I am what you would call an “undesirable customer” for most major banks. Ditto for my husband. They are onto us, for sure, which is why many credit card offers are currently off limits for yours truly. Either I don’t qualify due to 5/24 rule or the bank computer simply looks at my profile and spits out “Nope” on the decision page. I’ve noticed that many of our applications don’t even go into pending status anymore. Banks have gotten incredibly smart lately, much to my dismay.

But not all hope is lost as I wrote in my post on Terps Visa, an obscure yet lucrative offer. And what is better than one Terps card? Two, of course! Which is why I applied in my husband’s name, so we could double dip on the rewards. If all goes well, we should be able to mostly cover my parents’ airline tickets from Belarus to Florida next year.

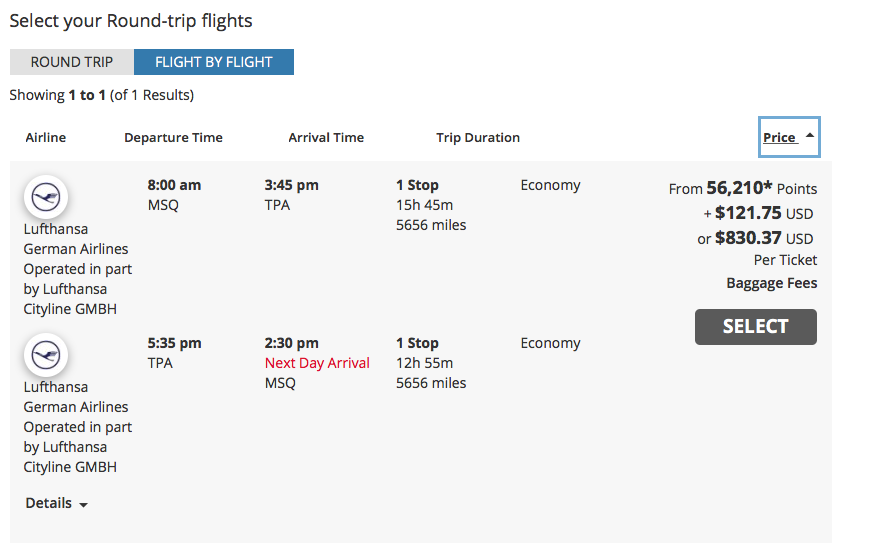

I just got my bonus, so was able to price out a random flight, while using rewards:

A quick math calculation will show that I would be able to get 1.25 cents per point. Very nice.

Just like my application, my husband’s went to pending status at first. But a few days later, he was approved. As I’ve mentioned before, I can’t guarantee that you will have the same result. But obviously, Terps folks aren’t that picky based on our experience with them. Plus, the card pays me no commission whatsoever, so there is definitely no incentive to push you in that direction.

If you are under 5/24, then going after Chase or possibly Capital One cards may be prudent at this time. Those will be harder to get once you go down deeper into the rabbit hole of miles and points. You’ve probably heard about new Southwest card offer that gives 30k points+Companion Pass for 2019. If you are planning to do a lot of flying this year, then the bonus is certainly worth considering. It’s not really an option for me, so Terps Visa it is.

So, now I have to find a way to spend $5,000 in 3 months. Honestly, between braces, things breaking down in the house and all other bills, this has not been an issue lately. At all. I actually finished minimum spending on the first Terps Visa ahead of schedule. In fact, I felt like I can probably sign up for another card if minimum spending requirements are $1,000 or less.

Looking at various offers, I decided to apply for Amex EveryDay (no annual fee) in my name. The sign-up bonus is only 15,000 Membership Rewards points, but my husband could refer me and collect 10,000 points as a result. It’s still not a mind-blowing offer, but it’s decent. I value 25,000 MR points at around $300. Plus, like I said, the minimum spending is only $1,000.

As far as I’m concerned, you can never have too many flexible points. It’s kind of like cash. Have you ever heard anyone complain that they have too much money in savings? Well, unless they are in bad health and regret not spending it on travel while they had the chance.

Off topic, but Nancy and I added our personal referral links to our Support the Site page in case you are looking to use them instead of affiliate links. The links have a mind of their own and occasionally stop working. Also, unfortunately, I can’t guarantee that every referral offer will be the best one out there 100% of the time (though I do try). So, always do research before applying.

Fail, then success

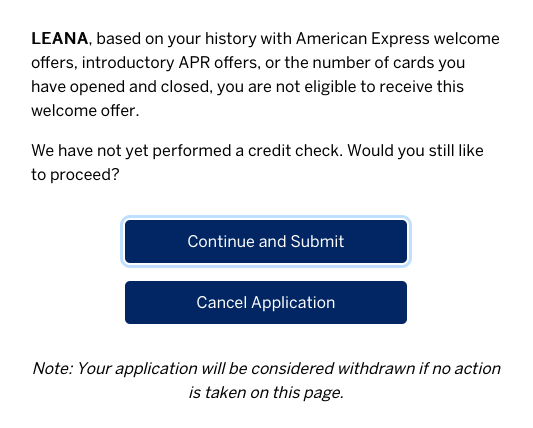

Unfortunately, I got the dreaded pop-up telling me that based on my history with Amex, I’m not eligible for new welcome offer. Darn it.

Well, you win some and you lose some. After giving it some thought, I decided to do an experiment. I wanted to see if the pop-up would appear on other Amex offers as well.

Well, you win some and you lose some. After giving it some thought, I decided to do an experiment. I wanted to see if the pop-up would appear on other Amex offers as well.

After looking at the line-up of cards, I’ve decided to apply for Hilton card with no annual fee. The referral offer (still available) is 100,000 points after spending $1,000 in 3 months. Hilton points aren’t that valuable, but 100k stash can still be leveraged nicely towards a getaway or two.

We live in Florida, so there are many fun options nearby. Hilton Orlando Bonnet Creek property can be booked for 40k-50k points per night and I’m sure my kids would enjoy the resort. See my review of Waldorf Astoria Orlando, its sister property. Just don’t burn your points on it because at 80k points per night it’s definitely overpriced. But you can walk over from Bonnet Creek resort to admire the chandelier and clock in the lobby at no cost.

<

p style=”text-align: center;”>Two words: Fancy pants

Not too long ago, Amazon had an option where you could cash out your Hilton points at 0.5 cents each towards valuable gift cards. Unfortunately, the promo was short lived and I missed it (both times). I saw a post on DoC saying that American Express is considering adding this option permanently to Amex Hilton cardholders.

That would be sweet, though I’ll believe it when I see it. But I am intrigued and would be inclined to hang onto my Hilton points for few years, just in case. A nice thing about regular Hilton card is that you don’t have to cancel it. If all goes well, my 100k points stash may someday be worth $500 in Amazon gift cards. I’m tingling with joy just thinking about it!

Anyway, the dreaded pop-up didn’t appear this time. Approved. Clearly, Amex uses a different set of criteria for its cards. I suspect that they are more picky when it comes to MR-earning products, not so much when it’s a co-branded card. Unlike Chase and its 5/24 rule, nobody actually knows what Amex’ proprietary formula is.

I was just happy to get approved. I speculatively value 100k Hilton points at $300 at most, and since I used my husband’s referral link, we collected 10k MR points in addition to that. All in all, a pretty nice haul and why I don’t plan to stop applying for new credit cards. At least not while (some) banks are still willing to approve me.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

if they continue finding any reason they can to deny points or claw them back, many of us won’t give them the chance anymore! I just upgraded a hilton card to an ascend with no language for 150k. Guess now I’ll be really shocked if I get the points!

@Lynn That’s a really nice upgrade offer! In all likelihood you will get the points, so don’t sweat it (yet).

@Lynn I had the same upgrade offer in my AMEX Aspire account that I had planned on doing. We stay at Hiltons a lot so it seemed worth it even with the high initial annual fee, but now I don’t want to try because I’m concerned they will deny me the bonus even if I do not get notified of ineligibility! Same for my husband.

Hopefully you won’t have a problem! It really is a great upgrade offer!

I’ll let you know if I get it. I’ve had the Surpass before that became the ascend, but I didn’t see any language that’s usually there disqualifying me. If you’ve never had the Aspire card before, I’d go for the offer or just apply directly, especially if you haven’t opened or closed many amex cards.

I thought I would add an interesting (ie not good) data point regarding Amex pop ups. My husband and I both applied for the SPG personal cards before August 26. We’ve never had the cards but we do have Marriott personal cards from 2015. We were both instantly approved and neither of us saw a pop up saying we were not eligible for the sign up bonus (we wouldn’t have bothered with the application otherwise). We met the minimum spends fairly quickly and I waited for the bonuses to post but they never did. Finally about a month ago I asked Amex about them and they told me neither of us were eligible and we should have seen the pop ups. Apparently the reason for ineligibility was because Amex thought we were churning their cards ie only getting the sign up bonus and then canceling (which was not true as I pointed out to them). We’ve both had 6 Amex cards (1 business and 5 personal – one used to be a Citi Hilton) of which we each canceled 2 cards after 1 year and 3 years, and we put decent spend on the ones we have. We’ve asked them to escalate and review our situation because their reasoning wasn’t even true in our case although I’m not hopeful 🙁 Has anybody else had this happen? I was totally dumbfounded. Btw Amex didn’t seem to care about other bank cards. They were insistent that we were churning their cards although they couldn’t tell me which cards we’d “churned”.

It makes me not want to apply for any new Amex cards! What if I don’t see a pop up, but I’m still not eligible for a bonus?

@Tammie That’s an extremely unfortunate development! I have seen similar reports and sadly, I’m not surprised. The pop-up system is not very reliable. I was skeptical from the beginning, actually. I got the bonus on my husband’s Hilton and Delta cards, so hopefully the same will happen this time. But I would be scared to apply for a card with an upfront huge annual fee, like Amex Hilton Aspire or SPG Luxury card.

The problem is that Amex has changed the language in the terms saying that they can deny the bonus for whatever reason. So there isn’t a whole lot a customer can do. I think it’s sneaky and unfair, but it’s just how it is.

I tried to apply for the Amex Gold card recently. The only cards I have ever had from Amex are two Hilton cards, which I haven’t canceled and still have. I got the pop-up also. Not sure why they pegged me as a churner.

@Jennifer I definitely think MR earning cards are tougher to get overall. Not sure how they determine “churning”, but it often doesn’t make sense.