Remember my post Why I plan to apply for Delta co-branded card (just not now) from few months ago? Well, I’ve decided that now is as good a time as any. No, I have zero interest in chasing Delta elite status that some Delta cards help you achieve via spending. And I don’t really have any specific plans to fly Delta in a near future, so free checked bag benefit means nothing to me. Finally, I don’t have any trips in mind where I would need to redeem SkyMiles fairly soon.

Why then? It comes down to accumulating miles at a very low cost, and this certainly qualifies. I don’t pay attention to all the bloggers who say SkyMiles are worthless (which they probably are for some), and instead prefer to do my own research. And what I’ve found is that Delta currency can be extremely useful under the right circumstances. SkyMiles never expire, so there is also no pressure to keep your account active.

You’ve probably seen blog posts mentioning periodic sales Delta seems to have to certain destinations. Prices can be dirt cheap at times, like 10k miles for a roundtrip flight to Caribbean. Yes, with Delta you pretty much pay what they tell you to pay. But let’s face it, very often the rate will beat anything you can find in a program with a fixed award chart.

There is another reason I’ve decided to pull the trigger now. I’m convinced that US banks will only keep tightening the rules, at least until the next recession is upon us. We’ve seen it with all the major players recently. Amex is somewhat unique because they use bonus qualification tool, which I wrote about awhile back. I’m still not certain what formula goes into it, but the goal is obviously to weed out anyone Amex deems to be a bad customer.

The tool has flagged me when I tried to apply for Amex Hilton Honors card (no fee), but not my husband. In addition, there have been many reports where the warning pop-up didn’t appear even though it should have, since that person happened to have the card they were applying for.

Regardless, Amex is sending a clear message to miles and points community and I fear things will only keep getting worse. I certainly don’t lose sleep over it and frankly, find the gnashing of teeth in the blogosphere/comment sections to be silly. Of course the banks will try to protect their profit margins. Why wouldn’t they?

Anyway, as I’ve said, few months ago I was thwarted in my efforts to get approved for Hilton Honors credit card. Would the same thing happen again if I applied for Delta offer? Nope. The warning didn’t pop up, and I was approved. Of course, it doesn’t guarantee that I will actually receive the bonus, though I should. My husband did get his 75k Hilton points as soon as he met the minimum spending.

Besides, I’m not risking prepaying a giant annual fee here, and 60k miles is nothing to sneeze at. One thing I did before applying is cancel my Hilton Ascend card. I’ve already paid the second annual fee and no longer have a need for the perks that come with Hilton Gold status since my husband still has his Ascend card. I figured it might increase my chances of getting approved for Delta offer without the dreadful pop-up spoiling my plans. I’m not sure that it did, but results speak for themselves.

Bottom line: just because the pop-up appeared before, doesn’t mean you will see it the next time you decide to apply for one of Amex cards.

For the record, I’ve applied for Gold Delta SkyMiles Amex card, details below:

- Limited Time Offer: Earn 60,000 Bonus Miles after you make $3,000 in purchases on your new Card within your first 4 months. Offer expires on 9/19/2018.

- Earn 2 miles for every dollar spent on eligible purchases made directly with Delta. Earn 1 mile for every eligible dollar spent on purchases.

- Check your first bag free on every Delta flight – that’s a savings of up to $200 per round trip for a family of four.

- Settle into your seat sooner with Priority Boarding.

- Enjoy a $0 introductory annual fee for the first year, then $95.

This card does pay us commission if you want to support the blog. Keep in mind, last time this offer came with $50 extra credit, and you may be able to pull it up on Delta.com when making a dummy booking.

Possible plans for Delta stash

This falls under “don’t count your chickens before they hatch” category, but I just can’t help myself. At some point, we will be going to visit my family in Europe, and this is where Delta currency would come in really handy. I’ve mentioned before that I would like to stop in Amsterdam, and Delta happens to have a non-stop route from Orlando. Not only that, but they also apparently started flying from Tampa airport, which is even more convenient for us.

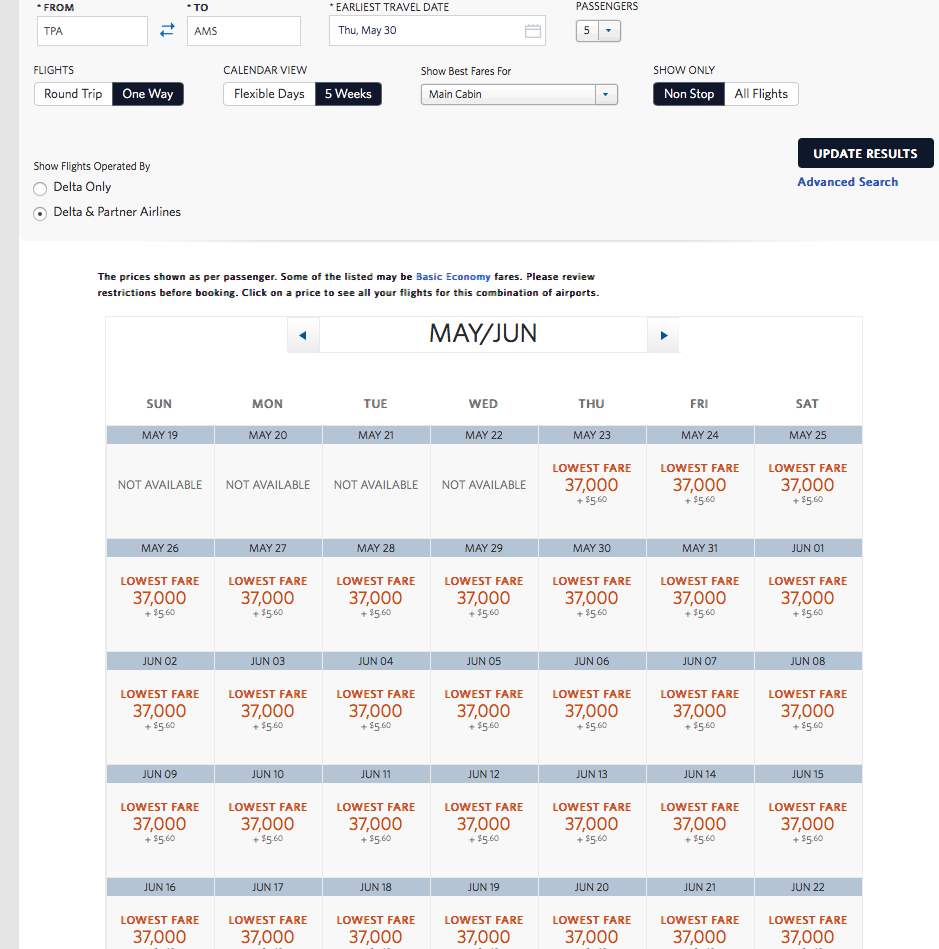

There is some availability for next summer, though we won’t be going for at least few years:

It’s not exactly dirt cheap, but it’s not horrible either, especially since Tampa doesn’t have a ton of options for those going to Europe. Plus, the flight times are excellent and did I mention that it’s a non-stop route?! I would have to top up the account with Membership Rewards that transfer to SkyMiles program 1:1 in order to get two tickets.

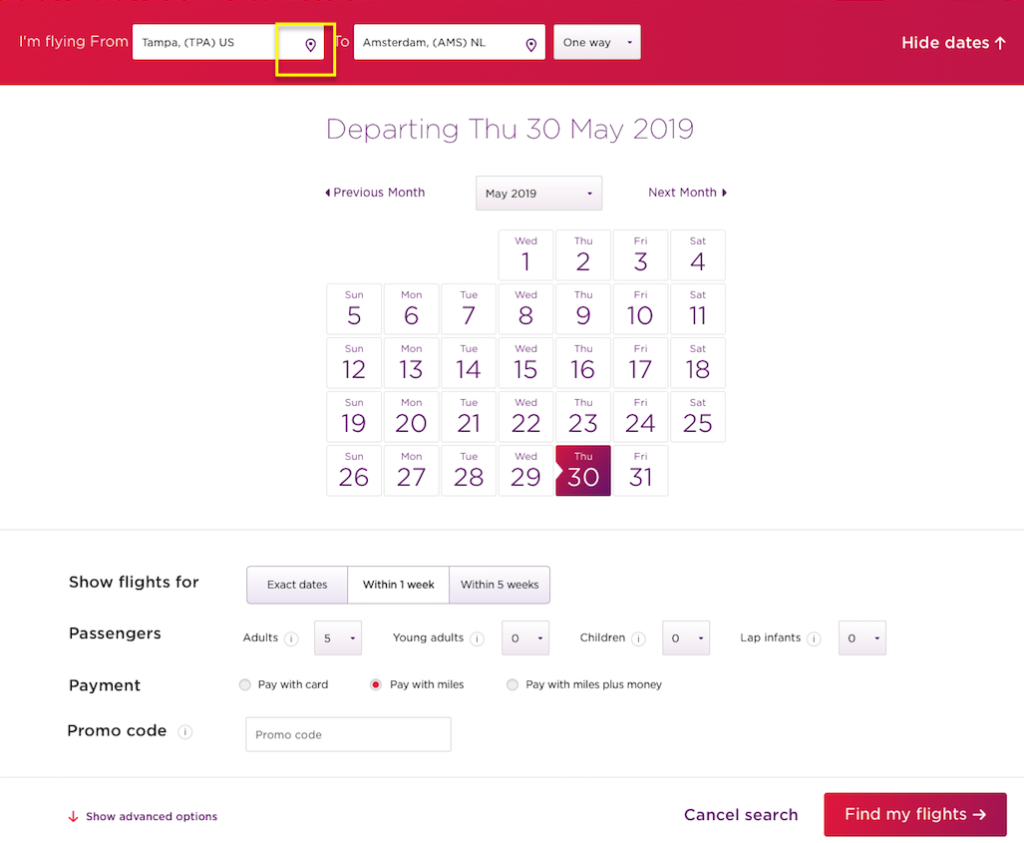

You may have noticed that I put five people in search. That’s because my sister-in-law will probably be coming with us. So, what about the other three tickets? We will probably use Virgin Atlantic program, a partner of Delta. Here is where it gets interesting. The same exact flights cost 30k Virgin Atlantic miles.

You can now book Delta flights online, just search for the airport manually.

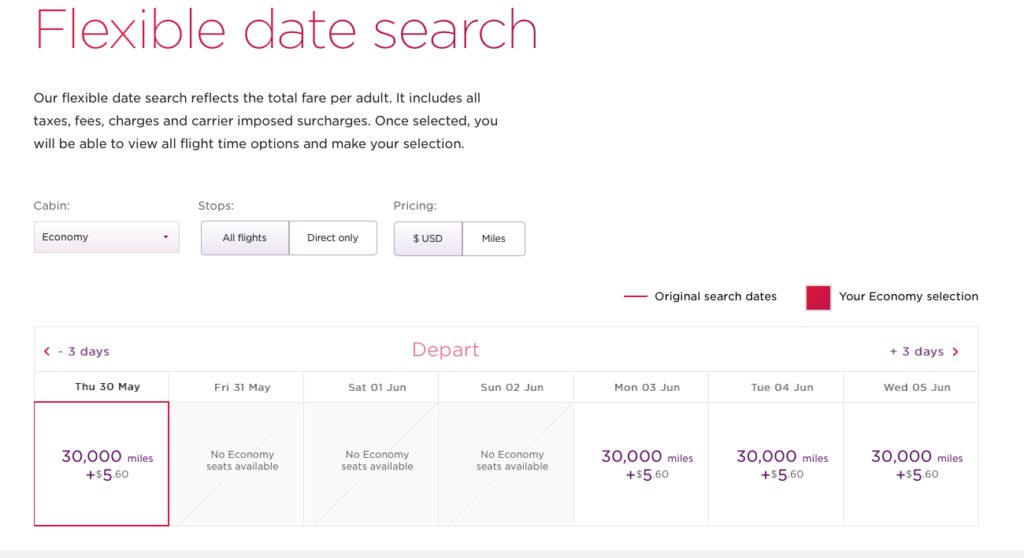

You will then see this screen where you can select the flight:

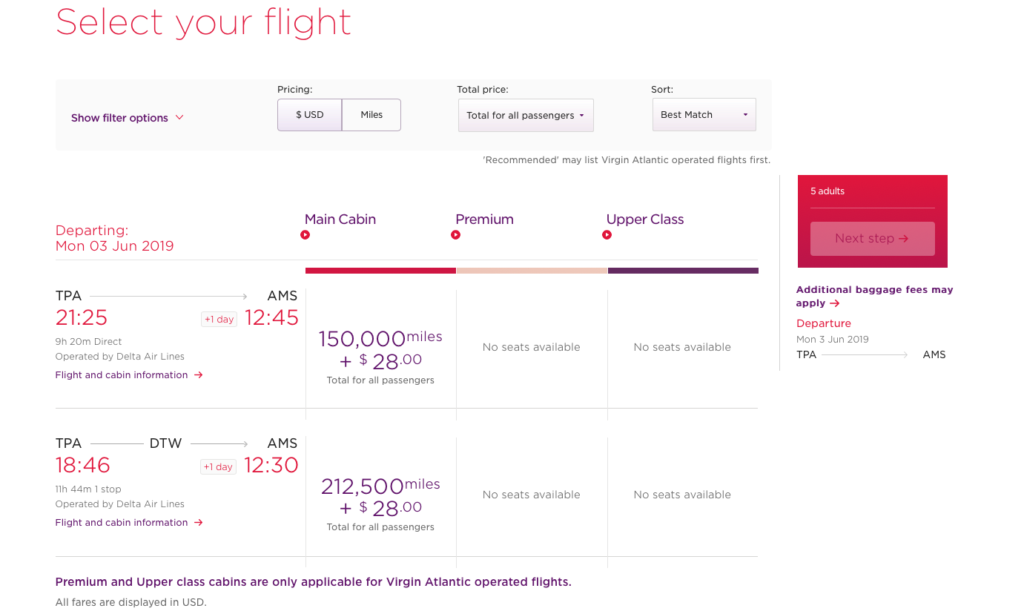

And here is the total price for five people:

Not too shabby, especially if you take advantage of a transfer bonus to Virgin Atlantic, like the one Citi is running right now. I’ve said before that Virgin Atlantic is somewhat underrated, though I fear many of the sweet spots will disappear when they revamp the program in a few months. Before you transfer your flexible points, call Virgin Atlantic and put your awards on hold (24 hours). That should be enough time for the miles to hit your account.

OK, if Virgin Atlantic program is so great, why bother with Delta cards?

Because I don’t have enough flexible points to book five Delta tickets. And I’m currently not eligible for any card that earns flexible currency. Well, I could technically try to pull up 25k points bonus on Amex Everyday in incognito browser like I did for my husband. But 60k Delta miles will beat 25k Virgin Atlantic miles even if you factor in higher award pricing.

The goal is to find a way to accumulate points at a low cost, and what can be cheaper than putting a $3,000 spend on a card in order to receive 63k miles? This isn’t rocket science, it’s simple math.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

“It comes down to accumulating miles at a very low cost, and this certainly qualifies.”

Yes, accumulate as much as one can while it is available.

“…it doesn’t guarantee that I will actually receive the bonus…”

You can chat with CSR to see what your earning structure and bonus are with this card. If no bonus, then no need to put spend on it.

@Rob That’s a good point. Though I will tell you this: Amex doesn’t stand by what their own reps tell customers. I’ve learned it the hard way. Still, it certainly won’t hurt!

Maybe do an online chat and take a screenshot in case there are discrepancies?

@Rob I’ll definitely do that. Though again, I did take a screenshot last time, but it didn’t matter. Still, it’s a good policy in case there is a dispute later on.

Leana,

I always had luck with “skypesos”. Despite being revenue base I feel it worked well for my needs. My son started kindergarten and I don’t think is right for him to miss school (he got a scholarship on a private school). So now I am on mercy of the evil school calendar. I had 120k Delta miles from signup bonus and 2 flights from my very unlikely gold status.I found 3 tickets to San Francisco to spend Thanksgiving with friends and family. 120k can get me to China with my son, but spending Thanksgiving with friends and my aunt is worth it to empty my account. BTW the revenue tickets would cost me $850 a piece…

Tania

@Tania Congrats on getting the full scholarship for your boy! How exciting. But yes, the school calendar is evil indeed. I constantly see deals that we simply can’t take advantage of. Oh well, the alternative is homeschooling and that is something I’m not willing to consider. Not yet, at least. I have zero patience and would never make a good teacher!

I think you got a fantastic deal with your Delta Miles. It’s true, there is seemingly always a better way to use your miles. Some sweet spot with crazy CPM value. But I tend to use miles for what I need even if the return isn’t spectacular, which it often isn’t in economy class. I doubt I’ll ever take a shower on the plane, but I honestly couldn’t care less. My home has a shower. 🙂