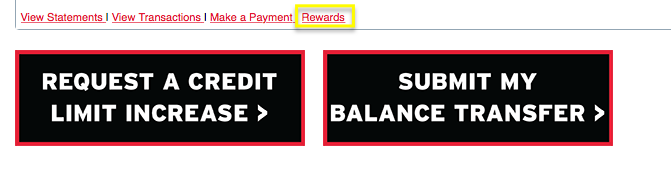

Redeeming points is pretty easy. You first click on “rewards” in your online profile:

Select “Redeem rewards” at the top, then “Travel”, then “Online reservations”:

After that, it’s self-explanatory.

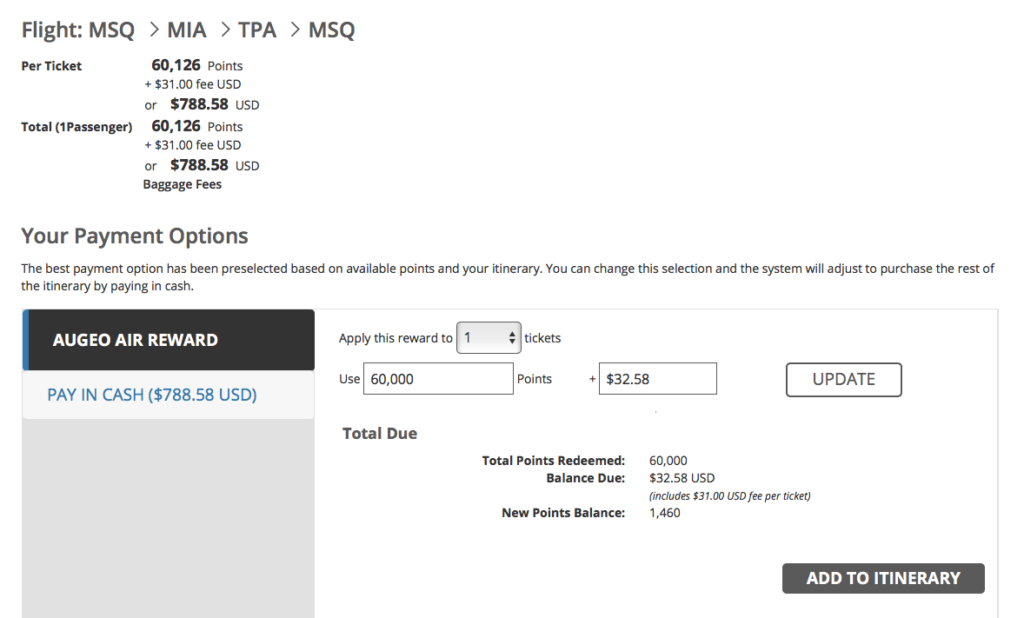

2. Using points on airline tickets definitely yields the best value.

You will get around 1.25-1.30 cents per point, which is on par with cards like Citi Premier and Chase Sapphire Preferred. Update: According to Doctorofcredit, Terps program has just devalued cash and gift card redemption options. Airfare value hasn’t changed…yet. Burn your points ASAP.

3. There is a $31 service fee per ticket, and you can not offset it with points.

I actually had 62,000 points in my account, but the website wouldn’t let me apply the whole amount towards the ticket.

4. You don’t have to pay the cash portion with your Terps Visa, it can be any credit card.

Speaking of, you have probably noticed that I chose to use 60,000 points and pay $1.58 on top of service fee. This was intentional. I used Chase Freedom to cover the cash portion in the hopes that the charge will qualify for travel insurance benefit. I’m not certain that it will, but it looks that way.

My mom falls into “immediate family” category, and as long as a portion of her flight is charged to Chase Freedom, we should be OK. I’m not certain the benefit will apply to non-US residents, and hope we don’t have to find out. See benefit file for Chase Freedom.

5. You can book multi-city itinerary as well as one-way tickets.

If you look above, you’ll notice that my parents will be flying to Miami (my mom has a friend there) and leaving out of Tampa. I plan to use Avios miles for one-way tickets from Miami to Tampa.

6. Prices are similar to what you’ll find on sites like Expedia, but selection is more limited.

At least that was the case for me. I did finally find an acceptable combination of flights, but it took some effort.

7. Confirmation email is sent out within seconds, and contains airline reference number (in my case Lufthansa).

This will allow me to keep an eye on the flights and monitor any schedule changes.

Bottom line

I’m very glad that I decided to pull the trigger on Terps Visa X 2. I was planning to pay cash for my parents’ tickets, so this decision has saved me around $1,300 (when factoring in fees and opportunity cost on minimum spending). Needless to say, I’m a happy camper.

With all the gnashing of teeth, discontent and (occasionally justified) anger that permeate miles and points community, it is important to keep things in perspective.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Ah, the Terps Visa. The one card my wife literally laughed out loud at when it came in the mail! Looks like I got in just before the bonus was lowered. Whew.

@Projectx My husband chuckled too when I handed him a credit card with a picture of a turtle. It looks silly, that’s for sure. But there is nothing silly about getting an almost free ticket for my mom.

I was thinking about applying for University of Illinois version, but it looks like the bonus is decreased as well.

Do you know of anyone that have both? When I applied for the Terps it said my application would be first reviewed by an underwriter. I don’t think I’ve seen any DPs of auto approval, which makes me believe they do manual underwriting on their apps. Which also makes me believe they would see the recent UofM card and deny the UofI card.

Hmm, I’m not sure. You actually bring up a good point. It’s totally possible (maybe even likely) that you can’t have both cards. The rewards program is run through the same website, after all.

@Projectx You’ve probably already seen it, but looks like Terps program has just massively devalued cash redemption options: https://www.doctorofcredit.com/terps-credit-card-massively-devalues-points-value-cut-in-half/

Flights show the same value (for now). I recommend you burn your bonus as soon as it posts. The best way to do it is to book Southwest flights and then cancel them. You do have to call in because I don’t think they will show up in online search. You will then have a year to use up the travel credit. Of course, I’m assuming you don’t need to fly on Southwest right now. Boy am I glad I just used mine up. Sheesh.

Great redemption! I just booked two separate Mexico trips for the family using AA miles. Got them in just before the 10% rebate goes away! Booking our hotels using Hilton points and free nights. Looking forward to diamond status and aspire resort credits! 😉

@Tammie Congratulations! Sounds like a great deal. I knew AA miles and Hilton points aren’t worthless. 😉

Thanks. Yah I don’t think they’re worthless either, but I do think it’s true that you have to be flexible and really look around for decent redemptions with those programs. They’re not always in plain sight. I’ve been fortunate with AA miles when booking trips to Mexico, but that’s about it! With Hilton redemptions I’m happy if I get at least 1/2 cent per point. Hilton points have also been easy to earn and status is easy to come by. We’ve had pretty good luck when we can book far in advance or during shoulder seasons. Peak is REAL tough

Tammie, I totally agree! Flexibility is key when dealing with miles. It can be really frustrating for a newcomer, but that’s just the way it is. If a person insists on only flying non-stop, during convenient times, and during peak travel season for sAAver level price, they are likely to end up disappointed. Not always, but often. AAdvantage program in particular can be quite frustrating these days. AA plays a lot of games: married segments and what not. I’m not a huge fan, but I will still happily accept 60k miles in exchange for one Citi credit pull.