Last week I’ve mentioned that Amex has recently installed a new bonus qualification tool. Short version: when you apply for a card, it will tell you if you are ineligible to receive the sign-up bonus.

I was a bit skeptical on whether you can actually trust it 100% (still am), but there is no question that it is a positive development. At least in theory, it will prevent folks from wasting their time, inquiry and minimum spending on a doomed offer.

In that post I’ve also said that I was thinking about applying for Hilton Honors American Express card. Not because Hilton points are super duper valuable, but because it’s a cheap way of accumulating them. You have to spend only $1,000 in 3 months to get 75k bonus, and there is no annual fee.

It’s tough to say whether the sign-up bonus will ever go much higher than 75k points (current increased offer that will expire June 27th), but I kind of doubt it. Hilton has fantastic coverage, so I’m sure that we will be able to put the points to good use… eventually.

I’m a bit concerned that Amex may institute a “family” restriction where if you had a certain card, you won’t qualify for bonus on another card that earns the same type of currency. Citi had this rule for the last few years. All of the above-mentioned factors made me decide that now is the right time to add Hilton Honors Amex to my collection.

Looking for value

Sure, 75k points bonus is not earth-shattering, but it is respectable. To me, it’s worth at least $250. I have my eye on Hampton Inn Spring Hill, Fl located near Weeki Wachee Preserve and Pine island (with a beautiful beach). It costs only 10,000 Hilton points, and having Amex Hilton card unlocks “5th award night free” perk due to Silver status.

My parents won’t be visiting us in Florida till 2020, but I think this hotel will be perfect as long as the price doesn’t change by next May. After factoring in points from minimum spend, just one bonus could potentially take care of five nights in two rooms, with breakfast and pool usage included. Now that’s value! And it sure beats having parents in my small house, where we would drive each other crazy.

Here is a short YouTube video of Weeki Wachee Springs boat cruise:

If you’ve never had Ascend version of the card, I recommend you consider applying for it instead. Yes, the fee is $95 (not waved), but you get 100k points, Gold status, weekend certificate upon renewal, plus ten entries to Priority Pass lounges. You can read more about the Ascend version here Both cards do pay us commission. Thanks for your support if you choose to use our links!

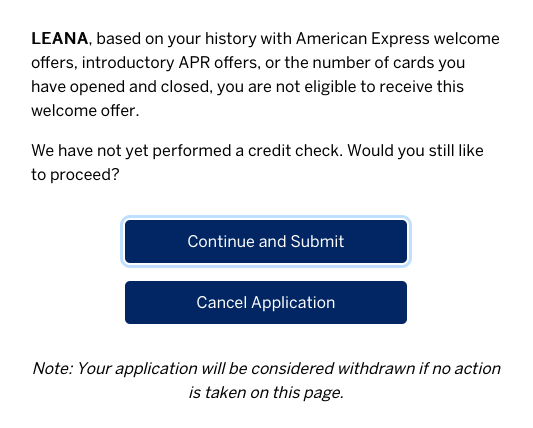

Both me and my husband currently have Ascend Hilton card, so we don’t qualify for that bonus due to “once per lifetime” rule. I decided to apply for Hilton Honors American Express card in my name and see what the Magic 8-ball, I mean, bonus qualification tool would tell me.

Darn it!

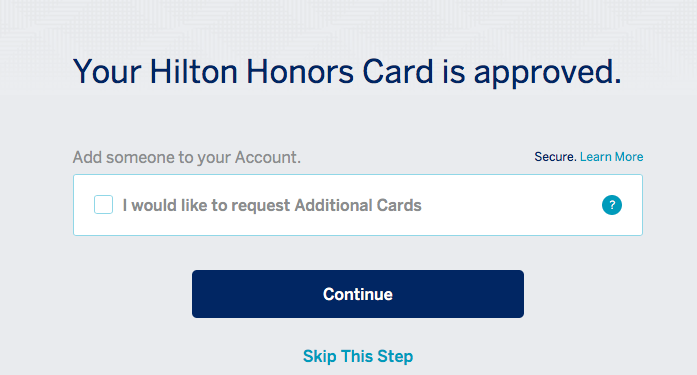

Hmm, I wonder what the tool will say about my husband’s eligibility. I didn’t have high hopes, but to my surprise, the same warning didn’t pop up. His application was approved. Wait, is this tool sexist?!!

I’m still not convinced that the bonus points will indeed show up, but I am hopeful. Plus, like I said, there is no annual fee and I’m only “investing” $1k of spending. I’m not risking much, that’s for sure.

Plus, we plan to cancel my husband’s Ascend card next year. There is a good chance that Amex will offer to upgrade his no-fee Hilton card to Ascend and will throw in some points as a sweetener. We will take the offer, of course, only to downgrade back to no-fee card later. I’m a gal with a plan, always.

What makes my husband a more desirable customer?

I don’t really know. We have a very similar Amex history, but there are a few key differences. I had a personal Amex Premier Rewards Gold card years ago and canceled it 10 months later. My husband just got approved for it a few months ago. Oh, and he had Amex Green card awhile back and paid $95 to renew it once (long story). Then again, I’ve just renewed my Ascend card and paid $95.

Aside from that, we have applied for the same exact offers and canceled them around the same exact time. Whatever algorithm Amex uses, it didn’t flag my husband, but it did flag me. Oh perhaps it’s a bug and the bonus will be denied in the end. Developing…

Readers, what has your experience with this new Amex tool been like?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

That’s what i thought may happen. It’s just another way to deny us even if we haven’t had that card yet. I mostly get the bonus and then cancel or downgrade their cards when the fee comes. I’ve had the no fee Hilton card and the Amex Everyday for a few years but don’t put much spend on them. Glad I got the Hilton Aspire card just before this. Still surprising that you were denied but not your husband! I think he’ll get the bonus.

@Lynn Yeah, it’s a good thing you got Aspire when you did. That’s the thing with this hobby, you never know what changes tomorrow might bring. Obviously, I don’t stress over it, but I also like to strike when the iron is hot. I do kind of wish we signed up for Delta cards when the bonus was increased, and before this new restriction was instituted. Oh well, you can’t win them all! Plus, I don’t have any need for Delta miles in a near future.

I still feel like I get tons of points at a greatly reduced cost, and I’m very grateful for that. While I’m not happy that Amex has made these changes, I’m at least glad they warned me so I wouldn’t waste my time on this card.

Leana, do you think that AmEx flagged you because you once downgraded an AmEx Personal Platinum to the AmEx Green card shortly after receiving the bonus 100K points? I think AmEx then clawed back the bonus 100K points.

Anna H, it’s totally possible. Then again, my husband did the same thing, so I’m not sure what the formula is. I’m definitely not complaining, it’s within their rights to tell me to get lost. I’m just confused why Amex feels my husband’s profile is better somehow!? Of course, there is no guarantee that he will actually get the bonus.