As many of you know, next year my family is planning to go on a grand/whirlwind tour of South Pacific. Not everything is finalized yet, and I’ll have several posts detailing my dealings with various frequent flyer programs. It has been an interesting and eye-opening experience, to say the least, so I hope my discoveries will benefit you guys. Spoiler alert! Avianca Lifemiles is the worst run frequent flyer program in the history of mankind.

But today I want to focus on purchasing airline tickets with cold hard cash. As much as I love miles and points, burning them is not always the way to go. As I’ve mentioned before, my sister-in-law wanted to fly on Fiji Airways, so she could add a stopover in Nadi for a few days. Not surprisingly, I don’t hoard Fiji Airways miles (points?) and have zero knowledge on the program.

But I do know that you can redeem Alaska and American AAdvantage miles on Fiji Airways flights. The former is a better deal because you can add a stopover for free, even on one-way tickets. Unfortunately, I don’t have a huge pile of AA miles because I’ve previously squandered them on first class AA flight from Tampa to Seattle and booking a condo in Florida Keys.

The leftover stash went towards Air Tahiti Nui flights for me and my husband. I do have 42k Alaska miles which can technically pay for one-way flight from Sydney to LAX, with a free stopover in Fiji. But once you pay cash for LAX-Auckland, NZ leg, the value just isn’t there.

I felt kind of bad that I burned extra 200k AA miles on redemptions that conventional wisdom in the miles and points hobby considers to be a terrible value. Was I wrong in my contrarian thinking? After all, those miles could pay for two tickets on Air Fiji. It costs a total of 95k AA miles+taxes to recreate my sister-in-law’s itinerary of “LAX-AKL, SYD-NAN, NAN-LAX.” Instead, I would have to cough up real cash for two tickets. The horror!

A sale on Fiji Airways

Fiji Airways releases its schedule almost a year in advance. I’ve been keeping an eye on prices, and they seemed to run at around $1350 per adult ticket, $1,100 for child. I didn’t check what the total tax was, but figured it wouldn’t be much more than $100. So, even with a price tag of 95k miles per person, I would get a return of more than one cent per mile (or so I thought). Naturally, I would redeem miles on adult tickets and pay cash for kids. Except, I didn’t have the miles, darn it.

Well, last week, I got a frantic phone call from my sister-in-law. She said she noticed that the tickets came down to $1,100 per person for adult, $890 per child. She wanted to book them right away. I didn’t have any new cards or minimum spending to worry about, so I just used my US Bank Altitude Reserve card. It gets 3 points per $1 on airfare, and you can redeem them at 1.5 cents apiece towards travel, which is what I intend to do.

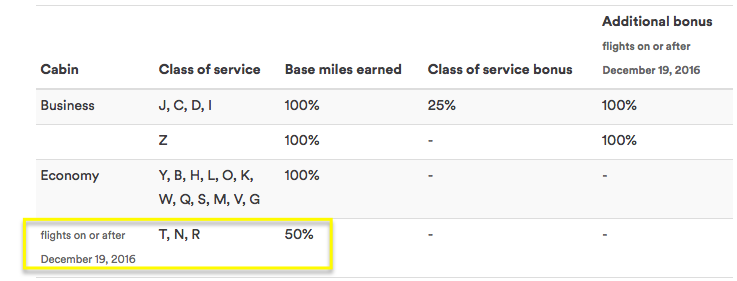

She booked three tickets, one for my son and two for her parents. I went ahead and paid for her and my daughter, and my total was $1,990. That amount should earn almost 6,000 points, which I will try to redeem towards $90 in airfare value. So, it’s fair to say that tickets ended up costing me around $1,900. My sister-in-law will earn 7,000 Alaska miles (half of the flown amount), which isn’t a huge deal, but still. It appears to be the best option.

A quick note to readers. If you are not sure where to credit your flown miles, use free website Wheretocredit to take all the guesswork out of it. Always collect miles (even a puny amount) since there is no cost associated with it.

A quick note to readers. If you are not sure where to credit your flown miles, use free website Wheretocredit to take all the guesswork out of it. Always collect miles (even a puny amount) since there is no cost associated with it.

Why using miles would make no sense in this scenario

First and foremost, the return flight we booked was not yet loaded in Alaska or AAdvantage program. Remember, you can only book 331 days in advance, and some foreign airlines open up schedule long before then. My sister-in-law would not agree to wait and risk missing out on the sale. Sure, $1100 per person is a lot of money, but considering the fact that they are getting a stopover in Fiji on top of all the other flights, it’s not a bad deal.

Interestingly, the outbound flight was loaded, but according to Experflyer, there were no award seats available (I’ll have more on that website in the upcoming weeks). So, it really wouldn’t work out regardless. My sister-in-law is not very flexible on dates due to her business.

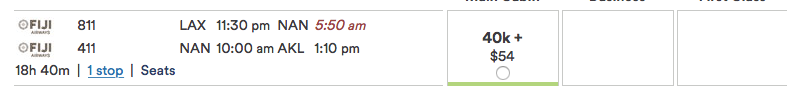

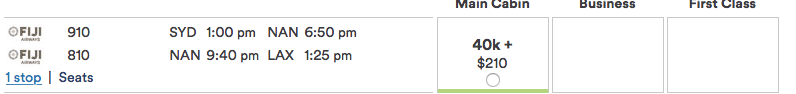

But let’s say perfect award flights were available. Here is what taxes run on this itinerary, according to Alaska Air website:

So, Alaska program would charge 80k miles, plus $264 in taxes per person. That’s not horrible, but you are getting only 1 cent per mile in value (compared to $1,100 revenue ticket), and you earn no miles or points on the flights. I would probably burn my miles, but I’m sure most of my brethren would pass on that one. After all, Alaska miles are considered to be quite valuable.

The math gets even worse with AAdvantage. You would have to drop 95k miles for the same exact itinerary. So, if you deduct $264 in taxes, you are getting 0.88 cents per mile and forego rewards associated with the ticket. By comparison, I was able to get around 1 CPM on the condo due to having AA co-branded credit card.

By the way, you can book Fiji Airways award flights on alaskaair.com, but you would have to call American in order to do that.

YMMV (as always)

In no way am I implying that you should burn your miles indiscriminately. If you have a flight coming up in the next year or so, and you think you can utilize your stash towards an expensive route, maybe it makes sense to hang on to your miles. It all depends on your savings account, though.

I needed that condo in the Keys and was planning to pay cash. Miles didn’t give me a mind-blowing return on my “investment”, but they saved me real money, dollars I can in turn use towards our trip next year. I’m not going to tell you when to burn miles and when to hang on to them. Only you can determine that.

I speculatively value miles at around 1 cent each. The emphasis is on the word “speculatively.” I didn’t really think we would be taking this trip next year, otherwise, I would probably hang on to my stash, just in case. Though as you can see, miles would do me no good in this particular case. When you have to coordinate your flights with extended family, it can be very difficult to match everything up, especially if they have little flexibility in their schedule.

Yes, we could have used the miles on another trip in a distant future. But my husband already said he doesn’t want to fly anywhere for three years. That’s his condition for going along with this madness, and I’m OK with it. Plus, even if he changes his mind (and I’ll make sure that he does!) and we end up going somewhere, we’ll probably fly Southwest. AAdvantage domestic sAAver availability is absolutely pathetic these days. But that’s a story for another post…

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Love your post as we are a family of 5 and wants to go to bora bora in 2020. So when you buy a ticket witb Alaska can’t you use the $99 companion pass for the other ticket?

@Trina Thanks! Taking five people to Bora Bora is not easy or cheap, but I’m sure with some planning you can pull it off.

As far as Companion Pass on Alaska, I do plan to use it for Virgin America flights for me and my husband. It’s only valid on Alaska and Virgin America operated flights, not partners. So it won’t help with Fiji Airways, unfortunately.

You have to pay if your dates aren’t flexible. Especially for the South Pacific. You’ll enjoy this trip inmeasurably once and even as it comes together.

As far as using cash for these things, so long as you’ve automated the saving side of your finances (i.e. ~10%+ going to that IRA), and you aren’t going into debt, and are building equity, and paying the bills, you are good to consume what you want. Kids college savings would be nice too!

Nancys post last week about travel burnout, and yours today about balancing the exhaustion of planning thee trips, have both highlighted for me how there’s a fine line between the fun of planning and travelling and the exhaustion of it all. Here’s to hoping we all are blessed enough to keep having these travel induced problems!

@Cheapblackdad You are absolutely right. It’s a tough balance, and I have been in a stage of travel burnout before. I’m sure it will happen again. My husband is in a state of perpetual travel burnout. LOL

This trip came out of nowhere. I had no time to prepare, save, anything! Even my mileage balances were kind of thin, so I had to scramble to get more in a hurry. But this sort of opportunity doesn’t come often, and I don’t want to have regrets about NOT taking it. We have been able to use miles on several routes, and I’m currently waiting to book a few more. At this point, we will just pay cash if we have to. I hope to reduce out-of-pocket costs as much as possible, of course.

As far as having your financial ducks in order… Well, it’s a bit complicated. I’ll have more on it in a few days. But basically, we are making some sacrifices that are not considered wise by financial experts. Like reducing retirements contributions for the next year or so. I figured we can always make more money, but we won’t be able to do this same exact trip. But otherwise, aside from 0% loan on the car, we have no debt. I hope to save some money by the next summer and plan to cut out a few things, like Disney. Ramen noodles, here we come! Stay tuned.

Sometimes it just makes sense to pay cash especially when dates are not flexible. Glad you got them on sale…I hate buying stuff at a premium.

@Stephanie For sure. It’s possible the price would go down further, but my SIL was itching to buy the tickets so she could start planning everything. For the sake of collective sanity, we pulled the trigger. This trip has been the most complex one I’ve ever dealt with in my entire life. So much stress, it’t unreal. At least paying for tickets with cash was the easy part!

I think the craziest thing in this post is that you aren’t working on any new promotions at the moment and didn’t have a minimum spend to meet. But I’m glad your trip is taking shape and coming together. Exciting!

@Jennifer LOL I know it. I’m waiting to go to Chase branch and try for CSP. But things have been hectic and I just haven’t been able to do it. I may even apply for Hyatt card online instead, but I’m not eligible for the bonus till September 1st. So, I’m sort of in a limbo at the moment! We didn’t think we would get Fiji Airways tickets so soon, so I was caught off guard.