Background

Late last year and early this year, I was holding off on new credit card applications to get under Chase’s 5/24 rule. In March, I decided to throw caution to the wind by breaking my holding pattern. Both my husband and I applied for the Merrill + Visa Signature card from Bank of America. I’m glad we did, as the bonus disappeared shortly after our applications.

We are past the minimum spending on our Merrill cards, and my husband was able to knock out the minimum spending for his Amex Surpass Hilton card on our recent home improvement project. Since I didn’t break my 5/24 holding pattern for just one card, it was time to find another useful credit card for my future travels.

Leana and I are both transparent about which cards we apply for and why, so I hope you will find my thought process useful in making your own card decisions.

Another Chase Branch Visit

My first choice for a new credit card is anything that earns Chase Ultimate Rewards points. Why? These are the most valuable points to me. I can transfer them to Southwest and Hyatt (two of my favorites), or book travel through Chase’s travel portal. I was hoping to get either the Chase Ink Business Preferred (80k-100k bonus) or the Chase Sapphire Reserve (50k bonus).

Of course, since I’m over 5/24, I can’t just outright apply for one of these cards online if I hope to be approved. I have to be pre-approved by Chase to even have a chance of being actually approved on the application.

Back in January, I visited a Chase branch to check on pre-approvals. I successfully applied for and was approved for the Chase Sapphire Preferred card, despite being over 5/24. Would I have luck a second time?

Unfortunately, I did not have any pre-approvals tied to my account, according to the banker. I also did not have any “offers for you” attached to my online profile or special invitation mailers (see this post from Doctor of Credit).

Analyzing Our Next Move

So now that those Chase cards were out, my husband and I could consider other offers. Last month, I had planned on applying for the Amex Surpass Hilton card to further build my family’s stash of Hilton points. However, I was no longer sure if that was the right card for me.

With the 5th night free benefit of the Amex Surpass Hilton card, we only needed ~160,000 points max to stay 5 nights at the destinations we are considering for next summer. So for me to apply for the card to round up 300,000 Hilton points for our family seemed like overkill. We decided to have my husband apply for the no-fee Amex Hilton card with 80,000 bonus points after $2k spending. That would put us at over 180k Hilton points, more than enough for what we needed.

So, I had to go back to our travel goals. After our trips this summer, we are heading to Hawaii next March and then potentially to Europe after that. We have our flights to Hawaii booked on points and are planning to use Merrill points for 4 out of the 5 return flights. However, we have zero airline miles we could use for a big international trip.

Deciding on Short-Term Strategy

I narrowed down my credit card choices to two: Citi AAdvantage Platinum Select or the Capital One Venture Rewards card.

The Citi AAdvantage Platinum Select currently offers 60K miles after spending $3000 in 3 months, annual fee waived the first year. This card does pay us commission if you apply through our site, and I’m not sure how long the offer will be available. You can’t get the bonus if you have opened or closed a Citi AA card within the past 24 months.(See this post on “It’s Raining AA Miles! Should You Scoop Them Up?”).

Since I live in an AA hub, these miles would be a start to accumulating a stash for a big overseas trip for my family. My husband could apply later in the year, and we could top off our accounts with the Barclaycard version of the AA card.

However, I feel like I could be jumping too soon on the Europe points stash. We will have a lot of out-of-pocket expenses for our upcoming summer trips to Canada, Alaska and California. I really don’t want to have to pay cash for our 5th Hawaii return ticket that we can’t cover with our Merrill points.

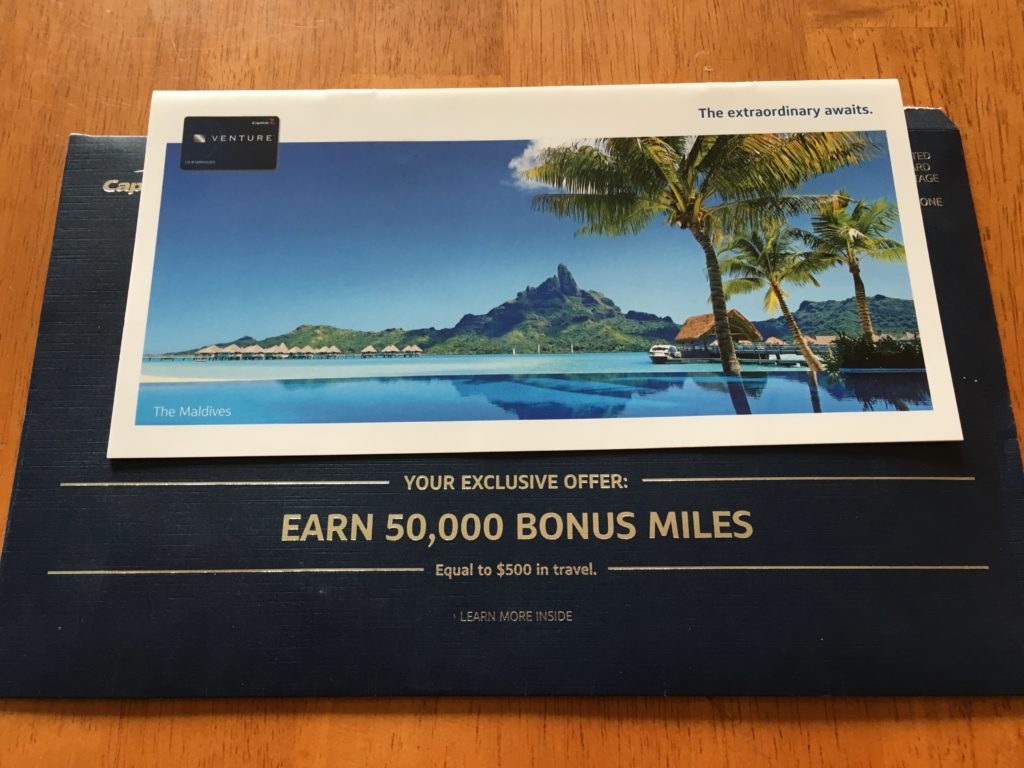

As luck would have it, a few weeks ago I got an offer in the mail from Capital One. The offer is for the Capital One Venture Rewards with 50,000 bonus points instead of the 40,000 public offer. That’s good for $500 worth of travel, and would be perfect for our 5th Hawaii return ticket. (See my post on snail mail credit card offers).

I decided that not having to shell out $500 in the next few months for a plane ticket is a better strategy for our family. I want to avoid paying out-of-pocket for our Hawaii trip as much as possible, and that might mean waiting to accumulate miles for Europe. We’ve got time for that later.

Therefore, I applied for and was approved for the Capital One Venture card with 50k bonus points.

Bottom Line

My credit card application strategy for this round was based on my short-term cash needs. Once we get through this minimum spending, we will go back to the drawing board. Who knows what credit card offers will be the best in a few months that align with our travel goals?

That’s part of what makes this miles and points hobby so exciting. It’s constantly changing and keeping us on our toes.

Have you thought about your next credit card application? What travel goal are you trying to cover with miles and points next?

Click here to view various credit cards and available sign-up bonuses

Author: Nancy

Nancy lives near Dallas, Texas, with her husband and three kids. Her favorite vacations include the beach, cruising and everything Disney.

We’re just finishing the spending requirements for a targeted mail offer of 85,000 combined points (I just need to top it off to 100,000 points) and these will take care of flights to Hawaii for next summer, and another 80,000 points to our favorite airlines with no award availability. Those may come in handy for a few mommy/daddy trips during the school year in the next few years. Will be applying for a new hotel card for 2 free nights in NYC, and maybe will look into the Merrill + card…I thought I read that you can call in and still apply for the bonus.

Woohoo, Hawaii!! Sounds like you have a lot of good travel plans. I did see on reddit that the Merrill + bonus is available by phone…hopefully it will stay alive!

Just one question…Does your credit score become negatively affected with opening and closing all of these credit cards?

Curious….

In the long term, no. In the short term, yes. Each time I apply for a credit card, my score goes down 5-10 points. But, within a few months, it goes back up. Both my husband and I have credit scores in the high 700s/low 800s, despite opening and closing 3-4 credit cards each year. We always pay off our balances in full each month.

To add to what Nancy said, check out this page of the blog https://milesforfamily.com/beginners-guide/ In short, the longer your history, the less impact new inquiries will have on your credit score. Of course, it varies by person, and for someone who has a very thin credit history, even one new application can have a detrimental effect. I recommend that people apply for one card and see what happens. It’s also not a good idea to get a new credit card if you are looking to apply for mortgage in a near future.

I’m so jealous you got the 50k bonus for the venture card. i just used my bonus for the Barclay arrival card. I’m also in a holding pattern. Haven’t applied for a card since March (eternity for a churner), but I also have no big expenses coming up until later in the year as all trips for this year are PIF (wohoo). I do have lots of travel spend coming up since we are doing Vegas (june), NYC (july) and WDW in August. We also have Hershey Park in November for their sweet lights/Christmas show. We’re staying at Hershey Lodge. I also booked Mickey’s Not so scary Halloween party for our trip in August (yeah, i know, halloween in August but we aren’t going again this year). I plan to put all expenses from these trips on my csr to get URs.

I do have a chase branch down the street. I plan to check for csp pre approval sometime in August since I got the Fairmont in January and I hear 6 months is the sweet spot for preapprovals from chase showing up.

I mean generic travel spend ie food,,lodging, transportation and excursions are paid.

Ugh..so many typos today. We just need to pay for food on these trips as lodging, transportation and excursions are paid.

@Natasha you have so many cool trips coming up! Hershey Park, I want to go! Glad you have your trips paid off, now you can relax and enjoy them.

I think you’re right about 6 months being the sweet spot for preapprovals from Chase. I have a few more months to wait and then I will try again.