One or more of these credit card offers may no longer be available. See our Hot Deals page for the latest offers.

A trip to Europe for five people can cost a boat load of cash. Lodging, dining and transportation…all of those things add up. So, look away when you see the word “free” and Europe travel mentioned in one sentence. Of course, you can save a ton of money by utilizing miles and points. Read my posts on redeeming miles for our transatlantic flights and using Ultimate Rewards and Club Carlson points in order to cut lodging costs.

But there were many travel-related expenses where using miles and points was either impossible or impractical. That’s what this post will focus on. The cards didn’t make our vacation free (not even close), but they helped immensely in making the trip relatively affordable. Without further ado:

1) PNC Premier Traveler Signature Visa

Before I go any further, let me mention the big catch for this offer and the reason why it’s not listed in my Hot Deals page. This card is only available to residents of the following states: Alabama, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Maryland, Michigan, Missouri, North Carolina, New Jersey, Ohio, Pennsylvania, South Carolina, Virginia, Wisconsin, West Virginia and Washington D.C.

If you happen to reside in one of these states, you should definitely consider it, especially if you’ve exhausted all of your other options. You get 30,000 points after spending $3,000 in 3 months, first annual fee is waived. Note that the terms say “billing cycles” instead of months. You earn 2 points per dollar on everything. The bonus is good toward a $300 rebate against travel purchases. Redemption starts at 5,000 points and equals $50. This offer now pays us commission. (Thanks to Doctorofcredit for originally writing about this offer a year ago).

How this bonus helped me pay for Europe trip

I applied in both mine and my husband’s names, which gave me around $720 to redeem toward travel purchases. I used 55K points ($550) for Ryanair flights which I’ve mentioned in my last post. I bought two tickets with one card and three with the other one. The rest of the bonus (well, minus 2K points) was used for $150 penalty on American Airlines when I canceled my husband’s AAnytime ticket and rebooked it at sAAver level (65K miles vs. 30K miles).

So if you have to pay penalty for switching an award reservation, don’t forget to use a card that comes with a bonus, redeemable on travel. The charge should code under “airlines”, so you’ll be good to go. I went ahead and cashed out 2K points toward $10 statement credit because I didn’t feel like charging $1,500 in order to reach $50 minimum threshold.

2) Wells Fargo Propel World

This card is no longer available online, and I’m not certain that it’s offered in branches or over the phone. I believe it is, but correct me if I’m wrong. I definitely wouldn’t wait too long to apply if I were you. Here are the details on the bonus:

- Earn 40,000 bonus points with $3,000 in net purchases in the first 3 months.

- Earn 3X points on Airlines, 2X on Hotels, and 1X on other net purchases.

- Get up to $100 in reimbursements each year for qualifying incidental airline charges like airline lounges, baggage fees, and more.

- Get complimentary room upgrades and more through the Luxury Hotel Program.

- First annual fee is waived.

You may want to read post The quirks of redeeming my bonus from Wells Fargo Propel , though it is few years old at this point. Just to avoid any doubt, Wells Fargo does NOT pay me to mention this card, I’m simply trying to help my readers.

From terms: “If you have opened a Wells Fargo credit card account within 16 months of this application you will not be eligible for the above introductory APR(s) and fees or any bonus rewards offers described below even if that account has been closed and has a zero balance.” I’m not certain if they mean just this specific product or any Wells Fargo card, so that’s something else to consider.

If you currently have another WF account, you can just call 1-800-932-6736 and apply over the phone. Otherwise, you’ll have to go to local branch. I did the latter and was successful, but my husband was denied.

How this bonus helped me pay for Europe trip

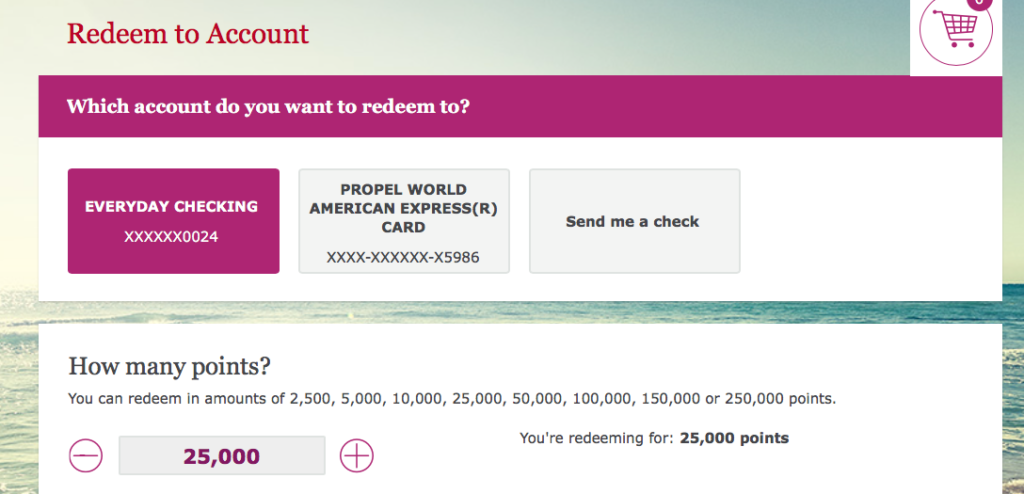

I completed my minimum spending about a month ago and just got the bonus yesterday. Since I have a checking account with Wells Fargo, I simply converted points into cash and transferred them there at no charge. I plan to eventually transfer the stash to my main checking account, which will help to pay the plethora of bills from our European adventure.

I had to make several redemptions, but got $425 out of this deal. I have 900 points left (worth $9) which I may or may not utilize. I’m definitely not losing sleep over it. But wait, there is more! Remember that $100 reimbursement benefit for incidental airline charges? I had to pay for an extra bag on Ryanair, so it came in handy.

It was really dumb because if I prepaid it when booking my tickets, it would have cost $30. Instead, I had to cough up $55. But there was no way around it. I could see that we were going to exceed the prepaid baggage allowance after buying souvenirs in Barcelona, and Ryanair has steep penalties.

So, before leaving on the trip, I prepaid an extra bag at the highest possible rate. Fortunately, since I used my Propel card, the charge was completely covered. In fact, I still have $45 left in benefits, which I plan to utilize toward luggage on our Spirit flight to Newark in the fall.

I would pay these fees anyway, so by that logic, the bonus is actually worth $500. That’s why I strongly recommend you get this card before Wells Fargo discontinues it.

3) Barclaycard Arrival Plus World Elite MasterCard

You knew it was coming, right? I’m sure you’ve heard about this one. Barclaycard Arrival Plus World Elite MasterCard is definitely one of the usual suspects and yes, the offer does pay us commission. But like I said before, it’s an easy card to recommend to anyone. The sign-up bonus is 50,000 points after $3,000 in purchases in 90 days, first year annual fee is waived.

That amount equals $500 that you can redeem toward travel-related purchases like airfare, cruise, hotels and car rentals. The card gives a 5% rebate on the points you redeem. Minimum redemption for travel is 10,000 points, equivalent to $100. Read my short review Current bonus is at an all time high.

The $100 threshold is a nuisance, I admit. Read my post Frustration Galore: Redeeming Barclaycard Arrival Plus Points for few tricks on how to maximize each and every redemption. However, it also helps to be on your toes when swiping the card, especially when an establishment lets you split payments (I’ll get to it in a minute).

How this bonus helped me pay for Europe trip

I applied in both mine and my husband’s names, which gave me around $1,120 to redeem toward travel purchases after factoring in minimum spending. I used some of it for our Hyatt stays, so we had about 70,000 points left in our respective accounts (worth $700).

My sister-in-law asked me if I pre-brooked any airport transfers. I didn’t, but it seemed like a good idea. We had success with a company SunTransfers in the past, so I compared their rates to competitors. As expected, they had the lowest price. Booking an airport transfer comes with pros and cons. You lock in the price ahead of time (usually comparable to what you will pay at the airport, sometimes lower) and you’ll have someone with a sign waiting for you.

Also, if you need a booster or a car seat, you can specify it in your booking (for an extra fee). So, basically, it’s a convenient, no-hassle option. The disadvantage is the fact that you won’t have time to grab lunch at the airport unless the driver is OK with waiting around (they may not be, since they are on the clock). Also, if the flight is delayed or you need to cancel the transfer last minute, it will be a nuisance, though you can pay few extra euros for insurance in case this happens.

Normally, I would book the transfers as one-way in order to have more flexibility. However, in this case this was a no-go option. The reason? Each transfer was less than $100 once converted from euros. So, by booking it as roundtrip (which we needed anyway), the charge became eligible for redemption.

The cost from Barcelona airport to our rental was $110 roundtrip, and we needed two transfers since we were planning to do a day trip to Mallorca (totally nuts). But that’s a story for another day…

Welcome to sunny Mallorca!

So, I made one charge to see how it would code. As expected, it coded as transportation, so I could use my points to offset it. I then made another charge of $110 and $196 for roundtrip transfer from Frankfurt airport to Wiesbaden. Each time I got 5% rebate in points. Off topic, but Radisson Blu Schwarzer Bock Hotel, Wiesbaden (about 30 minutes from Frankfurt airport) was a delightful surprise. Burn your Club Carlson points if you are in the vicinity.

Taxis in Germany are much more expensive than those in Spain, the fact that is not lost on Barcelona taxi drivers. Which is why they went on strike on the day we were set to fly to Mallorca. I’ll have more on it in a separate post, but the charge was refunded by SunTransfers, though redemption was not reversed.

This is not a wink-wink/nudge-nudge statement because I wouldn’t feel comfortable recommending making refundable travel reservations in order to cash out the points. But I didn’t plan on this happening to us, so I don’t feel bad about how things turned out.

I ended up cashing out the rest of the points toward a castle stay in Nesvizh, Belarus. This was actually one of the highlights of the trip and totally worth the splurge. But I did have to pay $400 for four rooms (including our VIP suite). I knew that I had about 34,000 points left on my card (worth $340 toward travel). Here is where I messed up.

When the charge showed up, I was given an option to redeem 30,000 or 27,500 points. Neither choice was ideal. Since I would get a 5% rebate, it would leave me with a sizable amount in points, but nowhere near $100 level. I decided to redeem 27,500 points, but now I have to charge around $1K in order to reach 10,000 points level. It’s not the end of the world, but still.

You see, I had an option to make two equal payments of $200 each, but I didn’t take it. So, be aware of the implications of your travel purchases and always ask if you can tinker with your payments. But either way, the bonus on Arrival Plus cards really came in handy during our trip to Europe.

When I signed up for all these offers, I didn’t have a clear plan in mind, but I knew that I would use them one day. And if I had any trouble utilizing the points, I could always buy Southwest gift card on Southwest.com or a Hyatt gift card inside one of their properties.

Bottom line

Travel to Europe is expensive, period. However, it is most definitely not out of reach for an Average Joe. By regularly saving cash throughout the year and taking advantage of various sign-up bonus opportunities, you can reduce the amount to a manageable level. I can’t think of a better use of Arrival points than treating my family to a unique castle hotel experience. If you are a new reader, check out my Free Consulting Service page and don’t hesitate to reach out if you want to save money on your next trip.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Nice write up. I love the Barclaycard Arrival Plus – hopefully, I can time it right to use it for a cruise.

@Stephanie Thanks! I love Arrival Plus too, it comes in handy for all the out-of-pocket travel expenses that can’t be covered via points. As far as reimbursement goes, you have 120 days after the transaction posts in order to be able to use the points. Hope you get approved.

Hi. Any data points on how aggressive PNC is about denying points for gift card purchases (as in Simon Mall Visa’s?)

Thanks!

@Skywardbd I honestly have no clue. You may want to search Flyertalk.com for data points. I only did organic spending on the card. It’s a smaller bank, so I imagine anything out of the ordinary will attract attention, but I’m not certain on that.

Hi Leana, what an amazing and thorough post about signing in bonuses and helping cover. So many expenses that add up in a trip like going to Europe. Thank you so much for sharing!

Hi, Carla! First of all, my apologies for the fact that your comment originally went to spam. I’m not sure why, but I’m glad I found it there. My blog has a mind of its own at times. 😉

Anyway, I’m glad you found the post useful. Sometimes I feel like I share too many details, but I think it helps to see sign-up bonuses “in action.”

That’s fine Leanna. I am also glad that you find it and could recover it. That has happened to me as well. 😉

Well as long as you keep saving for yourself some of your personal details I think you will be fine. Thanks again!