Growing up in a poor family and living during the collapse of Belarus’ economy, it was drilled into my head that we don’t replace things unless absolutely necessary. And even then, we try to first fix them with spit, glue and tape. I never forgot those lessons. Check out my 13-year old dishwasher:

The plastic cover for “Start” button got ripped off five years ago, so I put a piece of clear tape over it. Then, when it started peeling off, I put tape to hold the tape in place. Tacky, you say? I call it resourceful. And tacky.

According to Google, the average lifespan of a dishwasher is 8-10 years. So, it’s no surprise that mine is on its last legs. In fact, the poor thing has been dying a slow death for about a year now, yet I’ve refused to replace it, hoping it would heal itself. It didn’t. No, kids, we are not having an alien invasion! That’s just noise coming from the dishwater. During last week, I had to re-wash the glasses and finally decided it’s time.

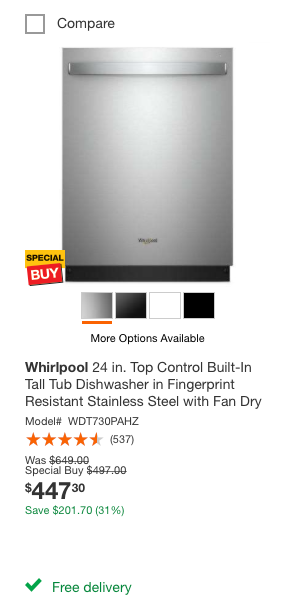

Trying to pick out the best dishwasher for the money is overwhelming, to say the least. I will happily spend hours researching destinations and hotels, but shopping for appliances bores me to death. So I looked at the reviews and settled on this beauty, sold at Home Depot:

With installation and tax, the total for the dishwasher came to $650 all-in. And it’s getting delivered today. If you have this model and it has been a pain in the behind, I don’t want to know!

Which card should I use?

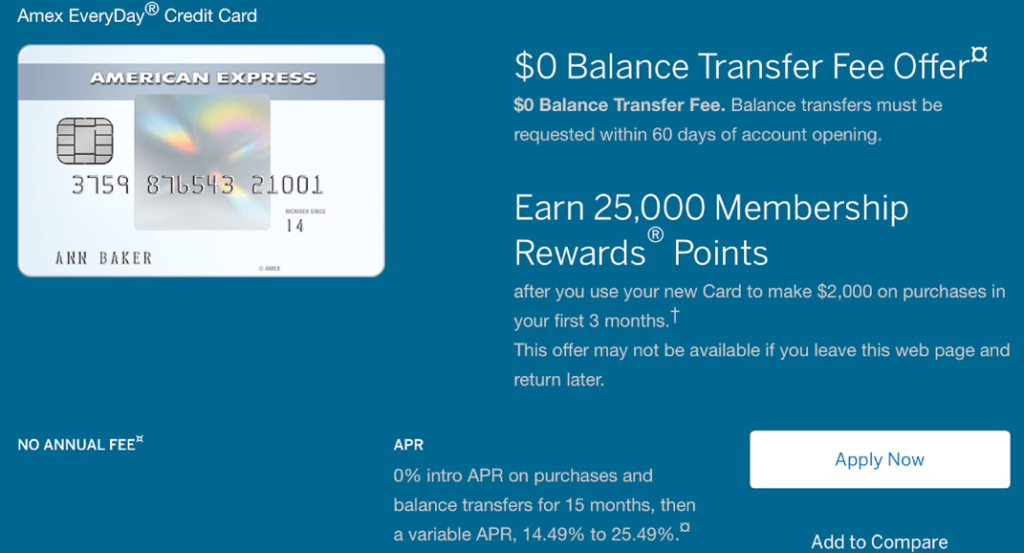

The most logical option would be to use my new Amex Everyday card, since we are still working on meeting minimum spending. An interesting twist is the fact that the offer comes with 0% APR on purchases:

I went ahead and searched the web for Home Depot discounts, checked Amex Offers in my profile, but couldn’t find anything. Last step: I went to Cashbackmonitor to see which portal offers the highest payout.

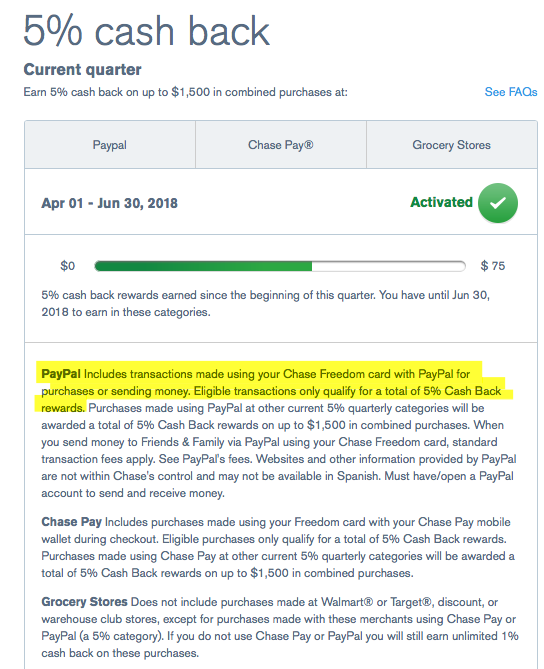

I was ready to enter my credit card number and then I noticed that Home Depot accepts PayPal. Hmm… That’s currently a bonus category on Chase Freedom. What to do? With Amex Everyday I can hit the minimum spending and put $650 in a CD for 15 months.

On the other hand, at that point I wasn’t planning to apply for a new credit card for at least three weeks. I felt like I could easily reach the required minimum spending threshold regardless.

Also, to me the current CD rates aren’t yet high enough to justify the nuisance of keeping track of the balance, making minimum payments etc. In the past, I did take advantage of 0% on purchases, but CD rates were 5%.

As I’ve mentioned in this post, I’m currently working on accumulating Ultimate Rewards currency. The goal is to transfer points to United program after converting my Chase Freedom to Chase Sapphire Preferred. I don’t know if my plan will materialize, but I would be earning 5 points per dollar regardless, an equivalent of 5% cash back.

I decided to… drum roll, please, pay with Chase Freedom. The allure of 5 UR points per dollar was just too strong. I also went through UR shopping portal in order to get an additional 2 points per dollar on Home Depot.

A killer combo for UR lovers

If you are someone who likes to collect Ultimate Rewards points through everyday spending, you should look into three cards. If you have a business, consider adding a fourth one into the mix. Keep in mind, all of these products are subject to 5/24 rule The information below is meant for those who are relatively new to the hobby.

1) Chase Sapphire Preferred ($95 annual fee) or Chase Sapphire Reserve ($450 fee, though there is a $300 travel credit that offsets it significantly)

You don’t need to have both, so pick the one that makes the most sense for your lifestyle. I put a comparison guide for an average Joe here

Why:

By having one of these cards, you unlock the ability to transfer points to various airline and hotel programs. With CSP, you can get 1.25 cents per point towards revenue travel, 1.5 cents with CSR. You also earn bonus points on dining/travel, and get travel insurance and primary car rental coverage.

2) Chase Freedom (no annual fee)

The card earns 5 points per dollar in rotating categories. Here are the ones for this quarter:

I find it interesting that you’ll earn 5 points per dollar even when you send money to someone via PayPal. That’s straight profit.

Why:

Who doesn’t like getting 5% cash back at the minimum? But you can potentially do much better. You can combine the points (for free) with those earned via Chase Sapphire Preferred or Chase Sapphire Reserve.

3) Chase Freedom Unlimited (no annual fee)

This card earns straight 1.5 points on all purchases. If you are after cash back, then this is not the best option because you can earn 2% with a card like Citi Double Cash.

Why:

You can combine the points with those earned via Chase Sapphire Preferred or Chase Sapphire Reserve. The latter lets you get 1.5 cents per point toward travel. So, if you go with this option, then 1.5 points will be worth 2.25 cents, which is a bit better than Citi Double Cash. Very often, you can get a much better value when transferring to airline and hotel partners, especially when doing so last-minute.

You can pay $450 per night for this Florida Hyatt resort in spring or transfer 15,000 UR points to Hyatt instead

4) Ink Business Cash Credit card (no annual fee)

This card earns 5% cash back (5 points per dollar) on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. See more details here You do have to have an actual business in order to apply. Also, technically, you are not supposed to use business cards for personal purchases.

Why:

Bonus categories on Ink Cash are actually lucrative on their own. As is the case with Freedom and Freedom Unlimited, you can combine the points with those earned via Chase Sapphire Preferred or Chase Sapphire Reserve. Also, the sign-up bonus on this card is currently 50,000 Points, the highest ever.

The strategy

1) Use CSP or CSR for travel purchases and dining (unless those are a 5% category on Freedom).

2) Use Freedom for rotating 5% categories.

3) Use Ink Business Cash at office supply stores and for internet, cable and phone services.

4) Use Freedom Unlimited for everything else.

If you do that, you will be getting the best bang for your buck when it comes to increasing your Ultimate Rewards stash, which IMO is the most valuable type of currency in the hobby. You can also transfer points to a spouse or domestic partner for free, which adds an extra layer of flexibility.

There is a rumor reported on Frequent Miler that Chase is currently considering doing away with ability to transfer points freely between UR accounts. It’s a concern, though nothing may come of it in the end.

Of course, don’t forget to factor in the annual fee and make sure to read my post on best two-card combos for an average Joe

You might also want to read the post on why starting with Chase cards makes a lot of sense for those who are new to this hobby and why Chase Sapphire Preferred is a particularly good choice for beginners.

I don’t think collecting UR points via everyday spending is a no-brainer for every middle-class person. I hate annual fees with the passion, which is why I chose to focus on Membership Rewards instead. Still, I have to begrudgingly admit that UR currency is the king of the miles and points hobby. And I have a new dishwasher to prove it!

All these cards pay us commission, but we also have a few personal referral links:

Nancy’s personal referral link for Chase Sapphire Reserve

Leana’s personal referral link for Chase Freedom

Leana’s personal referral link for Chase Freedom Unlimited (keep in mind that there is another offer for Chase Freedom Unlimited that gives 3 points per dollar during first year, but no sign-up bonus)

P.S. If all of this seems too confusing, feel free to email me at milesforfamily@gmail.com

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I have been putting things like appliances/expensive crap that can break on my AmEx in the hopes that if I need to call in the extended warranty, it will step in and take care of me. Fingers crossed I won’t even need to deal with that! Hope your new dishwasher is a keeper!

@Sensetosave That’s actually a good point and I thought about the warranty aspect of it. I forgot to mention it in the post. Ultimately, I decided that getting an extra year is unlikely to pay off. But wouldn’t it be ironic if my dishwasher does break down right after the warranty runs out! 🙂

@Leana – hope you enjoy the new dishwasher. I love new appliances, but I just hate paying for them 🙂 I’m going to be really tweaked if Chase stops all transfers as we just started putting a lot of our spend on our Freedom Unlimited.

@Stephanie Waiting for my delivery as we speak! I sure hope this thing won’t end up being a dud.

I definitely understand why everyone is concerned about Chase pulling the plug on transfers between UR cards. Those rumors have come around before and nothing materialized. Hopefully, it will end up being nothing this time, but we’ll see.

Looks like you got a nice dishwasher and also saved a little more with credit card spend. I like having options but sometimes I wish there were just one way to do things, especially when I realize later that I could have done it differently and saved even more. Thanks for the tip on using PayPal. What I don’t spend at grocery stores this quarter I will probably use the remainder of the $1500 allowance with Walmart gift cards using Chase Pay. I also like transferring Ultimate points to United Airlines like you plan to do, but I sometimes find that I can use fewer points (or find better flights) going through the Chase website to book using the 50% bonus for CSR, which will also award frequent flyer miles since I am purchasing tickets. I just hope Chase doesn’t make a change transferring points between the Freedom and Sapphire cards.

@Steve I just wish I could have found another discount to stack, but at that point I just needed to buy something. Anything! I can wash dishes by hand, but with two kids prefer not to.

Agree with you on checking revenue rates via CSR. That 50% bonus on redeeming points towards travel really is a game changer. I’m looking to convert my Chase Freedom next year, so we’ll see what airfares from Belarus run at that point. Right now they are sky high, so United transfer may be a better option.