If you’ve been following my South Pacific redemption saga, you know that I recently burned a TON of miles and points. When I said at the beginning of the process that everything must go, I meant it. Of course, I do still have some leftover miles and points. So, let me share the numbers with you. You won’t be jealous, I promise!

Traditional miles

American Airlines AAdvantage miles:

Mine: 1,500 miles

Spouse: 1,300 miles

Delta SkyMiles:

Spouse: 5,500 miles

Avianca Lifemiles:

Mine: 17,000 miles

Spouse: 20,000 miles

Alaska Air:

Mine: 11,500 miles, soon to be zero (post coming up)

Revenue-based airline programs

Southwest:

Spouse: 60,000 Rapid Rewards points for now, soon to be zero after redeeming them on gift cards (read my post for explanation)

Jet Blue:

Mine: zero, soon to be 61,000 points

Spouse: 1,500 points, soon to be 62,500 points

Flexible points

Spouse: 600 Membership Rewards

Hybrid points

Spouse: 50,000 Merrill+ points, redeemable towards up to 2 airline tickets valued at $500 each (or total $500 statement credit)

Hotel points

Mine: 6,000 Hilton points, 15,000 Wyndham points

Spouse: 23,000 IHG points, 15,000 Wyndham points, still waiting on 100,000 Hilton points that the rep said should be deposited this month (a post coming up soon)

Analysis of the current situation

As you can see, I have tiny balances in AAdvantage and Delta airline programs. Those won’t do me any good now, but at some point they may come in handy after I get approved for Citi and Amex credit cards. I’ve never had any Delta co-branded credit cards before, if you can believe it, so those are on my radar. I would like to wait till I have solid plans for Delta flights, so I can take advantage of a free checked bag benefit. But I may sign up in 2018 and collect miles speculatively.

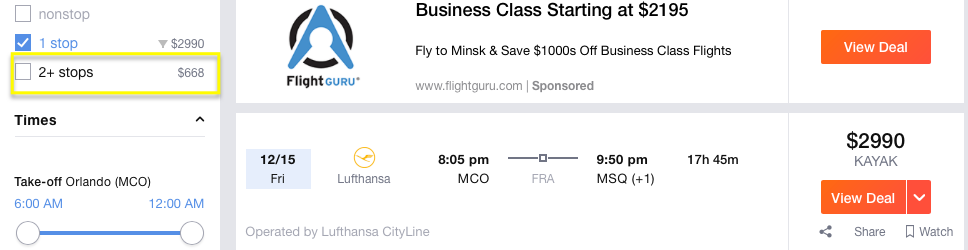

I keep Avianca currency as my emergency stash. You can redeem these miles on Lufthansa flights with no fuel surcharges. So, if something happens in Belarus, my miles may come in handy. Last-minute economy availability on Lufthansa flights from Orlando to Minsk seems to be decent, and the cost is 30,000 miles+tax. Avianca doesn’t charge close-in booking fees. Last-minute revenue Lufthansa fare from Florida is usually astronomical:

There is an option to pay $668 for a flight with 2 stops, but spending 30k miles still beats it by a long shot. Avianca will let you co-pay with cash if you are short on miles. So, technically, I could utilize our balances for a roundtrip ticket if needed. I recommend everyone keeps some traditional miles (or flexible points) as emergency stash, especially if they have relatives in another state or country.

When it comes to hotel points, we don’t really need them all that much. They are nice for weekend getaways, but it’s not the type of currency I want to hoard. I have gotten good use out of IHG program when we had a family emergency, so plan to hang on to our 23,000 points for now. As soon as Amex deposits my husband’s Hilton bonus, I will burn it for my in-laws’ stay near LAX after their flight from Sydney.

As far as my Wyndham points go, I plan to redeem them on vacation rental as soon as my husband and I get our 15,000 anniversary points from renewing co-branded Wyndham credit cards (current version doesn’t have that benefit).

Am I in panic mode due to my meager current supply of miles and points?

No way, Jose! My miles and points did exactly what I intended them to do. I spent time, energy and money accumulating them. And what better way to burn them than on my dream trip to South Pacific? I really don’t like hoarding. To me, the mile that is not used is a wasted mile. Plus, I like a good challenge. It’s kind of fun starting from scratch, to be honest. I’m looking forward to what opportunities 2018 will bring. Some will call me delusional (the hobby is dead, y’all!), others will call me an optimist. You be the judge.

Sure, it’s good to keep few currencies on hand. If you have flexible points, you are largely protected from major devaluations. When one program makes negative changes to their award chart, you can simply use another transfer partner. Plus, there is always an option to use points towards revenue travel. My biggest issue with flexible points is that they usually involve premium cards with an annual fee, though Amex has few notable exceptions.

Still, if you are sitting on large balances of flexible points (as in 500k+), ask yourself why? Is it because you are saving them for a specific redemption or simply because you are dealing with paradox of choice? Having plethora of options can be a blessing and a curse.

So, I would like to encourage all of you to make 2018 a year of spending. As in spending miles and points. You’ve worked hard to accumulate your precious stash, now it’s time to have some fun. Hawaii, Alaska or even South Pacific, anyone?

It’s closer than you think…

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Very interesting post!

As always, I appreciate your transparency and honesty. I too would be interested in knowing how many points other bloggers have in their stashes.

Over the years we’ve accumulated nice balances across a number of programs. However, since we need 4 seats and like to travel several times per year, we can easily go through 500K-600K points per year.

Participating in many different programs helps give us more redemption options when we have a specific destination and timeframe in mind, and not a lot of flexibility.

@Seth Thanks! I’m curious too, though I’m willing to bet that I have the lowest balances out of all the bloggers in the hobby. And I’m OK with that, actually.

I do think it comes down to how often one travels. We are planning to slow down after the trip to South Pacific, so I don’t have the same need as you guys. I renew hotel cards that come with anniversary certs, so those take care of local weekend getaways here and there. My husband isn’t much of a traveler and specifically requested we cut back on trips going forward. I would fly somewhere every weekend if it were up to me, but I don’t like traveling without him. I guess I’m old-fashioned that way.

I totally understand why you like to have nice balances in various programs. But I know you regularly put them to good use, which is the whole point.

I love this post! Thank you for sharing 🙂 I have a voyeuristic curiosity about my favorite bloggers’ miles/points stash 😀 😀 I’m currently hoarding as much points/miles as possible so that my hubby and I can spend them on comfy flights when we go on our world travel next year (which.. wow, it’s in just 71 days!). Being digital nomads, I’m thinking my chances of collecting miles/points will decline sharply. I just hope devaluations don’t hit hard w/in the next year or two. 🙂

@Army @ ClimberMonkeysAbroad Hey, my life is an open book. Maybe a little too open. Sometimes I have to remind myself that real people are actually reading my rants! 🙂

Hoarding definitely makes sense sometimes. Like I told Ian in the previous comment, going after low-hanging fruit is wise. Many opportunities available now may not be there later. I just got Jet Blue card X 2 even though I don’t have a short-term plan for miles.

I guess I’m opposed to senseless hoarding for hoarding sake. Many of our brethren spend their weekends (away from family and young children) doing MS when they already have millions of points. As far as devaluations go, they will always be there. Fortunately, if you accumulate points cheaply, you are unlikely to lose what you’ve invested in them.

I mostly do my miles/points research when I’m taking a break from my beloved current “regular job” (I’m an interpreter and translator), so it doesn’t cut into time I spend w/my new hubby (although I DO talk about it a LOT w/him lol).

Wyndham for the win! My wife and I each have that version of the card, too, and I decided not to drop them once they started offering redemption opportunities at condos and vacation rentals. The annual benefit became so, so much better! We’re sitting on like 135,000 Wyndham points combined. Trying to figure out where to take 2 of the kids with them this Spring.

I am unfortunately a hoarder. I think our Award Wallet balance is at 1.3 million points and miles.

Ian, Wyndham is most definitely a great program for families. The ability to redeem 15,000 points on an actual 1-bedroom condo is terrific. The website can be buggy and reps are generally clueless. Still, there is a ton of value to be had, especially during high season. I saw some decent Wyndham vacation rentals in Hawaii, though availability is spotty. You probably saw my post on few good deals in Florida https://milesforfamily.com/2017/12/14/excellent-deals-condos-family-friendly-resorts-help-wyndham-points/

As far as you being a hoarder, well, having 1.3 million miles and points in reserve is a good problem to have! 🙂 Plus, with a family of five, it probably won’t take long to burn them. Honestly, everyone has their own approach to collecting miles and points. I think as long as you can accumulate them dirt cheap and have some sort of a plan, it makes sense to take advantage of the low-hanging fruit while it’s still there on a “tree.”

However, I think many folks go through a lot of trouble when it comes to collecting points and never end up using them. Or they acquire at a much faster rate than they can burn them. We don’t travel that often, so my strategy works for us. Obviously, if someone is constantly on the road, short-term hoarding may not be a bad idea.