Premium cards are a tough “sell” when it comes to normal family in America. And for a good reason. There is usually a big hurdle to overcome, namely, a sizable upfront annual fee. It is a big issue, no doubt. Not everyone can cough up $400 or more for the privilege of “free” travel. Some of us may have to forego going out to eat or postpone buying a much needed new appliance for the house.

But if you really love to travel or simply like to pick up extra cash, paying those huge upfront fees is very often worth it. Of course, only you can decide if it’s something worth pursuing. As I’m sure most of you’ve heard by now, the offer on Citi Prestige has been recently increased to 75k points. However, it comes with $7,500 minimum spending requirement, a huge obstacle for most normal folks (my target audience).

Obviously, banks don’t operate in a vacuum. There is plenty of competition in USA when it comes to this particular sector, so when one bank does something, you better believe the other guys are paying attention. It’s impossible to predict what changes, if any, will take place when it comes to other premium cards on the market, but let me take a stab at it.

Chase Sapphire Reserve

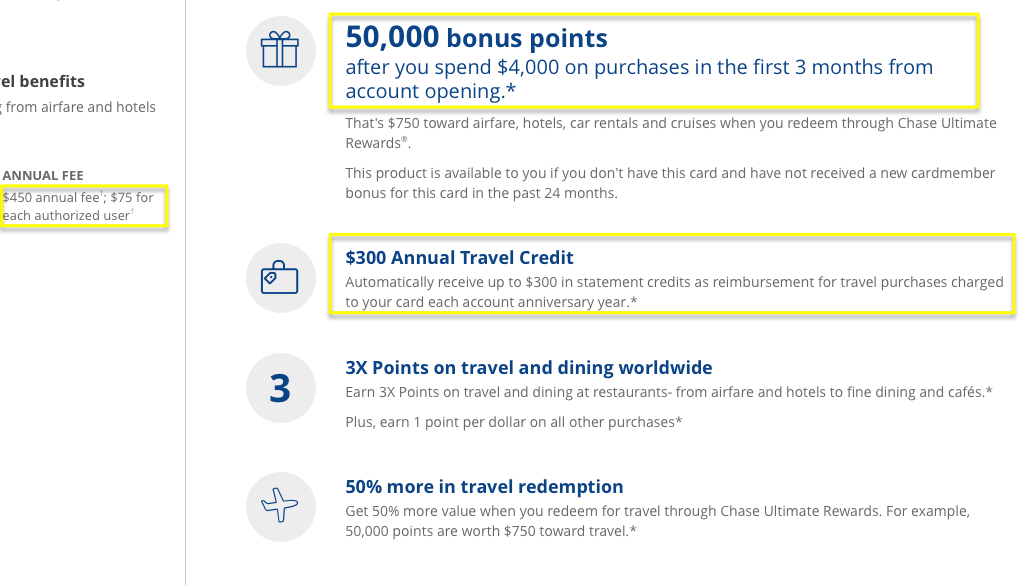

Here are the details on the current offer:

It’s hard for me to forget the good ole’ days, back when this card came with 100k points, and travel credit was based on calendar (not cardholder) year. Wait! That was only 4 months ago. Things change rapidly in this hobby, don’t they? What was once a spectacular offer, now is merely pretty good.

And it is still a good deal in its current form. Once you add up all the perks and points’ value from the sign-up bonus, it’s easy to see why it would be tempting to some folks. But I feel strongly that now is NOT the time to sign up. I think the heat from Citi Prestige and 75k points’ offer will motivate Chase to increase the sign-up bonus.

Plus, don’t forget, the travel credit on Citi Prestige is based on calendar year, so it’s possible to double dip. No such thing with CSR. That’s why Citi Prestige is going to steal the thunder from CSR while the bonus is increased. Citi is battling Chase for high spenders who won’t bat an eye at $7,500 barrier to entry, and this new development might be enough to persuade them. At least for the first year of membership.

Chase will have to increase the bonus on CSR or potentially lose out on this very lucrative market segment. I predict they will match the offer or even raise it to 80k points. However, I think there is a good chance that minimum spending requirements will be increased as well.

Obviously, I could be wrong. I have been wrong before. But I believe now is not the time to go for this card.

Verdict: Hold (for now).

US Bank Altitude Reserve Visa Infinite Card

Here are the details on the current offer:

- Earn 50,000 bonus points worth $750 in travel when you spend $4,500 in eligible net purchases within the first 90 days. Points do not expire.

- 3X points per $1 for eligible net travel purchases.

- 3X points per $1 for eligible net mobile wallet purchases.

- Up to $325 in statement credits annually for eligible net travel purchases.

- TSA Pre√® or Global Entry — up to $100 statement credit to reimburse you for your application fee — whichever program you apply for first.

- Relax with airport lounge access and stay connected with 12 Gogo Inflight Wi-Fi passes per year.

- Redeem points instantly with Real-Time Mobile Rewards Redemption.

- Elevated service levels with dedicated Concierge and Cardmember Service advisors.

- Annual fee is $400, not waived.

Be aware, you have to have an existing relationship with US Bank in order to apply. An eligible U.S. Bank account relationship is defined as: Checking or Savings account, Certificate of Deposit, Mortgage, Home Equity Loan, Home Equity Line of Credit, Auto/Boat/RV Loan, Personal Loans and Lines, Private Banking account or Consumer Credit Card issued by U.S. Bank.

I wrote a brief review of this card and mentioned that I applied for it myself. I’m thinking about applying for it in my husband’s name as well. Sure, I hate the thought of prepaying $400 annual fee. But considering the fact that he would get $325 statement credit towards travel purchases, it seems like a no-brainer.

The credit is good toward ANY travel purchase, not just flights (as is the case with Citi Prestige). There is no minimum and it’s applied automatically. I know for a fact that we won’t have any trouble utilizing the credit within the next 12 months. And if there is some leftover credit before I have to cancel Altitude Reserve, I can always buy a Southwest gift card directly from Southwest.com Those code as a travel purchase. But I seriously doubt I’ll have to worry about it, considering all the travel plans that are brewing in my brain at the moment.

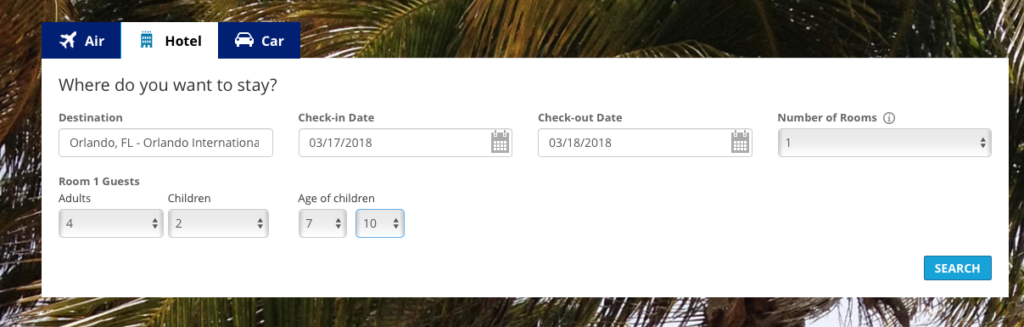

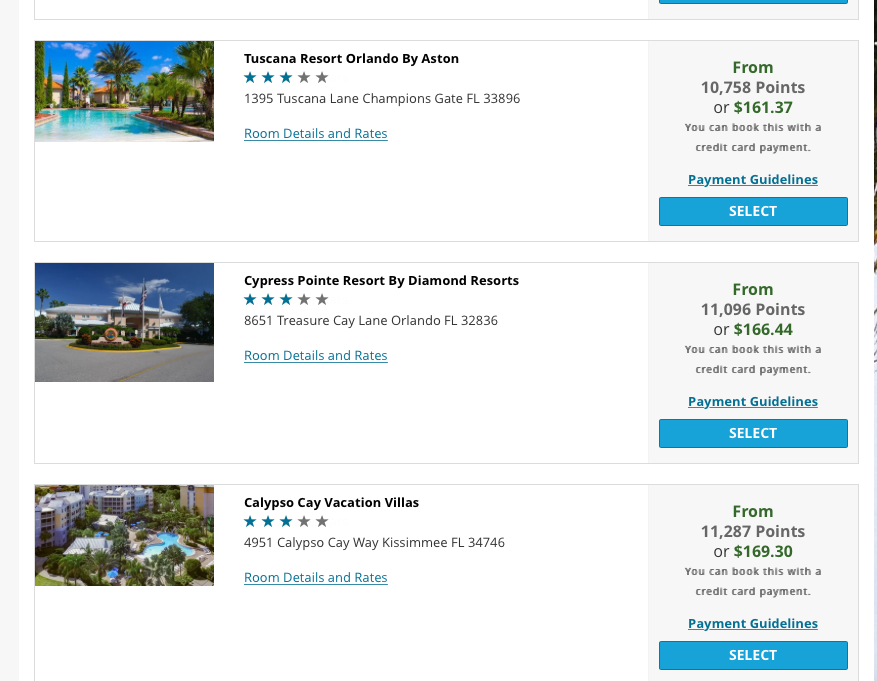

The bonus on Altitude Reserve card can be leveraged towards 2 and 3- bedroom vacation rentals. Here is a sample for Orlando area after I input the details:

There were 140 results, including some very nice family-friendly resorts. If you are planning to spend $750 on lodging near Disney, the bonus on Altitude Reserve card is almost as good as cash.

I think this offer doesn’t currently get as much coverage as it deserves. And yes, part of it is due to the fact that it doesn’t pay bloggers commission. Obviously, it’s not the most spectacular offer on the market, but it is solid, especially by US Bank standards.

It’s a very conservative bank that’s not exactly known for huge sign-up bonuses. Every two years, like clockwork, they increase the offer on Flexperks cards due to Olympic games and tie it to US medals count. Aside from that, there isn’t a whole lot of deviation when it comes to sign-up bonuses.

Look at Club Carlson co-branded cards. Even when the program was gutted, US Bank kept the sign-up bonus at exactly the same level. I’m a bit puzzled and can’t imagine people are going nuts over it, but the card is still around, so who knows. My point is, I will be surprised if US Bank decides to increase the current offer on Altitude Reserve. They might, of course, and I could be totally off on this one. But my money is on Chase, not US Bank.

Verdict: Consider signing up if it fits in with your existing plans.

Bottom line

For me, one of the toughest challenges as a blogger is predicting what will happen to any given offer. After all, I would hate for readers to miss out on additional points or cash back due to my bad advice. The question of when to hold and when to buy doesn’t usually have a clear cut answer. However, looking at past patterns and bank’s behavior, I can make an educated guess. So, take it for what it is, as in, with a grain of salt.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

[…] But overall, CSR is designed for a savvy business traveler who likes to keep it simple. A top notch product. Amex has to make much needed changes or lose the segment entirely to Chase and Citi. Citi Prestige may not be as hot as it once was, but it’s still a decent premium card, ahead of Amex Platinum in many respects. Not to mention, 75k points bonus is getting a lot of buzz. […]