Not long ago, American Express has launched a new card called Starwood Preferred Guest Luxury (see related post) The standard offer on this product is 100k Marriott points. However, some people, including yours truly, received a targeted offer of 125k points. The expiration date on my mailer is December 9th and up until recently, I was seriously debating on whether I should pull the trigger.

The problem is, I am currently working on meeting new minimum spending requirements on several cards. It will probably be the end of December before I finally take care of those. Another issue: on January 1st of 2019 I will be eligible for new sign-up bonus on Citi AAdvantage card.

I never really got into “targeted mailers from Citi” game, and prefer to do it the old-fashioned way. If you have no clue what I’m talking about, go to Reddit.com because it’s not something I’m comfortable with explaining. Anyway, AA miles may not be what they once were, but I will happily accept 50k-60k of them, especially when the annual fee is waived. What to do?

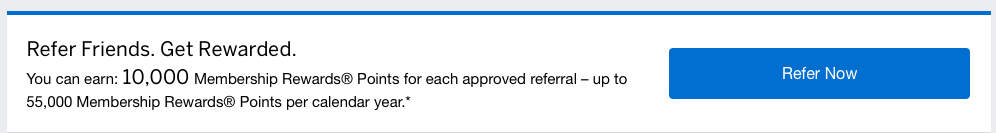

Fortunately, Amex has just solved this issue for me. I’m talking, of course, about personal referral links that can be generated for any American Express card, not just the ones you currently have. This is a new development, but here are few things we know:

1) Self-referrals seem to work, at least for now. I don’t know if Amex will crack down on this practice in the future, but there is nothing in the terms to forbid it.

2) Your referral will earn the type of currency that is attached to the card from which you generate the link.

See more details on this new development in DoC post and scroll through comments for the latest data points.

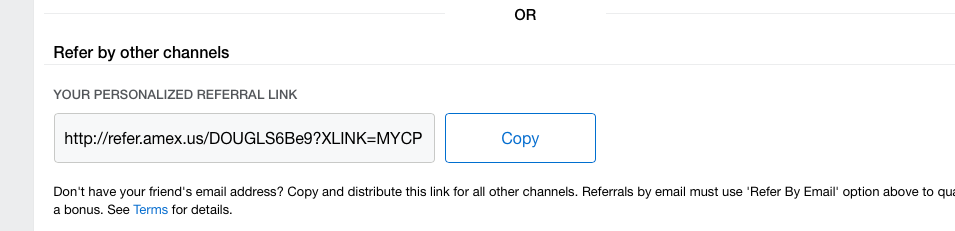

Let me give you an example. My husband has an Amex Everyday card with no annual fee. Let’s say I want to apply for Amex SPG Luxury card and use his referral link. Keep in mind that neither one of us currently has any cards that earn Marriott points. In order to generate the link, I would start by going to his Amex Everyday card profile:

I would click on it and find his referral link:

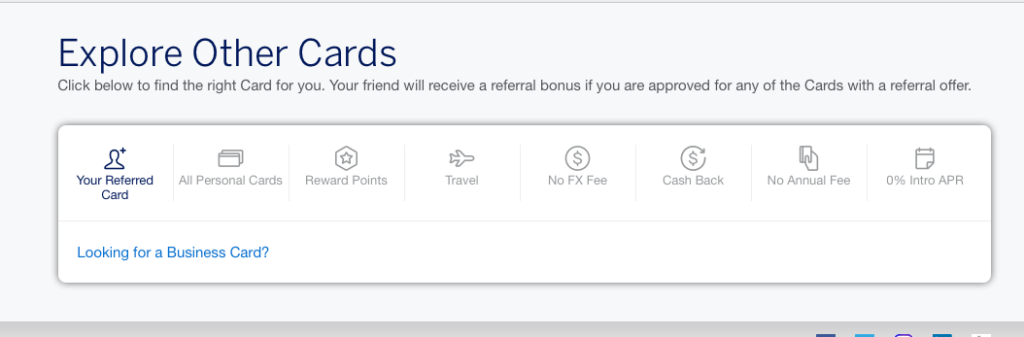

I would then paste it and scroll down to the bottom of the page because I don’t actually plan on applying for Amex Everyday:

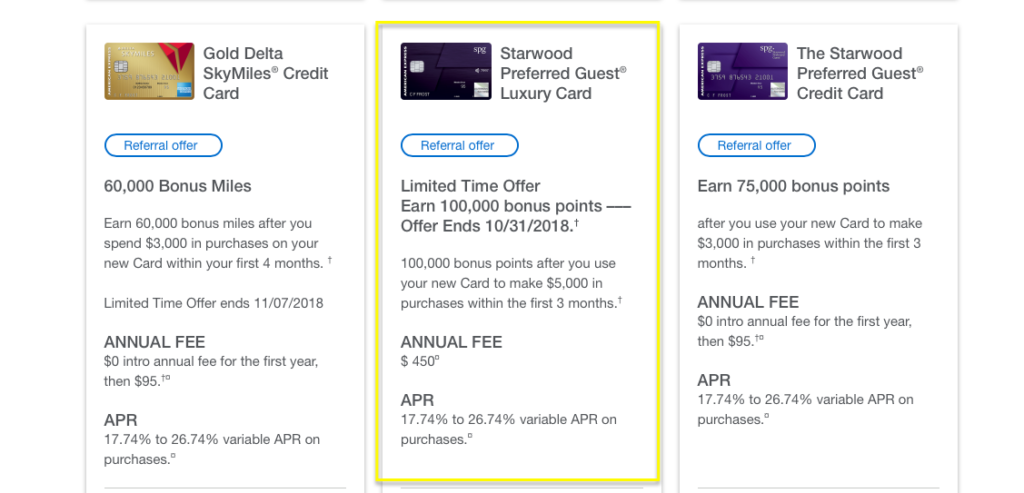

After clicking on “All personal cards” link, I find my Amex SPG Luxury offer:

Right now the ending date for the offer is October 31st, but I have every idea that it will be extended. But wait! It’s 100k points bonus, which is 25k points lower than my targeted offer. True, but if all goes well, my husband will get 10k Membership Rewards points for referring me.

To me, 25k Marriott points are speculatively worth roughly the same amount as 10k MR points. Remember, I would get no extra kickback when applying for targeted offer. So, as long as this referral program sticks around, it will be basically a wash. And who knows, maybe Amex will increase the official bonus in the future.

Application timing is important

Aside from wanting to apply for Citi AA offer next, there is another reason I want to wait on Amex SPG Luxury card. It has to do with $300 annual credit valid at any Marriott property. I certainly don’t want to arrange extra hotel stays just to take advantage of it, and would prefer to spend it organically. It goes without saying that the card will be canceled before renewal fee hits. Buying Marriott gift cards at the front desk should trigger the credit, but I would rather not chance it.

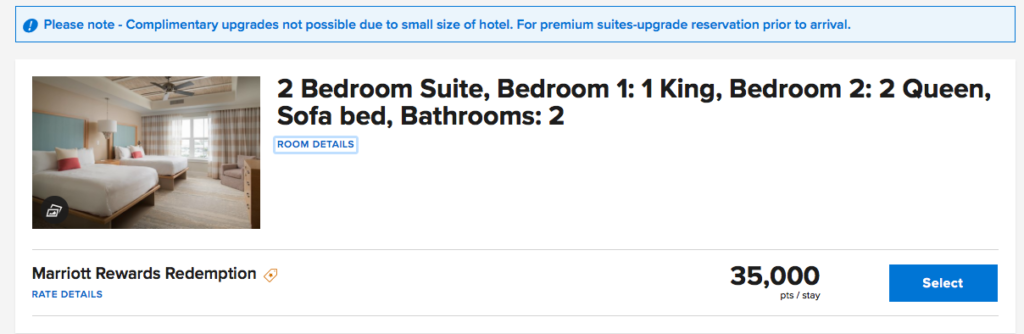

As it turns out, not long ago I’ve discovered a pretty sweet deal in our neck of the woods: Waterline Marina Resort and Beach Club, Autograph Collection A 2-bedroom unit at this property costs only 35k Marriott points, which is a bargain in my book. I’m hoping to bring my parents to US in March of 2020 and would like to spend at least a few nights at this resort. That means I really should wait until April of 2019 to apply for the card. That way we could utilize the $300 credit for several meals on-property. Yes, the unit has a full kitchen, but I would prefer not to cook non-stop while on vacation.

I’m hoping to bring my parents to US in March of 2020 and would like to spend at least a few nights at this resort. That means I really should wait until April of 2019 to apply for the card. That way we could utilize the $300 credit for several meals on-property. Yes, the unit has a full kitchen, but I would prefer not to cook non-stop while on vacation.

A nice thing about Marriott program is that you can reserve your stay even before you have the points in your account. So, I could lock in the award right after booking the flights and then apply for the card.

As I’ve mentioned before, Anna Maria island (where the resort is located) is one of my favorite places in Florida. During spring months you can’t even touch a motel room here for less than $250 per night. So paying 35k Marriott points for a 2-bedroom unit is definitely a hot deal.

We actually live only an hour away, so since my husband was off on Columbus day, we went for a drive to the beach. Plus, I figured it would be a good chance to scout the location of this Marriott property.

<

p style=”text-align: center;”>The hotel is set on the bay side of the island

The area around the resort is more built-up than I thought it would be. Also, the beach isn’t super close, though the hotel apparently provides free shuttle to its own beach club.

There are several places to eat nearby, so you won’t be held hostage by resort prices on food. Overall, the area wasn’t as quaint as I hoped it would be, but I still think it’s a terrific deal. And the beaches on Anna Maria island are absolutely beautiful.

There is a scenic park we stopped at, where you can sit on a bench right by the water.

If I wanted to spend 5 nights at this Marriott, I would need a total of 140k Marriott points, since the 5th night is free. In that case applying for targeted 125k offer would be a better deal. I will be OK with only 3 nights because we will probably end up taking my parents to another area in Florida, so it’s not a huge factor.

You don’t really need a reason to acquire Marriott points

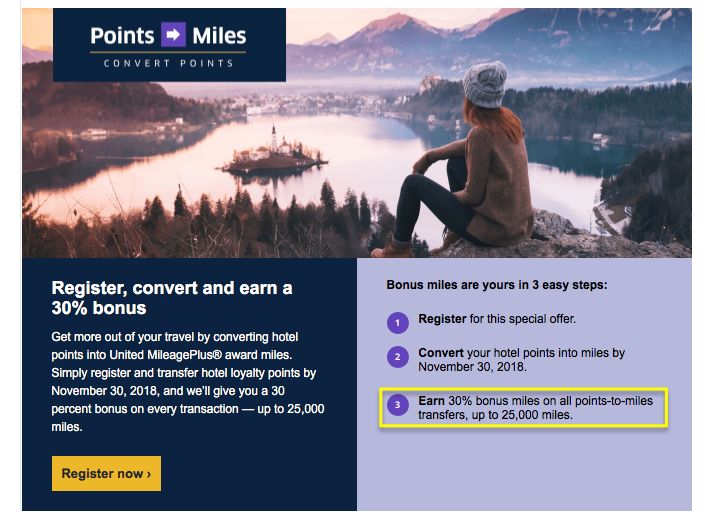

It certainly helps, but the points are valuable regardless. After all, you can transfer 60k Marriott points to 25k miles in many programs, including Southwest. Occasionally, there is a bonus, like the one United is offering right now.

It’s not advertised on Marriott side, but according to my email, all hotel programs are eligible. Keep in mind that Marriott already adds 10% bonus to all United transfers. That means that via this promo you will get almost 36k United miles per 60k Marriott points.

It’s an excellent transfer ratio and for some, will be worth doing speculatively. Basically, you are trading 1 Marriott point in exchange for 0.59 United mile, and that’s nothing to sneeze at.

United program is very user-friendly. The Star alliance redemption rates aren’t always the lowest, but at least you can book everything online and there are no fuel surcharges, ever.

If you are willing to go down the “rabbit hole”, take a look at this post by Nick at Frequent Miler blog. It has a good explanation of Excursionist perk, which is unique to United program.

One decent use that I can think of for normal people is adding a free inter-island flight leg in Hawaii. One of my readers has actually reminded me of it. There are many other possibilities as well.

I’m not sure I would start with Amex SPG Luxury card if you don’t currently have any other American Express cards, but if you are looking to apply, below are our referral links. Thanks if you use them! If you are interested in a different Amex product, you can simply scroll down to the bottom of the page and follow the steps outlined earlier in the post.

The 100k offer has expired, so I would hold off applying for now. If you are looking to apply, here is referral link for 75k points:

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] again, you should probably get Amex SPG Luxury card (see my review) that gives you automatic Gold Marriott status. This will allow you to earn 12.5 points per dollar […]