One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

This is a brief news recap from last week. For faster updates, follow Miles For Family on Twitter or check the feed on the right side of the blog.

1) As I’ve mentioned on Tuesday, the big news in the hobby this week is the release of Bank of America Premium Rewards Credit Card. I’ve added it to my Hot Deals page and you can find more info, as well as non-affiliate application link there. I don’t think it’s in the “keeper” category for most middle-class families, but the sign-up bonus is a no-brainer.

Unfortunately, I’ve seen many data points that lead me to believe that neither my husband or me will get approved for this card. The reason? Too many credit pulls and newly opened accounts. Nevertheless, I plan to give it a shot next month. Perhaps one of us will get approved.

I’m currently working on several new offers, but the allure of $500 is hard to pass up. I’m also interested in $100 airline incidentals credit because I will need to prepay checked luggage on Spirit. All in all, it’s a great deal during the first year and possibly beyond that for some. Stay tuned.

2) It appears that Barclay is imitating Chase when it comes to approving people for Barclaycard Arrival Plus World Elite MasterCard (the bonus has been recently reduced to 40k points). Namely, they look at how many new accounts (from all banks) you have signed up for in the last 24 months, and deny those they deem to be unprofitable.

Chuck at DoC wrote a post on it and invited readers to leave data points. It looks like the cutoff number is 6, as in 6 new accounts in the last 24 months, but it’s hard to say for sure. For now, the rule doesn’t seem to apply to co-branded products, though this may change in the future. See my post Ranking Barclaycard bonuses when it comes to family travel

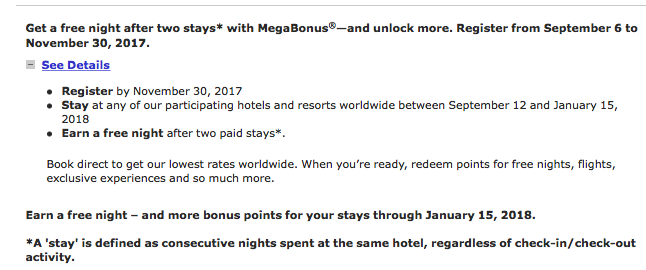

3) A decent promo from Marriott:

Register here Keep in mind that free night is valid at Category 1-5 Marriott properties. See all terms and conditions here There are several good hotel promos out at the moment. Which one you choose to participate in will depend on your preferences as well as upcoming plans.

4) 5 things you need to know about Delta miles by TPG. Here is the thing. Delta miles can be mediocre for some, super valuable for others. It really depends on your travel patterns. If you live near Delta hub and usually fly economy, you are probably in the second camp. I don’t think there is such a thing as “worthless” mile, at least not in absolute terms.

5) 3 things you need to know about your post hurricane Caribbean vacation plans by TravelingMom. I will have more on this topic within the next few weeks.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I just got denied for the BofA Premier yesterday. I’m so irritated. I’m probably at 8/24 but have an 800+ score. Oh well. Maybe I’ll try again at the end of the year when a few cards fall off. I really wanted the TSA Pre check for my oldest. Drats!!!! My first denial.

@Stephanie Oh man, I’m sorry to hear it. If you got denied, there is seriously no hope for me. I’m at LOL/24! That’s a new term for people like me. Well, the good news is, there are other decent offers for you to consider unless you want some of the inquiries to fall off first.

I’m glad we got our arrival cards in the last 2-4 months! We got the 50k bonus and had no issues with approval.

My wife and I don’t add each other as authorized users anymore. That allows us to keep our new accounts half of what they used to be when we always did the authorized user route. Takes some creativity to ensure as much as possible is going on the one card we are focused on as only one of us has it regularly, but it’s been working very well for us for about 2 years.

Cheapblackdad, I’m glad you got those cards too! Somehow you seem to time your applications just right, brother. 😉

I definitely agree on avoiding adding your spouse as an authorized user if at all possible. Of course, we are at a point where it hardly matters because we have so MANY credit pulls in the last 24 months, it’s not even funny. At some point, I will have to come up with a different strategy.