One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

A few weeks ago, Leana wrote about her recent credit card applications. My husband and I hadn’t applied for new credit cards since last July. I was shocked to learn it had been so long, even though I applied for a business credit card last fall. Since we have some larger expenses coming up, I decided it was time for another round of credit card apps.

Travel Goals, Restrictions and Previously Owned Cards

Before deciding which cards to apply for, we had to think about our travel goals. Where are we going in the next 1 to 2 years? What miles and points do we already have, and what could help us achieve our goals?

We have a domestic trip coming up this summer for a month-long condo rental. We plan to fly to Denver this summer and to Florida next January, for a total of three domestic trips. Next summer, we are planning on a longer international trip. My husband and I also want to have a short anniversary getaway, just the two of us. Those are ambitious plans for the next two years!

We are looking for cards that will help us pay for our domestic flights and/or strengthen our position to afford our overseas trip next year. Since we are about to go on a big trip to Hawaii, I don’t want cards with large upfront annual fees.

We have almost 300,000 AA miles, 160,000 Hilton points, ~19,000 Hyatt points and a few Marriott points.

Unfortunately, both my husband and I are under Chase’s 5/24 restrictions. We consistently run 9/24, and we both obtained 5 new personal credit cards last year. Neither of us can get the Barclaycard Arrival Plus again due to its 6/24 rule, and my husband already tried to get the Capital One Venture Rewards card again but was denied.

My husband has previously owned the Amex Premier Rewards Gold and I had the Amex Platinum card. We’ve both owned the Delta Amex cards, and we had the Chase British Airways cards in 2016-2017. So, we have a much smaller pool of cards to choose from than people who are new to this miles and points hobby. But, we still have options.

U.S. Bank FlexPerks Visa

I wrote about the higher bonus for this card during the Winter Olympics promo. This card is attractive to me because the points are worth 1.5 cents for travel that we could use for our upcoming domestic flights.

My husband and I both applied for the pre-approved version, which only requires $500 in spending to get 25,000 FlexPoints. The annual fee is waived the first year, and the pre-approved version offers 15 months at 0% interest for purchases. Our applications went to pending, but we were both approved one week later.

Since we’ve both had this card before, we likely won’t get the Olympics medal bonus. Even though the fine print says “Existing and previous FlexPerks Travel Rewards visa accounts do not qualify for Bonus FlexPoints for a similar account type”, other people report getting the base bonus of 25k points during multiple years and cards. After meeting the minimum spending on each card, we would have $765 in travel rewards to use for our next domestic flights.

Bank of America Premium Rewards Credit Card

This card currently has 50,000 bonus points after spending $3000 within the first three months. The $95 annual fee is NOT waived. You can use the points in the travel portal or for a statement credit. The card also comes with a $100 airline credit and a $100 Global Entry credit. If both my husband and I were approved for this card, we would have over $800 we could use for domestic flights (after factoring in the annual fees).

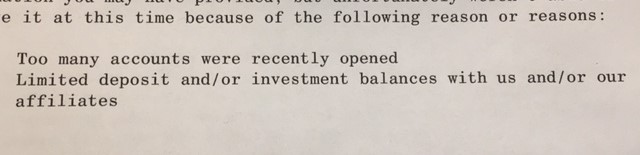

Unfortunately, we were both denied for this card. I was fairly surprised, because I consistently read that Bank of America has fewer approval restrictions than other banks. We only have one other BOA card. Our credit scores are both over 800. I even called reconsideration but couldn’t get approved for these reasons:

I might convince my husband to call a “resolution manager” (see this thread) on his denial.

This card does pay us commission if you apply through our affiliate network. The Capital One Venture card is a better deal if you can get approved for that instead.

Amex Premier Rewards Gold

As I mentioned above, I have never had the Amex Premier Rewards Gold card. Doctor of Credit recently posted that it is possible to get targeted for a version with 50,000 bonus points after spending $2000. The annual fee is waived the first year.

This card is attractive to me because Amex Membership Reward points have many transfer partners. I could transfer to British Airways Avios to use on domestic AA flights. Or, my I could transfer to another airline for an additional mileage currency for an overseas trip. Of course, I could always use the points for flights at a redemption rate of 1 cent per point for $500.

I applied, and I was approved.

Credit Card Apps Later This Year

I plan to keep checking if my husband can get an Amex Everyday card with 25,000 bonus points. We could both transfer our Membership Rewards points to British Airways and have almost enough for 4 round-trip tickets to Florida on AA.

Later in the year, we will apply for the Chase British Airways cards again. We have to wait 24 months since we were last awarded the bonus miles, which will be up for us this fall. Living close to an AA hub at DFW has made these BA Avios very useful to us in the past.

At some point, we will apply for the Chase Hyatt cards to get the ball rolling for our potential anniversary trip. And of course, any new credit cards that would help us with our domestic flights or our overseas trip will get my attention.

How did your last round of credit card apps go? What card(s) are you hoping to get in the future?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

I currently have a single BOA card-the Amtrak card. I’ve been cooling it with the apps-not for any particular reason but nothing really enthuses me or makes me want to apply. I also find that I tend to overspend when I have a MSR on a card. That’s the downside of churning.. “oh let me buy this to meet minimum spend”..lol Anyway, that’s great that you got approved for the PRG.

I hit AMEX hard in 2016-2017 and got the Plat 100k, PRG 50k, BBPlus 20k, Green 25k and SPG 35k. So far, in 2018, I got the Ameriprise Platinum for lounge access and got free global entry for both kids since DH is a free AU. We hit the Philly and LAS Centurion lounges on our recent trip to Vegas, Arizona and Utah. And Amex didn’t even hard pull me :).

@Natasha You’re right, the tendency to overspend just to hit the bonus is very real! Wow, you really maximized those Amex cards! I’m glad at least Amex is still friendly to those of us who are frequenters in this hobby. 🙂

I agree with Leana on the BoA underwriting criteria. They are constantly sending me pre-approval letters for all of their products, and we don’t own 1 BofA card and I don’t have accounts with them. I was denied for too many inquiries. That’s fine, because Capital One Venture accepted me instead which works out nicely for our upcoming trips.

@Stephanie I’m so glad you were approved for the Capital One Venture card!!

I really think BoA has a different (more strict) underwriting criteria for their Premium Card. I could be wrong, but I seriously doubt that getting approved for other BoA products is just as diffficult.

@Leana I hope you’re right, because I’d like to apply for the Alaska Airlines card sometime.

I’m nor surprised at the BofA denial. My wife and I have both struck out the past couple times, even though I don’t think it is because of their 2/3/4 “rule”. I think there are other factors in play, including the fact I still have three cards currently with them. Her denial surprised me more, as she has fewer hard hits, had had a longer run without cc apps, and only one current BofA card. But such is life in this game sometimes.

@snyderman Bummer! It’s par for the course when we are this far into the hobby, I guess.