As most of you’ve heard by now, Amex has just launched Starwood Preferred Guest American Express Luxury card. Here are main details on the offer (I’m bolding points that are important to me personally):

100,000 Marriott points after spending $5,000 within the first 3 months

$300 in statement credits for purchases at participating Marriott hotels each cardmember year

$100 Global Entry or $85 TSA PreCheck fee credit

Priority Pass Select membership (including two guests)

Annual free night award (up to 50,000 points) after card renewal

Automatic Gold status and the ability to earn Platinum after spending $75k in a calendar year

Boingo Wi-Fi access

15 elite night credits beginning in 2019

$450 annual fee, not waived.

Direct non-affiliate application link

Figuring out the value of the offer

Any time there is a giant non-waived fee involved, I think long and hard whether the “juice” is truly worth the squeeze. Often, applying for a card is indeed worth it, and it’s probably true in this particular case. However, this one is far from being a no-brainer for me. I speculatively value Marriott points at 0.5 cents apiece. Right now I don’t have any specific plans for miles or Marriott hotels, so this would indeed be my benchmark.

Following this logic, 100k points are worth $500 (to me). So far, so good. But remember, we have that giant $450 fee, so after deducting it, I’m left with only $50. So, now I have to figure out what other perks are worth in order to determine true value. We already got TSA PreCheck, and don’t plan to fly next year, so Priority Pass means absolutely nothing. Ditto for Boingo passes, Gold status and elite night credits.

The $300 in statement credits per cardmember year for purchases at participating Marriott hotels is the only perk on the list that I find enticing. But would I assign $300 value to it? No way, Jose! I usually use hotel points, and find Marriott hotels to be a bit overpriced. Yes, you can sometimes purchase Marriott gift cards on-property and hope that they trigger the credit, but it’s not a guarantee. So, I would have to apply with the assumption that I will be paying for a hotel stay.

We do have plans to overnight in Warner Robins, GA on the way to North Carolina next May. We would need three rooms, and they tend to run at $100 each. So, I could potentially use up the credit there. Then again, we were going to use IHG hotel points, and my sister-in-law is swimming in them at the moment. So, I really value $300 credit at maybe $200 max. That Marriott in Warner Robins runs at 12,500 points, worth to me approximately $63. So, I would have to choose to pay cash or use my existing bonus. Hence the value of $200.

So, that makes the offer worth $250 total. An OK bonus, but certainly not mind-blowing. Perhaps I’m overthinking this whole thing, but I just wanted to share my reasoning with the hopes that it may help some of you come up with your own number. If it differs from mine, it’s absolutely fine. For what it’s worth, I will probably apply for this card eventually, preferably before our stay in Warner Robins.

If you need AAdvantage or Alaska miles, you should absolutely consider this offer. You can transfer 60k Marriott points to 25k miles in many frequent flyer programs, which will otherwise cost you 2 cents apiece or more. The 100k points will almost cover a 3-night stay in many nice properties, including this beachfront Sheraton in Clearwater, Florida (35k per night) where Nancy vacationed with her family last March.

Who should seriously consider this card NOW

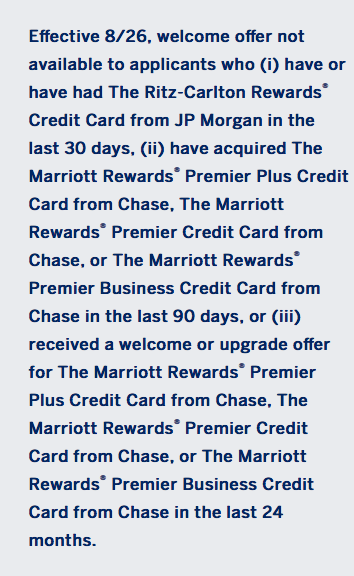

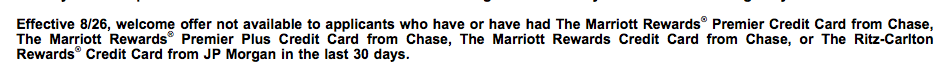

As many of you know, on August 26th, all Chase Marriott and Amex SPG cards will be subject to new restrictions (see full details on DoC) Here are the details that pertain to this particular offer:

Right now it’s August 24th, so as long as you apply and get approved before Sunday, you should be OK (in theory).

What about regular Amex SPG card?

Here is the current offer on the “plain vanilla” Starwood Preferred Guest Amex card:

- Earn 75,000 Bonus Marriott Points after you use your new Card to make $3,000 in purchases within the first 3 months.

- Earn 6 points for each dollar of eligible purchases at participating SPG® and Marriott Rewards® hotels and 2 points on all other eligible purchases.

- No Foreign Transaction Fees on International purchases.

- Receive 1 Free Night Award every year after your Card account anniversary. Award can be used for one night (redemption level at or under 35,000 points) at a participating hotel. Select hotels have resort fees.

- Enjoy complimentary, unlimited Boingo Wi-Fi on up to four devices at more than 1,000,000 Boingo hotspots worldwide. Enrollment required.

- $0 introductory annual fee for the first year, then $95.

So, the deal is this. Having the “vanilla” Amex SPG card will not preclude you from getting a sign-up offer on “luxury” card (again, in theory). So, if you currently have or recently had the mentioned Marriott Chase-issued products, you should probably consider applying before August 26th.

Of course, nothing is guaranteed with Amex, and applying for this offer may hurt your chances of getting “luxury” SPG card down the road. This is especially true now, with the introduction of bonus qualification tool. But it’s the chance I personally would be willing to take. Then again, I don’t really value the extras likes Priority Pass etc.

Bottom line

As always, the decision is yours. There are many other lucrative offers on the market, and skipping one or both of these products is not the end of the world. That said, Marriott points are quite versatile since you can redeem them on hotels or convert them to miles at a decent rate. This is the type of currency that I have no problem accumulating speculatively.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thanks to this blog post, I realized there was a hard deadline for me to make a decision about my husband’s and my next card(s). After weighing options, I decided to apply again for the plain vanilla Chase Marriott card before the the 26 August change in terms. We had applied back in March or April and were declined, and like last time, this time I got the response that they had to think about it and would let me know by mail within 30 days. So my husband applied again, and he got the same message. With those data points gathered, I decided to apply in my name for the so-called Luxury SPG card. We happen to have a Marriott stay coming up that we can use to take advantage of the $300 refund, though I can’t see that card being worth our keeping it long term. I got approved.

And then… yesterday we logged on to my husband’s Chase account to pay a bill on another card, and we saw that the Marriott card had been approved for him. My first worry was that they probably approved him after 26 August so he wouldn’t be eligible for the sign up bonus. We sent a secure message to Chase and asked about eligibility, and they confirmed that he was approved on 29 August but is still eligible for the sign up bonus of 75k points if he spends $3k in the first three months. I’m happy to have that reassurance from them and to have it in writing.

That’s going to be a lot of minimum spend to meet, but unfortunately/thankfully we have some big planned expenses coming up, and we’ll be able to do it. We’ll get a lot of bonus points out of it, too.

BTW, we applied for that Marriott card through your link. Thank you for the service your blog provides to us.

@Marianne Sorry for the late reply. First of all, thanks for reading and supporting the blog! I love getting comments like these, and hope you continue benefiting from the site.

Congrats on the approvals, it looks like you have a nice stash of Marriott points coming your way. I’m a little jealous, as I currently don’t have any! 🙂 BTW, it was very smart to get it from Chase in writing. Better safe than sorry.

I do understand what you mean by taking on a lot as far as minimum spending goes. I’m sort of in the same situation, except I won’t have any major bills till November. I was counting on Plastiq to make my car payments, but Visa no longer works for me. Oh well, I will probbaly preppy my power bill. It’s not like the credit won’t get used up eventually. It helps that we have some savings in the bank.

I totally agree — I can’t see the big excitement to spend $450 now. The miles are pretty much worth it, I agree, but I don’t really want to pre-pay for $450 worth of points. Yes, you get a $300 hotel stay, but I agree with you — that’s not really worth $300. Either I’m probably paying with points, or I’m someplace where there aren’t chain hotels so I’m not staying at a Marriott property, or I would find a cheaper cash price alternative to a Marriott. So yeah, maybe valuing that at $200 is fair.

Yeah, it’s a card that targets a specific group of people. I can see why those who are after Marriott status would find it enticing, but that certainly doesn’t describe me. Spending the $300 Credit will be a piece of cake for those who have plans to stay in a Marriott resort and who usually dine on-property. In that case, it’s almost as good as cash. Once again, I don’t see doing it in the next year. If you are desperate to top off AA or Alaska mileage account and can’t do it via sign up bonus, then this is the next best thing. Otherwise, just too much cost for too little upside. But I may change my mind in the future because it really comes down to travel goals.