One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

It’s back! The U.S. Bank FlexPerks Visa has a new sign-up bonus and a special promo tied to the upcoming Winter Olympics. Is it worth it?

My husband and I signed up for this exact card in 2016 during the Summer Olympics. I used the points for an overnight train trip with my kids last summer. A few things have changed since I had the card in 2016.

Current Offer for U.S. Bank FlexPerks Travel Rewards Visa

The current offer for the U.S. Bank FlexPerks Travel Rewards Visa (non-affiliate link) is 25,000 FlexPoints after spending $2000 in the first 4 months. The previous bonus was 20,000 FlexPoints.

If you apply between 2/5/18 and 3/10/18 and make your first purchase by 4/6/18, you are eligible to receive special promo bonus FlexPoints based on how Team USA performs in the upcoming Winter Olympics. Gold medals are worth 500 points, silver medals are worth 250 points and bronze medals are worth 100 extra points. Based on how Team USA performed at the last Winter Olympics, the bonus from the Olympic promo could be 7450 points or even higher.

The card’s $49 annual fee is waived the first year. The card earns 2X points in whichever of these three categories you spend the most on during the month: gas stations, grocery stores or airlines. You also get 2X points from cell phone providers, and 1X points on all other purchases.

For the business version (non-affiliate link) of the card, you earn 2X points on either gas stations, office supply stores or airlines. The annual fee is $55 plus $10 per authorized employee, waived the first year.

Prior to 2018, FlexPoints had tiered redemptions. However, FlexPoints are now worth 1.5 cents per point towards travel. After the sign-up bonus, minimum spending and forecasted Olympic bonus, the FlexPoints from this card are worth over $500.

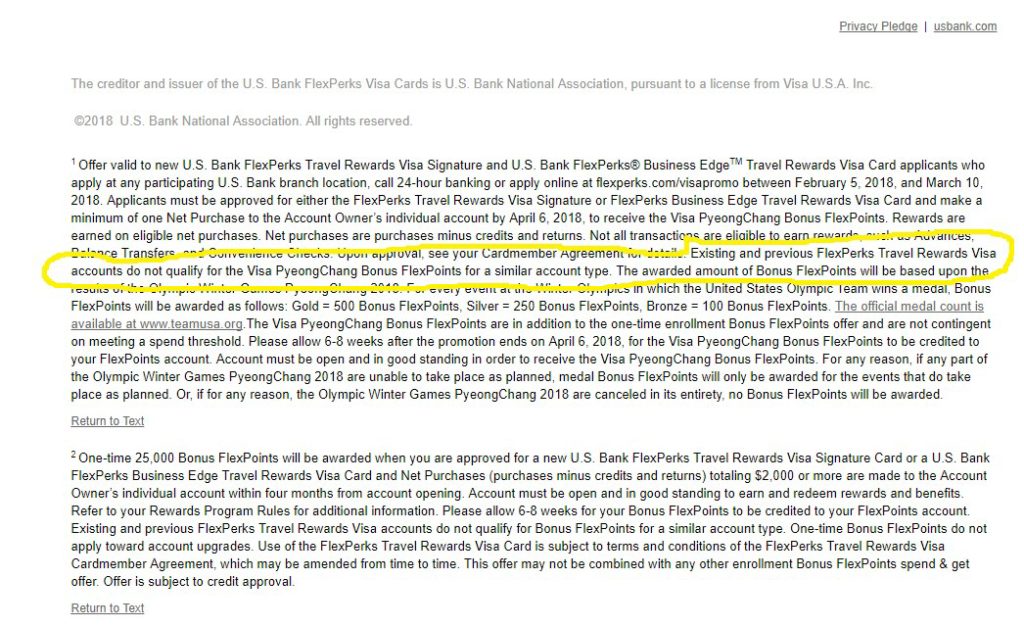

Note that the Terms and Conditions now say that “Existing and previous FlexPerks Travel Rewards Visa accounts do not qualify for the Visa PyeongChang Bonus FlexPoints for a similar account type.” Since my husband and I had the card in 2016, we would presumably not be eligible for the extra Olympic FlexPoints if we reapply.

The fine print also says that “Existing and previous FlexPerks Travel Rewards visa accounts do not qualify for Bonus FlexPoints for a similar account type.” However, in the past, people have reported being able to get approved for this card and reapply at the next Olympics. YMMV.

Getting Approved for U.S. Bank Cards

U.S. Bank is notoriously strict on approvals. Doctor of Credit recommends freezing SageStream and ARS credit reports before applying (see this post).

During the last Olympics promo for this card, my husband and I both applied and our applications went to pending status. We had to call U.S. Bank’s reconsideration line before getting approved for the card. U.S. Bank is sensitive to recent inquiries and applications.

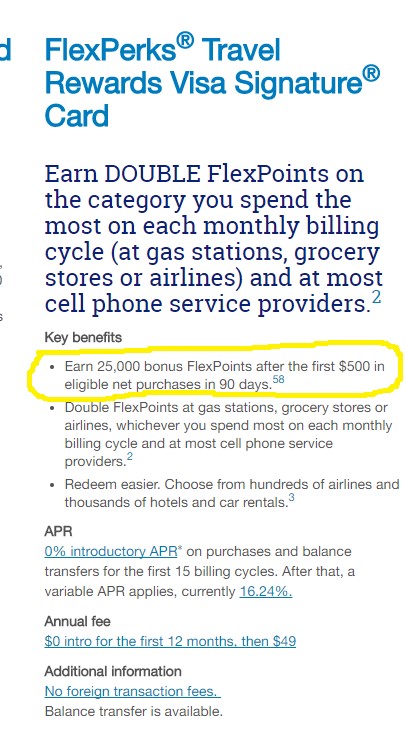

U.S. Bank has an online form you can use to see if you are pre-qualified for any of its cards. When I input data for both me and my husband, I found we were both pre-qualified for the FlexPerks Travel Rewards Visa. The offer included 25,000 bonus points after just $500 in spending (instead of $2000), plus 0% interest for the first 15 billing cycles. The pre-qualified offer did not mention the Olympics promo points.

Is this Card and the Olympics Bonus Worth It?

It depends.

If you are new to the miles and points hobby, I don’t recommend getting this card. You should start with Chase cards, since once you start accumulating more cards, you will be restricted from getting most other Chase cards (see this post). I recommend the Chase Sapphire Preferred or the Chase Southwest Rapid Reward cards, depending on your goals. I also rank the Capital One Venture Card and the Barclaycard Arrival Plus cards over this card.

However, if you are already over 5/24 and are looking for your next card, I consider this offer a low-hanging fruit. If you have two adults in your household that can apply, you get over $1000 in travel rewards for just $4000 in spending and no annual fees the first year. Typically, Team USA earns more medals in the Summer Olympics, but there is no guarantee that this offer will come around in 2020.

What about the U.S. Bank Altitude Reserve card? Isn’t that a better offer?

Yes, it does have a higher sign-up bonus (50,000 points) worth $750 in travel. However, the spending threshold to hit the bonus is higher ($4500 in the first three months). The card also comes with a $400 annual fee that is not waived the first year. You can offset the fee with the $325 in airline travel credits and the $100 Global Entry statement credit, but you still have to pay the annual fee upfront.

You must also already have a relationship with U.S. Bank to qualify for the card. Note: This card is in our affiliate network, let us know if you need help finding it. See Leana’s analysis of the U.S. Bank Altitude Reserve card here. If you are looking for a lower minimum spending and no annual fee the first year, the FlexPerks Visa is the better choice.

Are you going to apply for the U.S. Bank FlexPerks Travel Rewards Visa? Have you had the card before? Or is another travel rewards card on your list for your next application?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

I’ve never had this card, so might try applying right before the cut-off date. I want to see how many points are on the line before pulling the trigger. I doubt I’ll get approved, but who knows.

On pre-approved offer, I don’t believe US Bank will add bonus points unless Olympic promo is specifically mentioned on the page. I know some people used referral links in the past, and were shafted. I could be wrong, though.

~$500 for a no-fee for the first year card is very attractive, assuming the Olympic bonus points come in close to last time! You’re probably right about no Olympic bonus points in the pre-approved version. But the $500 spending requirement in the pre-approved offer is appealing, too.