One of the most challenging things in the miles and points hobby is figuring out when to pay cash and when to use points. As I’ve mentioned many times, everyone will have a different answer to this question, and it will largely depend on your points’ balances as well as upcoming plans. For more on this topic, I recommend you read my post How to minimize choice overload when it comes to lodging options

But let me show you the dilemma I faced recently and how I went about finding an optimal solution. One of the reasons I love IHG is the fact that it has properties literally everywhere. More importantly, they are clean, safe and often provide a semi-decent breakfast.

No, they are not fancy or anything like that. But if you want to visit a relative in a small town, Holiday Inn Express is usually the only decent option that doesn’t involve sketchy, dilapidated building with outside corridors, and weird guys hanging out in a parking lot. You know, the kind that usually gets two out of five stars on Trip Advisor and has reviews that mention bed bugs.

Obviously, I’m not saying that all budget motels are bad. Not at all, and we’ve stayed in plenty of those. But with kids, I look for a comfortable, safe environment, preferably with interior corridors, unless it’s a beachfront hotel. Holiday Inn Express usually fits the bill.

Visiting relatives in the middle of nowhere

Once a year my family likes to visit relatives who live in North Florida. Holiday Inn Express is our go-to place. Unfortunately, since it’s the only decent option in town, the rates hover around $145 all-in, more during holidays. Yes, completely insane, but my mother-in-law refuses to stay anywhere else. Of course, we have IHG points, and using them here is a no-brainer. The rate is 20,000 points per night, and Chase IHG cardholders get a rebate of 10%, so it brings it down to 18,000 points. Award availability is usually not an issue, emphasis on “usually.”

Not long ago, my mother-in-law told me she was planning on visiting her relatives during the first weekend of December. She wanted to take my kids and my husband’s sister, so they would need two rooms for two nights. Due to various commitments, my husband and I would stay behind. Not a problem, let’s burn some IHG points. Unfortunately, the hotel was only available on points for one of the nights. Darn it! This is the biggest issue with IHG currency, and something I’ve mentioned in my post I’m downgrading IHG “stock”

I tried to convince my mother-in-law to stay in a nearby town, to no avail. She said she would just pay cash for that particular Holiday Inn Express. My MIL is a big gal, so there isn’t a whole lot I can do. I told her I would redeem points for one of the nights, and let them pay cash for the other.

As I’ve mentioned earlier, the refundable rate came down to $145 all-in, so I started looking at ways to ease the pain. I remembered that Rocketmiles (my referral link) offers miles and points for booking hotels. The incentive can be substantial, especially if you take advantage of a promo. Now through November 18th, they are running a deal where you get 3,000 miles or points on your first booking, plus regular earnings:

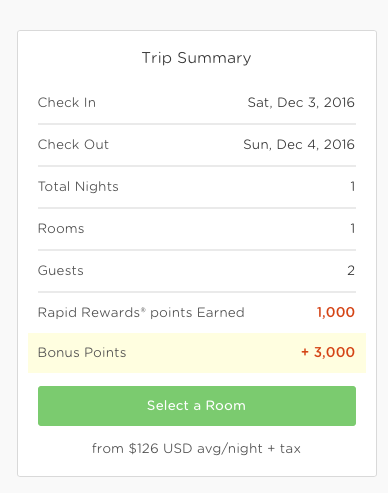

The rate is identical, and we would get 4,000 Rapid Rewards points per room. Not bad. Unfortunately, the rate is non-refundable, and they wouldn’t confirm our room preference, so this could be an issue at check-in. Let me see if this hotel is listed in Ultimate Rewards portal. Yes, indeed:

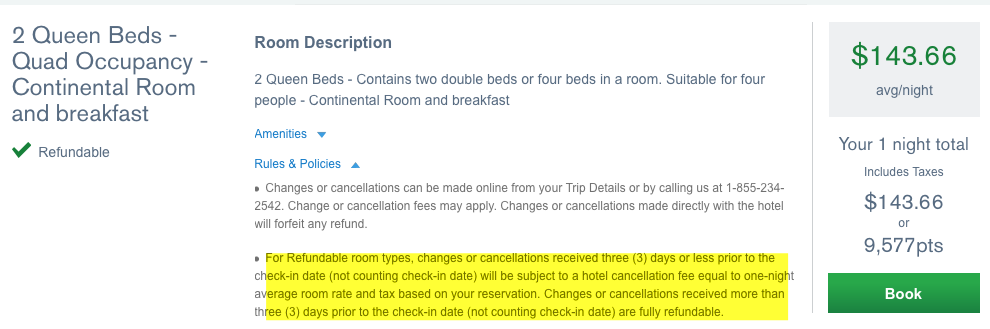

Due to having Chase Sapphire Reserve, I get 1.5 cents per point toward travel purchases. In this case, UR portal guarantees a room with two queen beds and you can cancel 3 days prior and receive a full refund. I like it better than Rocketmiles option because with my kids you just never know. They seem to time their sickness perfectly, as in, few days before we are about to leave on vacation.

What about Accelerate promo?

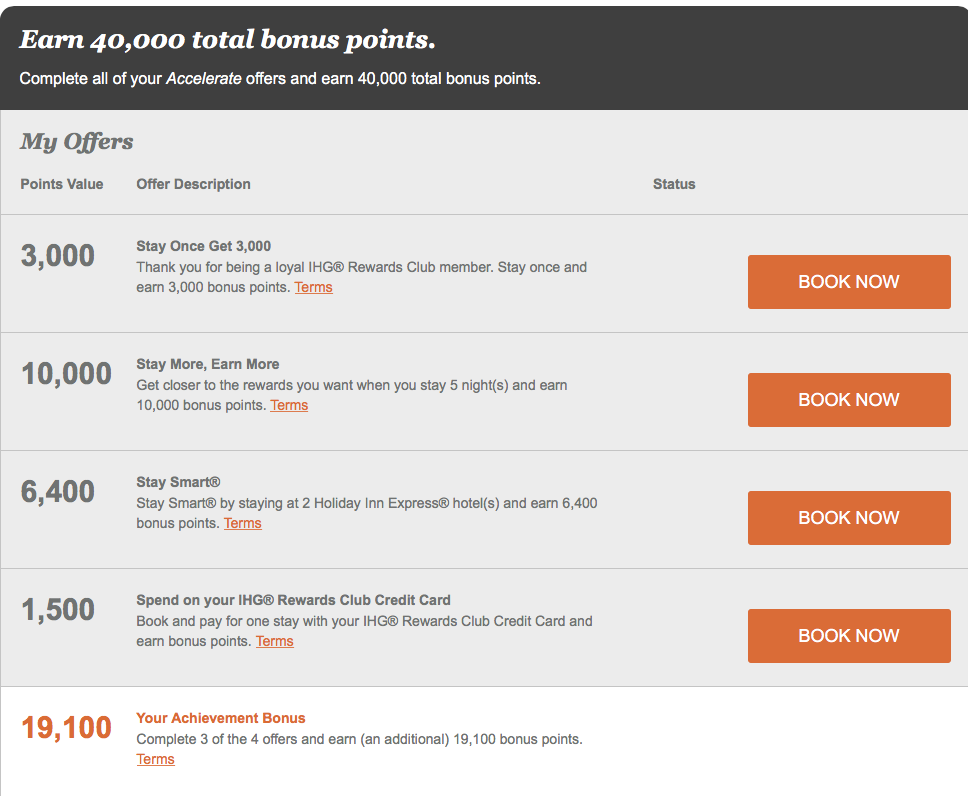

Through December 15th, IHG is running Accelerate promotion (register here) Originally, I didn’t plan to participate in it, though I did check the offers on all of our accounts. Since my in-laws are staying in a hotel at the beginning of December, we could possibly kill two birds with one stone. I checked and the only one that was mildly intriguing was the offer on my MIL’s account:

As you can see, we could get 30,000 IHG points after two separate stays at a Holiday Inn Express. My MIL is already paying for one, and I could do the second stay via mattress run by checking in over the phone. Or, my husband and I could do a short 1-night getaway at a nearby Holiday Inn Express, as long as the stay is before December 15th. I decided to do the latter.

We are planning on staying in Holiday Inn Express Port Charlotte It’s a no-frills hotel, located by the lake. Refundable rate is $95 all-in. While not cheap, once we factor in IHG points’ earnings on both nights, we will have close to 35,000 points. That amount is good for one night at a beachfront IHG property or seven at a PointBreaks hotel. I reserved the room under my MIL’s name and added myself as a second guest. It’s not a prepaid rate, so there shouldn’t be any issues.

Originally, we were planning on staying at Hyatt Regency Sarasota, partially due to Diamond status, but I think this is a better option. I’m actually running low on IHG points, and have specific plans for this Accelerate bonus. Another reason is the fact that we just stayed in Sarasota a month ago, and I want to do something different. Port Charlotte is located only half an hour from Boca Grande island, and my husband has been wanting to take me there. He has to drive there for work on occasion, and really enjoys the area.

To recap: I’ll be burning IHG points on two rooms/one night. For the second night, we’ll be using Ultimate Rewards for one of the rooms. The second room is booked via cash rate on IHG website. First, we made sure to go through Topcashback (my referral link) in order to get 3.5% cash back. According to Cashbackmonitor, this portal currently has the highest payout (make sure to type “intercontinental”)

Oh, and it goes without saying that I’ll be checking to see if by some miracle, IHG award rate will once again become available for the second night. If so, I’ll cancel my UR and cash reservations as long as there is no penalty.

Bottom line

This is definitely a prime example of OCD-type reasoning, and I’m not saying you should agonize over every single hotel stay in the same manner. But if you are going to pay cash, might as well get something out of it, right?

P.S. Check some additional tips in the comments section from reader Erik.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

It was incredibly comforting for me reading this post – in the sense that you are even more OCD than I am when booking 🙂

Just don’t forget to set up an alert on Hotel-Hustle so that when that room becomes available on points (and I am betting that it will), you can book it immediately.

@Uri I’m so OCD, it’s not even funny! Not that being OCD is funny, it’s a real medical condition. But yeah, my mind is like a crazy maze, always looking for ways to maximize various opportunities. It’s hard to shut it down, and blogging about it sure doesn’t help! Good point on Hotel Hustle.

DId you see the $50 gift card giveaway from IHG for staying 2 nights/

@Hilary Just saw it! It looks decent, but one stay has to be for two nights. So, it looks lie, we won’t qualify because we are using points for one of the nights.

Oops, meant to say “like.” It’s late!

I’ll throw two tips out there for good hotel cash rates without going down the Priceline/Hotwire route: 1) if you work for a large company, especially a multinational, check your corporate rate. Many companies have negotiated rates that are under $100 or significantly discounted off the publicly available rates. You simply have to show your corporate ID or business card at check-in (although in my experience, it is rare for hotels to ask for it). 2) check for other discounted rates that you may qualify for, like AARP, AAA, Costco, etc. AARP is a great one. Contrary to popular belief, there is no minimum age to join (they are a lobbyist group that need $$$) and the annual membership fee is only $16/year or less if you pay for multiple years in advance or take advantage of a promotion. I easily recovered my membership fee with a discounted stay at a Hilton brand property and the 15% off discount at Carabba’s, Bonefish, Outback, etc. AARP has many other discounts available across a wide variety of categories, including the famous British Airways discount widely trumpeted in the travel blogosphere.

@Erik Good points! Will update the post. I actually did check AAA rate, but it was exactly the same. But it definitely doesn’t hurt to see all available options. Which reminds me, I need to renew my AARP membership, I believe it just expired. We’ve used it at Carabba’s a few times, though we usually bring a coupon, and discounts are not stackable. But I agree, it’s a gift that keeps on giving, and well worth $16. But no, I have not used it on BA flights. I burn miles 99% of the time. Though you can snag a great deal on BA, especially when they have a sale on business class.