By Nancy

I used to ignore snail mail credit card advertisements and put them in the shred pile. Now that I’m a miles and points hobbyist, I look at each offer carefully. I recently got this offer for my Barclaycard AAdvantage Aviator:

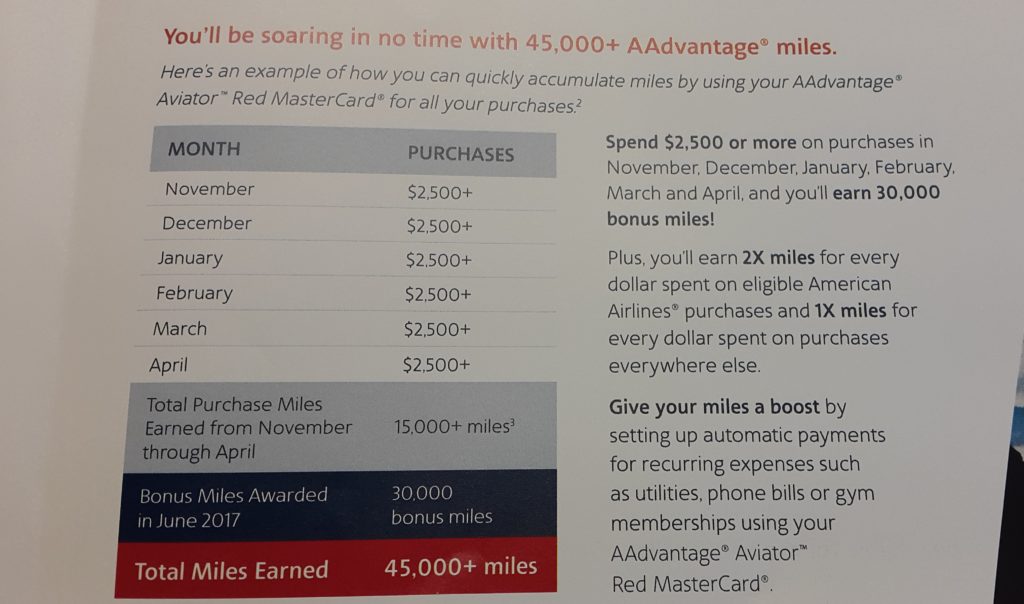

Woohoo! That’s 45,000 AAdvantage miles for renewing a credit card with an $89 annual fee. No new credit card sign-ups, no credit inquiries. What’s not to love? It’s a no-brainer, right?

My History with Barclaycard AAdvantage Aviator

I got this AAdvantage Aviator in January 2015 when it was US Airways card. At the time, Leana said the card was a no-brainer and the easiest way to get 50k miles. Getting the bonus only required one purchase and paying the annual fee of $89.

I made my purchase, and my miles were deposited quickly. Those miles later converted to American Airlines AAdvantage miles when the merger of the two airlines was complete. Easy, peasy!

Last winter, I got an email from Barclaycard with a retention offer. Spend $500 a month on the card for three months and get 15,000 bonus miles. I took the offer and paid the $89 annual fee.

I haven’t charged a lot on the card this past year, but I have three AA flights this year. The free checked bag benefit from the card is saving my family around $100 in baggage fees.

Recently, Leana was able to get a favorable retention offer this year of a waived annual fee and 5,000 bonus miles. Score!

Note: This card is currently not available to new applicants, but Barclaycard will be offering an AAdvantage card in 2017.

Details of the Retention Offer

Of course, the 45,000 miles on the flyer immediately caught my eye. But to get those points, I need to spend $2500 every month for six months, November through April. That’s $15,000 total. I could do that if we moved all of our monthly spending to the card, but that’s the top end of our monthly spending.

The bonus is actually 30,000 miles awarded in June 2017, so the total reaches 45k when combined with the 15k miles earned from monthly spending. If any one month falls below the $2500 minimum spending, or if I’m late on any payments, the bonus is forfeited.

The deadline to register for the special promotion is November 30.

What am I Giving Up?

My very wise Miles & Points Mentor (Leana) taught me to always look at the opportunity cost of everything. Could I be doing something better with my $2500 spending for the next six months?

Here are some things I could put that spending towards instead of this promotion:

- New Credit Card Offers. If we are putting our family’s monthly spending on the Aviator, we won’t be able to take advantage of new credit card offers until May 2017. We could miss out on another Chase Sapphire Reserve bonus. My husband has this card, but I’m hoping to get pre-approved in a branch. We could forego a high bonus on the Amex Platinum (rumors are circulating about new features in 2017), or another card with a great bonus offer. We had also planned on applying for the Chase Hyatt Visa in March so that we could have some free nights at a Hyatt in Hawaii for early 2018.

- Second tier bonus on British Airways Visa. Back in May, I was approved for the Chase British Airways Visa. The bonus was tiered: 50k bonus miles after $2k in spending, and an additional 25k miles after spending $15k in the first year. I’m about $6k short in spending to earn the additional 25k bonus. Putting the spending on this card would get me 31k additional British Airways Avios with the bonus and additional spending miles combined. BA Avios are valuable to me because I can use them on direct flights on AA from Dallas to Florida and Mexico for only 7500 Avios each.

- Additional points on US Bank Flexperks Visa. Leana wrote about this card and the Olympics promotion a few months ago. My husband and I both got the card and recently finished the minimum spending to trigger the bonus. However, our combined total points is about 74k. If we spend $6k more, we would have 80k points, which is enough for four airline tickets priced at $400 or less.

So what’s the plan?

For now, I will sign up for the special promotion, but I don’t plan on moving all of my spending to this card. There’s no harm in signing up for it, even if I don’t plan to follow through with all the spending.

Before my annual fee is due again in January, I’ll call Barclaycard to see if I can get a different retention offer. We have a flight on American next summer where I’ll need to check three bags, so it’s probably worth it for me to renew the card anyway. I’ll prioritize my spending on the US Bank Flexperks and British Airways cards until a stellar new card catches my eye.

Some of you may be wondering why I don’t do some manufactured spending so that I can get the Aviator retention bonus as well as hit the spending on the other cards. The honest answer is that I’m just not comfortable with manufactured spending. I know that many in the miles and points community have great success with it, but it’s just not my thing.

Did you get a tempting retention offer for the AAdvantage Aviator? What is your opportunity cost?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I have this card and just paid the $89 annual fee (3rd year) and I didn’t receive this offer! Or maybe I just missed it and threw it in the recycle… 🙁 And I easily hit the $2500 each month (all of our bills, less morgage are on this card)

Bummer! It might not be too late to call and ask if there are any retention offers or other promotions attached to your card. It’s worth a try!

I think this offer was widely targeted – I know several people who received it. My reaction was basically “meh” for the same reasons that you mentioned. Barclays need to come up with more compelling promos for the average person. The “get 15000 miles for spending $500/mo. for 3 consecutive months” offers were so much better.

On the AAviator, it’s worth noting that you should check to see if you get 10K bonus points deposited into your account on every anniversary date. That benefit is definitely worth keeping for $89 – AA miles for less than a penny is a good deal!. Many of the people who got the card during the transitional period for US Airways do not have this feature. You can check by logging into your account, clicking on “Rewards and Benefits” then “Rewards and Benefits Center” then “How My Rewards Work”. You should see “Earn 10,000 AAdvantage® annual anniversary miles after payment of the annual fee” if your card has this feature.

In my experience, the AA miles actually post to the account when they bill the annual fee, not after you pay it. Barclays are assuming that you will pay it (and I imagine they would claw those miles back if you cancelled).

Erik–I agree, last year’s offer was so much better! Unfortunately, my card doesn’t have the 10k anniversary benefit. I’m hoping when I call (close to my anniversary date) that I’ll get another retention offer, since I plan on keeping the card anyway.