One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

Please follow us on Facebook and Twitter for most important breaking news in the miles and points world!

1) The biggest story of the week was the announcement of the upcoming devaluation of IHG anniversary certificate.

It looks like Chase is now saying that those who have applied for the card between 1/1/2018 and 4/5/2018 will receive an unrestricted certificate on their first anniversary. The details are a bit hazy at this point, so keep an eye on it.

As I’ve said in the post update, I strongly believe that everyone who had the card less than one year should be given the same courtesy. This whole thing has been poorly handled by Chase so far.

In a bit of positive news, yesterday I’ve mentioned on Twitter that it looks like IHG has updated the list of ineligible properties and removed those that cost 40k points. As I’ve predicted, it appears that it was a matter of incompetence and not a nefarious plan.

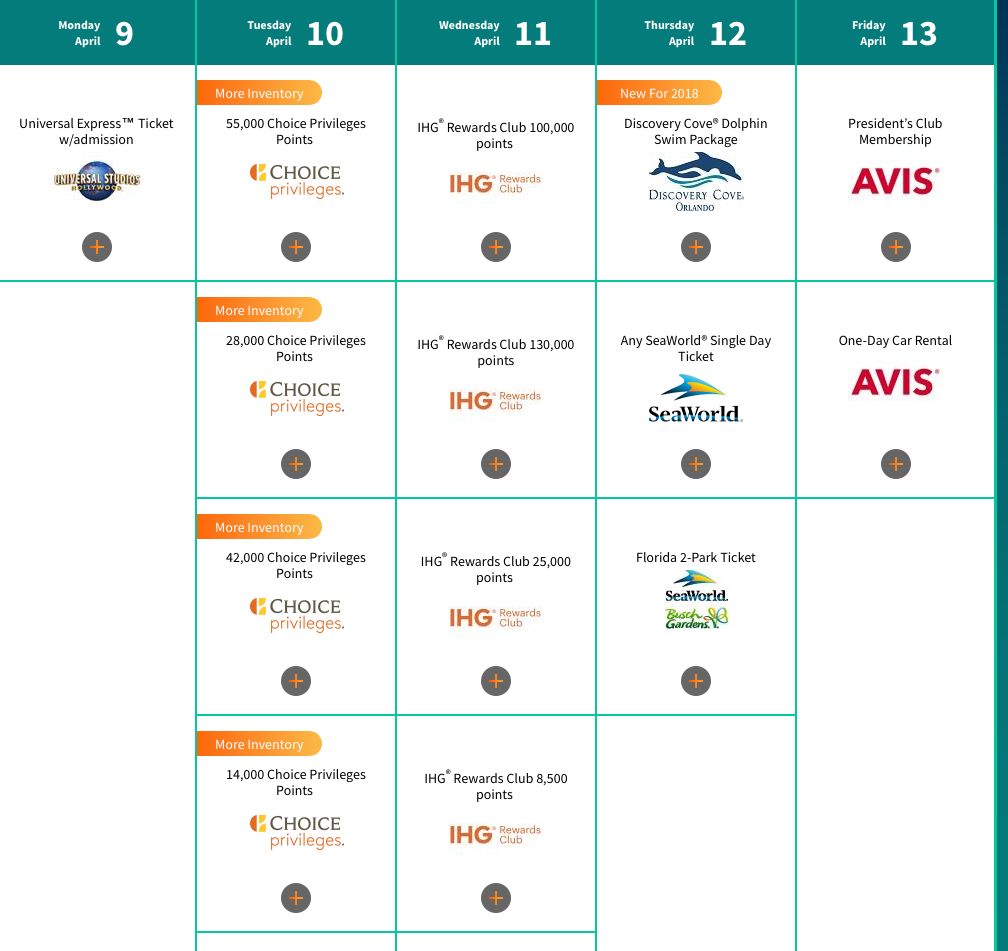

2) Daily Getaways is (are?) back.

The promo has been coming around annually, and this year is no exception. If you are a new reader, it’s basically a way to acquire points and travel deals at a discounted price. Some deals are a dud, other ones are pretty good.

I plan to highlight the most worthwhile promos to make sure you don’t miss out. I’ll also do a reminder on it every Friday. They have already posted a preview for the next few weeks, so check it out.

Here are the deals for next week:

If you are interested in a specific deal, make sure to sign up for an alert.

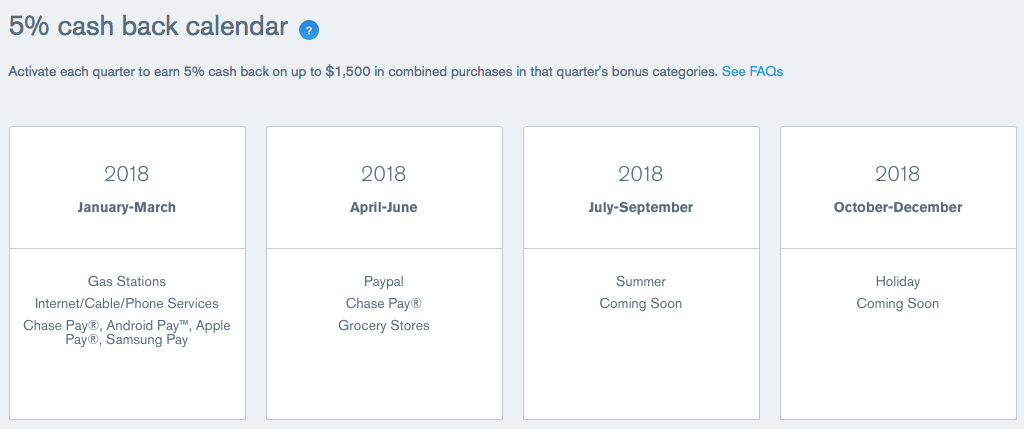

3) You can now earn 5 points per dollar on Chase Freedom on PayPal, groceries and Chase Pay:

Keep in mind that you can often buy popular gift cards like ones for Amazon and Disney at a grocery store. Another angle I haven’t thought about was reported on DoC blog. Did you know that you can use PayPal to pay your federal income taxes on websites like Payusaatax?

Even though you will pay a fee of 1.97%, you will come out ahead due to PayPal being a bonus category on Chase Freedom. Very interesting, and I may take advantage of this opportunity in order to pay estimated taxes on this blog.

Chase Freedom card (my personal referral link) is one of the better cards when it comes to everyday spending, which is why it has been on my “keeper” list from the time I started this site years ago.

When you pair it up with premium Chase cards, you can combine the points and potentially get more value. It is subject to 5/24 rule If you apply for it now, you will get 17,500 points after spending $500 in 3 months and adding an authorized user. It’s not an earth-shattering bonus, but the card is a good one to have in your wallet regardless.

4) You’ve probably heard that the link for new Barclays Arrival Premier (pays me no commission) is now live.

I’m not going to rehash the details on the card, you can read them on Doctorofcredit.

The fact that the product comes with no sign-up bonus disqualifies it right there (for me). Otherwise, it seems like an innovative card that falls short in key areas. For one, the transfer ratio to airline partners is not 1:1. Plus, the list is a bit weak right now. Overall, I fail to see how this card is better than Amex Blue Business Plus, that earns 2 MR points on everything on up to $50k per year.

If I had to describe a customer who may benefit from Barclays Arrival Premier, it would go like this: an organized person who can easily spend $25k per year, doesn’t chase new bonuses, prefers to book revenue travel, and for whom mileage transfers are more of an afterthought (though nice to have).

Let’s say one puts full $25k on this credit card and gets 75,000 points as a result. Those points can be redeemed towards $750 in travel purchases. Assuming you value them as much as cash, that’s a return of 3%. But don’t forget the annual fee. When we deduct it, it becomes 2.4% return, which is marginally better than Citi Double Cash.

Plus, you absolutely have to spend exactly $25k in order to receive this payout. Most folks will probably use MR or UR points for airline transfers before settling for poor Arrival Plus ratio. Overall, IMO it’s definitely not the card for an average Joe. If you are interested in this product, I would wait because I have a feeling that Barclays will add a sign-up bonus in order to entice folks.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leave a Reply