When a credit card pays out 5% cash back or an equivalent in points, it definitely gets plenty of coverage in the blogosphere. And for a good reason. Most cards pay only 1-2% cash back, so this is a huge bump on earning rewards. When you have a card like Chase Freedom, it gets even better. The points can be combined (at least for now) with those earned via a premium card and transferred to airline and hotel partners.

So, why do banks offer such a lucrative return? Any category that pays 5% is a loss leader, no doubt about that. The short answer: it’s a marketing strategy to encourage you to use your card for everything, including categories that only pay out 1% in rewards. People are creatures of habit, so most will stick with just one card. My husband is that way.

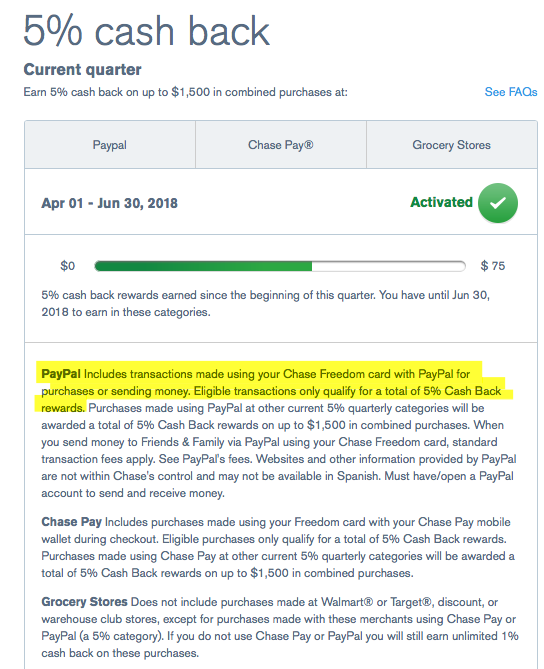

But we miles and points freaks are smarter than that! We will use Chase Freedom (my personal referral link) for 5% categories, and utilize other cards for everything else. Not too long ago I used my Chase Freedom for a dishwasher purchase. The main reason? PayPal is a bonus category this quarter and I’m currently working on a complicated strategy of acquiring United miles for my parents’ tickets from Europe to USA.

Few weeks ago I encouraged a reader to consider applying for Amex Everyday Preferred in order to maximize 4.5 points per dollar on grocery purchases (on up to $6,000 per year), which to me is an equivalent of 5% cash back. So, why the title then? Because some people who obsess over 5% categories fail to see the forest for the trees.

<

p style=”text-align: center;”>Photo by Stefan Steinbauer on Unsplash

Chasing new credit card bonuses will almost always beat maximizing 5% categories

Let me give you an example. I have just signed up for Citi Thank You Premier X 2. It doesn’t pay any bonus points on grocery purchases, but guess what? For the last year or so I have been buying my Winn-Dixie gift cards on Raise.com when it offers 5% off or 7% off coupons.

Factoring in the puny usual 1% off discount, it’s an equivalent of getting at least 7% cash back since I also earn the rewards on the credit card I use for purchase. I shop at Winn-Dixie on a regular basis since it’s more convenient and less disgusting than Walmart. Using up those gift cards is never an issue, and after buying dozens of them from Raise.com I haven’t had to deal with fraud … yet. Make sure to read this post that outlines dangers of buying gift cards from third-party resellers.

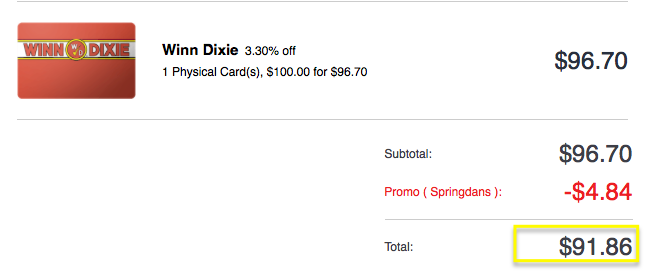

Despite potential issues, I keep on buying gift cards, but stick to reasonable amounts I can use up within a short period of time. Look at the deal I got from CardCash a few days ago:

As a bonus, I get closer to meeting my minimum spending requirements and collecting the large payoff, aka the sign-up bonus. Sure, buying gift cards via third-party reselling sites does involve a bit of hassle, but nothing too terrible.

But let’s say you are the type of person who absolutely hates dealing with gift cards. Citi Thank You Premier pays out 3 points per dollar on gas. It’s not as good as 5% cash back, but it’s pretty darn close. Once again, it’s all about that pot of gold at the end of the rainbow.

Even if you decide to forego 5% categories and earn only 1-2% in cash back on new cards, it will most likely still be worth it. For example, let’s say you have a choice between maximizing 4.5 points per dollar on grocery purchases or signing up for Citi Thank You Premier.

If you buy $4k worth of valuable retailers’ or Visa gift cards at a grocery store, you will get 18k Membership Rewards points. Not too shabby!

But let’s say you put that $4k towards meeting minimum spend on Citi Thank You Premier instead. You will get at least 54k Citi Thank You Points (factoring in sign-up bonus), and those are most definitely worth more than 18k MR points.

Not interested in Citi airline transfer partners or travel redemption option? You can simply redeem 50k points towards $500 statement credit. And cash is the most flexible currency out there.

Delaying applying for an offer comes with opportunity cost

Let’s say you decide that you really, really want to maximize 5% categories before applying for a certain card. That’s fine, of course. Just remember, most offers have a 24-months reset clock. The sooner you apply for a card, the sooner you will collect the bonus. The sooner you will be eligible for the next bonus. It’s a perpetual cycle, in a way.

Some people can juggle both. If you can take advantage of the most lucrative bonuses AND maximize 5% categories simultaneously, that’s an equivalent of having your cake and eating it too. But many low spenders usually have to pick one or the other, so choose wisely.

I’m someone who tries to take advantage of 5% categories, but I also don’t obsess over them. Due to 5/24 rule I don’t have any way of getting United miles aside from transfer via Ultimate Rewards, which is why I couldn’t resist using Chase Freedom for my dishwasher purchase. But it didn’t really interfere with meeting minimum spending requirements on my Amex card.

Also, if you use your Chase Freedom to send money to your relative/friend via PayPal, you can actually make a profit. They can simply write you a check or wire the money back to your account. There is absolutely no reason not to do so, plus, it’s explicitly allowed in the terms. Essentially, you would be buying UR points at a very low cost.

The same principle applies if you decide to use Chase Freedom for paying your estimated federal taxes, since some companies like PayUSATax accept PayPal. The 5 points per dollar in rewards will more than make up for 1.98% fee. If you overpay your taxes, they will be refunded when you file your 2018 return. Just make sure you can float the money till next year.

Exercise caution

In this hobby it’s incredibly important not to bite off more than you can chew, figuratively speaking. If you are someone who has a hard time juggling multiple credit cards, it’s better to pick few good options, based on your everyday spending patterns, and call it a day. And there is certainly an upside to not applying for a lot of cards: you don’t have to worry about Chase 5/24 rule or a potential bank shutdown.

I’m not trying to persuade you to do something you are not comfortable with. I’m simply encouraging readers to do the math and decide if their current strategy is working for them. Throwing all of your energy towards maximizing 5% categories is fine, it just might not get you the most points or cash back.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I have to agree with Austin. My wife and I have been facing more denials. Now I find myself turning to our 5% cards, my DoubleCash, and my wife’s Chase Freedom Unlimited for most things.

@Ian I hear you! I’ve been getting quite a few denials myself lately. I just keep trying till I finally get an approval. For now, I’m still finding worthwhile offers to chase after, and I’m definitely a hardcore churner. Have been for years. Opportunities are still there, I just have to occasionally settle for lower offers and less known banks. I know that eventually I will have to rely mostly on maximizing 5% categories. But I’m not quite there yet.

Fair point. It kinda depends on how far along you are in the journey – i.e., how many cards you have/how much you have abused your credit haha

For me, I have had to cool off with new applications simply because I’m running out of good offers and running into some denials. Thus, the 5% bonus categories become more attractive. Although I really only chase the Freedom 5% and rarely use the Discover 5%.

But for the average person, I totally agree. And I like the contrarian thinking – kinda rare in the points/miles blogosphere…

@Austin I couldn’t agree with your more! It absolutely depends on how far along you are in the journey. This blog primarily targets low-spenders who get new cards on occasion. I can’t tell you how often I interact with readers who haven’t applied for any new offers in a year or more. Yet, they make sure to diligently maximize 5% categories. There is absolutely nothing wrong with that, of course. Plus, if one is planning to apply for a mortgage, it’s only prudent to avoid extra inquiries. I just want to present a different argument because you can’t argue with math! 🙂

I was having a hard time maximizing some of the categories so I switched to the Freedom Unlimited. That made my life a whole lot easier.

@Stephanie Freedom Unlimited is a very good card for keeping things simple. My small recurring bills go on it because I just don’t have the energy to switch cards for $10-$40 payments each month. My father-in-law is an authorized user on my Unlimited card, and he uses it to buy me milk, bread and odd stuff while he is in the grocery store. He would never have the patience to keep track of 5% categories. Just like his son, haha!

I don’t think there is a right or wrong way to collect credit card rewards. Everyone has different circumstances and tolerance for jumping through hoops. Plus, there are much more important things in life to worry about.

I decided to go for the Discover It for the basically 10% back in bonus quarters in the first year since I have enough UR for awhile, and I appreciated that this is a no fee card I can keep long term. Have heard good things about Discover Deals, too.

So with that and my Freedom, I have two 5% cards, but even if I max out all quarters for both, it is $12k for the year and I will have other spending available to chase good sign up bonuses.

I have my cake and I’m chowing down! ????

Nice! You know, you make a very good point. Discover It is an exception because like you said, a diligent person can basically get 10% back via bonus categories.

Plus, its an excellent card to keep long-term. So yeah, if you have the patience, plus spending level to maximize bonuses AND 5% categories, it’s a win-win scenario.