I’m the type of person who always likes to have several trips lined up in advance. I would love to be spontaneous and just go with the flow for once but unfortunately, it’s not in my nature. Plus, daydreaming and planning the next vacation relaxes me and helps me disconnect from the crazy world we live in.

So of course, when I got my sign-up bonus (X2) on our Citi Thank You Premier cards, I started mapping out my next big trip strategy. Hawaii, South America, maybe even Tahiti…again? Between two accounts, we had access to 122k Citi Thank You points, which presented me with endless possibilities. I also currently have 85k Membership Rewards points, and many Amex mileage transfer partners overlap with Citi.

As I’ve mentioned earlier, I was able to match to the current 60k points offer by contacting Citi via secure message. For some reason, they deposited an extra 10k points into my husband’s account right away, but told me I would have to wait 1-2 billing cycles. Good enough, I’ll take it.

We just came back from a big trip, so I knew my husband wouldn’t be up for discussing travel. So, I planned to address the specifics in a few months. However, the other day he told me in no uncertain terms that he doesn’t want to fly anywhere in 2019. He just wants to go on a cruise that sails from our home state of Florida.

I knew I could probably change his mind, but decided it wouldn’t be fair. After all, he has just endured 10 flights in the span of two weeks Most of them were spent in a tiny economy seat, and he is a big guy. I thought it would be fair to do what he wants (for once). So, no flights for us in 2019 because I’m not crazy about taking the kids somewhere by myself.

So, I’ve decided to burn our Citi Thank You points on a cruise. Fortunately, it’s one of the best options in the program because you get 1.25 cents per point. For some unknown reason, Citi doesn’t advertise this type of redemption. They mention that you get 1.25 cents per point towards flights, but the reality is, you also get a bump in value towards hotels, cruises and car rentals. That makes the current bonus worth $750 towards travel, and that’s nothing to sneeze at.

Choosing the perfect cruise

This was my next dilemma. I looked at various sailings, and finally settled on 4-night Royal Caribbean cruise to Bahamas. As much as I would love to try Disney line, it ain’t happening due to ridiculous cost. It doesn’t mean you shouldn’t, of course. I simply wouldn’t enjoy myself knowing that I could take two cruises for what Disney charges for just one sailing.

It’s been 15 years since I’ve been to Nassau, and I’m looking forward to returning.The itinerary also includes a stop at RCL private island. I have decided to get two cabins because sharing one with a family of four would not be enjoyable for either me or my husband.

The sailing will take place during holidays so unfortunately, I didn’t snag an amazing bargain. But the price was decent (a total of $2160 for two balcony cabins, plus $200 in onboard credits), and my stash of Citi Thank You points would cover a good chunk of it. After we sailed in a balcony cabin in 2009, my husband refuses to settle for less.

<

p style=”text-align: center;”>Watching a sunset from the balcony

But then I started thinking: What if we paid for my sister-in-law to come and put the kids in her cabin? That way, my husband and I would have peace and quiet, but would have our spawn nearby at all times. My sister-in-law agreed. Winning!

Unfortunately, booking a triple occupancy cabin has raised the cost by $600, but I feel it’s worth it to spend some alone time with my husband. Plus, my sister-in-law really enjoys taking care of my kids, and they view her as a second mom. My son actually called her “aunt mama” once.

Booking the cruise through Citi Thank You Center

You can’t redeem your points online, instead you have to call 1-800-842-6596 number. But before contacting Citi, I filled out a price quote request on CruiseCompete You get several free, no-obligation quotes from cruise agencies. I often book cruises through Discover portal because you get 5% cash back on top of all the other perks. The downside is that you have to use Discover card.

After getting several quotes, I called Citi Thank You Center. A very nice agent confirmed that I can use my Citi Thank You points as a payment towards cruise. The cabin for me and my husband was more expensive compared to CruiseCompete quotes, but the triple occupancy cabin would cost an identical amount. So, I decided to book that one with my stash and go through another agency for the second cabin.

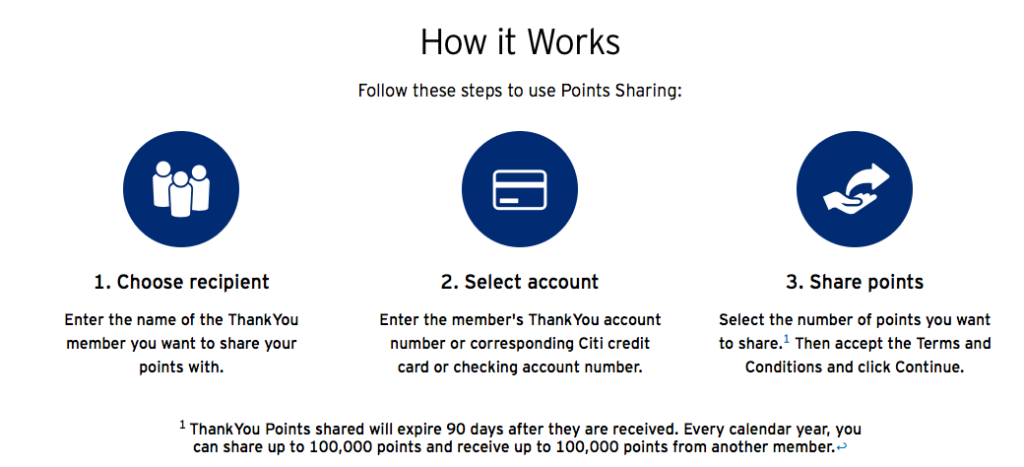

But first I had to combine the points. I put my itinerary on hold and hung up because I wasn’t sure how long it would take. I logged into my husband’s account and went to his Citi Thank You profile:

I then selected “points sharing”:

Note that shared points will expire 90 days after they are received, so do it only when you have specific plan for them.

Citi was being Citi, and as it turns out, I had two accounts, and my husband’s points ended up in the wrong one. No worries, I was able to combine them after some trial and error. With Citi nothing is ever simple. OK, time to book the cruise. I called back and drained my entire Thank You stash towards $1,529 cruise payment.

I still had a balance of $200 and decided to go ahead and pay it now, even though I wasn’t required to. You have to use a Citi card for your cash portion, and I plan to cancel my Citi Thank You Premier card in the spring of 2019. So, to be on a safe side, I decided to take care of everything now. From this point on, I can deal with cruise line directly.

My cruise fare is refundable (minus deposit), so I asked how it would be handled if I changed my mind. I was told that the refund would be in cash, not points. I can’t vouch for this since I’ve never booked a cruise through Citi before. Plus, I don’t really envision canceling unless there is an emergency.

All in all, I feel like I found a good “home” for my Citi Thank You points. It’s not an exotic redemption, but it’s what my husband wanted. Frankly, sailing on a ship (with food and entertainment taken care of) and without needing to fly anywhere, sounds pretty darn nice. Plus, I was able to bargain a 2020 Hawaii family trip out of it (more on that later).

P.S. Current 60k offer on Citi Thank You Premier card pays us commission. If you decide to apply, I hope you consider supporting the blog. As always, we only recommend cards that we personally find worthwhile, and I actually applied for this offer when the bonus was only 50k points.

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Did you book Mariner of the Seas?!?! How exciting!

@Nancy I sure did! Good detective work. Yeah, it has all kinds of amenities for kids, which is one of the main reasons I picked it.

You are so lucky that you can drive to a port! I guess technically I can too, as Galveston is about 5-6 hours away. There is a rumor that Galveston will be getting one of the newer big RCCL ships for summer 2020.

I am planning to book Mariner of the seas, Nassau and Perfect Day at Coco Cay soon. Hopefully on February 2020. Any tips or suggestions? How did you guess the points price for Choice? I checked and one night with cash and with taxes was $556!!!! That is an excellent idea if it would work. I have never tried Choice points. I heard you can only book maybe 1 or 2 months ahead on points and I usually plan way farther ahead than that! Have you used Choice points? Any info is appreciated! I will watch for the April Getaway sale! Thank you for the idea!

Great redemption. I used my 50k citi points from the card to book 4 AA flights from Disney to home this Veterans Day. I feel your husband on the no fly thing. 10 flights..,wow. Anyway have fun.

@Natasha I’m glad you were able to utilize the points towards AA flights. Citi Thank You program may not be as valuable as Chase Ultimate Rewards, but you get 1.25 cents per points on travel just like you would with CSP. That’s a pretty good deal in my book!

Yeah, my husband is sick of flying at the moment. He never really liked it, plus, we mostly do economy. This last trip with ten flights seriously messed him up. But I told him as long as he is married to me, he will be flying. He just scowled at me, LOL

I was just looking at cruises through Citi Thankyou, I’ve got a new Premier too! I wish they had cruises leaving from Europe, but they don’t seem to. Or can you book on your own elsewhere and then call for reimbursal?? It’s more just wishful thinking at this point though. We have just the one Premier, as my husband is neither US citizen nor resident, with no SSN. I have read people like him might still be able to get US credit cards, especially from American Express… haven’t tried yet though, and I’m pretty pessimistic, especially for rewards cards. I’m jealous that you’re already planning your next trip… we’re not planning anything for the time being with this baby coming in a couple months… maybe visiting family in the US and friends in Europe next spring / summer, but we’re definitely not making any concrete plans far in advance. I think a cruise might be too much for a baby under one… maybe after that. What do you think??

@Debra To be honest, I would wait till the baby is born before making any decisions on future vacations. All kids are different, so it’s impossible to say how yours will tolerate travel. I believe cruise lines requires babies to be at least 6 months old, but double check on this one. We actually took my daughter on a cruise when she was only 8 months old, and she did great. But it was a 2-night sailing from Miami, just to test the waters, so to speak.

So, I wouldn’t rule it out just yet, but see how things are before committing to anything. As far as booking European cruises through Citi, I’m pretty sure it’s possible. You do have to call and they will let you know if your desired sailing is available. But I’m sure they offer the same inventory as all the other cruise agencies. So, if you see it on http://www.cruise.com, chances are, Citi will offer it. But you do have to book through them and use the points towards the fare.

As far as your husband applying for Amex cards, I’m not really sure on this one. I thought you have to be a permanent US resident, but perhaps not.

Going on a.cruise in December. I’m interested in your comment about looking forward to revisiting Nassau. I was bummed about that port due to negative things I’ve read from other cruisers during my research.

What do you like to do in Nassau? Any recommendations for a family with 2 kids (6 & 4)?

@Lindy I liked Nassau, but it has been 15 years, so things might have changed for the worse. We just paid a local guy to take us around the island and show us the sights. I like the fact that the island is not flat like most in the Caribbean. Afterwards we also paid someone to take us to Atlantis. I think your kids would love that resort, for sure. That’s where I hope to take mine. At the time, they let you walk around and even look at the aquariums for free, but I don’t think that’s the case anymore. You can still enter the property and see a few things, but not like before.

One thing I may consider is buying Choice points during next year’s Daily Getaways sale and booking one night at Comfort Suites Nassau. The rate will be around $180, including taxes. We wouldn’t be staying at the property, the reason is, they give four Atlantis waterpark passes per room. That’s less than half compared to what Royal Caribbean charges. I’l have to think about whether it’s worth it, though. It’s a poor man’s Atlantis experience, I guess!

That is an excellent idea (Choice points for room)! Thank you for suggesting that! I just tried to see how many points are needed but it would not even let me see that because I did not have enough points. I HATE that! Cash price for day I looked at was $359 plus $197.17 taxes and fees = $556.17 !!! How were you able to guess the price with points?

@Clyn The award rate for Choice hotels doesn’t show up in search unless you have enough points, but you can see it when you click on individual hotel page. They list the rates according to seasons in the description of the property. It’s not a guranteee that it will stay that way, of course. I have seen reports of people booking a room in Comfort Suites and simply picking up passes. The property doesn’t care.

There may be an even better way to get the passes, though. I’m talking about free Atlantis stay via Wyndham status match https://milesforfamily.com/2018/11/09/should-you-take-advantage-of-free-atlantis-deal-via-wyndham-status-match/

I’m not sure it would work, however, because they may require an overnight stay.

So good to know. I have to wait til February to apply but want to play a summer cruise!

@HML Hope things work out for you! Yeah, aside from the hiccup with combining points, it was a pretty straightforward process. Dealing with Citi was no different than booking through a regular cruise agency.

I am in the middle of doing this exact thing – trying to book a spring cruise with points from my Citi Prestige! I don’t have nearly as many points as you do, so I thought I’d add that the Citi points can only be used for the deposit/*first* payment toward the cruise. I’m torn between just booking the room I want with what I have now or having my husband apply for the Premier, do the minimum spend, get the bonus, and then pay for most of it…

@Carole Thanks for confirming that Citi Points can only be used for cruise deposit. I sort of assumed it’s the case, but it’s good to know for sure.

As far as whether you should book the cruise with your existing stash ot have your husband apply for Premier. Obviously, I can’t give a definitive answer. Three things I recommend you consider:

1) Is it a cruise during a major holiday? Part of the reason I wanted to lock in the price now was due to this very factor. I figured it’s unlikely that the price will go down. But you never know with these things, of course.

2) If the price goes up, will you be OK selecting a different cruise? Assuming it’s not a holiday week, there are always some sort of sales going on. If you are flexible, you should be able to find a good deal.

3) Can you use Thank You points for paid flights, hotels, car rentals or mileage transfers in a near future? If so, then using the points towards this particular cruise is not critical. I plan to cancel my Premier cards around April, and I’m not sure I’ll have solid plans by then.

Hope this helps!