Last month I wrote a post about my reluctance when it comes to relying on credit cards for travel insurance. I did mention that for simple trips it’s probably a good idea, though. My reader Tania has reached out to me and kindly offered to share her experience with filing a trip delay claim on her Citi Prestige.

Be aware, Citi Prestige only offers partial coverage. In the event of trip cancellation, you will be entitled to a refund of what you actually paid. So, if you are redeeming miles, paying award taxes with Citi Prestige may not be a good idea. I would choose Chase Sapphire Preferred or Chase Sapphire Reserve when given an option. In this case the reader filed a trip delay claim and her expenses were covered, since she used Thank You points earned via Citi Prestige to pay for her flights.

Tania:

Last year I applied for Citi Prestige. I enjoyed the bonus and the regular perks ($250 annual airfare credit, lounge access and Global Entry fee reimbursement) which more than made up for the $450 annual fee. For most regular folks such a high annual fee is really hard to justify. It was for me. But after my travel delay insurance ordeal this card is a keeper.

Every year I travel to Orlando so my son can spend time with his dad’s family and so I can escape the frigid New York weather and visit my friends in Florida. I work really hard to accumulate the points which ease my financial burden and help me maximize vacations.

Last May I scored a great deal and used American Airlines miles to cover a stay in Hyatt Regency Grand Cypress, plus a rental car. We flew on revenue Delta fare via Citi Thank You points, earned with Citi Prestige.

Our flight was scheduled to leave Orlando at 8pm, but around 2pm I got an email from Delta advising me that the flight was delayed 90 minutes. Thanks to Hyatt Explorist status (via Mlife status match) I was able to secure a late check out at 4pm. With plenty of time to spare, I decided to meet a friend for ice cream before heading to the airport. I knew a storm was approaching New York, but I was still hoping to get out of Orlando.

Around 6pm I was at the parking lot chatting with my friend when I got an email and text message from Delta telling me my flight was canceled and that I would now depart at 7:30 AM the next day. For 30 seconds I was in panic mode. But thanks to the miles and points gods I remembered about the travel delay insurance. I pulled my Citi Prestige out, called the number on the back of the card and a friendly rep transferred me to the insurance agent.

It took maybe 5 minutes for the agent to explain the process. She advised me not to worry about costs and even suggested a nice restaurant for dinner. I was told the insurance would cover up to $500 (hotel, meals and rental car late fees). I decided to call Delta to schedule a later flight the next day so I would not have to wake up at 5 AM. I was able to secure a 10:30 AM flight. I’m not going to lie, I was very temped to book Disney’s Polynesian resort and character breakfast at Ohana’s, but I was not in a financial position to “test” the insurance.

So I used the Hyatt app to book a standard room at the Regency hotel inside the Orlando airport. The property is super convenient because it’s located inside the terminal, so I was able to return the rental car without any penalties. The last minute rate was $189 plus tax. I did everything standing in a parking lot while my son played with my friend’s daughter inside the ice cream shop. We were very tired, so I decided to go out for a light dinner and drive to the airport to return the rental car.

My son was so excited to stay in a hotel inside the airport. We were lucky and scored an upgrade to an airport terminal view (funny enough, this is considered a premium room). Next day we enjoyed a nice breakfast at the hotel and caught our flight well rested.

Later I downloaded the form from the Citi Prestige website, filled out all the information, scanned my receipts and sent them to the email address provided. 30 days later I got the credit on my statement.

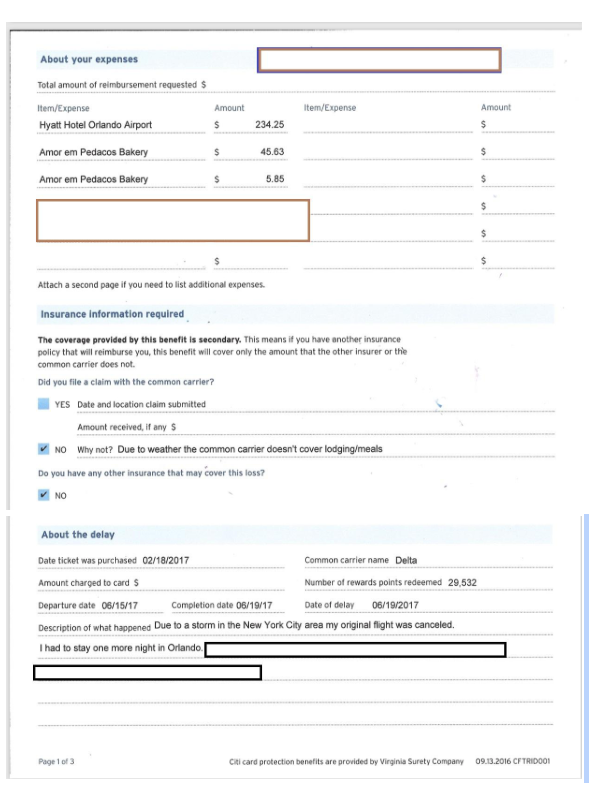

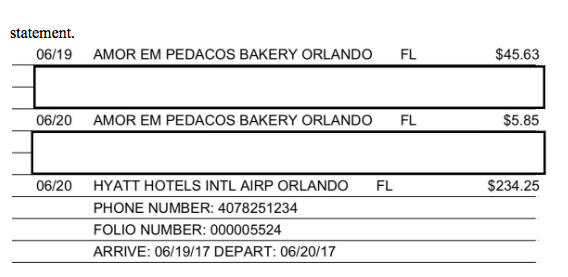

This is what my claim form looked like:

The costs were reimbursed 100%:

Lessons learned: Travel insurance is your friend, always have your cell phone fully charged, airlines and hotel apps are helpful, and spending time reading miles and points blogs always pays off.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thanks for the play by play. It’s super helpful to hear that you didn’t panic – I would’ve probably had a panic attack. So I’m assuming the flights need to be booked using my CSR for the trip insurance to kick in?

@Stephanie That’s correct. CSR offers the best travel insurance on the market, hands down. If you pay taxes on award tickets with CSR, you will be covered. I recommend you see my linked post at the beginning for more info and read the breakdown on Frequent Miler.

CSR also has trip interruption insurance. I don’t have the prestige so I use csr. Great story.

@Natasha True! That’s why I mentioned it at the beginning of the post.

Leana and Nancy,

I am glad I can help. Your blog has helped me so much throughout the years. So many trips and so many memories thanks to miles and points.

@Tania Thank you for your kind words! It means a lot when people appreciate all the time and energy that Nancy and I have poured into this site.

This is a great example. Thanks for sharing!

Thanks, Nancy!

This is very good to know!

Thanks for sharing!

@Lindy Glad it was helpful! I’m grateful to Tania for being generous with her time yet again. She has also contributed a post on her Disney cruise https://milesforfamily.com/2017/05/12/cruise-toddler-disney-magic-good-bad-magical/