By now, I’m sure most of you are familiar with Plastiq (my referral link, you get 500 fee-free dollars on a new account). Normally, I’m leery when it comes to letting third-party providers handle my car payments. But I gave it a shot, and don’t have any complaints so far. I’ve seen others mention that Plastiq didn’t deliver their payment on-time, so I’m certain it’s “YMMV” type deal.

Why Plastiq is useful for low-spenders

Plastiq charges a 2.5% fee, so in majority of cases, it’s simply not worth it for everyday spending. One exception: meeting minimum spending requirements. As most of you know, I switch credit cards regularly in order to collect new sign-up bonuses. While not the right strategy for everyone, it works for me and that’s that.

Anyway, since I don’t do any manufactured spending, applying for some credit card offers would be out of the question if it wasn’t for Plastiq. It’s one of the reasons I recently felt comfortable applying for Citi Thank You Premier X 2.

Of course, as I’ve said before, you should not count on Plastiq being around next month or even tomorrow. Companies often shut down without notice. But so far, it seems to be chugging along just fine. There were a few setbacks recently. One major development: you can no longer use Amex cards for mortgage or car payments. MasterCard has not been affected so far, though that may change in a near future. You can still use Amex cards for:

- Residential Rent

- Government Payments

- Education

- Utilities

- Club fees and memberships

Not just for minimum spending requirements

There are a few other reasons I can think of where using Plastiq may make sense:

1) When you are trying to reach a threshold in order to get a specific credit card benefit.

One obvious example is a free weekend night on Amex Hilton Honors Ascend that I wrote about on Friday. You get it after putting $15,000 on the card each year (in addition to free weekend night you get upon your first renewal). It’s not something I would ever consider doing, but to each his own.

It definitely wouldn’t make sense to pay 2.5% fee on the whole $15,000. But if you are close to that amount already, Plastiq could help you get over the finish line. Sure, you will pay a fee, but in all likelihood, the free weekend night will more than make up for it.

2) You get a juicy retention/spending offer.

Banks will often try to entice you to use their cards by giving you specific challenges. As in, “spend this amount in three months, and you will get an X number of points or miles.” Everyone should crunch the numbers in order to determine if an offer is worth pursuing, of course. But assuming it’s enticing enough, but you can’t quite get to that amount via your organic spending, Plastiq may come in handy. But have a back-up plan, just in case.

My “facepalm” moment

Before you resort to using Plastiq, I recommend you make sure that your provider definitely doesn’t accept credit cards. Some don’t advertise that fact on the bill or don’t mention the website where you can make your payment. I’ve learned this the hard way. I’ve been using Plastiq to pay my daughter’s orthodontist bill. I could stop by the office and use credit card there, but it’s out of my way, so Plastiq seemed easier.

Well. The other day I asked the receptionist if they can accept payment over the phone, but she said No. But then she mentioned that I can go to their website and pay via credit card there. I didn’t even know they have a website! So all this time I was paying a 2.5% fee to Plastiq for no reason whatsoever. It wasn’t a huge amount, but still. Definitely not my proudest moment.

<

p style=”text-align: center;”>Photo by Dmitry Ratushny on Unsplash

It’s a free ride, but you’ve already paid

You know, like the verse in Alanis Morissette’s song “Ironic”? I’ll explain in a minute. The reason I wanted to put this post together is due to email I recently got from Plastiq:

Update: Plastiq has sent out emails that starting June 1st, the limit will be $250.

My new Citi Thank You Premier happens to be a MasterCard! I would gladly pay a 2.5% surcharge in order to meet my minimum spending requirements, but I’ll happily take 0% fee instead. Sadly, I’ve already sent one car payment the day before the promo came out. Sigh.

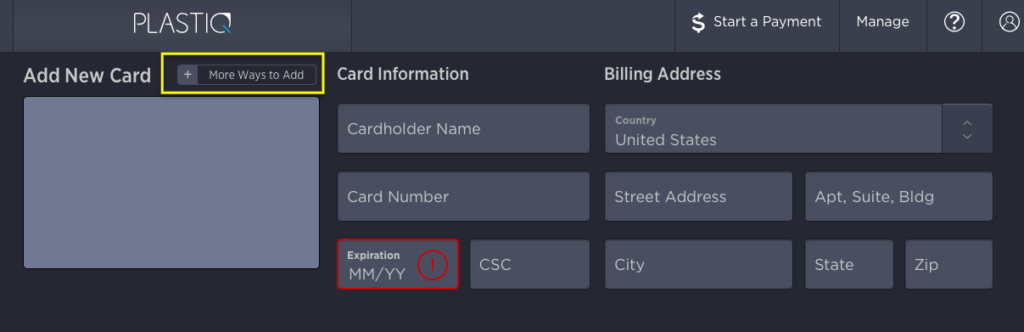

Getting a Masterpass account is very easy. You have to sign up via this link and then put in your MasterCard info. When adding the card to your Plastiq account, go here:

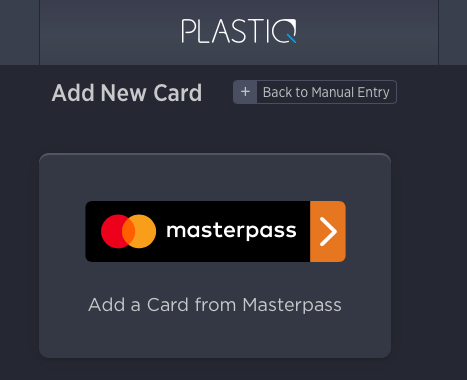

Click on it and you will see this screen:

Follow all the payment steps, and you should see $0 fees from Plastiq on the final screen, as long as your payment doesn’t exceed $500. If it does, you will only pay fees on the excess amount.

Bottom line

This is a pretty decent promo, and you can schedule an unlimited number of payments through September 30th, 2018. If you normally use your checking account for mortgage/car payments and happen to have a MasterCard, might as well earn some free points/miles in the process.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

“One major development: you can no longer use Amex cards for mortgage or car payments. Visa and MasterCard have not been affected so far, though that may change in a near future.”

I’m probably wrong, or maybe things have changed, but at some point Plastique told me that I could only use MC or Discover to pay mortgage, that AmEx AND Visa were no longer allowing…? If Visa is still working for mortgage that’s good to know! I’ll keep in mind for future bonuses and see what happens.

You are absolutely right, I got confused. I remember seeing posts that Visa cards are still accepted for mortgage payments, but that is apparently no longer the case https://dealswelike.boardingarea.com/2017/11/20/plastiq-visa-mortgage/

I never paid mortgage via Plastiq, so it was a non-issue for me personally.

Oh wow. For once I knew what I was talking about! Haha! Well that’s good and bad news because paying via Plastiq adds another layer of work to my life. I’m kind of relieved to not be able to, because if I would feel obligated to use Plastiq if I could. 🙂

LOL I think you know more than you realize!