Now and again I get emails from readers asking me what they should do with their flexible points before canceling a premium card with a huge annual fee. So, let me highlight one of those exchanges. The situation here is a bit unusual because the reader is an expat living in New Zealand. However, I think the principles will apply to regular folks who live in US and mostly travel domestically.

The dilemma

This person has an Amex Platinum card that earns Membership Rewards points. She got it 10 months ago and received her sign-up bonus without any issues. Now the $550 annual fee is about to hit the account and she is not sure what to do with her significant stash of points. She absolutely does not want to pay the fee in order to renew the card.

She travels to US to visit family on a regular basis, and usually flies Delta from LAX to Minneapolis (Delta hub) after her flight from New Zealand. So, naturally, her first inclination is to simply dump her stash to Delta. MR points transfer to the program on 1:1 basis. That sounds reasonable, but there might be a better alternative.

Before I highlight my advice to her, let me state upfront that you should always attempt to preserve your flexible points if at all possible. Once you transfer them to a specific airline or hotel program, you limit your options considerably. It doesn’t mean that you should pay the annual fee on a premium card, but weigh pros and cons before taking the leap. You should, of course, contact Amex and ask for retention offer before you do anything.

When it comes to Membership Rewards program, you have an option of signing up for The Amex Everyday Card from American Express. There are various targeted offers on this product, but official (affiliate) offer comes with 10,000 points sign-up bonus. The card has no annual fee and earns real transferrable MR points. Best of all, if you cancel another MR-earning card, those points will be safe.

If you have a business, you may want to consider The Blue Business Plus Credit Card from American Express. It also doesn’t have an annual fee and earns 2 MR points per dollar on everything. Be aware, 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter. When this card first launched, it came with the sign-up bonus, but that’s no longer the case. As far as I know, the affiliate offer on this card is the best out there.

However, not everyone wants or is able to sign up for another American Express credit card. In that case, you will need to choose how to spend your points before canceling your MR-earning card. So, assuming you got nowhere during your retention call or online chat, it’s time to look at your options. See my post for more on this topic.

If you have to pay for a revenue ticket in a near future, you could simply redeem your MR points towards airfare at 1 cent apiece. It’s not a great return on your points, but bird in the hand…and you know the rest. When I cancelled my Amex Green card in May, I chose to transfer 10k points to Plenti program which gave me a $100 discount on groceries at Winn-Dixie. At the time, I simply couldn’t think of a program where I would feel comfortable “parking” my miles long-term.

That being said, if you fly on a regular basis, transferring points to miles speculatively could make sense.

Three things to consider

When you transfer flexible points to miles, you are basically selling the former in hopes of getting better than 1CPM (cents per mile) return down the road. Even though technically MR points can not be cashed out at this rate directly, there are many gift card options, not to mention, Plenti program that will provide this type of return. So, I think it’s fair to set a baseline at 1 cent.

You need to be fairly certain that your investment will pay off because your situation may change drastically in a near future. You may travel frequently now but health problems, income drop etc. could derail all those flight plans you currently have in mind. Of course, you can’t live your life based on “what if”, but it’s prudent to think of potential setbacks and how you will adapt to them.

Three questions to ask:

1) Do I live near a hub served by this particular airline?

People love to hate on Delta, but if you mostly fly domestic economy and live near Delta hub, this is a terrific program for you. Very often Delta program will price short-haul tickets at 5,000 miles one-way. That’s only 5,000 MR points transferred on 1:1 basis. Ignore the haters, and do your own research.

The same principle applies to when you live near American, Alaska Air or United hubs. Since all traditional American-based programs offer “standard” level redemption at a higher cost, you can be sure that you will be able to use up miles as long as you fly occasionally. Will you get better than 1 CPM return? You may or you may not, but you should come pretty close.

2) If I’m transferring to a foreign program, is it trustworthy?

I’ve been burned by foreign programs before, so tend to be leery when it comes to speculatively accumulating miles in them. (Just to clarify, I don’t think American-based programs are morally superior to foreign ones, it’s just that there is more accountability since all of them sell miles to banks.)

There are a few exceptions, like British Airways Avios and Virgin Atlantic Flying Club. I consider them to be fairly stable overall. Plus, the latter is owned by Richard Branson, aka the coolest dude in the world. I’m kidding, of course, you should never transfer your miles based on charismatic personality of airline’s CEO.

But the programs I’ve mentioned have two things going for them. The miles don’t expire for three years and can be preserved as long as you have earning or burning activity. That’s important because some programs (like Singapore KrisFlyer and Air France) have draconian rules in this department. If your plans for miles fall through, you may be in a pickle.

Also, British Airways and Virgin Atlantic usually announce devaluations well in advance. Obviously, past actions don’t guarantee what happens in the future but still, reputation matters.

3) Do I have Plan B and C in mind?

I recommend you don’t fixate on one specific redemption because it may not be there in the future. Airline programs change rates constantly, and that “sweet spot” may go poof next year. What will you do with your miles if that happens? It’s good to find other possible uses as a back-up plan. Remember, you can’t transfer your miles back to MR points, so you will be at the mercy of that particular program. Think of it as selling your mutual funds and buying stock in one specific company instead.

My advice to reader in New Zealand, plus an amazing discovery

While I do think transferring to Delta speculatively makes a lot of sense in her specific situation, I told her to look into Virgin Atlantic program instead. Why? It mostly has to do with current 30% bonus on transfers from Membership Rewards.

I’ve already mentioned earlier that I consider it to be a fairly stable program. So, it comes down to this. In order to go with Delta option, 1 Delta mile has to be worth more than 1.3 Virgin Atlantic miles. I don’t believe that’s the case in my reader’s situation (though it may be for you).

Here is why. When it comes to Delta flights, she is mostly interested in non-stop LAX-Minneapolis route. The “low” level in Delta program itself runs at 12,500 miles, which is identical to what Virgin Atlantic charges for the same flight. Recently, the latter program started allowing one-way redemptions at half price, a positive development. Be aware, only non-stop flights price out at the level specified on the Virgin Atlantic website.

Sure, the partnership between Delta and Virgin Atlantic may be dissolved in the future. That’s why it’s crucial to have a back-up plan. Fortunately, living in New Zealand opens up all kinds of opportunities to squeeze terrific value out of Virgin Atlantic miles. Here are just a few partners:

This reader has mentioned that they have plans to fly to Australia in a near future, so Virgin Australia option may come in handy. The redemption rate isn’t spectacular, but it’s an option nonetheless.

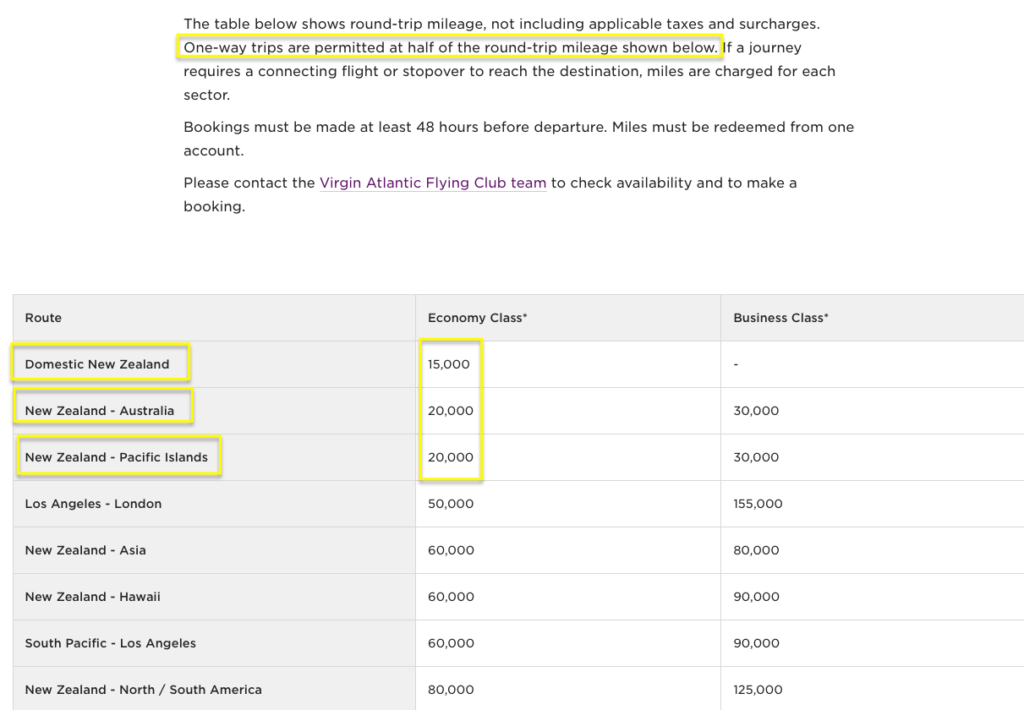

A really terrific deal is Air New Zealand partnership. Here are redemption rates:

Keep in mind, the quoted mileage is for roundtrip flights, but you can redeem for one-ways at half the cost. Few spectacular deals come to mind: 10k miles one-way in economy for a flight from Tahiti to Auckland, 10k miles one-way from Queenstown to Melbourne (Australia). Business class on those routes is a great deal as well, at only 5k miles upcharge each way compared to economy. Wow! And here I thought I got a good deal by spending 30k AA miles on Air Tahiti flight from Papeete to Auckland.

Award availability from/to US on Air New Zealand isn’t that great, but it’s OK as long as you stick to Southern Hemisphere. You can do a search on United.com (though don’t trust it 100% percent). You will have to call Virgin Atlantic to book your award tickets because they don’t show up online.

The least lucrative option is transfer to Hilton program on 2:3 basis. It’s not great, but it’s yet another way to spend Virgin Atlantic miles. Hilton has a few properties in New Zealand as well as Australia. See more details on all redemption partners here

Bottom line

My advice above is just that: an advice. Ultimately, I can’t guarantee that Virgin Atlantic option will pay off for this reader in the long run. Perhaps transferring miles to Delta (or another program) is the way to go. Everyone has to weigh pros and cons and determine for themselves what to do with their flexible points. When running out of options, you may even consider swallowing the annual fee and “buying” yourself another year to make this decision.

Readers, what would be your advice?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Thanks everyone!

I do have the AmEx Blue, so I could leave my points with AmEx, but I’m nervous about leaving points with AmEx in case they decide to take them away under new terms when I don’t renew my Platinum (unlikely but possible). I have over 80,000 Delta points, so if I transferred my points to Delta I’d have 230,000 points in one place, which would be nice.

I guess at thee end of the day these are three good options:

a) Keep points with Am Ex Blue (keep flexibility but risk losing points when I cancel my Platinum to AmEx under new terms, low risk, but risk indeed)

b) Move points to Delta (a program I know, trust, use, and has no expiration date, but $90 transfer fee)

c) Move points to Virgin Atlantic with no transfer fee and with a 30% bonus, fly on Delta for same amount of miles and open up possibility of trip to Tahiti (a leap into the unknown as it’s a program I’ve never used).

I wish I could have all three options at once: flexibility in a program I trust with 30% off and no transfer fee.

Does anyone know much about Virgin Atlantic availability? Hard to check since you have to book redemption flights on phone…?

What great miles and points therapy! Thanks again everyone!

No problem! Whatever you decide will be fine, I’m sure. I’m here to help. On Delta redemption via Virgin Atlantic, you should be able to search award availbility online. See this post http://onemileatatime.boardingarea.com/2017/08/02/redeeming-virgin-atlantic-miles-on-delta/#comments If this doesn’t work, look for 12,500 mileage pricing for LAX-MSP route on delta.com If it shows up, Virgin Atlantic should be able to see it as well.

You will have to call for other partners, though. Economy availability from Tahiti to Auckland seems to be OK. Air New Zealand flies the route few times per week. Check united.com for availability before calling.

Thanks Leana! I’m getting really excited thinking about Tahiti.

Virgin Atlantic does seem to have the most options so that may be the best route. As for Delta, I’m not a hater at all. They have actually been good to us, and I love the fact that our points don’t have an expiration date.

@Stephanie It’s hard to say with 100% certainty which option is best. Impossible more like it! In general, Virgin Atlantic is considered to be a second tier mileage program. But in this case, I believe it’s her best bet, especially when taking transfer bonus into consideration.

Hi Stephanie. Just rereviewing everything before making a decision and wanted to say YES! I love the no expiration date! It’s another of the reasons I could potentially be comfortable moving my points to Delta. They’d just sit there and be there when I need them and I don’t need to worry about them! (Until some big merger and change of rules comes along I suppose! You can never win right? Even though they never expire I have to keep checking to make sure that the rules haven’t changed! )

I’m facing the same dilemma ie signed up for the AMEX Plat in Nov 2016. Fee is about to hit. Called for a retention offer and was only offered 15,000 MR after 3k spend. Luckily targeted for BBPlus with a 20k sign up bonus after 3k spend so I can cancel my Plat without penalty.

@Natasha Sounds great! My SIL got the same targeted offer on this card, and I encouraged her to apply. She spends quite a bit each year on her business, might as well collect 2MR points per dollar. Up until this point, she was getting 1.5% cash back per dollar in rewards. Weak sauce.

If I were her, I would get another MR earning Amex card to park the MR points until she knows how to use them for sure. Some options: Everyday Preferred (has annual fee), Everyday or Blue for Business.

@Winnie Definitely. This is the most logical choice, especially if we are talking about sizable stash of MR points. That’s why I’ve mentioned it at the beginning of the post.

In the reader’s situation, I’d consider transferring to Aeroplan.

Here’s why this is a contrarian view:

1) There are no Amex transfer bonuses to Aeroplan (and apparently haven’t been for a few years).

2) One way tickets from NZ to the US cost 45K (as opposed to 40K with Virgin Atlantic/UAL/AA).

3) Aeroplan miles expire after 12 months…..HOWEVER, unlike Singapore miles they can be extended with any activity in your account (i.e. you don’t have to take a flight). I just extended my points by watching an Aeroplan marketing video and answering two questions.

Here’s the main reason to consider transferring to Aeroplan:

1) Aeroplan availability for United’s Auckland-San Francisco flight is pretty good. We found availability for 4 on our dates of travel the last two years. Also, since SFO is a United hub, you should be able to connect onward to Minneapolis nonstop on the same award.

In theory, you would also be able to book Air New Zealand’s flights to Los Angeles/Houston/San Francisco/Honolulu and onward to Minneapolis with United – however, Air NZ’s availability is somewhat scarce in my experience.

@Seth Aeroplan is a good option, definitely. If there was a bonus on transfers from MR, I would recommend that this reader looks into it. Alas…

In general, I find that Aeroplan is pretty good when it comes to award availability plus, it has the most robust network of partners since it’s part of Star alliance. In any case, I plan to forward the post and encourage her to read the comments. Thanks!

Hi Seth. Just wanted to thank you for this advice. I think the first time I read it I was overwhelmed with information and couldn’t make sense of it all. Now that the end of the month is nearing and the Virgin Atlantic bonus offer will be expiring soon I’m re-reviewing everything a little slower and trying to make a decision. I have just booked my July tickets to MN on American and UG! What a horrible and complicated flight schedule! If we don’t use these MRs toward the trip to Australia I’ll definitely keep your suggestion in mind for a future trip home!

Question for you……why not transfer to Air France and use that to book Delta? Don’t they have a better Award chart?

It’s a decent program, sure. Air France has better prices for flights to Hawaii and Caribbean, among other routes. That said, this reader is mostly interested in non-stop LAX-Minneapolis flights, and those cost 12,500 miles via Air France, identical to Virgin Atlantic. Also, Air France Flying Blue miles expire if you don’t fly within a certain time period (or it used to to be the case, I haven’t checked recently). Plus, Air France doesn’t currently have a bonus on transfers from MR program, otherwise I would definitely mention it to her. It is a very strong program, I’m just not sure it’s the best fit for this particular reader. But it may be for other people.