When it comes to business credit cards, my strong opinion is that you should only apply if you have an actual business. You won’t see me doing a “wink wink nudge nudge” thing, even though it means a potential loss in commission.

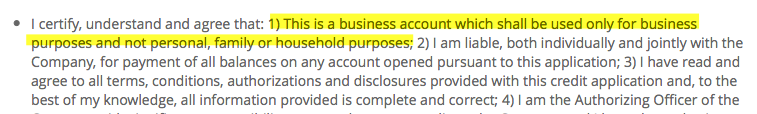

That said, many of you (including myself) do have a legitimate business. I’m a blog owner and have to file a Schedule C to report my earnings each year. But up until now, I haven’t actually applied for a business credit card. Why? It all comes down to that pesky line on the application page:

Most business cards that have a decent sign-up bonus (my main requirement) have a significant minimum spending attached. Usually, it’s $3,000-$5,000 in three months. So, in order for me to collect the reward, I would have to actually use the card. I do have business expenses, of course, but they don’t add up to $3,000 in 3 months. Thank goodness! I would have quit this blog a long time ago.

For that reason, I have been avoiding business cards. Sure, I could maybe put my travel expenses on a business credit card. Since blog’s content is directly tied to travel, I could perhaps justify it that way. But the thing is, I don’t deduct any trips on my tax returns. My travel is personal in nature, the content is more of a bi-product. I don’t ever plan a trip mainly for research purposes. And it would be deceptive for me to make that claim to IRS.

To be clear, I’m not passing judgement on anyone who uses business credit cards for personal expenses. This is your call to make, not mine. I would never want to come across as “holier than thou”. Plus, I’ve certainly made my share of mistakes. But it is my blog, and this is where I get to express my opinions.

That said, I have absolutely no problem with taking advantage of any offers I’m eligible for (as long as it doesn’t involve deception). That’s why when I saw that there is a 50k miles bonus (annual fee of $95 not waived) on AAdvantage Aviator Business MasterCard that had $1 minimum spending requirement, I finally found the One. I could also use “free checked bag” benefit, since we have some AA flights coming up in a near future. Direct application link (pays no commission)

Denial and making a reconsideration call

Unfortunately, my application was denied. I wasn’t too surprised because I can’t seem to get approved for personal version of this card. And I’ve tried-twice.

I hate, hate, hate making reconsideration calls. It’s an intricate “dance” that you have to perform just right or fall flat on your face. But I had to at least give it a shot since I had about 75% success rate in the past. Three out of four ain’t bad, right? Last year I had to work like a dog to get approved for BoA Premium Rewards credit card. But I got it after spending an hour on the phone, and have a $400 profit to show for my efforts. You can read more on the card here

So, reluctantly, I called 1-866-408-4064 (Barclays reconsideration number). The credit analyst picked up the phone right away. She was very friendly and asked me a few questions about my business. She then said she would take another look at my credit file.

She came back and asked me why I opened four new credit card accounts in the last six months. I told her I like the rewards and benefits that different products offer (100% true). I gave her the example of Chase Hyatt credit card that comes with a nice bonus, mid-tier Hyatt elite status, and free night certificate upon renewal. In retrospect, mentioning Chase wasn’t the smartest thing to do.

There was a long pause and then I got the dreaded news. She said they have recently approved me for Jet Blue credit card and wanted to see me use it before they would approve me for yet another product. I thanked her for her time and hung up the phone.

The analyst did her job and I commend her for seeing me for who I truly am. If I’m not currently using my existing two Barclays cards, the logic dictates that I’m unlikely to make up for those 50k AA miles’ bonus that Barclays bought from American Airlines. Dang it, why do Barclays reps have to be so competent? I did forget to offer to reallocate the credit line, but judging by the tone of her voice, I doubt it would have made any difference.

Barclays is notoriously tough when it comes to reconsideration calls, so I wasn’t entirely shocked by the outcome. But I still recommend you try if you are in the same situation. It won’t hurt to put some spending on your existing Barclays cards first, something I failed to do.

Now what?

I don’t plan to give up on business cards just yet, and will be on the lookout for an offer that has low minimum spending requirements+ attractive enough bonus. I still have options when it comes to personal cards, though my choices are dwindling. Maybe I should start doing “research” trips?

P.S. If you are looking to sign up for a business card, check out this list of the most lucrative offers on the market.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Just a thought – you don’t necessarily have to make only tax-deductible purchases on business cards. You could get a biz card with a high spend and put, say, your travel charges on it. You could then later decide (with the help of a CPA perhaps) if those taxes qualify for a deduction or not.

@Austin That is certainly a creative way of approaching it! I like it.

Yeah, that’s why, if I did it, which I don’t! Haha! I’d be SUPER conservative. 1% sounds a fair compromise to me! -assuming you review the place, restaurant, etc on your blog. 🙂

Oh interesting. If I remember right you used to be an accountant so you should know. The reason I had the thought was because my tax person told me I could deduct a percent of my travels to MN since I spend part of the time on my rental property. Last summer I spent most of the time with my family – but I did spend one solid day re-oiling a floor and kitchen counter. I never bothered with the deductions but if I ever do I’ll double check with my tax person regarding “primary purpose of travel”. Thanks!

@Talchinksi You know, even though I used to do taxes for a living, travel blogging was uncharted territory for me! I did a bunch of research and there is a lot of conflicting info on the internet. There was a case when IRS went after one travel blogger and made him pay back a ton of money because he deducted way too many expenses.

But you are doing field research that ends up on your blog…? I would think you could deduct 5-10%. Maybe 1% at a bare minimum! I go home to visit family – but work on my rental property while I’m there (maybe 8 hours out of 3 weeks). My tax guy told me I could figure out how much time I spent on work vs pleasure and deduct a percentage of flights, rental car, meals, etc. I haven’t bothered…yet. But maybe one day. 😉 Of course, at the end of the day you have to do what you’re comfortable with.

@Talchinski This is definitely a grey area. The thing is, I can deduct whatever I want. The big question is: will IRS agree with me in case of an audit? The travel has to be primarily business-related, so deducting 5% probably won’t cut it.

I think you could deduct a percentage of your trips…? And using that logic you could use the biz card to pay for trip expenses…?

@Talchinski This is a bit complicated. Don’t get me wrong, I will gladly deduct anything I’m allowed to deduct. When I attended FTU seminar in Tampa, I claimed the expenses on my tax return. It was a 100% business-related trip. As far as all of my other travel goes, the main purpose is to spend time with family. I suppose I could attend a seminar of some sort and combine business with pleasure, but I don’t really want to. I don’t even do any social networking and rarely check emails while on vacation. The idea is to unplug and focus on my family.

Amex business accounts seem to be a bit easier to get.

@Tscateh That’s my understanding as well. If an offer with low enough minimum spending comes along, I will absolutely consider it.

I’ve been denied for this one too. Barclays was kind to me in the beginning, but they’ve really tightened up it seems.

Jennifer, that seems to be the case for many folks. This bank really doesn’t like extending too much credit, and they like to see some sort of activity on their existing cards. I plan to try again, but will do things a bit differently this time.