One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Reposting this information since the annual fee on Barclaycard Arrival Plus World Elite MasterCard is now waived. If you’ve signed up for this card recently, make sure to contact Barclays and request that they match it.

Here are the key details on this product:

1) Get 60,000 bonus miles after spending $5,000 within the first ninety (90) days of account open date.

2) The card earns 2 miles (points) per dollar.

3) Miles can not be transferred to airline programs.

4) You can redeem 60,000 points towards $600 in travel expenses.

5) You have to redeem at least 10,000 points at a time, so the travel purchase has to be $100 or more. You can redeem miles toward statement credit, but value is cut in half, so you want to avoid that option if at all possible.

6) You still get 5% rebate on redemptions.

7) The annual fee of $89 is now waived.

The card pays us commission. Thanks if you choose to support the blog!

Is the card worth getting?

Absolutely! You can basically get a profit of $600, assuming you plan to pay cash for travel anyway. And I’m not even taking into account the 5% rebate which will sweeten the deal further. The minimum spending requirement is a bit high (it used to be $3,000), but it’s definitely within reach of most normal families. I know that between groceries, power bill, gas and everything else, we can easily put $1,666 on credit cards each month.

For majority of folks, this card will not be worth renewing. You’ll have to charge a small fortune on it each year to justify $89 fee, when taking into account 5% rebate on redemptions. Most folks will do better with Citi Double Cash or one of my other “keepers” on the list

How easy is it to get approved?

Not easy at all if you are like me. Barclays is usually pretty tough on approvals, especially for those who like to switch cards on a regular basis. All the recent data suggests that Barclays has now implemented an unofficial 6/24 rule. It works the same way as Chase 5/24 rule.

What it means is if you got 6 or more new cards from any bank in the last 24 months, you will be automatically denied. The rule is not set in stone, but latest data points suggest that it recently started affecting co-branded cards like Wyndham Visa Signature I wrote about yesterday.

Will you get the bonus if you had Arrival Plus before?

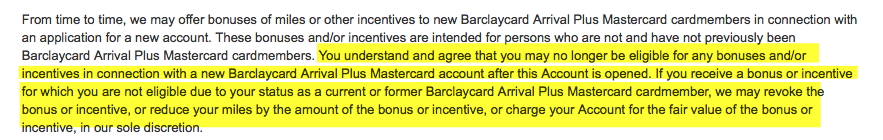

In the past you could receive the sign-up bonus multiple times without any restrictions (aside from 6/24 rule). However, take a look at this new verbiage on Arrival Plus application:

I don’t remember seeing it before and I’m not aware of any other blog mentioning it. Basically, it means that Barclays may claw back the bonus AFTER you receive it or may even charge you for it after you redeem the points. This is a new development and a sign that like American Express, Barclays is on a mission to weed out the deadbeats.

I’ve had Arrival Plus before (few times actually), so this new verbiage gives me pause. I think I’m going to sit this one out.

How to increase your chances of approval

We don’t know the exact criteria Barclays uses, aside from the fact that they don’t like to see multiple recent inquiries and accounts. However, we do know that putting a lot of spending on your existing Barclay cards before applying for new one seems to increase your odds of approval.

Also, reducing your existing credit lines may be prudent because Barclays is a conservative bank and doesn’t like to extend too much credit. I also think that closing all of your existing Barclay cards first can improve your chances. I’ve been following this thread on Reddit and it seems that most “6/24” people who got approved for Arrival Plus are those who didn’t have any opened Barclays accounts at the time.

Perhaps it’s a coincidence, but I doubt it. I truly believe that having existing accounts invites more scrutiny, as in “fresh meat” is likely to slip through the cracks. But once again, nobody knows for sure, so the only thing you can do is try.

Bottom line

This isn’t the most lucrative bonus on the market, but it’s nothing to sneeze at either. I do think that folks who are new to miles and points hobby will do better to concentrate on certain Chase cards first. If you’ve already applied for those, then Arrival Plus is worth considering, especially if you don’t currently have any Barclay cards in your wallet. Just keep in mind the fact that you may not get the bonus (or get it clawed back) if you had this card before.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I see this Barclay Arrival Plus usually compare to Capital One Venture. I am trying to understand the redeeming part of these cards (not the earning which is straightforward at 2x per dollar). Capital One Venture credit card offers an “erase” feature that redeem earned miles to credit travel expenditures. Barclay Arrival Plus has something similar: redeem for travel purchases. Aren’t these just a statement credit? How is Capital One or Barclay different (from the standpoint of redemption) from AMEX Blue Cash Everyday or Discover it Cash Back or Bank of America Premium Rewards? Do these not offer cash back and doesn’t need to be redeem for travel related expenses?

I am looking to complement my miles/points earning with a “cash back” type credit card. The goal is to offset travel cost for places that can’t be redeem with miles/points (like a Bed and Breakfast lodging).

@Rob Basically, you are on the right track as far as Arrival Plus vs. Capital One Venture comparison goes. There are a few key differences between the cards. Capital One doesn’t offer 5% rebate, but it does have a partnership with Hotels.com where you earn 10 “miles” on hotels. Also, Capital One has lower redemption threshold compared to Arrival Plus. In addition, you can use points towards valuable gift cards like Target at the same rate as travel purchases. With Arrival Plus the value is cut in half, as in you will have to redeem 10,000 points on $50 gift card/statement credit.

It’s a bit of a travesty to call these points “miles” because they basically work like cash back, only in a more restrictive manner. I’m guessing that banks use the word “miles” for marketing purposes since it has a nicer ring to it. Both cards are worth getting for the sign-up bonus, but something to keep in mind is that Capital One pulls all three credit agencies.

Arrival Plus can make sense as an everyday card for some high spenders. But unless you charge a LOT of money on it, you will not recoup the annual fee via 5% rebate. Some people get it because it supposedly works well overseas, but it doesn’t seem like a good enough reason to pay $89 each year.

If you want something simple, it’s hard to beat Citi Double Cash with $0 annual fee, though it does have Forex fees. If you are willing to jump through some hoops, it’s also tough to beat Alliant Visa Signature http://www.alliantcreditunion.org/bank/visa-signature-card (non-affiliate link)

It will pay 3% cash back during first year, 2.5% afterwards. There is a $59 annual fee, waived during first year. It’s probably the strongest cash back card on the market at the moment. Either option will beat Arrival Plus or Venture in my opinion. You can also see my list of best everyday cards for a middle-class family here: https://milesforfamily.com/2018/02/26/best-two-card-keeper-combinations-lower-income-family/

Of course, you will get the highest return if you constantly switch credit cards, but it’s not for everyone.

Feel free to email me at milesforfamily@gmail.com with any additional questions or comment here.

Thank you for responding. I have been looking at Capital One Venture card for a while now to use with travel were miles/points redemption can’t be used; haven’t pulled the trigger as I am sitting on Chase 4/24 (will get a Chase card first before getting other bank cards). I believe the everyday / keeper card link (https://milesforfamily.com/2018/02/26/best-two-card-keeper-combinations-lower-income-family/) was my first exposure to the Bank of America Premium Rewards credit card (thanks to a comment by Robert, what a great name).

Bank of America Premium Rewards with their Preferred Rewards program (hitting Platinum Honors) will give 2.62% on non bonus spend. My research shows that this is the best return in non bonus spend category. Is there a card that is better? Yes, one has to meet the Platinum Honors of $100K (I have that in my IRA; just need to move from Schwab).

While looking at BofA Premium Rewards card, it started to cause confusion with Capital One Venture and cash cards in general. Cash cards state that you can redeem cash a statement credit. Capital One, with their earned points/miles, states you can “erase” only travel expense. From my point of view, this is basically a statement credit. Thanks for clarifying.

@Rob You are absolutely correct. BoA Premium Rewards is your best bet as long as you don’t mind tying in your IRA with that bank. It’s a niche product, so I don’t really focus on it, though perhaps I should.

I guess my assumption is that most people wouldn’t want to switch their retirement account for a marginal credit card benefit. I keep my IRA in Vanguard, and am pretty happy with low fees. The blog also targets low spenders who will presumably take advantage of bonus categories on various cards.

But yeah, if you are willing to transfer assets, this card is as good as it gets if you want to keep it simple.

I have been in the work force for quite sometime with various employers. I was lucky enough to be able to contribute max 401k during those years (now rollover to IRA at Schwab); this was before kids and a mortgage. I don’t do too much with my IRA; mainly buy and hold on a handful of securities.

Yes, the goal is to use cards along with a bonus category. This BofA approach for non bonus spend categories. Getting 2.62 is better than getting 1x.

As mentioned before, thank you for family focus travels/points/miles blog.

That wording is definitely enough to scare me away. Nope, not worth it. I wonder if they will start adding that verbiage to all their cards. Another data point, I applied for the Barclaycard AA business card while I still had an Arrival and a personal Barclaycard AA card open. I eventually canceled both of those and no longer had an open card with them. I applied for the business card again and was approved even though I was over 6/24.

Jennifer, I’m seriously tempted to cancel my existing Barclay cards and try applying for business Aviator. I would hate to give up my Wyndham card though because it gives me 15,000 points upon renewal. Plus, there is no guarantee I will even be approved. Decisions, decisions…