Update: this card is now subject to 5/24 restriction.

If you are my target audience (middle-class family who takes 2-3 trips per year max), then the short answer is No. Below is the long version.

New World of Hyatt Credit Card

A few days ago, Chase has released new Hyatt co-branded card, and the old version is no longer available to applicants (unless there is a zombie link I’m not aware of). Here are the details on the offer:

- Earn up to 60,000 Bonus Points – 40,000 Bonus Points after you spend $3,000 on purchases in the first 3 months from account opening

- Earn an additional 20,000 Bonus Points after you spend a total of $6,000 on purchases within the first 6 months of account opening – free nights start at 5,000 points

- Earn 9 points total per $1 spent at Hyatt – 4 Bonus Points per $1 when you use your card at Hyatt hotels & 5 Base Points per $1 you can earn as a World of Hyatt member

- Plus, earn 2 Bonus Points per $1 spent at restaurants, on airlines tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

- Receive 1 free night every year after your cardmember anniversary at any Category 1-4 Hyatt hotel or resort

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

- Get automatic World of Hyatt Discoverist status for as long as your account is open and 5 qualifying night credits toward your next tier status every year

- Earn 2 qualifying night credits towards your next tier status every time you spend $5,000 on your card

- The annual fee of $95 is NOT waived

Leana’s Hyatt card personal referral link

Nancy’s personal referral link

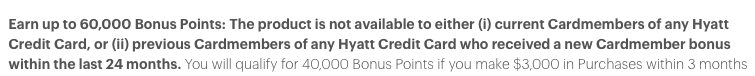

Make sure to take note of this restriction:

Main differences compared to the old version:

1) The sign-up bonus is richer. As long as you are able to spend $6,000 within six months, you will get 60,000 points compared to 40,000 points offered on the old version. This is an excellent deal, as many Hyatt properties cost just 5,000 points per night.

2) The annual fee is $95 compared to $75 on the old version.

3) You get 4 bonus points on paid Hyatt stays. I redeem hotel points 99% of the time, so this is of little importance.

4) You will now earn 2 points per dollar on local commuting and gym memberships. Again, meh. If you have US Bank Cash Plus, you can earn 5% cash back on gyms.

5) Spending (lots of it) is tied to top-tier status. Don’t care.

6) You earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year. This is a potentially valuable perk, but not to me. Most of my spending goes toward new sign-up bonuses where I can get a much better ROI. That said, I can see why many in the hobby will probably pursue it.

Let’s say you use the card towards non-bonus spending each year and put exactly $15,000 on it. You will get 15,000 Hyatt points+free night good at Category 1-4 Hyatt hotel. If you used a 2% cash back card like Citi Double Cash, you would get $300. Many Hyatt resorts cost way more than $150 during high season. Here is just one example in Florida

<

p style=”text-align: center;”>Not a bad deal for 15,000 Hyatt points per night, eh?

If you plan to redeem the certificate at an airport hotel, then this isn’t much of a perk. I do think that for some, using Hyatt card for non-bonus spending will make more sense than using Chase Sapphire Preferred or Chase Sapphire Reserve. Well, assuming you like Hyatt properties.

The math will be a bit different with Chase Freedom Unlimited since it earns 1.5 UR points per dollar, and you can pull points with those earned via premium card. You would be foregoing 22,500 UR Points if you go with Hyatt Card instead.

Still, as long as you are planning to transfer to Hyatt program and redeem points on a Category 4 Hyatt hotel, AND you can spend exactly $15,000 each year, Hyatt card will be a better deal. If you prefer flexible points, then it’s a different story.

Just keep in mind that your favorite property may switch categories while you are close to $15,000 spending mark. Have a plan B and C when it comes to your hotel points. Always.

I’m pretty sure Chase has released this card in response to Amex Hilton Ascend which will give you free weekend night (at most properties) after spending $15,000 each year. To me, Hyatt card is superior since you can use your cert any day of the week. For those who want to stay in top-tier Hilton properties on a weekend, Ascend will be a better fit.

Conclusion: I’m happy to keep my current version with $75 annual fee. However, if you have a decent amount of non-bonus spending each year and you really like Hyatt resorts, consider upgrading.

What about those who currently don’t have the old version of Hyatt card?

Depending on your goals, you may want to consider applying for this card. Obviously, there are many other offers on the market and only you can decide which one will suit your needs best. As I’ve mentioned last week, current increased offer on Marriott co-branded card will expire on July 12th. You may also want to look into Chase Ritz-Carlton card.

If you are new to this hobby and don’t have any plans to stay in a Hyatt, it’s probably best to start with cards like Chase Sapphire Preferred, Chase Sapphire Reserve or Chase Ink Business Preferred (all three earn flexible Ultimate Rewards points).

As of now, Chase World of Hyatt credit card is not subject to 5/24 restriction. However, Viewfromthewing blog reports that this will likely change in a near future. When? It’s anyone’s guess. If you currently have the old Hyatt card and are mostly interested in the sign-up bonus, it could make sense to cancel it and apply for the new version. Of course, you would be rolling the dice with 5/24 rule and risk not getting approved. It’s your call.

The sign-up bonus on Hyatt card is excellent, no question about it. I do believe that even with $95 annual fee, the Hyatt credit card is worth renewing, at least for now. Obviously, I much prefer the $75 fee, but I will probably keep it even if Chase forces the conversion. Of course, it all depends on what kind of Category 4 Hyatt hotels will be available at the time. I will say that looking at current award chart, many are most definitely worth $95 per night, at least in my opinion.

Few examples:

Florida

- Hyatt Centric South Beach Miami

- Hyatt Place Marathon/Florida Keys

- Hyatt Regency Coconut Point Resort and Spa

- Hyatt Regency Grand Cypress

- Hyatt Regency Orlando

- The Confidante Miami Beach

California

- Hyatt Centric Fisherman’s Wharf San Francisco

- Hyatt Centric Santa Barbara

- Hyatt Place Santa Cruz

- Hyatt Regency La Jolla at Aventine

- Hyatt Regency Mission Bay Spa and Marina

- Hyatt Regency Monterey Hotel and Spa on Del Monte Golf Course

Washington

Costa Rica

Whether it’s worth putting $15,000 spend on the card yearly will depend on your circumstances.

Readers, who else is planning to hang on to the old version of the card?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I’m actually kind of bummed that they changed the products with no advanced notice. I applied for the old card the day before they released the new one! The good news is that I was approved (my first new Chase card in over a year and I am well over 5/24) – the bad news is that they wouldn’t match me to the new offer so I missed out on 15k points. Oh well! I guess that’s the way the hobby works:) On the bright side, I have a lower minimum spend and annual fee, so I won’t complain too much.

That stinks, but congrats on approval! I would try again and request a match if I were you. Maybe call and ask for a supervisor? I agree, this new Hyatt card came out of nowhere. If I had advance notice, I would warn the readers for sure.

But like you said, you will have lower minimum spend, which is a silver lining. Plus, you will have a lower annual fee. But do try to contact Chase one more time.

Unfortunately, I gave it another shot last night and was once again told that they would not match the offer. Oh, well! Thanks for suggesting it. Was certainly worth a shot.

Ugh, sorry to hear it! We’ve all been there.