I’ve written before about my love/hate relationship with bank bonuses. It is definitely a more tedious process compared to applying for credit cards. You normally have to perform several tasks in order to finally get your sweet payoff, and occasionally, the banks will try to weasel out of it. On top of it, just setting up an account may require a phone call or two. I honestly don’t remember the last time when signing up for a bank promo went smoothy for me.

For those reasons I rarely get my husband involved in the process, and usually only set up accounts in my name. Despite the drawbacks, the ROI on my time is tremendous, and I can certainly use extra cash to pay for all of my upcoming travel plans in 2018. Unfortunately, the fact that you need to be detail oriented (which I’m not) often works against me.

Not paying enough attention to fine print

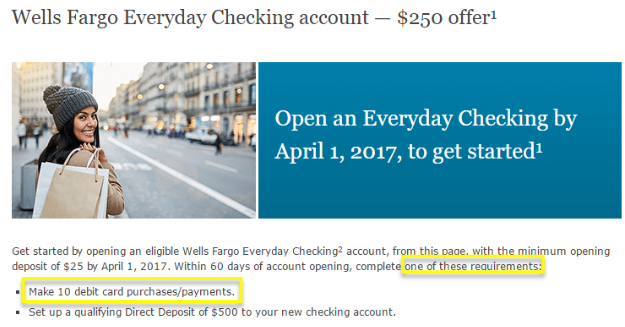

You may remember this Wells Fargo promo from earlier in the year:

At first, the offer contained “targeted” language, so I decided to skip it. But when I saw that it was finally open to anyone, I decided to go for it. And why not? Who doesn’t like receiving $250 in exchange for making 10 payments? I actually skip promos that require direct deposit. I realize that other methods will sometimes trigger it, but it just feels sketchy to me.

Anyway, I set up an account, deposited $1,500 in order to avoid monthly fees and scheduled 10 payments. The terms were fulfilled… or so I thought.

Five months later, and no bonus in sight

I know that some banks take their sweet time depositing bonuses, so I wasn’t too concerned at first. Then I saw that many were having trouble with Wells Fargo honoring the deal. Great. Time to make some phone calls. I wanted to send a secure message to Wells Fargo, but couldn’t make it work. So, I contacted them over the phone. Mistake number one: I didn’t save the screenshot of the offer and WF rep couldn’t find any info on it in my account.

Fortunately, Doctorofcredit blog had the post in its archives. So, I simply gave the rep instructions on how to find the info. He told me they would investigate it and would get back to me in one or two days. A week later I still haven’t heard anything, so made a second phone call. After a long wait, I finally got someone and had to explain the whole thing yet again. As you can imagine, no investigation was actually done on my behalf despite promises to the contrary.

I insisted on them taking care of the matter because I didn’t trust Wells Fargo to follow through. So, I was transferred to another department and a nice rep seemed eager to help me. Once again, I told him how to find the terms of the promo on Doctorofcredit blog, which he did. He told me that as long as I have fulfilled the requirements, he would credit the $250 bonus.

I was starting to feel giddy inside, alas, my joy was short-lived. Turns out, I’ve scheduled payments via Bill Pay online, and those don’t qualify. I had to use my actual debit card. My heart sank at the realization of my stupidity. The rep was apologetic, but there was nothing he could do. Case closed. I gave Wells Fargo an interest-free loan for 5 months. That lady on the promo page (the one who is smiling from ear to ear), she represents the bank.

Cover your butt!

Literally and figuratively. Remember the character of Vitruvius from the “Lego Movie”? There is a scene where he says: “He is coming. Cover your butt”:

I think this is a good principle to live by when it comes to bank bonuses. If they require 10 purchases, go with 12, just in case few don’t register. Et cetera, et cetera. The bigger the bonus, the more careful you should be. Honestly, how hard was it for me to make those darn 10 debit card purchases? Not hard at all.

Sure, I like to use credit cards in order to get closer to collecting new sign-up bonuses. Still, making 10 purchases at McDonald’s that total $5 each surely wouldn’t make a huge difference, would it? As a result of my own stupidity, I missed out on $250 (a bit less since bank bonuses are taxable).

I’m not giving up on bank bonuses

Say what? Like I’ve said before, I’m not perfect when it comes to this hobby and make mistakes on a regular basis. I view each fail as an opportunity to learn and do better next time. As always, it’s important to look at the big picture and overall, I still come out ahead. I make sure to record my hobby adventures in the blog: the good, the bad and the ugly. This definitely falls into “ugly” category. On to the next one.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I hate the debit card transactions and direct deposit requirements for all the bonuses. Way too much work and tracking for my already busy schedule. Glad some people can take advantage of it, and I’m sorry you didn’t get your bonus. It’s so disappointing when you don’t get your bonus. Did I tell you that I could’ve gotten back 10% of my JetBlue redeemed points a few weeks ago, but since I had to jump on the random price drop (and didn’t have my JetBlue Plus card on me) that I lost out on 5,000 extra points. I have to keep telling myself that I got an awesome deal since the price jumped right after I got them.

@Stephanie I feel the same way! Though to be fair, this promo was one of the easier ones. Sigh… That’s why I can’t believe I was so careless with $250. That’s a lot of money in my family! As for Jet Blue thing, don’t feel bad. Been there, done that! I purchased tickets not too long ago and overpaid by $140, all because I procrastinated and didn’t jump on a sale when I saw one.

I’m reluctant to do bank bonus too unless it is really lucrative. First off, I do feel bad if I don’t intent to be a long term customer. Besides, it is just too much hassle. After the 100,000 miles crawled back by AE, I became a lot of choosy. Don’t want to deal with unnecessary frustrations nowadays.

@Sheila I understand what you are saying. For me, it depends on the institution. I would have a hard time taking advantage of a promo at a small credit union vs. large for-profit bank. Plus, I do end up keeping some of the accounts long-term. But I agree, the hassle factor has to also be taken into consideration.

On Amex clawback, I recommend you contact Alex at darr@darrlawoffices.com. He is a very capable lawyer who may be able to help you. The consultation is free and I don’t get any referral for recommending him.

Hi! I opened the Wells Fargo account a couple of weeks ago. When I put gas, I pay $1.00 with the bank card and the rest with whatever credit card I’m working on. I have to figure that amazon reload thing though, it seems easier but they may crack on it. I feel for you Leanna, I’ve done a couple of super dumb things like that but in my case, more than $250 were lost so, not too bad in your case. I feel getting $200 from Wells Fargo is more than my share revenging those people that were hurt by them with last year’s scandal.

@Leticia I hear you! I’m not out to get revenge when I do these promos, but I know what you mean LOL It always amazes me when folks say that we are the bad guys for taking sign-up bonuses from poor banks. Right. I’m bummed by my fail, but there is literally nothing I can do at this point. My goal is to help others avoid the same type of mistakes.

I️ got pnc $400 and am working on 2 more for $400….bmt bank and Wells Fargo.. I️ did 10 50 cent Amazon reloads with my debit card so hopefully will get the bonus.

@Natasha Well done! That’s quite a haul.

I can’t give it up – I’m hooked. In about a year and a half I’ve earned $2125 plus 50,000 american airline miles plus a $200 uber credit….and waiting for another $100 to post.

@HML Nice! Can’t argue with success.

Wow, HML! I’m impressed!

I quit doing bank bonuses. That’s where I draw the line. I had a bad experience with Huntington Bank where we earned two separate bonuses (his and mine, business and personal) and it literally took 1.5 hours to get the accounts closed. Worse, they gave us the side eye the entire time. Never again.

@Holly I don’t blame you. About half of the bank promos I’ve done turned out to be a huge pain in the behind. It’s the other half that keeps me going! Now and again I’ll get $200-$300 for doing almost nothing, which is pretty sweet. But yeah, I almost expect to call a few times and deal with nonsense. This fail was totally on me, though. So far, bank reps haven’t been rude to me, so I’m sorry about your experience.