Right now the blogosphere is probably buzzing in excitement over the increased 75k offer on Citi Prestige, that was supposed to go live yesterday. And hey, I admit, there is a good reason for all the hoopla. It’s the highest ever publicly available bonus on this particular product. Plus, with latest tightening of Chase and Amex rules, many folks are running out of good options to apply for. Guilty!

It’s not as great of an offer as 100k bonus on Chase Sapphire Reserve (now expired). But it’s definitely solid. However, as I’ve mentioned in my Friday post, the biggest issue is huge minimum spending requirement. Putting $7,500 on credit cards in 3 months is probably nothing to those who do manufactured spending. If that describes you, great. You should consider getting this offer, assuming you looked at other cards on the market.

But I’m primarily writing for normal people who probably should skip this offer and focus on something a little more realistic. Enter Citi Thank You Premier card. First, here are the details:

- Earn 50,000 bonus points after spending $4,000 in purchases within the first 3 months of account opening

- 50,000 ThankYou® Points are redeemable for $625 in airfare on any airline, anytime with no blackout dates when booked through the ThankYou Travel Center or $500 in gift cards when redeemed at thankyou.com

- Earn 3X Points on Travel, Including Gas Stations

- Earn 2X Points on Dining Out & Entertainment

- Earn 1X Points on All Other Purchases

- No expiration and no limit to the amount of points you can earn with this card

- Points Transfer allows you to transfer points to participating airline and hotel loyalty programs

- No Foreign Transaction Fees on purchase

- Annual fee of $95 is waived for the first 12 months.

The card pays us commission. Aside from targeted offers, the sign-up bonus on this product has been hovering around 30k points for over a year now. So, obviously, this is a big improvement. I personally signed up for this card back when the bonus was tiered and you had to keep it for two years in order to receive the entire amount. The structure is much more simple now, which is good news for normal folks.

According to terms:”Bonus ThankYou Points are not available if you have had a ThankYou Preferred, ThankYou Premier or Citi Prestige card opened or closed in the past 24 months.” So, if you have a Thank You points earning card that is currently open, don’t close it before your application because it will disqualify you from getting the sign-up bonus.

Why Citi Thank You Premier is a viable alternative to Citi Prestige

1) Lower minimum spending requirements.

This one is obvious. One card requires you to spend $7,500 in 3 months and the other $4,000. Always consider opportunity cost when choosing offers. Will getting Citi Prestige prevent you from signing up for another desirable card?

2) Waived annual fee.

Another no-brainer. Citi Thank You Premier waives the fee for the first year, while Citi Prestige will charge you $450. Sure, you can recoup the latter, but it’s not as simple as many make it sound. Speaking of…

3) The $250 travel credit on Citi Prestige is only good toward flights.

You can get it twice if you sign up within the next few months because it’s currently based on calendar year. If you have flights coming up, great! If not, you may find yourself buying airline gift cards like I did last year, just to take advantage of it. It’s still a good deal, obviously. However, you may end up with a dilemma on your hands: Should I sell the gift cards at a loss or spend them on another trip? You could find yourself planning an unnecessary vacation just because. If you are on a tight budget, it’s not always a wise idea.

So, the point is, it’s not exactly fair to assign face value to this travel credit perk. It’s nice, but it will involve hassle, keeping track of various dates etc. If you are an infrequent traveler like me, you may end up with a bunch of Southwest gift cards and planning a trip to Jamaica. This may or may not have happened in real life. OK, it did happen. Though to be fair, we loved the trip.

4) You can use points from Citi Thank You Premier toward cruises and hotels and get 1.25 cents per point.

A weird thing about Citi is that they don’t advertise this sweet perk for whatever reason. Why, I have no idea. I even reached out to Citi to clarify this point:

Citi rep just sent me a link to the page that lists benefits, and it’s not on there. Thankfully, Robert Dwyer checked it for me and yes, you can still redeem points towards hotels, car rentals and cruises at 1.25 cents apiece. Awhile back, Nancy was able to redeem points from her Citi Thank You Premier card towards a stay at an all-inclusive resort.

The same benefit is not available via Citi Prestige. Of course, there is an option to combine the points between the accounts for free if you happen to have both cards.

5) For a regular family, all the fancy perks on Citi Prestige are a bit overrated.

Don’t get me wrong, airport lounge access and travel insurance are nice. But last time we flew to Europe, I probably got $4 value out of my Priority Pass benefit because we didn’t have time to go to the lounge or it was located in another terminal. TSA pre-check is great, but many other cards offer it as well. As far as travel insurance goes, I usually buy my own policy because well, I’m paranoid.

Obviously, all those perks combined are worth something, I just don’t think they are a game-changer for an average Joe. Are you a frequent traveler who is planning to pay cash for lounge access and TSA pre-check? Then it’s a different story.

6) Both Citi Prestige and Citi Thank You Premier points transfer to loyalty programs at the same exact rate.

While redeeming points toward revenue fares at 1.25 cents apiece is a good deal on its own, under the right circumstances, transferring to miles can be leveraged to your advantage. The most valuable transfer options at the moment are probably Singapore KrisFlyer and Air France Flying Blue. Both transfer 1:1 from Citi Thank You program. Let’s take a look at how we can leverage these for family:

Singapore KrisFlyer: The transfer takes 1-2 days. Costs 12,500 miles one-way to fly to Alaska on United, compared to 17,500 through United Mileage Plus. Also, it costs 17,500 miles one-way to fly to Hawaii, compared to 22.500 through United program.

Air France Flying Blue : The transfer takes 1-2 days, though some have reported that miles show up instantly. Miles can be redeemed for one-way tickets on Delta. Sweet spot: It costs 15,000 miles one-way to fly to Hawaii and Caribbean (less than through Delta award chart), though availability can be hit or miss.

See my post on best mileage deals for flying your family to Hawaii

You can also redeem miles for economy tickets to Europe on Air France with minimal fuel surcharges. The normal cost is 25,000 miles one-way (a decent deal from West coast). However, they regularly have a a 25% and 50% off sale on award mileage requirements from certain cities in US. Potentially, you can fly for 12,500 miles (Thank You points) one-way to most of Europe and even Israel.

You may want to open an account now because apparently, opening it and transferring miles immediately triggers fraud warning. FYI, last time I did transfer to Air France, they let me put tickets on hold for 14 days before I had any miles in my account.

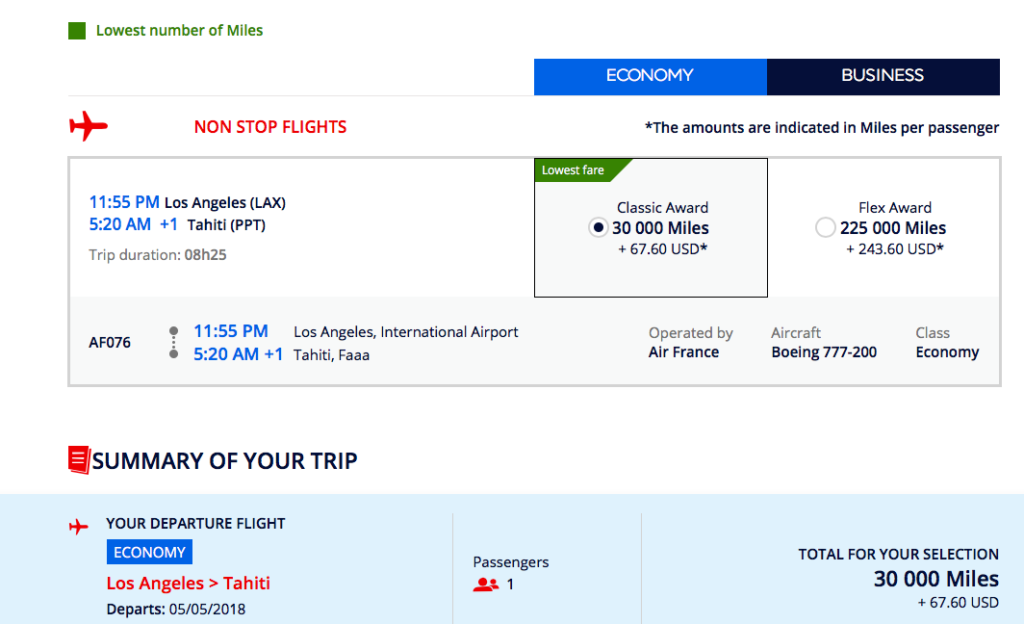

Fancy an anniversary trip to Tahiti with your spouse? Air France program is your best bet. It costs 30k miles to fly one-way from Continental US to Papeete. Availability is usually excellent because Flying Blue releases more award seats to its own members. But, but, but, what about fuel surcharges?

Well, let’s compare the cost to other programs. AAdvantage charges 80k miles roundtrip on partner Air Tahiti Nui, plus $80 in taxes. Delta charges 100k miles, plus around $80 in taxes on Air France (its partner), and much more on Air Tahiti Nui.

Or, you can book an award via Air France program which can be reserved online (unless there is a glitch). You’ll pay 60k miles, plus $190 in taxes on economy roundtrip ticket. And you’ll get a much better award availability. Air France website is a bit wacky, so you may have to call in, especially when trying to piece together a trip that includes Delta leg from your home airport.

Here is an example of what an award will cost when flying from LAX to PPT one-way in May of 2018:

The website returned error when I tried to add MCO-LAX leg. But assuming Delta has one-way award tickets that cost 12,500 miles via Delta.com available, it should be possible to call Air France and add them to your itinerary at no extra charge.

If both spouses sign up for Citi Thank You Premier card, they will only need about 12,000 miles after factoring in minimum spending, in order to get two roundtrip tickets to Tahiti. You can use Ultimate Rewards, Membership Rewards or SPG points to top up your account.

Who should NOT apply for Citi Thank You Premier

While I consider applying for Citi Thank You Premier card a no-brainer overall, it’s not a no-brainer at this point in time. Why? There are other good deals to be had which should probably be prioritized at the moment. Few obvious ones that come to mind: Wells Fargo Propel World (see details) and Merrill +Visa Signature 50k points offer (reportedly, still available over the phone).

Both require some hoops to jump through, but the rewards are most definitely worth it. Also, if you are new to miles and points hobby, you may want to start with Chase cards. Otherwise, the bonus on Citi Thank You Premier card is nothing to sneeze at. And once again, if you can easily handle the spending requirements on Citi Prestige, you should consider it as well.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Great post! Laughed out loud at several points. Love your sense of humor. What happens when it’s annual fee time with this card? Can you downgrade the card and keep the points? Or do you try and spend the points in the first year? I’ve never had Thank You points.

Amanda, my sense of humor is an acquired taste! I’m glad you enjoy it. Not everyone does.

With Premier card, you have a few options when the fee hits. You can spend points on travel and redeem at 1.25 cents each. This is probably the best option. You can also transfer to mileage programs, though I’m not sure I would do it speculatively. Air France and Singapore programs are usually best, but miles expire after few years. So, there is risk. You can also redeem on gift cards, but it’s the worst option. I’m not sure you can redeem on cash 1:1 yet, I think Citi is planning to add that option.

All in all, redeeming on travel at 1.25 cents per point is probably the best deal. There is usually an option to downgrade to Citi Thank You Preferred. It has no annual fee, but you only get 1 cent per point on flights and you won’t be able to transfer to airline programs. If you cancel Premier card, the points will expire, so spending them first is a must.

Overall, I think this is a very good deal. Let me know if you have any questions.

I was thinking about applying but I have 120,000 MRs to use – hopefully before AF due in Jan. And 300,000 UR points to use before CSR AF hits (also in Jan) It’s a good problem to have…but is it too much? Maybe I should focus on burning what I have and save this one for next year…? Or just go for it cause you don’t know if it will be here next year!? Argh!

Haha! It is definitely a good problem to have. Only you can decide on this one. Look at your plans and make the call. One thing to keep in mind with Premier: the sooner you apply, the sooner you can cancel and reset the clock on 24 months between canceling and reapplying. Makes sense? It is a good offer, and worst case scenario is getting $500 in gift cards. I know you fly Delta due to having family in Minneapolis. Air France is a good program for those flights because it partners with Delta. Of course, be very careful because miles do expire. But that could be one possible scenario: transferring to Air France if you can’t find any other good uses. It’s a decent offer, it’s not “drop everything and apply” offer, if that makes sense. I would be applying, but I won’t qualify for the bonus till next June.

Yep. Makes sense on the 24-month clock. I know everyone hates Delta miles, but they don’t expire, which is something I love about them. But sounds like Citi doesn’t partner with Delta directly huh? Would have to go through some other program like Air France. I’ll think this one through and decide next week. Any hunches about how long the offer will last, all-knowing one? 😉

I have no clue as to how long this offer will be around. I imagine it won’t be going away for at least a month or so, but who knows. And no, Citi doesn’t partner with Delta directly. You will have to use Air France program. See this post for more: https://milesforfamily.com/2015/09/07/a-case-study-from-boston-to-hawaii-via-citi-thank-you-points/

It’s great for flights to Tahiti and Hawaii from US. And hey, you can fly with AA miles from Tahiti to Auckland! There is an idea for you. 🙂