This is a brief news recap from last week. For faster updates, follow Miles For Family on Twitter or check the feed on the right side of the blog.

1) Hotel points to Etihad Guest 20% transfer bonus by Milevalue. Read the article to see why this may be a good deal for some. Those who are looking to fly to deep South America and Europe (during off-season) should definitely pay attention to this transfer bonus.

If you live in New York area and are looking to fly to Brussels in business class, you might be able to do it for only 36K Etihad miles roundtrip, plus $100 in taxes. Read this post for details. Warning! Etihad Guest agents are notoriously difficult to deal with. Do your homework ahead of time before calling.

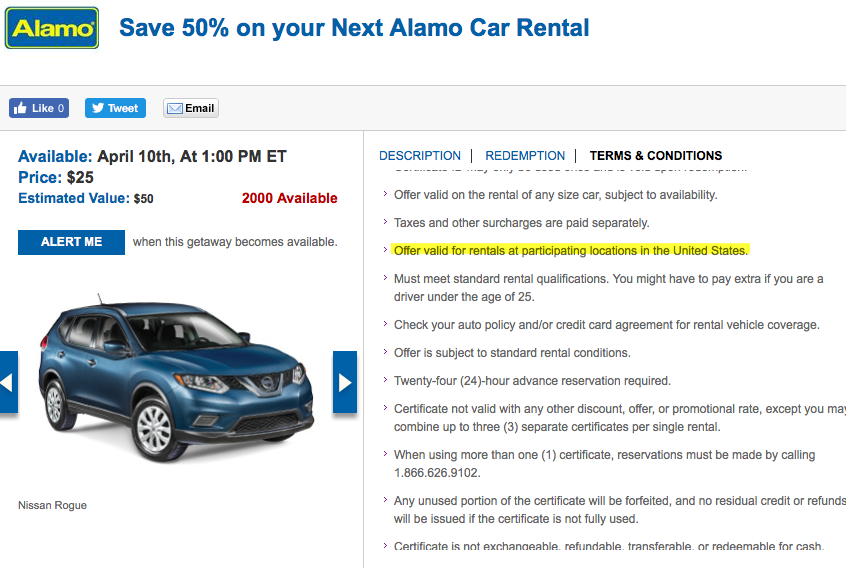

2) Daily Getaways has released a preview of deals for next week. The only two worthwhile ones IMO are Alamo (April 10th) and Busch Gardens (April 13th). Alamo offer is definitely a good deal, but only IF you actually plan to rent from Alamo and IF you are OK with non-refundable nature of this purchase. Another thing that concerns me is the highlighted statement:

In order to avoid a nasty surprise, call ahead and find out if the rental franchise you are considering renting from will honor this discount. You can combine up to three vouchers towards one reservation, but they are only valid on base rate, not taxes or fees.

Also, be aware that certificate is not combinable with any other discount, offer or promotional rate. I’ve read comments from folks who bought this certificate last year, and they all had good experience. So, it’s definitely legit. You will do best on short rentals, obviously. Bottom line: A no-brainer deal for some, but beware the fine print.

If you are looking to visit Busch Gardens, $45 price per ticket is probably as good as it it gets, unless you get an annual pass.

3) Hotel promotions update for April 2017 by LoyaltyLobby. All programs, all on one page. Some promos are mediocre, a few are pretty decent. I don’t think any of them are worthy of a mattress run, but if you have plans to stay in a particular chain, might as well get extra points.

4) Capital One 360 is offering a $200 Money Market Bonus if you deposit $10,000. Read all the details on DoC. I took advantage of this deal few years ago and actually kept the account open. I like how easy and user-friendly the website is. So, if you have $10,000 laying around and earning almost nothing, give this deal a shot. However, first, make sure to read the second part of this post to see some other good options for stashing your emergency fund.

At some point I plan to dedicate a separate post to my experience with chasing after bank bonuses over the last few years.

5) My IHG points were stolen and IHG won’t help by TravelCodex. This doesn’t surprise me at all, as IHG is an extremely inept program, at least judging by my experience with them. Definitely keep an eye on your loyalty accounts and consider signing up for free version of Awardwallet

6) You can now earn 2.5% cash back on everything via Alliant Visa Signature (3% during first year). Read the post on MtM for full details The question is: should you drop everything and get this card? It depends. I’m not going to because most of my spending goes towards sign-up bonuses.

The biggest deal breaker, of course, is $59 annual fee, though it’s waived during the first year. Overall, it’s definitely a good product for those who like to keep things simple and who have a considerable amount in non-bonus spending. Keep in mind, you have to spend close to $12K before you break even compared to cards like Citi Double Cash and Fidelity Rewards Visa Signature. Both of them have no annual fee. For that reason, I don’t plan to add Alliant Visa Signature to my list of best long-term cards for middle-class family.

I just don’t think the juice is worth the squeeze on that one. Yes, you’ll get that extra 0.5% in cash back. But you have to jump through multiple hoops to get approved for the card and spend $12K just to break even. Most normal folks will use cards like Chase Freedom for 5% categories and sign up for new bonus offers here and there, so it will likely be a wash.

Additionally, I fully expect Alliant credit union to reduce cash back rate at some point. So, I’m saving my credit pull for something else and I think you should too. As always, do the math and decide if the card will work for your specific situation.

If you’ve found this content beneficial, please look at Support the Site page for ways you can help keep the blog running. Also, subscribe to receive free updates through email and recommend the site to your family and friends. You can follow us on Twitter, like us on Facebook and download free e-book

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Ah, IHG. I had a strangely fortuitous experience with IHGs ineptitude recently. Allow me to recount the tale.

In March, I decided to take advantage of IHGs Elevate promotion. I had booked 4 nights across 2 IHG properties for a recent business trip to Orange County. I would be flying out of Chicago, and got a hotel the night before my flight as we are a ways away from ORD. This set up would allow me to net something like 10k points.

The day of my arrival, I got a an email informing me my Chicago airport property was no longer in the IHG portfolio.

I was frustrated by this, as I definitely would have opted for my usual Marriott or even Hyatt properties for this trip, but went with IHG for the promo. I emailed IHG my disappointment and a request to still receive the points from the promo.

No dice they said, as I had not actually signed up for the promo. Whoops. That’s on me. I signed up after the fact just in case, on the way to the airport the morning after my first stay, but gave up altogether contacting IHG and arguing my case. After all, first world problems, right? People are getting sarin gassed by their own government and I’m over here trying to get 10k IHG points. Time for some perspective.

Well, a few days after my stays, I got all the bonus points associated with the promo. No explanation, just got the points, despite being told to take a hike.

The End.

Also, it was my worst hotel stay since an ill fated stay in a very dangerous Milwaukee area hotel with my family as a child.

@Cheapblackdad Congrats on getting the points in the end. IHG is crazy like that, but sometimes it works to consumer’s advantage. This is partially why I stopped doing their promos. I just got sick of making phone calls and fighting for my points. But if a super lucrative promo comes around, I’m sure I’ll bite… again.

I’m sorry the hotel was a dud. IHG is also very inconsistent when it comes to quality. This ain’t no Hyatt!