If you have relatives in another country, you are probably in a perpetual state of either planning an expensive visit there, or finding ways to bring your family to you without going bankrupt. That’s basically my reality.

As soon as I burn miles or points, I have to start accumulating them all over again. Fortunately, I’m an optimist and believe that things will somehow work out. And they usually do! I don’t hold on to my miles and points as if they were a precious treasure.

<

p style=”text-align: center;”> Has this hobby turned you into a Gollum character from “Lord of the rings”?

Has this hobby turned you into a Gollum character from “Lord of the rings”?

Plus, I think I would be bored to tears if this hobby ever seized to be a challenge.

That said, as banks introduce additional restrictions, my options are becoming more and more limited. When it comes to my parents’ tickets, last few times I was able to utilize currencies like Flexperks and Merrill+ as well as good ol’ cash.

The prices on tickets from Belarus to USA have come down substantially in the last five years. Often, I was able to find a revenue rate of $700 per person or less, so I just used flexible points/travel credits and saved the miles.

Revenue price on Lufthansa is trending upwards

Lufthansa is by far the best option for my parents because it means only one connection in Frankfurt. Last time I booked them on KLM/Delta flights and regretted the decision. They had to collect their bags/go through immigration in Atlanta, and almost missed the flight to Orlando.

My parents don’t speak English, which complicates the matters further. So from now on, I really want to stick to Lufthansa if at all possible.

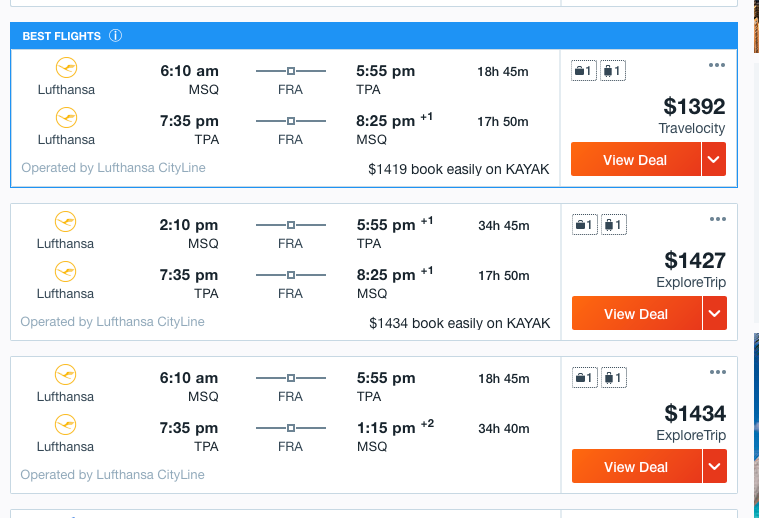

I’ve been following the price trends recently, and it looks like the tickets have gone up significantly, even during fall:

Any month I’ve checked, I was looking at a minimum of $1,200 per roundtrip ticket. At this rate, using flexible points will not be my best option. Even if I get 1.25 cents per point, I would be looking at spending 96k points or more. Sure, it would include $120 tax, plus the tickets would earn miles, but still.

Frequent flyer miles: a hedge against inflation

While I don’t value miles as much as most people in the hobby, I definitely think you should have them in your “travel tools” arsenal. Better yet, collect flexible points which you can transfer to airline programs immediately (I recommend focusing on either UR or MR programs).

Miles are terrific when you have to fly last-minute because revenue rates tend to be quite high. But they can often be useful even for economy flights on which you redeem far in advance.

While award rates on business and first-class tickets to Europe have gone up significantly over the last few years, economy redemption has been holding steady. That makes sense, especially due to introduction of low-cost carriers like WOW and Norwegian. Often you can fly to/from Europe for less than $400 all-in. At that price, using miles will make zero sense.

But the thing is, there is a big difference between flying from a major hub like London/Paris/Frankfurt and flying from a remote corner of Europe like Belarus. Yet both cost 30k miles one-way via most programs.

There are two options to avoid fuel surcharges on Lufthansa flights: United and Avianca. I currently don’t have any United miles and due to 5/24 rule have no way of signing up for Chase Ultimate Rewards cards or United co-branded products. The same goes for my spouse.

I have 20k Avianca miles and my husband has 17k. I keep those as an emergency stash in case I have to fly home at the last minute. Avianca charges 30k miles one-way, so I would have to buy additional miles at 1.5 cents per mile during the time of redemption. For last-minute ticket it would definitely be worth it.

I do have a sizable stash of Membership Rewards points, but all of MR Star Alliance transfer partners add fuel surcharges to Lufthansa operated flights.

Putting my mom’s United miles to good use (eventually)

You should collect miles whenever possible, as long as it costs nothing. Unfortunately, I don’t always follow this rule myself. But when I used flexible points for my parents’ tickets, I did make sure they earned United miles on Lufthansa flights.

OK, I admit, one time I had to request the mileage credit 5 months after the flight commenced because I forgot to enter my mom’s frequent flyer number. Another confession: I just discovered that her United miles were set to expire next month. Oops! I went ahead and purchased a $5 Walmart e-gift card that earned her 2 miles and extended the expiration date by 18 months.

The miles posted instantly. So, my mom currently has 13,365 United miles in her account. But how do we top it off to get to 30k level? Buying miles is very expensive and will negate any savings on the airline ticket.

However, I have 25,000 non-transferrable (for now) Ultimate Rewards points, earned via my Chase Freedom credit card. To new readers: you can only transfer UR points to airline and hotel programs if you happen to have a premium Chase credit card like Chase Sapphire Preferred. I don’t.

The plan

I will be applying for Citi Thank You Premier card next month. Citi points transfer to Avianca Lifemiles 1:1, so that’s one possible way of getting what I need. But I like to have a Plan B when it comes to my parents’ tickets. After all, Avianca may add fuel surcharges on Lufthansa between now and next year. I’m also kind of hoping to use Citi Thank You points on a Bahamas cruise.

I went ahead and added my mom as an authorized user to my Chase Freedom (free). She doesn’t have a SSN, but I wasn’t required to add it. When I get ready to book the tickets, I will check if award seats on Lufthansa via United.com are available. Usually, my parents have some flexibility in their schedule. It’s possible that I will only be bringing my mom, which means I would need 60k United miles.

If I find the award seats, I will convert my Chase Freedom to Chase Sapphire Preferred. It will mean paying $95 annual fee, but additional cards are free. Since my mom is listed as an authorized user, I will simply transfer UR points instantly to her United frequent flyer account.

Hopefully, I will get more UR points between now and next year to cover her roundtrip ticket completely. Chase Freedom earns 5 points per dollar in rotating categories, so I will be paying more attention to those. But it would be worth it to convert Chase Freedom to Sapphire Preferred even if it meant redeeming miles on one-way ticket.

Fuel surcharges from Minsk to Tampa can be as high as $400, so paying $95 annual fee on Chase Sapphire Preferred +$110 tax would still save me a lot money. Plus, it will be nice to have access to Southwest and Hyatt transfers for one year.

I’ve seen reports that $95 fee doesn’t get charged right away, so I could technically convert the card back to Freedom right after United transfer. But I’ll probably hold on to the card and not try to poke the bear (aka Chase).

My plan won’t work if you need points immediately because conversions from Chase Freedom to Preferred (or back) can take a day or two, though in the past I got it taken care of within three hours after sending a secure message in my profile.

Regardless, this is my patented way of having UR points without actually having UR points. And who knows, maybe the prices from Minsk will come down significantly between now and next year, and I will simply use cash to book the tickets. Developing…

P.S. If you are planning to apply for Chase Freedom online (subject to 5/24) in a near future, I hope you consider using my personal referral link

It will help me get closer to my goal since I would get 10,000 points per approval. Thanks in advance! If you live near Chase branch, you may be targeted for a higher offer if you stop by. You might also want to read my post on why starting with Chase cards makes a lot of sense for those who are new to this hobby.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

It’s a battle! I regularly fly our son’s family to USA from Berlin in addition to flying there with my wife. We usually use United points as they prefer flying LU. I admit, I buy points (always when on sale or with bonuses), and I don’t regret doing it. I hoard my UR points whenever possible and feel comfortable violating several “points hacking rules” consistently. My bottom line is seeing our granddaughters at least twice a year. The struggle is real, Leana, but we carry on. :>)

@Russ The struggle is real! It is expensive when you have family overseas. But I’m sure your granddaughters appreciate seeing you twice each year. What better way to spend miles/money could there be?

No need to feel embarrassed about buying miles. Whatever works! I know Avianca program is a good deal for premium cabin redemptions on Lufthansa.

After you have changed Chase Freedom to CSP, I don’t think you can change the CSP back to Chase Freedom after getting the United miles. I believe you would need to wait a year.

@Steve Thanks for the data point! I’ve read that some people were successful in the past, but that has probably changed. Honestly, if I convert Freedom to CSP, I plan to hang on to it for a year anyway. It stinks to pay $95 fee, but it’s still cheaper than coughing up crazy Lufthansa fuel surcharges.