There is some uncertainty, so it’s up to you whether you want to take a risk with this application. I saw it first reported on Doctorofcredit, and wanted to wait till we had some data points before covering it. The biggest issue is that the offer may be targeted (we don’t know this with 100% certainty), so proceed at your own risk.

Let’s get to it:

And here is direct application link (pays me no commission)

Here are key points:

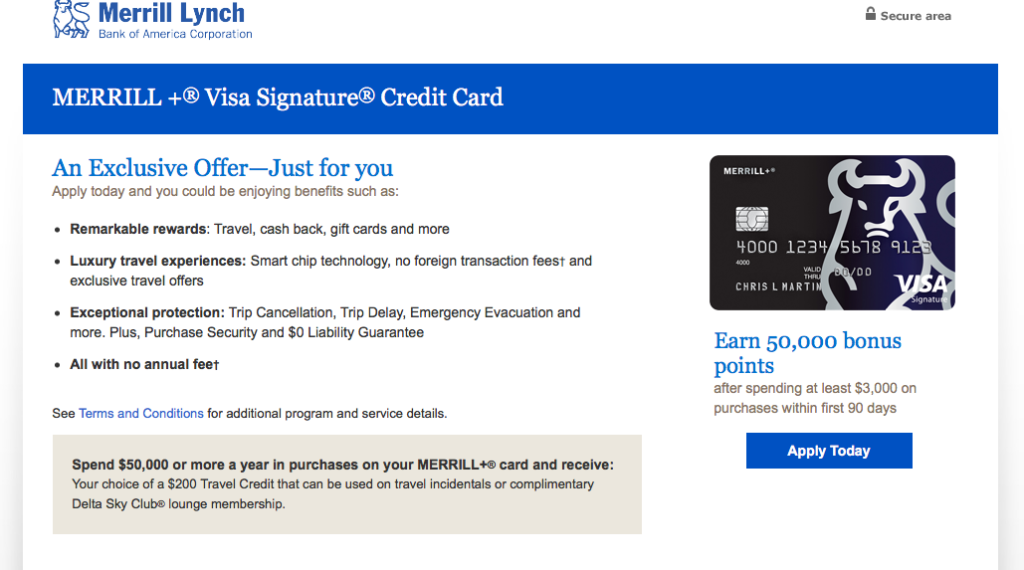

- There is no annual fee.

- Minimum spending requirements are quite manageable at $3,000 in 3 months.

- 50,000 points are worth $500 or potentially up to $1,000 towards airfare.

Conclusion: It’s a fantastic deal! A no-brainer if everything goes according to the plan.

My experience applying for this card

After looking at data points, I knew my application would likely go to pending status. And this is indeed what happened. Dannythedealguru has provided this phone number 1(866) 811-4108 ( Bank of America reconsideration line). I called and was connected to credit analyst. I was then put on hold, and the lady came back and told me I was approved. No questions asked. Easiest reconsideration call ever!

So, to recap, this is a fantastic deal if you are willing to take a chance on it. I recommend you take a screenshot of the offer just in case. Nobody asked me about my financial relationship with Merril Lynch, but this could turn into a problem later on. I just don’t know one way or another. Otherwise, it’s a great deal. Hopefully, I just found a way to pay for my dad’s ticket to US.

The application link may die soon, so I recommend you don’t delay pulling the trigger if you can handle the risk and minimum spending requirements. It doesn’t pay me anything, so there is zero incentive to recommend it.

Readers, who is applying for this card? Please, share your experience.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

A bit late on this question but: do you know if this can be used on multiple tickets? And can you cover the difference with cash? Ie purchasing 4 tickets at once that total $1200 would only cost you $200 in cash? Or can the points only be used on a single ticket at a time?

Hi CBD! Leana is traveling, so I’m going to try to answer this. As far as I can tell, your scenario wouldn’t work. I’m reading it as a minimum redemption of 25,000 points for one ticket valued up to $500. Check out page 9 and the fine print on page 35: https://card.ml.com/cms/published/root/rps/pdf/MerrillPlus2016Guide_470072PM_030116_compressed.pdf. You can pay cash on top of that, but I think you’re still out 25k points for each ticket. I still think this card is a great deal! I might apply for me and my husband after the new year.

@Nancy Oops, I didn’t see your comment! Thanks for answering.

@Cheapblackdad From what I’ve understood, 25,000 points will cover a ticket up to $500 in value. After that, it’s one cent per point. So tickets can cost more more, you just won’t get 2 cents per point. So, if you have to get a ticket that costs $250, you’ll pay 25,000 points, if it’s $600, you’ll pay 35,000 points. Makes sense? I believe it can be used for multiple tickets, but I’m not sure. Either way, it’s a great offer even if you just cash it out.

Oh, and it looks like this is the only working link https://applyonlinenow.com/USCCapp/Ctl/entry?sc=VACSTX#tc

I recommend you apply soon because it may not be around much longer. Limited time offer!!! Get it now!!! But it doesn’t pay me, so nobody can accuse me of being sleazy. 🙂

It’s very tempting

@HML That’s why I applied!

So on a scale of “Home Run!” to “They will claw the points back Amex Plat Style” where does this fall?

@Cheapblackdad That’s a million dollar question, and I don’t have the answer. Which is why I included a warning to my readers. I’m betting on “home run”, baby!