Many of you probably got a kick out of my miserable experience with redeeming Avianca miles on Air New Zealand flights. When the whole thing transpired, I kept thinking: well, at least it will make for an entertaining post! Unfortunately, I wasn’t done with Avianca LifeMiles program, not yet. I had to book (or attempt to book) one-way flight from Sydney to San Francisco for me and my husband. And I had to use separate accounts, which made me very nervous.

Suppose I was able to book one ticket, but what if the website broke down when I tried to redeem miles for the second one? Then I would have to go through this whole rigamarole with Avianca again. The award seat would probably dissapear by the time I finally got a reply via email. My nerves were already shot at that point and I sure didn’t feel like getting a lecture from my Colombian pal on how I should have picked option 2 for English. Nevertheless, I had to try.

Rarotonga, here we come!?

First I looked on United.com to see what was available at 40k miles level, the only type of economy award bookable via Avianca. I saw a very tempting option on Air New Zealand. You would have to fly non-stop from Sydney to Rarotonga (Cook Islands), spend 14 hours on the island during the day, and then continue on to Los Angeles.

I was seriously salivating at the prospect of tacking on another South Pacific destination to my already jam packed itinerary. But then I started thinking about my travel-averse husband and decided nope. Plus, Avianca seems to have an issue with booking awards on Air New Zealand. But what a cool route! Apparently, spotting any award availability (coach or business) on Air New Zealand is a hobby unicorn, and I saw it with my own eyes. And had to let it go…

There was availability on non-stop United operated Sydney-San Francisco flight. Perfect. I checked Lifemiles.com and the flight was showing there as well. After saying a short prayer, I started the booking process for the first ticket. The cost is 40k Avianca miles, plus $113 in taxes (including bogus $25 Star Alliance fee).

Everything was going smoothly. Could it be? Would I really be able to book my flight without any issues? Alas, my hopes were dashed to pieces when I got this weird error message “we apologize, Iberia is experiencing difficulties communicating with Lifemiles program.”

Huh? What does Iberia that belongs to OneWorld alliance have to do with United flight? Wait, Avianca partners with Iberia? That’s pretty cool. Focus, Leana. My heart sunk at that point. But I figured I would try to go through this whole online process again before calling my Colombian amigos. And it worked! I seriously felt like singing for joy. One down, one more to go.

I used my husband’s miles for the second ticket and that one got booked on the first try. I was issued confirmation numbers for United.com and was able to access the reservations right away. I was even able to select exit row seats, a sanity saver during 14 hour flight. So, the website does work, just not all the time, and not on all partners.

Saving Avianca miles for a rainy day

I was debating on whether to redeem Avianca miles on the fourth ticket from New Zealand to Australia (repeating the whole back and forth email process that took four days). I decided to hang on to my Avianca stash. Here is why. I’ve burned almost all of my points on this trip next year, just like I said I would. Seriously, aside from Lifemiles, I’m down to 11,000 Alaska miles and 5,000 miles on Delta (post coming up).That’s it, period.

I have no flexible points either. Avianca miles are redeemable on Lufthansa and there are no fuel surcharges. One-way cost of ticket in economy from Florida to Belarus is 30k miles plus $30 in taxes. Avianca will serve as my mileage emergency fund in case I need to get home at the last minute.

If I were to redeem Lifemiles stash on Air New Zealand flight, it would cost me 21k miles, plus $75 in fees. One-way flight to Belarus can cost as much as $1k when buying last minute. By comparison, Air New Zealand flight runs at $260 and that includes taxes. As crazy as this program is, logic dictates that this is not the right time to “sell” my miles.

Avianca lets you copay with cash, so I figured that’s what I would do if there was an emergency. I have 17k miles in my account as well, which could possibly be utilized for a return flight. I went ahead and burned US Bank Altitude Reserve points instead, at 1.5 cents apiece. Maybe I just convinced myself to save Avianca miles just so I wouldn’t have to deal with their call center. You decide.

Should you speculatively hoard Lifemiles currency?

I would have to say that for the price of the annual fee, it may not be a bad idea. Just make sure to remember how dysfunctional the call center is if you do. Still, 60k miles can almost cover 5 one-way economy flights from lower Continental US to Alaska on United, and that is nothing to sneeze at.

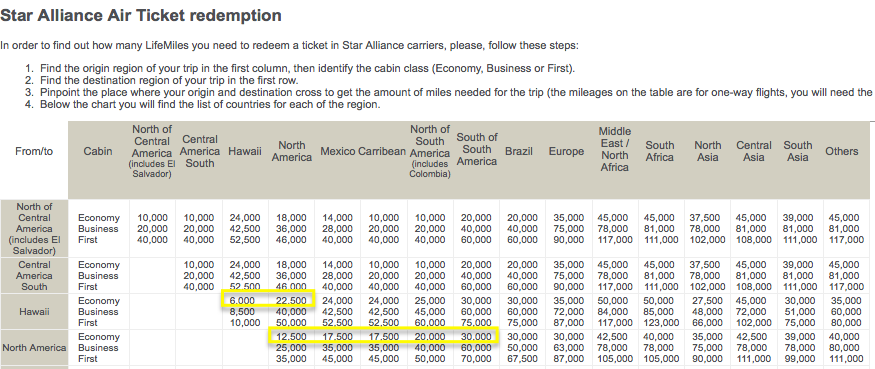

Other decent values: 22.5k miles one-way to Hawaii, 20k miles to northern part of South America. Do keep in mind that in order to book the award at those prices, there has to be low-level availability on United.com. Here is Avianca Star Alliance award chart:

Let me emphasize this again: if something goes wrong and you have to call, you will need to drink a few glasses of wine beforehand. If you have a complex itinerary with connecting flights and one of them changes departure time, you may be in big trouble.

Unless you are a grizzled miles and points hobbyist like me, you will be better off exhausting all of your other options first, before “spending” your valuable credit pull on Avianca credit card (find more info and non-affiliate link here).

According to DoC, Bank of America has just launched a new premium credit card with a bonus that’s worth at least $500. That would definitely be my choice if I could only pick one offer, but make sure you can handle minimum spending requirements.

But all in all, paying $149 for 60k miles redeemable on Star Alliance carriers (and Iberia!) is a good price, no question about it. Well, assuming you don’t go nuts from dealing with their Colombian call center. Therapy bills will surely kill the deal.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I will also say the Avianca card takes a few months to “train” if you are making large grocery store purchases (more that ~$300). It took three months of calling their fraud prevention line to get $500+ transactions to go through at the store (at least 20m per call). All seems to be working well now as I am able to regularly do $1k+ transactions. But as with all things Avianca it seems nothing is easy, but the payoff can be huge.

Xshanex, thanks for sharing your experience! I didn’t realize that people actually put regular spend on this card, but I guess 2 miles per dollar on groceries is tempting if you know how to maximize the award chart.

I agree, though, it’s not an easy program to deal with, and I tried to emphasize it several times in my post. This is not a card for beginners, but for folks like me who are running out of options.