As I’ve said many times before, this hobby is getting tough for people who constantly switch credit cards. It doesn’t mean that all hope is lost (see my post on Terps Visa), but getting approved by most major banks is an ordeal these days.

Citi, I can always count on you!

I’ll start with a positive development. I recently applied and was approved for Citi AAdvantage Platinum Select card. I used non-affiliate link that comes with 40,000 miles+$200 statement credit on AA.com purchases after spending $2,000 in 3 months.

Apparently, 10% rebate on award redemptions is going away on May 1st, but the card is still worth getting for the initial bonus.

The affiliate offer is 50,000 miles after spending $2,500 in 3 months, which may be a better deal for some. I definitely prefer $200 statement credit to 10,000 miles since it can be used on AA gift cards. Plus, it’s not subject to award availability. Though once again, it depends on what you are looking to get out of this particular bonus.

But it gets better. Some folks have recently gotten a targeted offer of 70,000 miles. I wasn’t so fortunate, but I know that Citi is usually pretty good about matching. So, after receiving the card, I did an online chat with a Citi representative and asked about this much better offer.

The rep put me on hold and came back with good news. Approved! I’m supposed to receive a letter of confirmation. I’m not positive on whether I’ll still get the statement credit but even if not, 30,000 miles are worth more than $200 AA gift card (to me).

On to the bad news…

Amex and BoA fails

Since we can easily handle a minimum spending of $5K in 3 months, I decided to apply for a card in my husband’s name as well. But which one? Since Amex has recently increased offers on several cards, that’s where I turned to first. It appears that the best offers can be accessed via personal referral links or in incognito mode.

I checked my husband’s Amex referral link, and there were several very attractive bonuses on credit cards. The one that caught my eye was 30,000 MR points on Amex Everyday Preferred ($95) after spending $2,000 in 3 months. I was debating on whether to upgrade my Amex Everyday (no fee) to this card anyway, but would certainly prefer to get a sign-up bonus if at all possible. I consider this product to be one of the best “keeper cards” for a middle-class family

I’ve never seen an offer on this card higher than 20,000 points, and was quite intrigued. So, I went ahead and applied, but got the dreaded pop-up telling me he is not eligible for the bonus. I knew from my previous experience with Hilton card that the pop-up may appear on one Amex card, but not on the other. So, I decided to try applying for Gold Delta SkyMiles Credit Card from American Express.

While regular affiliate offer comes with 60,000 miles, you can get an additional $50 credit thrown in when you apply via referral link. Anyway, unfortunately, the same pop-up appeared again. No other offers looked appealing to me, so I gave up. If you are looking to apply for an Amex card and aren’t able to generate your own link, here is my referral link. Thanks in advance! Be aware that sign-up bonuses tend to fluctuate.

I decided to try applying for Bank of America Premium Rewards credit card (see more info on it here). I didn’t have high hopes since my husband was rejected for it twice before and sure enough, he got an instant denial. Since his credit got dinged, I figured we might as well try applying for another BoA card in hopes that the inquiries would get combined.

I chose a 40k miles offer on Alaska credit card. I fully expected for my husband to get approved, but nope. Denied again! I sure hope the inquiries do get combined. Historically, Alaska offer has been easy when it comes to approval, but obviously things have changed.

I decided that my husband’s credit got enough trashing for the day.

Cathay Pacific credit card offer from Synchrony bank

I was determined to apply for another card in my name, but it was clear that I wouldn’t stand a chance with major banks. After looking in obscure corners of internets, I came across this non-affiliate offer on Cathay Pacific Visa Signature card. Through March 31st, you can get 40,000 miles after spending $2,000 and paying $99 annual fee. I believe the regular offer is 35,000 miles.

I wrote about this card before, but never pulled the trigger on it. The main reason: miles expire after three years, and there is nothing you can do to prevent it. Any time a program has a draconian policy like that, it goes to the bottom when it comes to value of miles. While three years seems like a long time, we are not frequent travelers, and I still need to get rid of my Avianca leftover stash. I hate to invest $99, plus the foregone points on $2,000, only to lose it all in the end.

However, I was curious about one specific route: Honolulu-Osaka. If you follow this blog, you probably know that I’m planning a trip to Japan with a stopover in Hawaii in 2020.

My in-laws won’t be coming, but I still need a ton of miles for four of us in order to pull it off. Originally, I was planning on using British Airways Avios on JAL for this leg of the trip. But it certainly would be nice to hang on to them and utilize Asia Miles instead.

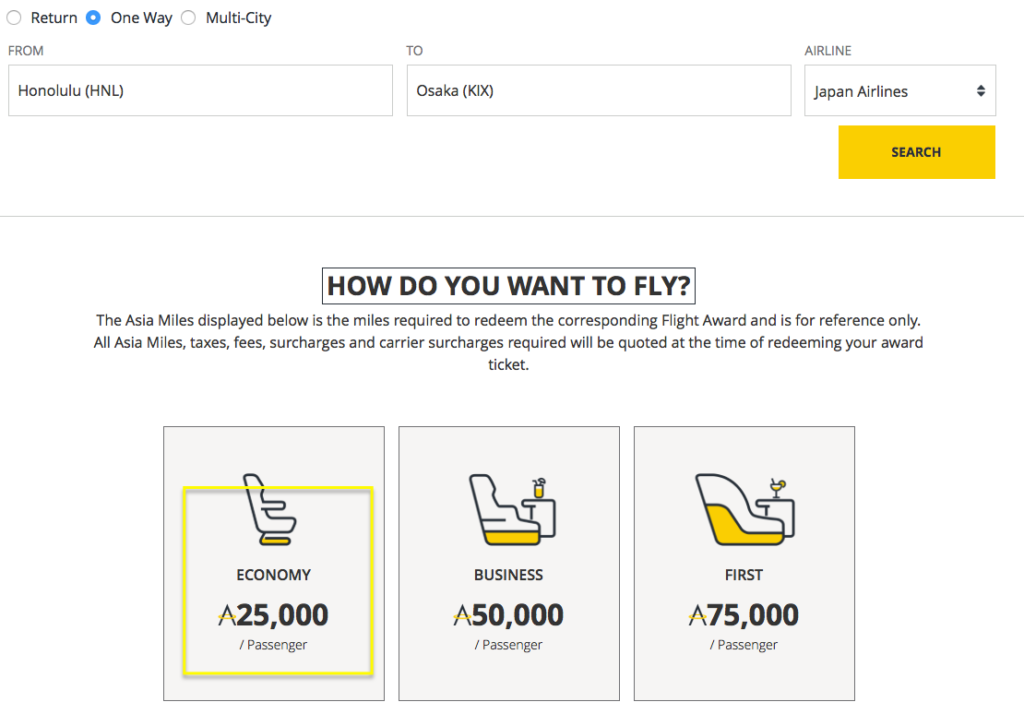

The cost for one-way flight is 25,000 Asia Miles, identical to what Avios program charges:

See this Cathay Pacific calculator for your desired route. You are now allowed to book one-way (rather than just roundtrip) flights on JAL, a welcome hobby development.

See this Cathay Pacific calculator for your desired route. You are now allowed to book one-way (rather than just roundtrip) flights on JAL, a welcome hobby development.

I almost applied, but then I remembered that one of our readers mentioned to me that Asia Miles agents seem to be clueless, and often quote incorrect award rates. You have to call for JAL award flights or fill out an online request form. This program is the Avianca Lifemiles of OneWorld. Except it’s worse because the miles have a hard expiration.

Update: you can now redeem Asia Miles on JAL flights online without having to call in. This makes things far more interesting…

Also, if I wanted to book two tickets, I would have to transfer 8,000 Membership Rewards points in order to top off the account. The transfer isn’t instant, so I would need to do it speculatively in order to get the flights I want. And that’s assuming I get a knowledgeable Asia Miles agent to begin with. I’ve also heard bad things about Synchrony bank, which is another strike against this offer.

If our plans change, I would be stuck with expiring miles in the event of cancellation. Maybe I’m getting lazy in my old age, but I. just. want. simplicity. Avios may not be the best program out there, but at least I can book JAL flights online and not have to deal with Asia Miles rigamarole. I decided to skip this card (for now). Anyone wants to change my mind?

If you are running out of options and need miles redeemable on OneWorld alliance and Alaska Air, you may want to look into this offer.

Accepting the upgrade offer on my Amex Blue Cash instead

I’ve noticed that my Amex Blue Cash card (no annual fee) had an upgrade offer to Preferred version ($95 fee). I would get $250 after spending $2,000 in 3 months. There would be no credit inquiry, but I was still on the hook for $95. This is a puny offer, no question, but I’m seriously running out of options. The card earns 6% cash back on groceries (on up to $6,000 per year) and 3% on gas. Not bad at all, and I might even renew it next year if things in this hobby keep going the way they are going.

Plus, if I put spending on this card, I’m hoping that it will put me in a better position to qualify for sign-up bonus on Hilton Aspire, which I plan to apply for in a few months. Why not now? I want to time it just right so we could use airline lounge access in case the trip to Japan materializes. I’m a gal with a plan, always. Unfortunately, the banks seem to have other plans these days. Except for Citi, bless its heart!

Of course, life goes on, and in the grand scheme of things, all of this matters very little. Plus, I have enough miles and points for several years’ worth of travel, no manufactured spending involved. So no, the sky isn’t actually falling despite my clickbait title.

Readers, how is your credit card hustle going nowadays?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

@Leana. Not really. I am doing 1 Citi AA card/65 days in a 2 player mode but you can easily do 1/33 days. Same same since early 2017, I am on my #16 and my sister is pushing into teens. You got to pay YQs of JAL redemptions using Cathay miles or Avios do not you? That bank is actually fine, nice website and no issues, just as you said, the only thing is that hard expiration is kind of sucks. I did a round of these cards a while ago and still sitting on 37.5K X 2 times, did not get to looking into using them. I recall the offer was 35K but no fee at the time. I am just burning AA on these JAL/QR/Cathay/MH redemptions. Taking family of 6 over Christmas/New Year to ski in Japan, combination of 2 flights/direction, mostly Y,but a couple of J and F seats as well. Let me know if you changed your mind regarding the mailers, I get too many to be able to use them. Sorry, I do not read your blog regularly. Удачи

@Boris Thanks for stopping by! There is actually a sequel to this post: https://milesforfamily.com/2019/03/13/why-i-decided-to-apply-for-synchrony-cathay-pacific-visa-x2/

Except, my in-laws won’t be coming with us after all (a sequel to the sequel :)), so I hope to use Asia Miles instead of Avios for our flights. It’s true that AA program doesn’t pass along fuel surcharges on JAL. That said, the rate is higher on most routes, so it’s a wash IMO. I tend to piece my flights together as they open up, and distance-based programs work in my situation.

As far as AA mailers go, I appreciate the offer. I’ll keep it in mind.

Can I ask if the Citi AA had the 24 month language? I used to be able to find the non24 mailer codes but those are even hard to find! Thanks for sharing your attempts!

@JB Yes, the app had the standard 24-month language. I qualified for the bonus, so it wasn’t a concern. I never really did the whole “mailer code” thing, but I’ve heard it’s getting tougher.

Recently got accepted for Barclay AA Aviator card–60,000 points–use once–$95 fee. It’s my third time for this baby; 23 months since last approval. My wife, oddly, I thought, went pending. AMEX is getting very picky, denied bonuses, wife and I, on Hilton cards. We are big Hilton users, so that one hurt, I was spending that Aspire bonus. :>( I’ll take what I can get. Between spending, buying points, and sign up bonuses we are doing fine and enjoying our business class flights.

@Russ I can not for the life of me get that darn Aviator Card! And I’ve tried multiple times over the years. If I ever get approved, I will probably faint from shock. 🙂 Barclay is very smart. But it’s all a game to me, I don’t take this stuff personally or let it affect my quality of life. It’s still (mostly) fun to pick up miles and points with minimal effort and turn them into amazing memories.

I am counting on getting approved for Hilton Aspire, though it sounds like I probably shouldn’t. Plus, even if I get approved, the signup bonus isn’t a gurantee.

It does me nervous to apply for cards with giant annual fees.

I am 3 for 3 this year after slowing down in 2018. I got the Barclays biz aviator and the Hilton no fee for $100,000 hh honors points. I also got the Citi biz 60k miles plus $250 gift card.

@Natasha Nicely done! I may have to slow down myself, but not by choice, haha. I do need to crunch the numbers and see if it’s worth it for one of us in the family to get under 5/24. So far, the answer has been No. But it is something to think about. At the very least, I need to stop adding my husband as an authorized user to new cards.

I’m considering the same thing, Leana. We should both be able to get the citi AA card again this month, after waiting 24 months since closing, then not sure we’d get any others. I upgraded hubby’s Hilton Amex card to Ascend using an email with no language. He did have the Surpass in the past, so wasn’t sure he’d get the 150k points, but he did! With Amex you never know what they will do with no explanation!.

@Lynn I’m glad your husband got the upgrade bonus! If I ever see a similar offer on one of my Amex Hilton cards, I will for sure bite. But so far, no dice.

I was a little nervous about getting 100k points on regular Hilton Amex, but the points posted without issues. I am Concened about applying for Aspire due to $450 initial fee. With Amex, you just never know. But factoring in $250 Resort credit and weekend night, I would be breaking close to even if Amex folks decide to shaft me out of 150k points. It is definitely a concern, but many things in this hobby require a leap of faith.

Yes, it is definitely getting harder to be approved for cards, even with a great credit score. I have been trying REALLY hard to not apply for any cards for a while, hoping that will increase my chances. I would love to get under 5/24 so I could get a Sapphire card. But that’s a year away, not sure I can wait that long! LOL! Last year when Barclay had a 45k offer for Wyndham I applied, my husband applied, and my friend who had only 6/24 applied and we were all denied. Luckily her husband was just 2/24 and he was able to get it. We both have 3 nights scheduled at an all inclusive for next February to take advantage of the last of the 15k a night anywhere price. Sad to see that deal leave as well. This game keeps getting harder for those of us that are not big spenders. Do you think it helps if the bank sees recent spending on the cards you currently have with them? I have heard that can increase your chances of getting approved. I appreciate your article and insight on current changes in this ever changing game! Thank you for your time and effort! Clyne6

@Clyn6 Thanks for your comment! I’m glad you guys were able to take advantage of the all-inclusive Wyndham deal.

If things keep going this way, I may have to get under 5/24 myself. What is this world coming to! 😉 But if the choice is between applying for 5 cards with $100 initial bonus and waiting to qualify for 50k UR points on CSP, the answer is obvious. I’m not quite to that point yet, and keep finding worthwhile offers here and there, but it’s getting really tough.

As far as putting some spend on existing cards in order to increase your odds of approval, it does seem to work with certain banks. Barclays is just one example. For other banks like Chase, it’s unlikely to help, especially if you are restricted by 5/24 rule. So, the short answer is: it may not always help, but it certainly won’t hurt.