You’ve probably heard that applications for new Amex Hilton cards (including Ascend and Aspire versions) are now live. It was a long-anticipated development, and miles and points community is buzzing with excitement. The big unanswered question up until this point was what kind of sign-up bonus each product would have. We now know the answer.

Most people will probably be interested in Ascend and Aspire versions, so that’s what I’m focusing on in this post. But first, let me highlight few important details on each card:

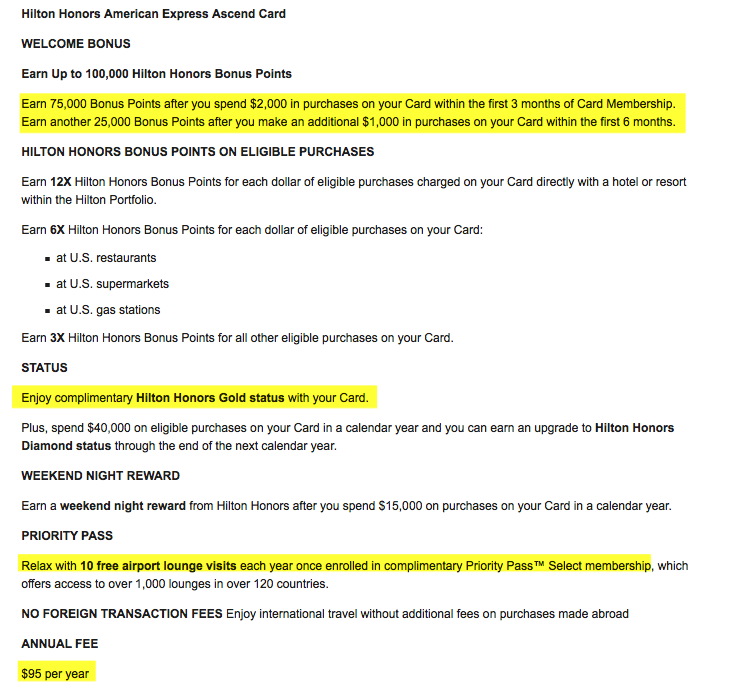

Details on Ascend card:

To those who have canceled their Amex Surpass hoping that Ascend would be considered a new product, there is hope. The current terms have this verbiage:

How Amex will view this situation is anyone’s guess because we, obviously, don’t have any data points yet. If you were contemplating applying for this card hoping to double-dip, I would do it sooner rather than later before Amex decides to change the language. My Surpass was already converted to Ascend (that was fast!)

Priority Pass lounge perk:

I was very curious about how the 10 complimentary passes would work. I was pleasantly surprised that you will be able to use them for guests, not just primary cardholder. Nice!

This is a sleeper benefit for families, and a decent alternative to renewing high-fee cards like Chase Sapphire Reserve. Obviously, I’m assuming you also value Hilton Gold status (free breakfast and possible suite upgrades) which is complimentary as long as you renew the card and pay $95 each year.

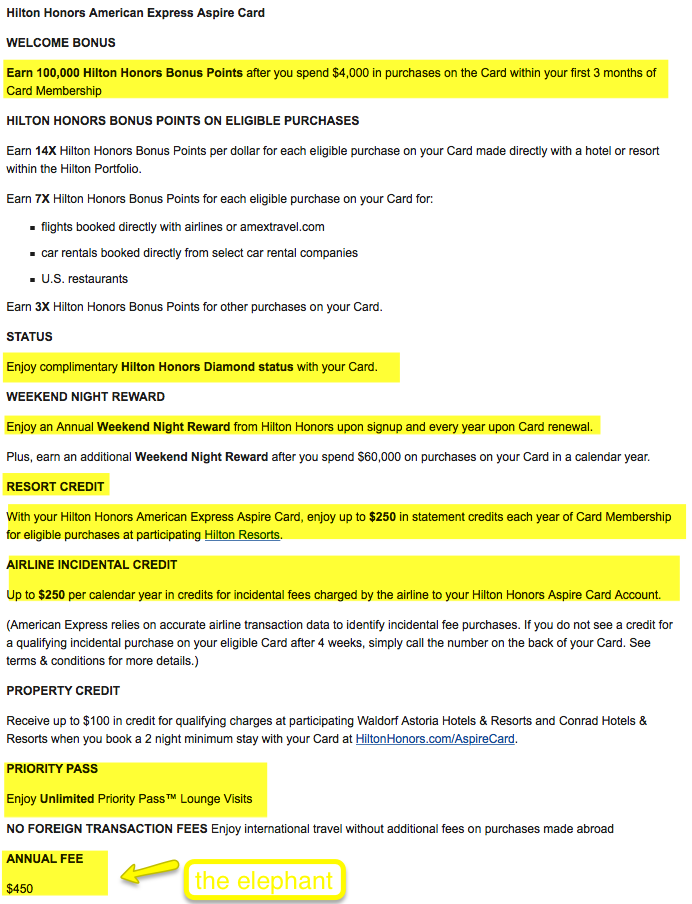

Details on Aspire card:

This is a totally new product, so everyone is technically eligible.

Which card is better?

1) Sign-up bonus

While Aspire requires $4,000 in spending in order to collect full bonus compared to $3,000 on Ascend, you also get a free weekend night with the former card.

Winner: Aspire

Update: for a limited time, Ascend Card offer comes with free weekend certificate upon first renewal. You have to apply by June 27th.

2) Perks

Aspire gives Diamond status, while Ascend gives Gold. You are more likely to get a suite upgrade if you are Diamond. Plus, you get free access to lounge (if property has one) and few other benefits. The fact that suite upgrade is not guaranteed makes Hilton top tier status not quite as valuable to me. For frequent travelers, it’s probably very appealing. But overall, for normal folks, Gold will suffice.

You also get unlimited Priority Pass lounge visits with Aspire. It’s nice for those who fly often and have no access to this perk via other cards.

For most families who fly few times per year, 10 passes will be enough. Plus, remember, you can bring two free guests with your unlimited Priority Pass. Having 10 passes gives you more flexibility and may be a better fit for families of four or more.

If you plan to stay in a Hilton resort, getting $250 credit would be a huge win. When we stay in resorts, we usually end up spending a good bit of money on food because it’s too hard to go off-site. Apparently, even room charges (and potentially Hilton gift cards bought at the resort) will trigger the credit, but I can’t vouch for that.

So, this is a valuable benefit, but ONLY if you were already planning on vacationing in a Hilton resort. You can see the eligible list of resorts here There are quite a few in Orlando and other popular tourist destinations, so maximizing this perk shouldn’t be too hard for most traveling families.

On airline incidentals credit: this perk could be a game changer. If you can buy airline gift cards and get them reimbursed, this would be a huge win. I’ve never done it because the terms prohibit it, but use your own judgement on this one. Still, I don’t recommend you apply for the card counting on it. If it works out, great. If not, you will have to be satisfied with all the other perks you are getting.

Winner: Aspire

3) Annual fee

This is the biggest downside of Aspire card. Coughing up $450 upfront for normal folks is a tough pill to swallow, especially when we are talking about a hotel card. Ascend has a much more reasonable $95 fee, which will be palatable for most families who don’t earn six figures.

Winner: Ascend

4) Renewability (my patented term)

This will depend on your individual needs. For some, paying $450 each year to renew Aspire will be a deal-breaker. The same goes for Ascend, too. Sure, retaining Hilton Gold status and getting 10 Priority Passes in exchange for paying $95 fee seems like a decent value proposition. But once again, if you rarely fly or stay in Hilton hotels, it may not be the card for you.

Frequent travelers who love Hilton and have no problem spending $250 yearly at Hilton resorts, should absolutely consider keeping Aspire in their wallet. You get a “free” weekend night just by renewing the card. Even if you don’t take advantage of airline credit, your net cost will be $200. For that amount you will get a weekend night valid at most properties, plus Diamond status. It’s a total no-brainer for those who live on the road.

Winner: it depends

Which card should you apply for?

That’s a million dollar question, isn’t it? For those who recently canceled Surpass hoping to collect new bonus on Ascend, there is a compelling reason to apply for it now. Just be prepared to fight with Amex for your bonus. But the bottom line is: the terms don’t preclude you from qualifying, not yet.

For everyone else, the decision will depend on your individual needs.

Do you have plans to stay in Hilton resorts during the next year? Can you easily utilize the “free” weekend night? Will unlimited Priority Pass access benefit you significantly? Is having a better shot at a suite and other Diamond perks important to you? Can you afford to pay $450 fee upfront? In that case, you may want to consider Aspire.

Leana’s personal referral link for Aspire

Nancy’s personal referral link

Do you simply want to collect some Hilton points for road trips around US? Will you only be flying once or twice with your family in the next 12 months? Is Gold status sufficient for your needs? Are you on a tight budget? In that case, consider Ascend.

Full disclosure: We do make commission on Ascend card. We also earn commission on the business version of this card if you feel inclined to support the site.

Are you new to the hobby and haven’t yet applied for Chase cards? Do you currently have zero plans for Hilton points? In that case, forget Amex Hilton cards and focus on flexible points or other bonuses instead. Chase is a good place to start, and you can see my reasons in this post.

I’m seriously tempted by Aspire card because I happen to have plans to stay in a Hilton resort. That said, it will only be for one night, and I can’t imagine that I will spend $250. I could, but why? That means I would have to find ways to maximize the credit by planning other stays within one year, and I don’t like to have that type of pressure. We could utilize the weekend night without any issues, though. Decisions, decisions…

Readers, what are your plans?

(hat tip to The Gate for providing details on the cards)

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Здравствуйте Леанна. I liked your comparison of the cards. I received the ascend card because I had the Citi Hilton catd. When looking on my American Express account page it only offers the Aspire card as an upgrade with no bonus points offered. I have called Amex but they said I am not eligible for the sign up bonus. Strange, I will keep waiting as I have Diamond status until next year. Hopefully it will change. Thanks for your post.

@Michael Здравствуйте! Thanks for your comment. I tried to keep the comparison short and sweet. I’m working on being more concise, which isn’t always easy. 🙂

You may get a decent upgrade offer later on. I definitely wouldn’t settle for upgrade without the bonus. What’s the point in that? May as well apply for Aspire card. Speaking of, I’m pretty sure the Amex rep is mistaken. You are eligible for bonus on Aspire product. It’s a brand new card.

If I had the Surpass (now automatically changed to the Ascend) and got the signup bonus, can I also get the Aspire and get that signup bonus?

@Jason I don’t see why not. It’s a separate product, and you should definitely be eligible for the sign-up bonus on Aspire even if you previously got bonus on Surpass. My guess is that Amex won’t give out bonus on Ascend to those who had Surpass (though it’s not 100% clear at the moment), but Aspire shouldn’t be affected.

Thanks for the review Leana; I love the comparisons. We have no plans for staying at Hiltons at the moment, but this may come in handy for a roadtrip.

Stephanie, glad it was helpful. I think both offers are worthwhile in theory. It just depends on your plans. I’m debating on whether I should pull the trigger on Aspire. But that $450 fee, yikes!