1) More details have emerged on the new US Bank Altitude Premium Visa Infinite card that is supposed to launch on May 1st. Few most important takeaways:

- You’ll be able to apply in branch or online starting May 1st. Note that you have to have an existing relationship with US Bank.

- The sign-up bonus will be 50,000 points after $4,500 in spending within 90 days of account opening. This is worth $750 towards travel or $500 statement credit.

- There will be $325 annual travel credit (per cardmember, NOT calendar year). It can be used against purchases made directly from airlines, hotels, car rental companies, taxis, limousines, passenger trains and cruise lines. So, it will be similar to CSR in that respect.

- You’ll be allowed to transfer Flexperks points to Altitude points at 1:1 ratio, not the other way around. I suspect that eventually Altitude points will also be transferrable to Flexperks.

- No airline or hotel transfer partners for now.

- Annual fee is $400 for the primary cardholder and $75 for authorized users.

- Lots of premium perks: airline lounge passes, GOGO passes, travel insurance, blah, blah, blah. Not a swaying factor to me, but it’s an added bonus.

So, basically, if you utilize the credit for travel expenses where you would otherwise pay cash, you are looking at a profit of $675 after deducting the annual fee. But only if you redeem points towards travel. If you redeem towards cash, it’s $425 profit, which is still pretty good.

Keep in mind, at this point we are still reporting rumors. The sources are legitimate, but things may change between now and the launching date of the product. I’m definitely interested in this card, but it’s highly unlikely that I’ll get approved for it. Remember, US Bank is very stingy even with their cr#ppy offers like Club Carlson. Imagine what it will be like with a premium card like Altitude. But I’m still planning to give it a shot. Developing…

Read DoC post for the full scoop.

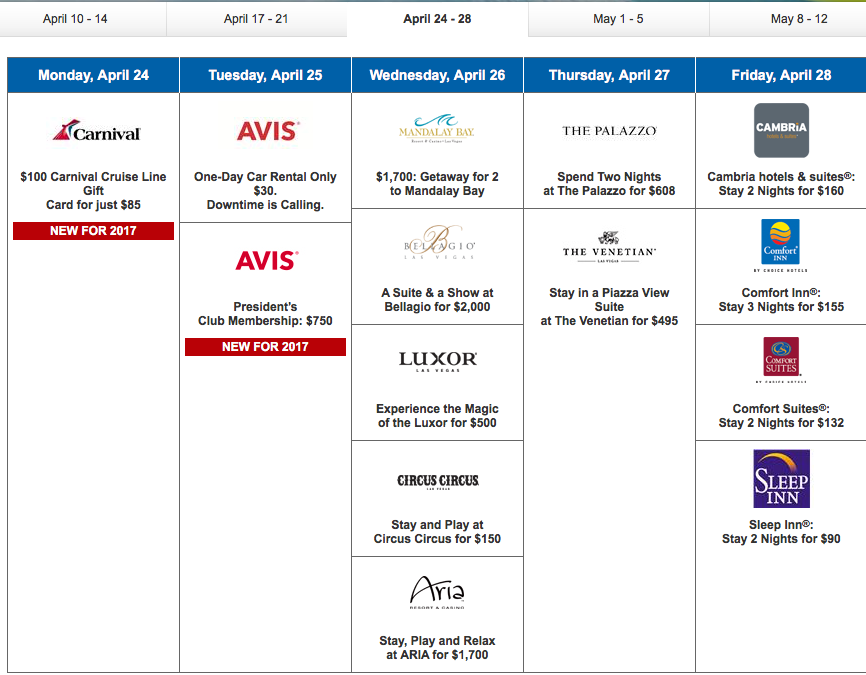

2) The third week of Daily Getaways is upon us, amigos!

Most of these deals are self-explanatory. If you plan on saling on Carnival within the next two years, it might be worth it to purchase three gift cards (the maximum quantity allowed). Be aware, they have to be redeemed by November 30th, 2018. From terms: “Gift Cards are redeemable at participating Carnival Cruise Line® ships for passenger travel to pay for ticket purchases and as deposit to an onboard account.” This is good news to those who have already booked their Carnival cruise.

Verdict: Good deal for those who will be sailing on Carnival cruise line in a near future.

The same principle applies to Avis certificates. Just make sure to read all the fine print. Let’s skip Wednesday and Thursday deals, shall we? Ok, we are on Friday deal that has a potential to be spectacular for some folks. The key word here is “potential.” I plan to devote a separate post to this deal, so keep an eye on it next week.

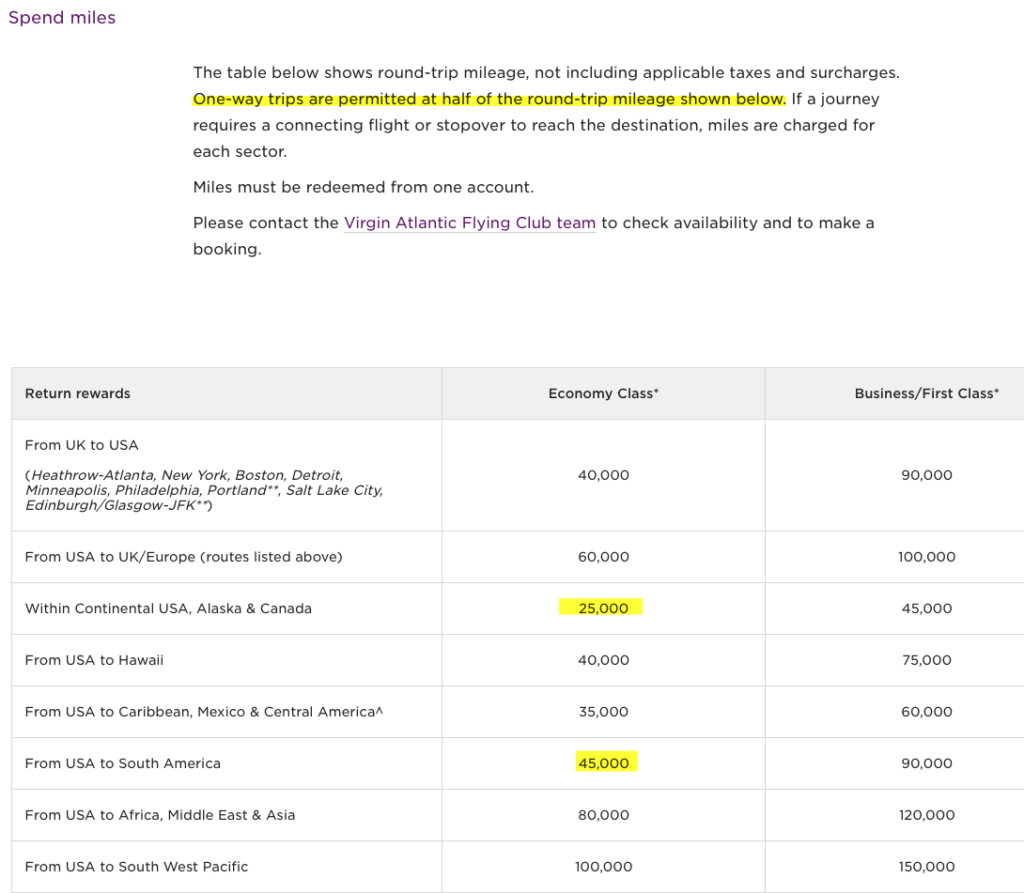

3) Through 5/22/17, get 30% transfer bonus on Amex Membership Rewards/Virgin Atlantic. So, you’ll get 1,300 miles per 1,000 MR points. Who may want to consider it: those who need to fly to (not from) London and who live near airports served by Virgin Atlantic (see this page for mileage requirements).

Another reason you may want to consider this deal is if you need to redeem miles on non-stop Delta flights. Here is the page for Delta redemptions via Virgin Atlantic program. And here is the chart:

They used to have a roundtrip requirement for Delta, but I can see that it’s waived now. I’ve actually redeemed Virgin Atlantic miles on Delta flights for my brother-in-law and you can read about my experience here It’s a quirky program that can be quite useful under the right circumstances.

Keep in mind that Virgin Atlantic miles transfer to Hilton program (2:3 ratio) and IHG (1:1). Neither option is worth it IMO, though reportedly, you can get Spire elite status with IHG via this transfer, which will give you an additional 25K points’ bonus. I still don’t think it’s worth it to dump your valuable MR points speculatively for this opportunity, but the option is there if you need it. (hat tip DoC)

4) How to fly to Hawaii with miles (cheapest ways) by Milecards.com A great resource if you are looking to fly to this beautiful state in a near future. Redeeming miles to Hawaii can be quite challenging for families who are only able to travel during peak season, but it’s not impossible. I’ve devoted quite a few posts to this topic, but folks never get tired of talking about Hawaii. So, there it is.

Have a good weekend!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leana,

Do you know if you can use the choice hotel points for different hotels in that brand than are listed? I have a quality inn in montreal I’ve been eyeing and this would be perfect but not sure if it would work – it says you get points into your account, can you use them anywhere?

@HML Yes, you absolutely can! As long as Choice points are redeemable at that property an there is availability, you are fine. I plan to publish a post on it Thursday but for now, see this overview from last year. For the most part, the info is still relevant https://milesforfamily.com/2016/04/01/an-overview-of-next-week-of-daily-getaways-promo-should-you-bite/

Thanks!