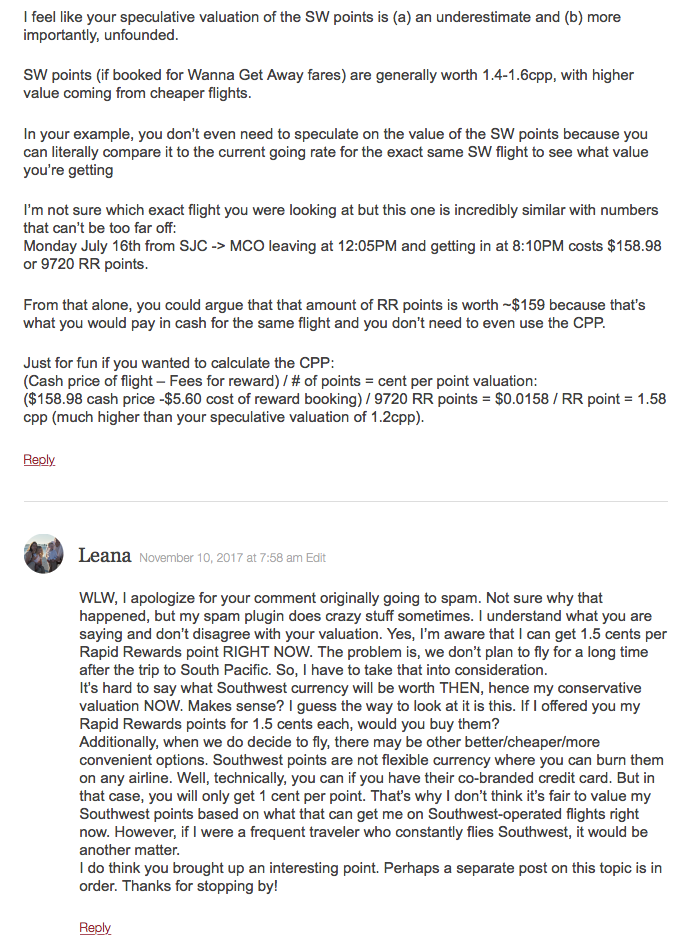

Few weeks ago I published a post on my dilemma of redeeming Southwest Rapid Rewards points vs. using 2 for 1 certificate from Alaska credit card. I ended up burning Southwest currency (for now). But that’s not what this post is about. I’ve mentioned that I speculatively value Rapid Rewards points at around 1.2 cents each. I got an interesting comment and wanted to share it, as well as my response:

The reader was 100% correct in saying that you can get around 1.4-1.6 cents per point towards Southwest flights. And that’s the problem. While many people fly Southwest quite often, we don’t. All of my husband’s immediate family lives right here in Florida. So, we don’t technically have to fly anywhere aside from Europe, where I grew up. And Southwest doesn’t fly to Europe, at least not yet.

All of our flights on Southwest fall into “non-essential” category. In the last few years we have flown to Buffalo as well as Jamaica, twice. In those cases, burning Southwest currency was by far the best option. That said, we recently flew to Newark and used Spirit due to off-peak award redemption. I’m also intrigued by Jet Blue because it has a really good coverage from Florida to Caribbean. As I’ve said last week, I have 122k points hopefully coming my way soon. Yay!

The biggest reason for my conservative valuation is the fact that we don’t have any firm plans to use Rapid Rewards points within the next few years. We are looking into flying to Halifax, Canada as well as visiting my family in Belarus. Oh, and I have a dream of visiting Costa Rica. I can’t think of any instance where Rapid Rewards stash would come in handy.

Obviously, things can come up unexpectedly. But booking Southwest flights last-minute is usually not the way to go because prices tend to be quite high. The program works best for leisure trips that you book way ahead. In most cases, traditional miles will be a better fit in the case of emergency as long as there is award availability. See my related post for overview of best last-minute mileage options

So, my point is, I can’t really say my Rapid Rewards are worth 1.5 cents each right now. They aren’t. If someone offered them to me at that price, I wouldn’t pay it. No one would. Hence, the need for a more realistic number. In fact, the more I started thinking about it, the more I realized that I wouldn’t buy Rapid Rewards points for 1.2 cents apiece (again, right now). I’m not sure I would even pay 1 cent. Which brings me to my next point…

Walmart gift cards: Now or never

I’ve mentioned before that some of you may want to renew your Premier version of Chase Southwest credit card, especially if you don’t have an emergency fund. The reason? Ability to redeem the points for valuable gift cards (like Walmart, Target and Amazon) at a favorable rate.

I actually decided to renew my husband’s Premier card for that very reason. We do have an emergency fund, however, we are also spending an unusual amount on travel over the next year. Add to it a few medical emergencies, and out savings account is in a very lean shape at the moment. We are not poor by any stretch of imagination. We also don’t have any mortgage or debt aside from 0% loan on my husband’s fancy Ford Mustang.

We are, however, a one-income middle-class family (my blog brings in profit, but this could change tomorrow, so I cant’t count on it). We also live in a rural area with very few decent jobs. Off topic, but if you are in the same spot, please, make sure to buy a term life insurance for both you and your spouse! Do it TODAY because you never know what will happen tomorrow.

The trip to South Pacific next year is putting a serious strain on our finances, to the point that I’ve decided to forego contributing to an IRA for 2017 (we do still contribute to my husband’s 401(k) up to company’s match). So, I’m seriously thinking about redeeming 90k Rapid Rewards Points towards $900 in Walmart gift cards. The latter would be almost as good as cash to me.

As a result, it will allow me to contribute $1k to an IRA. Boom. Yes, I know I could get around $1,350 in Southwest flights from those 90k points. But guess what? The IRA will probably be worth at least triple that amount in few decades. My husband’s Southwest card will be up for renewal in a few months, so I have to decide what to do with the points before canceling it.

Obviously, I’m hesitant to cash out my stash for the purpose of funding an IRA (how boring!) But it just feels right.

Staying in my own lane

I’ve been thinking about something Nancy said in one of her recent posts: “As a miles and points travel blogger, I immerse myself in the industry news. I’m bombarded by photos and videos of travel bloggers living it up in first class suites and lie-flat seats. At times it’s hard for me to step back and look at things from a beginner’s point of view or for the average American family.”

While my post isn’t focusing on first class vs. coach debate, I think the principles still apply. We simply can’t afford to take trip after trip after trip (like most other miles and points bloggers do) without severely damaging our finances. I’m happy for those who can, of course, but that’s just not my reality.

As nice as it is to burn Southwest points rather than spend cash, I won’t fool myself into thinking that my flight is free. Not if I had the chance to burn points on Walmart gift cards and failed to do so. As much as I love travel, I love being financially responsible even more. I feel like I owe it to my children.

Readers, what are your thoughts? Am I crazy to let go of my Southwest stash?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I think this is an inane discussion. You are free to do whatever you want with your points, but I’m not sure why you feel it’s necessary to try to convince others that you have made a smart decision. The reason why nobody would buy your SWA miles for 1.5 cents apiece is because that’s pretty much full value, and they can easily acquire the points for less than that. If you were to offer them for 1.0 cent each, I’m sure you would have lots of takers. It’s like lamenting the fact that nobody will buy your $900 Walmart gift card for $900. Offer it for $500 and you could sell it in a heartbeat. All you have done is taken one of your family’s assets and converted it into a cash equivalent at a discount. And you did it at a price that you are happy with. Good for you. However, you just as easily could have taken another asset into a pawn shop to get some cash. That might have been a good way to raise the money that you need. But it doesn’t mean that it was a smart decision or that it’s something that you should encourage other people to do. The bottom line is, you sold something for less than it’s worth to raise some $$$, which is normally not the best way to conduct your financial affairs.

@Scott Thanks for stopping by! First of all, you are misunderstanding my post. I’m most certainly not encouraging anyone to do what I did. Everyone has different circumstances and if you fly Southwest frequently, it would be crazy to convert points to gift cards.

I’m also not trying to convince anyone that I made a smart decision. Truth be told, I’m not convinced myself! I was simply recording my thought process in a post, which is a nature of blogging. Some may find it applicable to their own situation, others won’t. Either way, I appreciate your comment.

Hi Leana. I understand your conservative valuation. I did the same with VX miles. Everyone was saying it’s worth 2.3 CPP. I valued it at about half of that because VX doesn’t fly out of my airport and their access to partner space was extremely spotty. So I agree the valuation is dependent on your usability.

@PointsAdventure Thanks for stopping by! I tend to be very conservative when valuing Miles speculatively. I actually cashed out Citi Thank You points towards Walmart gift cards few years ago before canceling Premier Card. Southwest does have good coverage from Florida. The problem is, none of our upcoming short-term plans involve Southwest.

It’s hard to not get caught up in getting the best value for your points when you get fairly deep into this hobby. After all, we work hard for those points. Plus some bloggers really stress this and awesome redemptions become bragging points. I love getting great redemption values but I have tried to detach myself from the snobbery of it all.

I do what I want to do and what’s best for my family and I concentrate on how the points make ME happy. So I say BRAVO to you! Do what’s best for you and block out the noise.

@Lindy Thanks! I agree. We all have different circumstances. While some can afford to take 10+ flights per year, we simply can’t. I love a good redemption as much as any other blogger, but I also like to contribute something to retirement each year.

To be clear, I don’t think there is anything wrong with going on trips on a regular basis. Nobody should EVER apologize for the way they travel. Some prefer business class and fancy hotels, and that is perfectly fine. I’m not resentful of them in any way. Jealousy is something I try to avoid at all costs. It’s a dark hole that leads nowhere.

I am in a weird position where my business (aka this blog) is directly tied to travel. Less travel =less interesting content. Less content = less readers. However, I’ve decided a long time ago that I won’t let my site determine the way I travel.

I think it’s a great decision. If $900 for essential shopping at Walmart (obviously for nothing frivolous) allows you to contribute to an IRA and gives you some peace of mind, and you don’t want to have 90k RR points to burn instead, then by all means! I actually get anxious when I have too many miles and points and find myself looking for excuses to burn them… You might well find such an excuse in the next few years, but you seem to have enough upcoming travel plans and dreams already where you can’t use them, and do you really want to tempt yourself to make more? Like you say, even if the flights are free, trips are expensive, and I think you should heed that little voice that’s telling you to cut back a little. Frugality is a great virtue. 😉 AND you will still have a big pool of points sitting around for domestic and Caribbean destinations anyway, and there will always be more opportunities to earn points!

We are going through a mini financial squeeze at the moment which has slightly depleted our emergency fund, and I am oh so anxious to put the money back in over the next two or three months, so I’m especially receptive to your line of thinking. 🙂

@Debra I’m sorry about your financial emergency! We’ve had quite a few of those this year. The worst one was my root canal that set me back almost $2,500. Yikes. It’s good that we have an emergency fund for stuff like that.

For me it’s always a battle of living in the moment vs. thinking long term. I do have a weakness when it comes to travel. It’s something that truly gives me joy. We also splurge on local activities with our kids and other stuff that don’t require a plane ticket.

Lately, my husband has been feeling worn out. He doesn’t like to fly, and convincing him to go somewhere is getting harder and harder. I’m hoping to use Jet Blue Points for Costa Rica in a few years and maybe go to Europe. Beyond that I just don’t see how Southwest fits into my plans. And I’m not a fan of hoarding points for 3+ years. Like you said, I may end up planning extra trips and spending money we should be saving instead.

Hi Leana, I am going to go with you are crazy! Haha I hear where you’re coming from but I think the fact that you have recently cashed in so many points is exactly why you should hang onto these. You just never know when something might come up and as much as I love jet blue it doesn’t always go everywhere conveniently. I rarely use southwest but just recently had a situation where all the other airlines wanted $600 or very high points for a flight and southwest was $200 cheaper. Still pricey though for five of us so was glad I could use points rather than cash. I think you should keep them on hand just in case. But like Jennifer said above I still have a mortgage so feel free to disregard!!

@Kelly I hear you! All good points. The thing is, I am a little crazy. I tend to go for cash whenever possible and perhaps have a short-sighted view when it comes to travel. You are absolutely right. Opportunity may present itself and I won’t have any Southwest points to take advantage of it. And I agree, Jet Blue and Southwest have somewhat different networks. Apples and oranges, I guess.

The biggest reason I’m leaning towards liquidating my entire RR stash is the avalanche of travel expenses that came my way in the recent months. Anything I can do to offset it seems like a good idea, especially if it allows me to contribute to an IRA. Plus, I’m an optimist. I think bonus opportunities will still present themselves in the future years. I like Southwest, but I’m not “married” to Southwest. We can always chase fare deals and go wherever the sale will take us.

You have to do what makes sense for your family. Right now, SW makes sense for us so while I don’t have many SW points, I have over 110,000 UR sitting there. Also will have 120,000 Jetblue points..decisions, decisions… I think this makes sense for you Leana and you don’t have to explain yourself to anyone.

On another note, can you believe Banff is only 4 months away??

@Natasha It is hard to believe that Banff is only 4 months away! It seems like you guys just booked the trip. Enjoy Fairmont hotel, it is a super classy property.

I may very well end up regretting redeeming Southwest points on gift cards, but it’s a chance I’m willing to take. I can’t really think of an instance where they will come in handy in the next three years or so. Plus, in the meantime I will have my Jet Blue stash to spend down. A good problem to have!

This is a really interesting viewpoint, Leana. We’re based out of the midwest and have family spread across the country, so SWA miles are fairly useful for us (even if it means we have to make at least one stop on every flight!), but I can totally see how using them for “good as cash” gift cards makes sense for you. Go you for making the responsible decision!

@Tscateh You know, I really struggled with this decision. I’m not convinced that this is the best option, to be honest. However, I don’t want to renew my husband’s Southwest card, so it’s now or never. Getting that Jet Blue stash (if all goes well) kind of sealed the deal. I know it seems crazy for a travel blogger to do something like that, but I have to be practical. We are spending a fortune on this trip to South Pacific, plus hosting my parents here in Florida in 2018. Oh, and we just got Legoland annual passes (stay tuned for tomorrow’s post). Something’s gotta give.

I’d have a hard time parting with them, but that’s because with the 5/24 rule, it’s hard for me to earn them. Those 2000-point flights to the Cayman Islands and Turks and Caicos sure are alluring. I have no immediate travel plans to take advantage of those cheap flights, but someday… And SW will start flying to Hawaii soon. I’m curious to see what those flights will run.

But I’m sure this is why you are debt free and have your mortgage paid off and we don’t. Ha. Your reasoning is sound and works for you.

@Jennifer I wish we were debt free! Even with 0% financing, that Mustang loan is a huge albatross around my neck. But as long as my husband has his job, I know we’ll manage it.

I understand what you are saying. It’s hard for me to earn UR points or Rapid Rewards these days. What sealed the deal is the fact that we’l be getting a ton of Jet Blue points soon. Jet Blue has a good coverage to Caribbean as well. Plus, the thing is, we like to take cruises out of Miami, no airfare required. I’ve already started redeeming my Southwest points on Amazon and Walmart gift cards. There will be less temptation to fly somewhere and spend our hard-earned money. It’s not very sexy, but I never claimed to be sexy. I’m a lame mom! 🙂