One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

One of the “keepers” I have in my credit card wallet is the Chase Disney Visa. What makes this card so special to me?

On the surface, it’s not as exciting as other cards. The no-fee version of the card offers new cardmembers a $200 statement credit after spending $500 within the first three months (via my referral link; the public bonus offer on the no-fee version is only $100). Compared to other card bonuses that are worth $500+, that’s not impressive. It also only earns 1% on all purchases and is subject to Chase’s 5/24 rule for approval.

So why do I keep the Disney Visa in my wallet?

Special Vacation Financing

The main draw to this card for my family is the special vacation financing. You can get 0% interest for six months on Disney vacation packages. At the parks, hotel reservations or ticket purchases by themselves do not qualify for the 0% financing. You must purchase a vacation package that includes lodging and tickets together. This feature is not available with the debit card version.

Disney Cruise Line reservations count as vacation packages, which is how my family has most often used this benefit. We’ve sailed on DCL 7 times, and I do see more DCL cruises in our future.

For most Disney cruises, you must pay the final payment 90 days before you sail. However, if you put the final payment on your Disney Visa, you have an entire six months to spread out that final payment. With the high price of Disney Cruise Line, the extra time sure comes in handy.

On DCL, you can also use your Disney Visa to add on-board credit to your account before you set sail and purchase special in-room amenities (like Star Wars decorations and blanket) before you cruise. Those purchases also qualify for 0% financing. Again, it’s nice to be able to spread out those charges over 6 months instead of paying for them in one lump sum.

Be aware that any charges to your Disney Visa once you’re already on board the cruise ship DO NOT qualify for the 0% financing. So, it’s better to estimate your on-board charges before you leave and pre-purchase on-board credit.

10% Off Disney Purchases and Select Dining Locations

Disney Visa cardmembers get 10% off purchase at the Disney Store and shopDisney.com. Cardmembers also get 10% off purchases of $50 or more at the parks and 10% off dining at select locations.

On a Disney cruise, if you designate your Disney Visa as your on-board credit card, you also get 10% off purchases in the on-board gift shops. Oh yeah!

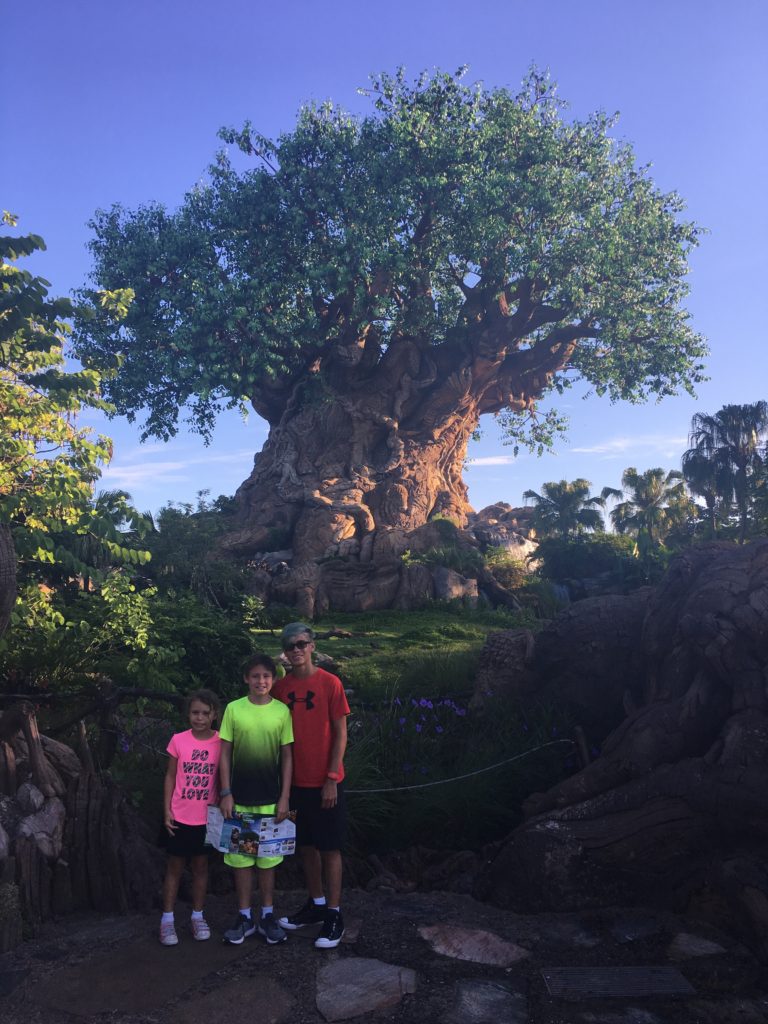

Cardmember Exclusive Photo Ops

Cardmembers get exclusive character photo ops at both Disneyland and Walt Disney World. At Disneyland, there is a separate photo op at both Disneyland and at Disney California Adventure. At Disney World, the special photo ops are at Epcot and Hollywood Studios.

The nice thing about these special photo ops is that you don’t have to use a Fast Pass to reserve a spot. The lines are usually much shorter, and you get a free photo download.

No Annual Fee

My version of the Chase Disney Visa has no annual fee (there is another version with a $49 annual fee). It costs me nothing to keep it every year. Since my family goes on a Disney cruise or visits the parks at least once per year, keeping this card makes sense for me.

Who Shouldn’t Get the Disney Visa

If you are looking for a card to help you earn miles and points for a Disney trip, this is not the best card for you. The sign-up bonus is lower than what you can get on other travel rewards cards.

You’re better off getting an airline card or two combined with a hotel card to get free flights and hotels for your Disney vacation. Or, consider a card with flexible points you can use on any travel expense, like the Barclaycard Arrival Plus with a bonus currently worth $700.

But, if you visit the Disney parks frequently or cruise on Disney Cruise Line often, the benefits of the Disney Visa are worth considering.

Disney fans, do you own the Disney Visa? Why or why not?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

I really don’t see much value in the Disney Visa. I can frequently purchase Disney gift cards at a 10-20% discount from face value which I generally use on dining or park tickets.

The Citi Prestige card gives you the fourth night free on hotel bookings twice per year. You’ll get maximal value with 4 or 8 nights at Disney World. You can book a Disney resort through the thank-you travel portal. This could easily save you $700 or more on a booking which easily covers the annual fee on the card. Just be sure to compare the prices on the Citi website vs Disney’s prices. You’ll also get a $250 travel credit with the Prestige card which helps to reduce the card’s net annual fee.

@Barry Yes, there are definitely better cards out there to save money on a Disney vacation. I do love the 0% financing and the other onsite benefits, though. I got this card years before 5/24 was a thing.

I’m keeping mine for those reasons 🙂 I miss the Pink Carriage Design; I loved that one.

@Robin I never saw the pink carriage design! My husband was glad when the Darth Vader design came out because he didn’t like previous design he had.

The Chase Disney debit card comes with the same benefits minus the 6 month financing.

@Jared I don’t use a debit card but it’s nice that there are multiple options with similar Disney benefits. The debit cards don’t earn any points and don’t have a sign-up bonus.

I also have the card for the same reasons you shared, but also love the Disney designs. You get to choose from several and somehow just adds a little pixie dust to my wallet!

Oh yes, how could I forget about the fun designs? I have the castle design and my husband has Darth Vader.