When you have a family, chances are, at some point poop will hit the fan, figuratively speaking (and sometimes literally). This is exactly what happened to us recently. But let me back up.

While I’ve always made sure to have health insurance policy in place, I’ve skipped dental benefits. My husband’s family policy at work is quite expensive ($150 per month, I think?), so it just didn’t seem worth it. After all, insurance is for events that can potentially bankrupt you.

So, last November I declined dental insurance thinking we couldn’t possibly come out ahead by having it. Wrong! Just a month later we found out that my daughter needs braces. What the heck? Since when did kids start getting them at eight years of age?

Anyway, as it was explained to me by orthodontist, the braces will help my daughter have beautiful straight teeth and give her the confidence to take over the world. How can you put a price on that? Well, he did, namely $4,500 and that’s just the first phase.

We will need to pay that much again when she turns twelve. Well, doctor knows best. It’s not like he is biased or anything. 🙂 He did let us set up monthly payments for few years, but it’s just another bill designed to slash my travel budget. Hands off my trips!

But wait, there is more! Just few days ago I found out that I need a root canal. The price? Around $1,800 including the crown. I wanted to grill my dentist on whether it truly is necessary, but the dark spot on X-ray spoke volumes. Plus, I recently had pain in my jaw. Eh, I’m part Russian, I can live with it. My ancestors gave birth in the field (with no help), then got back on a horse to go take care of the household the same day. Root canal? We don’t need no stinking root canal.

OK, so yes, I’m having a root canal in few days. My dentist was adamant that I need to take care of it before my upcoming trip to Jamaica. You know what the crazy thing is? Part of me is a little bit happy. Why? Now I will have no trouble meeting minimum spending requirements on my husband’s Merrill+Visa Signature. Only in this hobby can one be happy about an unexpected bill.

You need an emergency fund

The following information is not meant for those of you who have all your ducks in a row, so to speak. But I do feel it’s important to address this issue. Hopefully, my write-up will not come across as patronizing, that’s not my intention. But very often we get caught up in travel and how fun it is. And yes, it is fun! But you know what is even more fun? Being able to pay for root canal without going into debt.

These recent developments would be crippling to our finances and budget if we didn’t have an emergency savings account. Sure, I hate parting with cash just as much as anyone else, but at least we don’t have to change our lifestyle drastically due to this medical emergency. We don’t have a huge amount in savings, but it’s enough to provide a cushion when inevitable budget buster arrives. We don’t plan to cancel any of our upcoming trips, but will cut back on local weekend activities. Legoland pass ain’t happening this year.

That’s why I recommend you focus on establishing an emergency fund before you even think about taking a fancy vacation. No, I don’t believe that all travel should be cut off. To me, it would be super depressing. But I urge you to stick to cheap road trips where you can use up your existing stash of hotel points. You can even consider draining you AAdvantage mileage account and burning miles on hotels at a penny each if you happen to have a co-branded credit card.

Do you absolutely have to fly in order to visit close relatives? Try to burn individual miles first and save your flexible points, especially Ultimate Rewards currency that can be easily converted to cash. If you have a large stash of Rapid Rewards points and happen to have Chase Southwest Airlines Premier Rewards card, consider renewing it for another year. This will give you access to gift card redemption option for places like Walmart and Amazon. You can currently redeem 10,000 points on $100 gift card, which isn’t too bad.

Cash, cash, cash!

You should also try to focus on cashback or flexible points bonuses till you have at least some money put away. Merrill +Visa Signature I’ve mentioned earlier is a good candidate. Another great option: Chase Sapphire Reserve. I strongly recommend you apply for it in branch before March 12th if you can cover $450 initial fee. Update: the 100k points bonus has expired.

Normally, I would encourage folks to use points on travel redemptions. Same goes for $300 calendar year allowance. However, I recommend a different strategy for those of you without an emergency fund.

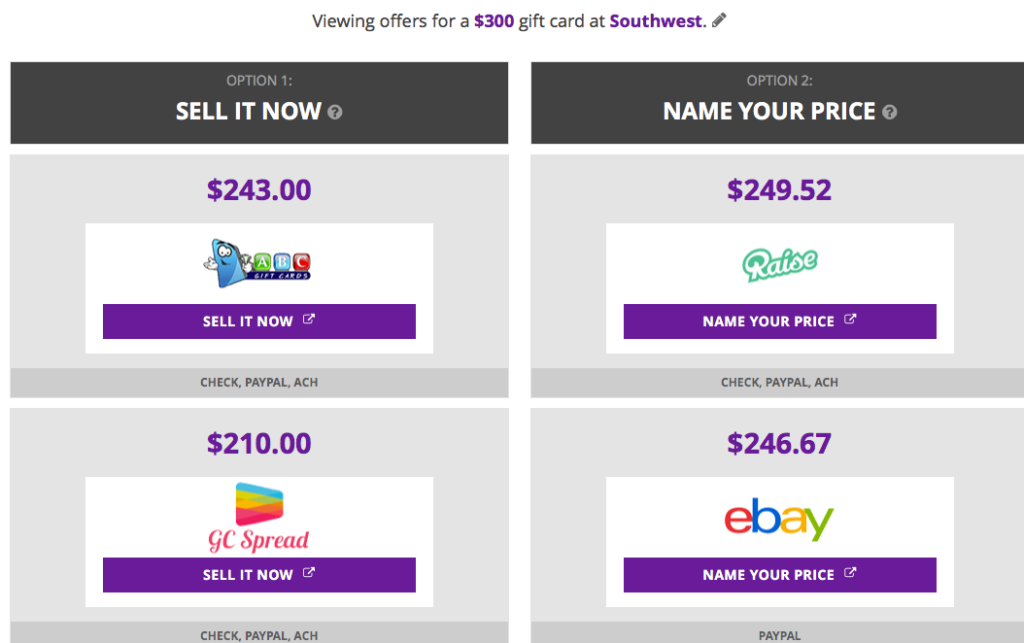

Here is my suggestion. As soon as you get CSR in the mail, buy electronic Southwest gift card through Southwest.com Those should code as travel purchase. Obviously, I’m assuming you don’t have any non-negotiable travel expenses coming up in a near future. OK, you got the gift card. Now sell it to a third-party reseller. You can check the rates on this page of Giftcardgranny

<

p style=”text-align: center;”>Your can check on other options as well. Marriott and Hyatt gift cards bought inside hotels should also code as travel purchase.

I recommend you stay away from Ebay. I’ve dealt with ABCgiftcards and had good success with that store. You can sell your Southwest gift card electronically and get the same payout rate. But, but, but, why would one want to take a loss? The idea is to recoup part of your $450 fee. If you don’t, your human nature will try to find a way to spend this allowance on travel instead. And like I said earlier, travel is not a priority right now. Rinse and repeat next January with your second $300 allowance.

I also recommend you hang on to your 100K points till you have some actual money put away. That’s because you can cash out 100K UR points on $1,000 in real cold hard cash. This is your emergency fund for the moment. Having those points and knowing what you can do with them will give you the motivation to get your finances in order. I recommend you pick a realistic goal, something like $1,500 in 10 months.

Got that amount saved up? High five! Time to burn some or all of your Ultimate Rewards points from CSR bonus. You don’t have to, of course, but you’ve worked hard and deserve a prize. There is nothing wrong with rewarding yourself for a job well done. If you prefer to leave the stash alone, there is nothing wrong with that either. You DON’T have to redeem your UR points on travel. Just make sure to convert CSR to Chase Freedom or Chase Freedom Unlimited before twelve-month mark. Or you can renew CSR depending on your needs.

Good places for stashing your emergency fund

Netspend account

If you only have $1,000, this is a good place to park your savings. Read my post on how you can earn 5% interest. Be aware, you can now only get it on $1,000, but still. You’ll get $20 bonus for opening the account and making a small deposit, which is a nice perk.

Here is my referral link, thanks in advance if you use it. After you get your account set up, refer your spouse and pick up another $20. Make sure to set up automatic monthly transfer of $1 from your main checking account in order to avoid inactivity fee.

Insight account

You’ll be able to get 5% interest on up to $5,000 per account and both spouses can get one. Doctorofcredit has a good overview. My husband and I each have Insight account, and we haven’t had any issues. Once again, set up an automatic monthly transfer of $1.

If you take advantage of both opportunities, you can have $12,000 ($6,000 if you are single), earning 5% interest. The best part? You can withdraw the money anytime, which is the number one requirement of any emergency fund. Of course, it may take a few days to get it transferred, but in the meantime you can just use a credit card to cover an unexpected bill.

Roth IRA

There are many reasons to get a Roth IRA: tax-free distributions during retirement, potential Saver’s Credit and more. I’ve mentioned it here because any contributions you make can be withdrawn penalty-free, anytime, for any reason. Only interest is penalized.

This makes Roth IRA account an extremely good candidate for an emergency fund. Just make sure you stick to CD’s and other risk-free savings vehicles. If you don’t end up needing the money for emergencies, great! But you definitely don’t want to cash out your IRA when the market is down. I recommend credit unions because they usually have better rates. See this article for basics on Roth IRA

Bottom line

While this blog primarily focuses on travel and ways to do it on the cheap, we live in a real world. It is much easier to enjoy your trip knowing that you will have the money to cover an unexpected emergency when you get back home. It’s about balance, and travel should not be at the top of your priority list. At least that’s what I keep telling myself. Well, I’m off to do my root canal. Yay!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Leana, you must’ve sent Murphy my way…water heater burst and we are looking at major $$$ for repairs…sigh.

@Natasha Oh no! Sorry to hear it. I’m waiting for something else to happen before our trip to Jamaica. Ugh.

Looks like I need to move our emergency fund to different accounts! We’re only getting .5% interest at Emigrant Direct.

@Nancy Definitely get Insight account in yours’ and your husband’s names. It’s hard to say how much longer 5% rate will be available, but might as well get in on it while you can.

Hey at least it’s going towards minimum spend 🙂

@Natasha Exactly! The only silver lining to the otherwise crappy situation.

Sorry to hear about the dental troubles! This may be the only chance I’ll ever have to promote my post about dental insurance on a points and miles blog, so here it is:

http://saverocity.com/pfdigest/dental-insurance-worth-money-depends/

@Nick No problem! Promote away. Yeah, I saw that post. Your plan is cheap. I would have no issues paying that kind of a premium. Honestly, our orthodontic benefit is pretty pitiful. Something like $1,000 per year. But this root canal has definitely shifted value proposition, and not in my favor. Oh well, you can’t win them all.