A few months ago I published a post outlining my plans for a semi-camping experience in Lion Country Safari KoA I call it that because we were supposed to be staying in a cabin, not sleeping in a tent. However, there would be no bathroom or shower in the unit. Yeah.

I had second thoughts from the get go because this type of travel isn’t normally my cup of tea. However, I knew my kids would love it, so I kept the reservation. Well, six days before the trip I found out that I goofed big time. You see, several months ago my sister-in-law has mentioned that she would be taking the kids to Cirque Du Soleil performance in Tampa on Saturday December 21st. Our campground stay (on the opposite coast) would be from December 20th-22nd.

I wanted to go ahead and cancel our stay, but we would lose $150 deposit. So, we decided that we would pack all the junk and go to Lion Country Safari KoA for just one night. That way we would still get to have the bathroom-less lodging experience and be on speaking terms with my SIL. #Winning

Alas, it was not meant to be because on Thursday I got a phone call from the school’s nurse telling me my daughter was running a fever. So, off to the doctor we went. To be honest, I was actually relieved that we wouldn’t have to drag all of our junk for one-night stay.

However, we would end up losing $150 deposit and I was hoping the campground manager would take pity on us since I now had a legitimate reason for cancellation. She was kind enough to give me $35 refund which is better than nothing, so my total loss was $115. I’m not complaining because they didn’t have to give me anything.

The thing is, I probably could have gotten that $115 back if I paid with the right credit card (which I didn’t). I used my Chase British Airways Visa since at the time, I was working on meeting minimum spending requirements for new bonus.

Most of my trips fall into two categories: expensive/complicated vacations and local weekend getaways. When it comes to former, I always buy trip insurance, for reasons outlined in this post. I used to not give much thought to short local getaways, but will from now on. When you have kids in public school, they get exposed to all kinds of germs. Right now there is an outbreak of flu on our community, so it’s not surprising that my daughter picked up the virus.

There is a misconception out there that only premium credit cards with big annual fees have adequate travel insurance. Not necessarily. In fact, I have at least three cards in my wallet that come with travel insurance. They are: Merrill+Visa Signature (no annual fee, no longer available for new sign-ups), Chase Freedom (no annual fee) and Chase Hyatt Visa ($75 fee, but annual hotel certificate makes up for it) . Which one offers the most comprehensive travel insurance? Let’s take a look.

The devil is in the details

1)Chase Freedom (link to benefits file)

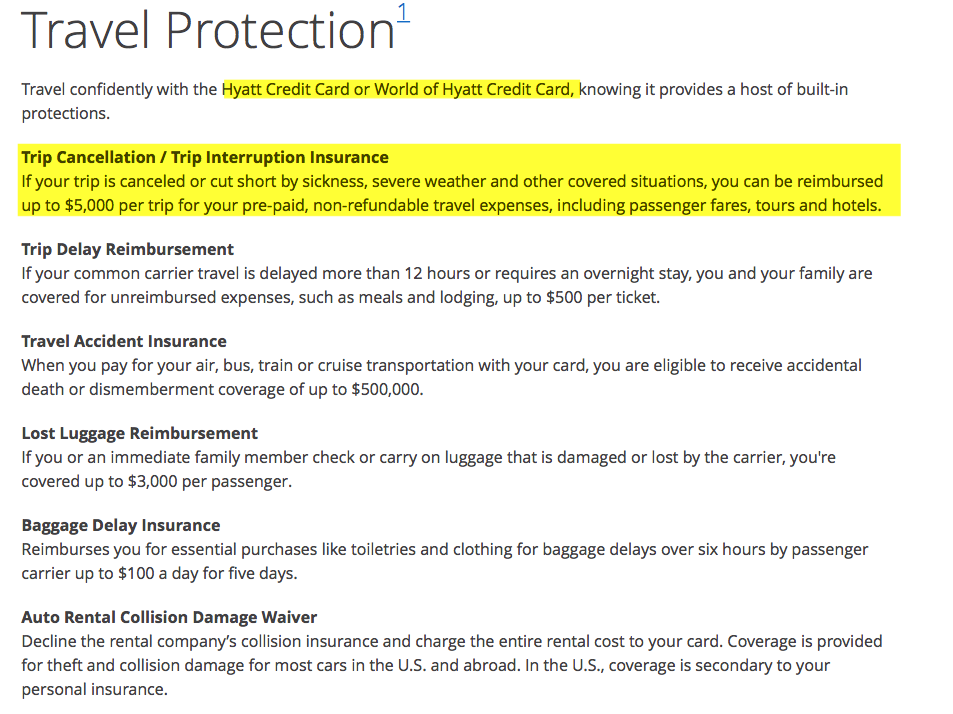

When you scroll down to travel insurance section, here is what it says:

Digging deeper, this is what “fare” term means:

So, it appears that my campground deposit would not be covered under Chase Freedom policy.

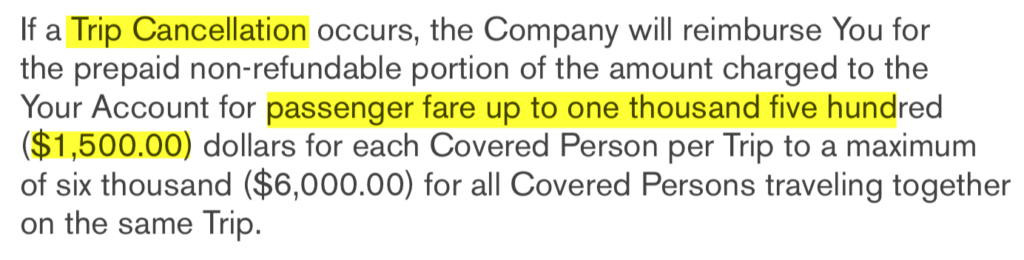

2) Merril+Visa Signature (link to benefits file)

As I said earlier, the card is no longer available for new sign-ups, but many of us in the miles and points community have it.

Similar to Chase Freedom, the benefits guide uses the term “fare”, which I assume only includes airline/train tickets and cruises:

I couldn’t find more detailed information on travel coverage, but I’m fairly certain that I would be out of luck if I used my Merrill +card.

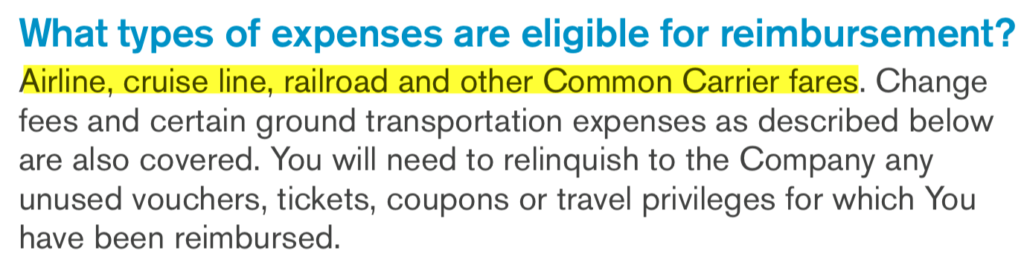

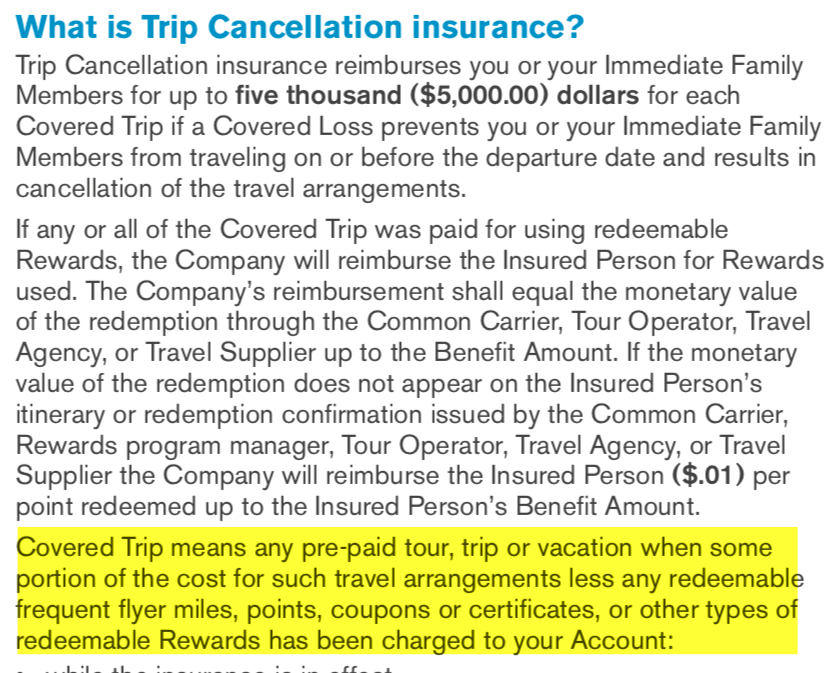

3) Chase World of Hyatt Visa Signature (link to benefits file)

Both old and new versions of the card have identical benefits.

It appears that the definition of covered travel expenses is more broad:

I imagine that campground would be considered a hotel, but I’m not 100% sure. When you dig deeper, it appears that it should at least fall under “vacation” category .

I imagine that campground would be considered a hotel, but I’m not 100% sure. When you dig deeper, it appears that it should at least fall under “vacation” category .

Ding ding ding!

The winner: Chase Hyatt credit card

Bottom line

Of course, if you have another premium credit card, your travel coverage may be superior to Hyatt co-branded product. Incidentally, the benefits guide for Chase Sapphire Reserve uses the term “trip” rather than fare. But since I don’t have CSR, my best bet is from now on to stick to Hyatt credit card for all travel reservations where I don’t purchase a standalone insurance policy.

I plan to keep renewing my Hyatt Visa anyway due to annual Category 1-4 certificate, and few points I would earn from another card are not worth it in case we need to cancel our travel plans. And with small kids, the chances of that happening are always more than zero. Plus, the card is now subject to 5/24 rule, so I’m definitely not getting rid of it. I think even with $95 annual fee, it’s still worth it.

Leana’s personal referral link for Hyatt credit card

Nancy’s personal referral link

Sure, it’s tempting to use a card where I have to meet minimum spending, but it’s simply not wise. Lesson learned. Will we ever go back to Lion Country Safari? I hope so. Will we stay in a cabin with no bathroom? Eh, maybe not.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thank you for posting this, I did not remember Hyatt has that good of coverage!! And yes it is always a dilema of which card is best for the particular trip I am planning.

Have you ever filed a claim on the travel insurance you buy? I have heard many stories of it being a huge hassel to try to get any money from a travel insurance policy. Lots of people say it’s great, but then when you ask you find out they have never filed a claim. So how can they say it’s great? Just curious if anyone has info. Thanks!!!! Clyn6

Once I dug deeper, I too was surprised by how good Hyatt Card travel insurance is. As far as fling claims, yes, I have done it three times actually. All worked as intended, which is why I’m a big believer in a stand-alone insurance policy. I recommend http://www.insuremytrip.com

Many people rely solely on credit card travel protection. That’s fine, but there are caveats (see my linked post). For those with pre-existing health conditions, a stand-alone policy with a waiver if you purchase within 14-21 days after making a travel deposit, is definitely the way to go.