I’m sure this will come as a shock to most of my miles and points brethren, but I’ve never had Alaska Airlines Visa Signature Credit Card. Gasp! Yes, I know the miles are super duper valuable, but I just didn’t feel the need to apply, I guess. For one, the bonus used to be rather small (25K miles). But more importantly, the terms indicated that there was a chance of getting approved for a lower offer of 5K miles.

That concerned me, so I never pulled the trigger because I didn’t want to potentially waste a credit pull on such a puny offer. They don’t tell you ahead of time what the criteria is, so it’s a bit frustrating, to say the least. That’s why before I do the full write-up, let me mention this important tidbit of information:

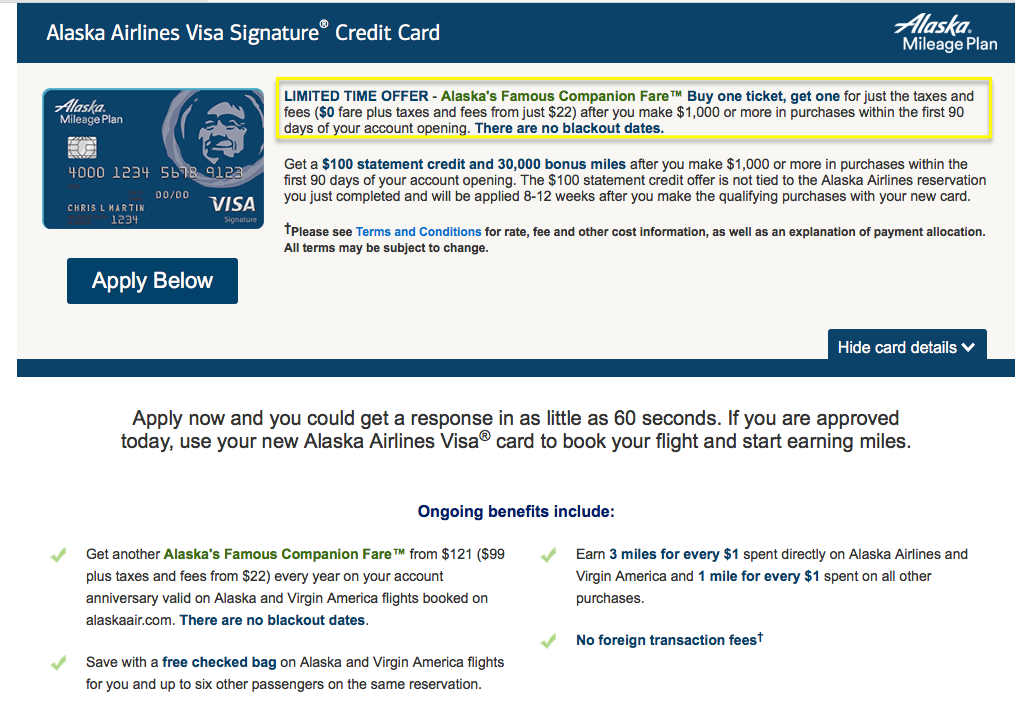

“Visa Signature® cardholders who make any combination of Purchases totaling at least $1,000 that post to the account within 90 days of the account open date will qualify for 30,000 bonus miles and a round-trip coach Companion Fare on Alaska Airlines or Virgin America from $22 (USD) ($0 base fare plus taxes and fees, from $22 depending on your Alaska Airlines or Virgin America flight itinerary) when traveling with another passenger on a paid published coach airfare on the same itinerary, booked at the same time on alaskaair.com.

Platinum Plus® cardholders who make any combination of Purchases totaling at least $1,000 that post to the account within 90 days of the account open date will qualify for 5,000 bonus miles and a $50 Discount Code entitling the primary cardholder to up to $50 off a published base fare on Alaska Airlines or Virgin America round-trip or one way travel at alaskaair.com.”

Once again, there is no way of knowing which version you’ll get approved for, and at least one of my readers got stuck with 5,000-miles offer. So, it’s not all that uncommon. That said, I decided to pull the trigger and fortunately, was approved for Signature version.

Here is why I did it.

Southwest, Delta, Virgin America or United?

Last week I’ve mentioned that we are thinking about doing an epic trip to South Pacific next summer. This elaborate plan is like a puzzle, and there are many pieces that have to fit together just right in order to pull it off. Something I’m not certain on are the flights to/from LAX. Sure, I can utilize Southwest points, but there is a connection involved. The less complicated I make this trip, the smaller chance there is of my husband asking for divorce once it’s all over.

So, I started looking at other options that don’t involve a connection, even if they end up costing me more miles or cash. After all, Rapid Rewards points can be redeemed on Walmart gift cards, so in essence, they are almost as good as cash. I could always redeem Southwest points on gift cards or simply use them to book direct flights on other carriers. The option is listed under “more rewards”:

Basically, you can do an exchange of sorts in order to contain out-of-pocket costs.

Basically, you can do an exchange of sorts in order to contain out-of-pocket costs.

Always remember that Rapid Rewards points have tangible value, especially if you happen to have a co-branded Southwest credit card. So I encourage you to think outside the box and consider the alternatives. Let’s say you find a Southwest flight with a connection that costs 10,000 points. Or you can take a direct flight on a legacy carrier for $130. If you are tight on money and have no flexible points, you could simply use 13,000 Rapid Rewards to book the latter. I would. Of course, you will be foregoing flexibility, so it’s something to consider. I’m not saying it’s a good use of Southwest points, but it’s an option nonetheless.

I’m hoping to fly to LAX on Friday evening, so we can leave for Tahiti on Saturday. My husband can only take two weeks off consecutively, so time is at a premium. Unfortunately, airlines know that Friday is a popular day to fly, so saver awards on Delta and United (12,500 miles one way) are rare. Especially non-stop options.

And since we would have to fly in the evening, non-stop is the only logical choice. I figured I would just plan on redeeming miles at standard level. There is a possibility of using AAdvantage, of course, since LAX is one of their hubs. However, we will probably burn most of my remaining AA miles on flights within Australia (10,000 miles one-way on partner Qantas).

I thought about applying for recently increased Amex Delta offer, but I didn’t want to take on an additional $3,000 in minimum spending requirements. Chase co-branded United credit card is subject to 5/24 restriction and I don’t have any transferrable UR or MR points. What to do?

Enter Alaska Airlines credit card. The best offer is via direct link and comes with $100 credit.

If you apply for personal and business versions of the card (direct link) simultaneously, your inquiries might get combined, though there are no guarantees. To my best knowledge, business offer doesn’t come with free companion certificate or $100 statement credit.

Don’t ignore the Companion Fare certificate

At first glance, the offer doesn’t seem all that impressive. I mean, 30K miles when other banks offer 60K? But looks can be deceiving because the free Companion Fare certificate sweetens the bonus substantially. You will also get an anniversary certificate for $99 base fare after renewal next year.

Update: the offer has been extended.

Few additional details on the certificate:

“Visa Signature® consumer credit card holders qualify for their code after making $1,000 or more in purchases in the first 90 days of account opening. The companion fare code will be credited to the primary cardholder’s Alaska Airlines Mileage Plan account approximately two billing cycles after qualifying, and then on an annual basis dependent on your enrollment anniversary date. Once ticketed, travel can be completed after the expiration date — 12 months from date of issue.”

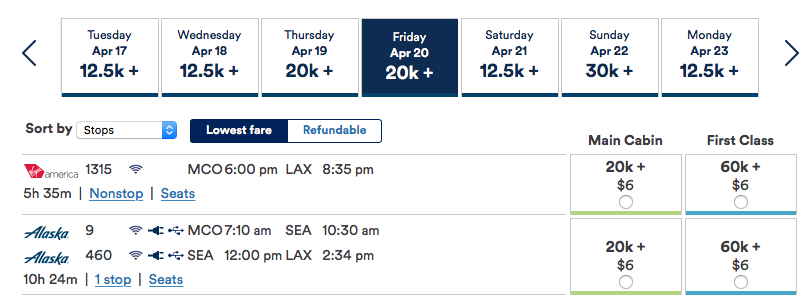

I actually called and was told that the certificate can also be used for one-way flights. You can see all FAQ on companion perk on this page.

It can be a great deal for many Alaska operated flights to Hawaii, as well as state of Alaska, of course. But those are not the ones I’m currently interested in. I’m after Virgin America operated fights from Orlando to LAX and possibly SFO. Virgin America happens to fly to both of those airports non-stop.

But what about flight prices?

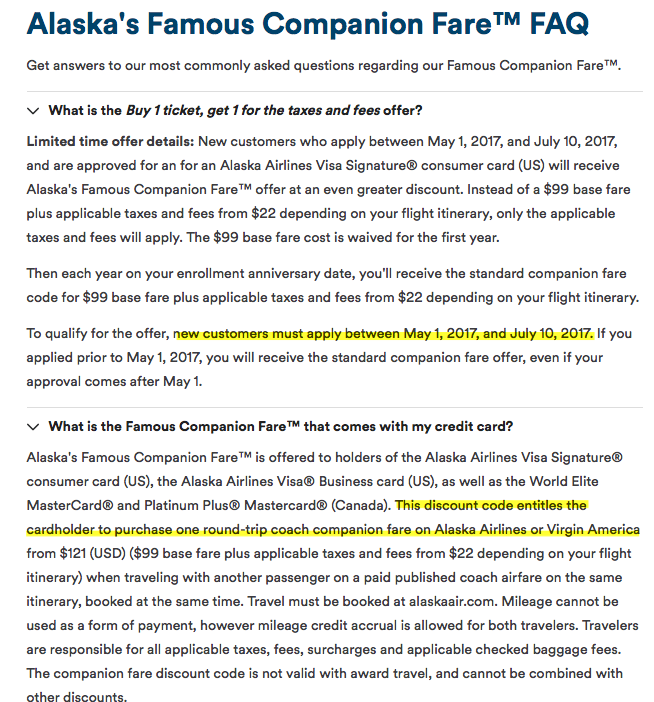

They seem to be comparable to other carriers. Right now Virgin America’s schedule is only open through April, so it’s impossible to say what the fares will be like for July of 2018 (the time we intend to go on our trip). But here is a quote for the end of next month, on one-way flights leaving Friday evening:

While Virgin America is a bit higher, I would get free checked bag via credit card, plus BOGO on the ticket. Not to mention, I like the idea of landing in LAX at 8:20 PM. But wait, I’ve said I intend to burn all miles no matter what! That’s not exactly true. Faced with the option of paying $260 and burning 40K valuable Alaska miles, I would be inclined to go with the former. Speaking of…

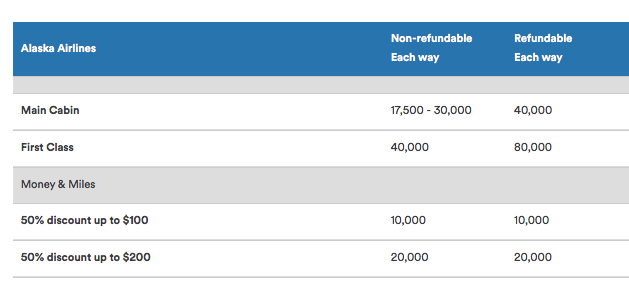

The option to burn miles is there if you need it

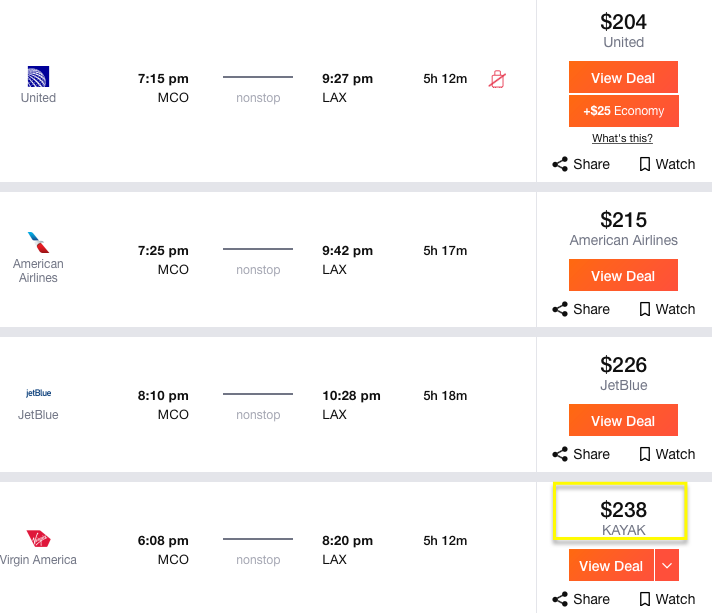

Let’s say flights for my dates will be exorbitantly expensive, something like $400 one-way per person. I could use miles instead. At the moment, I have 12K Alaska miles I got via promo awhile back. While some dates run at 30K miles per person, most cost 20K miles one-way. The sign-up bonus should increase my balance to over 40K miles total, good for two tickets.

Here is the example for MCO-LAX flight:

Anything close to 1CPM (cents per mile) is OK by me. Once again, it’s impossible to predict what things will look like in a few months, but that can be said about all programs. If I don’t collect Alaska miles ahead of time, I won’t have Virgin America option at all when the time comes to finally book the tickets. A lot of what we do in this hobby requires a leap of faith.

And Alaska miles are quite valuable, so collecting them speculatively isn’t a bad idea. Not since I plan to wipe out most of my mileage balances, which I do. Plus, you can receive the sign-up bonus from Bank of America few times per year if you are so inclined. And did I mention that Alaska miles can also be used on Qantas, so I could just burn AA miles on flights to Orlando if needed? That’s plan A, B and C for you.

While I discourage all consuming, out-of-control hoarding where you collect millions of miles each year for no reason aside from the fact that you can, having some miles on-hand is not a bad idea. This is especially true when minimum spending requirements are quite reasonable, which is the case with Alaska co-branded card.

If you are looking to fly a short non-stop flight on Alaska operated route, you can potentially score some decent bargains. Prices start at only 5,000 miles one-way within Continental US:

And here is a rate to Hawaii:

If you can find two one-way tickets for 17,500 miles, your sign-up bonus will give you all but 4,000 miles, factoring in minimum spending. This is one of rare times where it could make sense to buy miles.

Bottom line

Yes, there are certainly more lucrative offers on the market, but Alaska card is a gem under the right circumstances. If you live in one of Alaska hubs or an airport served by Virgin America, you should absolutely look into it. Just don’t forget that the application requires a leap of faith!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Nice write up…I had received this offer in the mail, but didn’t have any immediate plans to use it. Now we’re working on 2 Delta Amex offers…thank goodness it’s for 4 months @ $3,000 spend on each card. This would definitely be a great option for us to get from LAX-MCO in a few years…I hope this offer comes back around.

Thanks again!

@Stephanie Thanks! I’m sure the 30K offer with $100 credit will still be around. I’m not certain on the free companion pass. But like I always say, good deals will always be around in one form or another.

Flying to the South Pacific is complicated and crazy-expensive! We are going to Bora Bora in August. My plane ticket was paid for by a travel brand, but I had to pay for hubby if I wanted to bring a guest. I wound up paying for his IND-LAX flight with AA miles one way and Membership Rewards the other direction. Then I paid cash for the LAX-PPT and PPT-BOB legs. It wasn’t ideal but I didn’t have time to earn and strategize the miles, either. I think the ticket to BOB from PPT alone was around $400 round-trip. Better be worth it! =)

Holly, I need to reach out to some of these brands and see if they will sponsor me! Well done, my friend. 🙂 I’ll be on the lookout for your posts on Bora Bora because I’m curious what you will think of it. Like me, you tend to cut through the hype.

Yeah, for sure, Tahiti is crazy expensive. I think we should have the miles needed, but then there is the issue of award availability. And get this, we will probably only spend 1 or 2 nights in Bora Bora. So, I’m not sure if it’s even worth it. But then again, I’ll be kicking myself if I don’t stop on the way to New Zealand. We are already heading that direction, so…

I don’t know, sometimes I think I’m losing my mind, or what’s left of it.

It has nothing to do with my blog, unfortunately!

@Holly I really doubt that hotels will be dangling an overwater bungalow in front of me based on my blog stats! I’m very happy for you and hope you guys enjoy it.

I’m really hoping to use my IHG cert at Thalasso in Bora Bora. Now that would be an epic redemption, for sure.