As many of our readers know, my miles and points strategy mostly involves constantly switching credit cards. It’s not for everyone, and in no way am I implying that you should follow my lead. But that’s how I’ve been doing things for over a decade. And therein lies a problem.

My husband and I have (or had) so many credit cards, the banks often get spooked when they pull our respective credit reports. Obviously, we don’t fit the profile of a normal customer. What do you mean most stay-at-home-moms don’t have 40 credit cards?

On top of it, the banks have become much smarter recently and put a set of restrictions that automatically prevent us from getting approved. But but but… good credit score? It doesn’t matter.

Fail, fail and yup, another fail

I started to drool over US Bank Altitude Reserve card as soon as it came out. It truly is one of the most underrated offers on the market right now. I don’t necessarily think that newbies should go for it, but then again, I’m definitely not a newbie. Unfortunately, US Bank is usually tough on people like myself, so I was in shock when my application was approved. What’s better than one Altitude Reserve? Two, of course.

So, for the last few months I was on a mission to double dip by applying in my husband’s name as well. To no avail. He was rejected three months ago after the application went to pending status. Same thing last week. I really wanted this card so I could cover my flights from Papeete to Bora Bora, but it looks like it’s not going to happen.

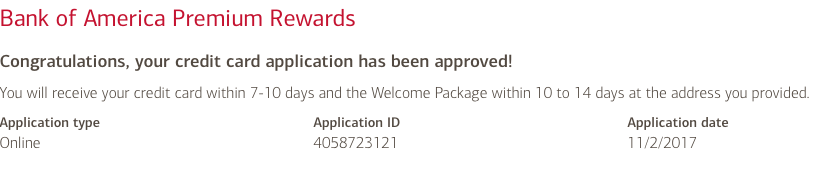

Moving on. I decided to go ahead and apply for Bank of America Premium Rewards Credit Card (pays us commission, find more details here) Basically, the bonus represents at least $400 in profit, possibly more if I utilize airline incidentals credit. So, it’s definitely a decent offer. I applied in my name and few days later found out that the app was denied by checking status online.

I figured I would try applying in my husband’s name. Same story. The reason for all three denials: too many recently opened accounts. That is a tough objection to overcome during reconsideration process.

<

p style=”text-align: center;”>A bait for my reader Cheapblackdad, who has been MIA lately!

Should I bother with reconsideration call(s)?

Even though my husband hates getting involved in this hobby, he will do what I ask of him as long as I don’t ask on a regular basis. I had to decide if calling US Bank will likely yield any results. I’ve never had any success with reconsideration calls to this entity, so after some back and forth I decided to let it go.

I may try applying again in 3 months and maybe following up at that time. US Bank only pulls Transunion credit bureau in Florida, so extra credit inquiries shouldn’t affect my chances with Chase, Citi and Amex (who usually pull Experian and Equifax). I went ahead and called Bank of America reconsideration line (current working number is 1-866-505-7481). I’ve had pretty good success with BoA in the past, and was hoping for it this time.

My conversation with credit analyst

The credit analyst was very nice and said she would take another look at my credit report. She mentioned that the reason for denial was pretty straightforward: too may recently opened accounts. I couldn’t really argue with that and figured that was the end of it. But then she said something that made me hopeful. She mentioned that BoA has already extended enough credit to me via two existing credit cards: Merrill+ and Alaska Visa Signature.

I pounced on this comment like a dog. I politely asked her if it would be possible to reallocate some of my existing credit to the new card. She then put me on hold. After twenty minutes she came back and said she is still working on it. I told her not to worry and to take her time. It’s very important not to put any pressure on the credit analyst and let them do their thing. Threatening with closure of your existing cards and general rudeness will probably get you nowhere. Remember, they are doing you a favor, not the other way around.

It’s important to look at the situation from their point of view. How would you see a customer who already has two credit cards with your bank and constantly opens new lines with other guys? You would think something fishy is going on, right? I find that sign-up bonus itself is rarely brought up, and it makes sense. As much as banks dislike it when you take $400 from them and move on, they are terrified that you will max out your $10k credit line and not pay it back. That’s the main reason for denials.

And whether you like it or not, that’s how we appear on paper. It’s up to you to convince the credit analyst that you are not that guy/gal who is planning to buy a bunch of expensive stuff and move back to Belarus (in my case). Whatever you do, stay calm and don’t come across as desperate. FYI, this advice works when you are dating as well.

I also recommend you have a good answer for why you want the card. Be honest, but don’t be stupid. When I was asked this question, I said I like the rewards structure, the airline incidentals credit and the fact that the card earns 2 points per dollar on travel. All are 100% true. I had my answer prepared ahead of time, and recommend you do as well. The rep wasn’t hostile in any way, she was simply doing her job.

After spending about 45 minutes on the phone, the credit analyst finally told me she would recommend the card to be approved, but it would take a few days to know for sure. A week went by and nothing. I made a few follow-up calls and they kept telling me it’s still in review process. I pretty much lost hope but eventually, the card was approved. Wohoo! I had to work my tail off for this one.

The lessons

I need to invent a time machine so I can jump few years into the future when we are in the midst of a recession. Oh, it’s coming! Folks, you heard it here first. In all seriousness, at some point I fully expect banks to be less picky and once again start courting those of us with excellent credit scores. Multiple credit inquiries? We don’t care about no stinking credit inquiries!

I’ve always been a “bird in a hand” kind of gal. I’m not on a quest to beat Chase 5/24 or Amex “once per lifetime” rule. The latter is definitely more challenging, though I’ve heard that according to Amex, you are “reborn” every 7 to 10 years. YMMV If I decided to skip various lucrative offers in hopes of making my credit report pristine, I would have to give up thousands of dollars in rewards.

Cards like Merrill+ (now discontinued) and Wells Fargo Propel World (reportedly still available over the phone) each gave me $500 or more in rewards earlier in the year. US Bank Altitude Reserve wasn’t even around at that point. Plus, even if I skipped those offers, there would be no guarantee that I would get approved for it. I did apply for Hyatt card with the idea of getting two nights at Park Hyatt Sydney that goes for $1k per night. Do I need a fancy hotel? Nope. Is it worth $1k? No way. Is getting a stay there in exchange for one credit inquiry kind of cool? You bet.

The thing about miles and points hobby is that there are no guarantees. I do try to be picky when applying for new bonuses. And giving our respective credit reports some time to recover is definitely prudent, no argument there. I should probably start putting together a strategy on earning points via everyday spending. Gasp!

But if I see a great offer, I’m going for it. Win or lose, the only thing I can do is try. Hmm, did someone say Jet Blue credit card is offering 60k points right now? Yes, I know I will probably get denied. Or will I?

Image courtesy of Ambro at FreeDigitalPhotos.net

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Great news on the BofA card!!!! I got denied big time (too many inquiries)…I had no prior relationship with them so not even worth it. I’m hoping to get 1 or 2 cards next year and will let hubby take a break so we can get him under 5/24.

@Stephanie Thanks! Yeah, I remember you telling me that you got denied. I’ve heard this card is a tough nut to crack for folks like us. You may want to call reconsideration, though. Who knows, maybe you can reverse the denial. BoA credit analysts are very friendly, in my experience.

Congrats on getting approved for BOA card! I just applied and was approved for the Jetblue 60k mastercard from Barclays. Should pay for our flights to SLC and Vegas next year. Great article!

@Natasha Congrats! I’m glad you got approved for 60k Jet Blue offer. What a deal! I don’t even have any Jet Blue plans and am salivating over it. But Barclay doesn’t like me, so I doubt anything will come of it.

Do you still have that Merrill+. Are you using it in any way?

@Caveman Both my husband and I have the cards, but we are not using them. I know some like to MS on Merrill+ to get Delta lounge access, but it’s obviously not worth it for my family. I have redeemed 50k points from my card, but my husband still has his stash intact. The card has no annual fee, so I’m not under pressure to get rid of it. Though maybe I should have in order to improve my chances with BoA Premium Rewards. Who knows?

I admire your tenacity! I couldn’t take that many rejections without getting incredibly spooked. My wife was declined for a cap one venture card, and I decided to just hold off on apps until sometime next year. I’m at 7/24 and she’s at 8/24. We’ve stopped adding each other as authorized users and started storing cards in our phones to ensure we can both spend on the right card without adding new AU accounts to our credit reports. Pretty happy with how that’s gotten us into single digit apps in last 24 months.

But, it will really take us about another year to get just under 5/24. Not sure I have that patience. We have just the one April Hawaii trip planned for now but I imagine we’ll be anxious to do something after that, and our points levels are pretty low. But I’ve challenged us to get our student loans payed off before I start hitting the points and miles game hard again.

Between points and miles earnings from work travel, everyday spend, and a cushion of about 200k worth of points spread across several acccounts, we’ll have to make due over the next year.

Cheapblackdad, you are alive! I knew my bait would work. 🙂 I hear you loud and clear. I’m a firm believer that folks should do what THEY are comfortable with. That’s why I put a disclaimer at the top of the post. Slowing down on new apps or stepping away from this hobby for a time (or even permanently) is never wrong if it makes your life less stressful.

Let’s face it, those of us with families and young children already have enough on our plate as is. And good offers will always be around, I guarantee it. Who knows, maybe by skipping these cards now you’ll qualify for something incredible in a year or so, like 100k offer on CSR.

I really need cash for our trip next year, so I’m willing to put in extra work and add extra dings to my credit report. I don’t like calling reconsideration line, and avoid it like a plague when it involves my husband. But in this case I felt I had a decent shot, though as you can see, it wasn’t easy. The game is getting tougher, no question about it. I do plan to put together a strategy on everyday spending because that’s where things are heading for me. But for now, I’ve got $3k in minimum spending to worry about so I can collect my $400 in profit. Life is good!