I don’t want to turn this fiasco into weekly series, but I know many of you are wondering about my progress. So, here it is. The last time I gave an update, I said that Amex responded to our first CFPB complaint. Both my husband and I got a letter saying that they will not give us back 100K points. When it came down to Amex chat, it said that the rep meant that my husband would not lose the points he earned on everyday spending. This is absurd on so many levels.

I went ahead and filed a second CFPB complaint in both of our names. In it I once again asked for points to be reinstated and offered Amex to upgrade back to Platinum if necessary. I also made an argument that any well-trained rep would mention to the customer that he/she would lose 100K points due to conversion. My words: “Surely, you aren’t telling me it’s a conspiracy and Amex wanted to find an excuse to keep the bonus?”

Our requests fell on deaf ears. We got template responses where they said they wouldn’t give us back the sign-up bonus. However, they were “pleased” to inform us that the points earned from everyday spending (3,800 apiece) were ours to keep. How generous. I’m going to be honest, I was starting to feel bad for poor American Express, but not anymore.

So, here is what I’ve decided to do:

- I’ve sent a claim notice to Amex in two separate envelopes. You can find the form here It doesn’t cost anything other than certified postage fees. Currently I’m awaiting an official response from Amex.

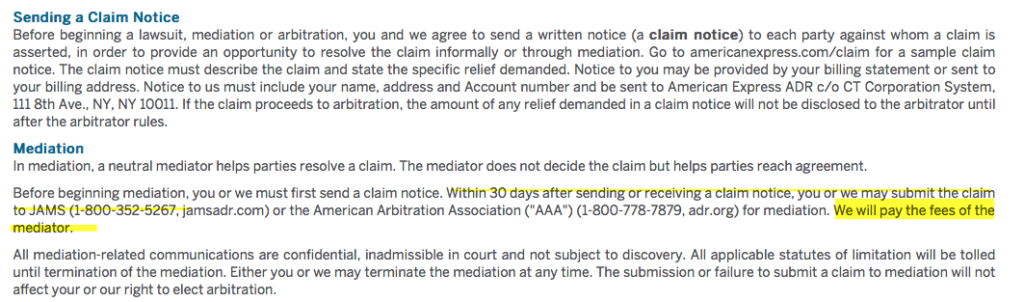

- If I don’t hear back soon, I will go ahead and start mediation process. Here are the details from Amex website:

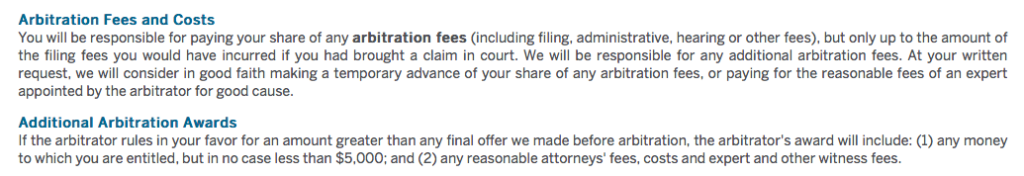

So, basically, in order to start mediation process, I had to first send in a claim. The part that caught my eye is a statement that Amex will pay for mediator. If I’m understanding correctly, that’s not the case with arbitration. See more on it here

And here is the exact wording:

I’m not a lawyer, so all of this legal “speak” is giving me a headache. But it does appear that mediation is the better choice. Additionally, I saw one report on Flyertalk where a person was successful when they chose mediation option, as it’s supposed to be more consumer-friendly. I honestly have no clue if that’s the case or not.

It appears there is a conflict of interest if Amex is the one that chooses a mediator. After all, if they send regular business their way, the firm has an incentive to side with American Express, right? That’s why I’m seriously thinking about starting mediation process myself within the next few days.

If mediation leads nowhere, I’ll look into filing a small claim. In fact, I would do it already, but the cost is substantial. It’s $175, but we may be able to file just one claim for both me and my husband. I’m not positive on that one, but will look into it once (or if) my other efforts fall through. To be honest, I’m willing to invest $350 to see this process completed once and for all.

I plan to claim value of 1.25 cents per MR point, plus lost wages for the time I could have been working on my blog instead. We live in the middle of nowhere, so chances of Amex arbitrator not showing up are pretty good, which means victory by default. I don’t know if we’ll win, but I’m willing to give it a shot. At this point, it’s a matter of principle.

Why I’m not letting it go

Well, I’m not going to lie, the main reason is I would like to get compensated for the loss of our points. Amex is on a witch hunt and it’s time someone stands up to them. Obviously, it’s nothing personal. I get why they took the points, but the bottom line is, I’ve fulfilled the terms and they chose to use a lame excuse to claw them back.

I looked through all the paperwork, and nowhere did it indicate that conversion will result in the loss of points. There is a part that says: “It may take us 6-8 weeks to deposit the bonus.” However, it doesn’t say that once they deposit the points, they might still be in pending status. In fact, it clearly said “earned” in my profile. So, what it amounts to, Amex was looking for any excuse to claw back the bonus, and I’ve conveniently provided it to them. Was I stupid? You bet. But once again, I didn’t break any rules.

I’ve noticed there has been a lot of backlash in the community with folks saying that people like me deserve what happened to us. Fair enough. I’m not trying to come across as some sort of a poor victim. We won’t be starving even if I end up losing in court. I only want to exercise my rights, that’s all. Isn’t it what Amex is doing with clawbacks for manufactured spending? Why is it OK for big corporation to enforce terms, yet it’s sleazy for the little guy to do the same thing?

This hobby revolves around taking advantage of various deals and loopholes. Some, including members of my own family, feel it’s unethical to sign up for bonuses only to dump the card shortly after. I respect this point of view and don’t try to argue and convince them otherwise. My position has always been that it’s OK to take advantage of deals (aggressively marketed by the banks, mind you) as long as you go about it in an honest manner.

I’ve passed on a number of offers because I felt uncomfortable pursuing them. That said, my definition of what’s ethical probably differs from yours’, which is why I do my best not to shove it in people’s faces. But when I feel strongly about something, I speak up. There are shades of grey, and then there is black and white.

Of course, my biggest reason for recording this ordeal is making sure you, the readers, learn from my mistakes. It wouldn’t come to this (I think) if I only kept the card open for another 7 months or so. Plus, Amex may blacklist us for life. Well, somehow I think we’ll survive without Hilton points and Delta miles.

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Hi, can you briefly follow up on what happened? I was in a similar situation but gave up, so would like to know if you were able to get your points back.

@Tom Hi! I had a follow-up post on it, but had to take it down. Unfortunately, I can’t give you any details on the outcome. However, I strongly recommend you contact Alex at darr@darrlawoffices.com The consultation is free, and he will be able to give you advice on your particular situation. I don’t get any referral commission for mentioning him, so there is no conflict of interest. Good luck!

Hello Leana: How did this ever turn out? I had my miles clawed back and your case seems even stronger than mine, so interested in how it got resolved (if at all). Thanks–and fingers crossed you got more than 3,800 . . .

@FlyerDad Thanks for stopping by! I’m still working on it and will update once there is a resolution in place. It is a super slow process, for sure.

hey Leana, any updates?

@Tazz Hi! I’ve been working on starting a mediation process. American Express is refusing to cooperate, and won’t give us any details on who to contact. We mailed a letter and currently awaiting a response. As soon as I know more, I plan to write a post on it. Hopefully, I’ll have some sort of a resolution one way or another. Stay tuned.

To those who seem so quick to judge I would like to say: “People who live in glass houses shouldn’t throw stones”.

I’m already visualizing the duct tape over your mouth. LMFAO!

It’s unfair! They took my points from me! WHOAHHH! WHOAHHHH!

You tried to beat the system but the system beat you. Did I see someone in here said you’re a good actor? I gotta agree with that person. You sure are a good actor. Grow up and play a game fair and square like all of us. Don’t be a fraudster!

Totally support your fight! Fingers crossed things will eventually work out for you!

@Bobby I appreciate it! To be honest, I just want this ordeal to be over. It’s sucking a lot of my time. But I want it resolved, even if I end up losing in the end. #closure

I don’t think that you are allowed to mediate or arbitrate at all. I’m thinking that those options are for when you have an issue with a merchant, not with AMX. In the Additional Terms, it states,

“All questions or disputes about program eligibility, earning points or using points will be resolved solely by American Express.”

So I don’t believe that this strategy is going to get your 100K points back. Try asking them if you can switch back to the original card, and that if they allow it then you are more than willing to pay the $450 fee. That is about the only solution I can think of, if they will go for it – I don’t know.

No, the arbitration section (which includes both the mediation and arbitration provisions) is quite clear that it applies to disputes with Amex.

As you mentioned, the “Additional Terms” section does say “All questions or disputes about program eligibility, earning points or using points will be resolved solely by American Express.” However, the “Arbitration” section then says “For this section, you and us includes any corporate parents, subsidiaries, affiliates or related persons or entities. Claim means any current or future claim, dispute or controversy relating to your participation in the program, these Terms & Conditions or any prior program agreement, except for the validity, enforceability or scope of the Arbitration provision. Claim includes but is not limited to: (1) initial claims, counterclaims, crossclaims and third-party claims; (2) claims based upon contract, tort, fraud, statute, regulation, common law and equity; (3) claims by or against any third party using or providing any product, service or benefit in connection with the program; and (4) claims that arise from or relate to (a) the program account or any point balances on the program account, (b) advertisements, promotions or oral or written statements related to the program or any reward or (c) the redemption for and use of any reward.” followed by “You or we may elect to resolve any claim by individual arbitration. Claims are decided by a neutral arbitrator.”

This is a contract of adhesion, and Amex drafted it. These are contradictory terms. As a general rule, in this situation, courts will apply the “contra proferentem” rule, which means that such an ambiguity will be construed against the drafter. If Amex refused to arbitrate, it may be necessary to file suit to compel arbitration (or, for that matter, file suit on the underlying claims and let Amex motion to compel arbitration based on the arbitration clause they said didn’t apply to the claims). However, I find it really unlikely Amex would try this stunt — it’s a losing scenario all around for them.

@Nick I’m fairly certain it doesn’t apply to clawbacks, just MR program in general. But we’ll see. If necessary, I will file a small claim. In fact, it’s looking likely since

Amex isn’t cooperating with my mediation demands. Oh, and I’ve tried to pay the fee back in order to reinstate the points. I’ve requested it multiple times, over the phone and in writing. Ironically, it would be better if I kept Platinum, took advantage of $400 airline credits, got TSA pre check etc,. and then converted the card next year. It would end up costing Amex more money, but I would be considered a good customer. It’s a weird game we play!

A con artist created a plan with an intention to commit a crime. He took advantage of his victims, stole his victims’s money, betrayed his victims. Then he kited the money to different banks and masked it as legit transactions. He got caught and was charged with wire frauds, Ponzi scheme, etc.

This whiny crooked actor/actress came up with a plan with a clear intention: stealing points from Amex (and probably other institutions too). Then transferred points to other programs. But this crooked actor/actress got caught and now acting like a 5 year old child. Crying fouls, screaming unfair/deceptive bitching and whining blah blah and playing victims.

Like I had said earlier: Quit playing a victim and please consider a career in acting. Grow up and take responsibility for your dishonesty, your behaviors and your actions. You clearly intended to cheat and defraud Amex (and other institutions) before, during and after you applied for the bankcard.

The real victim here are Amex and other legit point/rewards earners.

Just a side info… I do NOT work for Amex or any financial institution. I got to this page from DoctorOfCredit and I got fed up with this crooked actor/actress blogger of this site.

@Derrek J I didn’t actually read your last comment, but I’m about to close up shop (aka blog) for the night. So just wanted to say: Bye Felicia!

Derek J is posting under several different names. Whos b the scammer now?

Are you an actor/actress? You should consider acting career. You played & pretended to be a victim very well.

Derreck J: ENOUGH. There is a real person behind this blog & your comments are hurtful. I, for one, appreciate this honest & thoughtful blog.

That real person behind this blog is a CON ARTIST, a WHINER, a CROOK, FRAUDSTER.

By the way… I do NOT work for Amex or any bank.

BALONEY! YOU ARE A FRAUD! YOU ARE A SCAMMER! You got greedy and you got caught. Grow up & Take responsibility for your cheating actions. You clearly intended to cheat and defraud Amex before and after you applied for the bankcard. The real victim here is Amex.

@Derrek J Thanks for stopping by! I appreciate your input.

didn’t realize amex workers were allowed to post on blogs of this nature. You must be butt hurt about this.

Amex will pay for all but $250 of a JAMS arbitration, pursuant to the JAMS Consumer Minimum Standards (read them, they’re short and simple and apply to you). A completed JAMS arbitration can easily cost $20k+ in arbitrator fees alone. I’d expect them to give you your points back rather than pay this with a very shaky case.

By my reading of the T&Cs, you are in the right if you didn’t MS. There is no requirement to pay an AF or keep the card for any period of time. The bonus is still yours.

@Anonymous Thank you so much for your comment. It’s funny, I was actually just discussing this point with JAMS person because I saw the $250 fee listed in the terms. He said that $250 applies to arbitration, but Amex will pay mediator’s fee in full. We’ll see. I’m just starting this whole process, so will update once I know more.

Oh, and I forgot to add: No, I definitely didn’t do MS with Platinum card. If I did, I would let it go because it’s against the terms of the offer. Actually, I don’t MS, period, which is a good thing, considering the stakes in this case.

Awesome. Good luck! I don’t see that you have done anything wrong per the T&Cs Amex drafted, so I don’t know why you’re getting the response you seem to be getting (unless there’s a ton of sock puppets around). Amex isn’t some mom & pop operation that got blindsided by a poorly-conceived promotion, they’re a large and supposedly sophisticated multinational financial institution. They would expect you to honor your side of the contract, so they need to honor theirs as well.

If I were in your position and had to arbitrate with Amex on this, I would review the applicable law (in particular, my state’s UDAP law) and see if I had a reasonable legal basis to demand punitive damages. Based on the many accounts I’ve read of similar issues, I don’t believe Amex is acting in good faith. They are looking for any reason to claw-back these bonuses, to the point of outright making up reasons. The clawbacks for MS may be valid, but the “you didn’t keep the card long enough” and “you previously held a different Platinum product [1]” reasons are baseless and unsupported by the terms Amex drafted.

I also wanted to add that, while AAA arbitration is an option with Amex’s arbitration clause, most are of the opinion that JAMS is more favorable to consumers.

(Full disclosure: I have no skin in this game, as I didn’t take advantage of this particular offer, nor do I have any personal grudge against Amex. I have been observing the issue, though.)

[1] At best, this is ambiguous. IIRC, the terms refer to having previously held the same product. The standard Platinum and cobranded Platinums have different characteristics — different fees (in some cases), different benefits, and different designs. Furthermore, Amex has historically (when not trying to find reasons to claw-back bonuses) treated them as separate products, and many have reported Amex CSRs telling them this. I also believe that some Platinum offers contain terms to the effect of “not available to customers who have previously held any card in the Platinum Card family,” as opposed to the standard “not available to customers who have previously held this product,” which further suggests a distinction. Finally, these ambiguous terms were drafted by Amex, and customers had no reasonable opportunity to negotiate them with Amex. As a general rule, in this situation, such an ambiguity is likely to be construed against Amex.

Thanks for the info! I might pass it on to JAMS guy if

I don’t hear back from Amex within the next few weeks. I did give him the phone number of Membership Rewards department, but they won’t release any information at this point. The most important part is that I started mediation within 30 days of mailing the claim notice, just as required. He did say that if they don’t get ahold of anyone, they will just mail the papers Amex. So, it’s not a lost cause, it will just take longer. It appears Amex is intentionally stalling the process hoping I’ll give up.

Yup, this whole deal with 100K Platinum offer clawbacks has been insane. I’ve never seen anything like it. Obviously, Amex is looking out for its bottom line, but so am I! 🙂

It’s really weird. The JAMS guy wanted some contact information to start the process. He doesn’t know who to talk to about my mediation. When I called Amex, nobody would give me any details. I even called the headquarters, and the person just hung up on me. Basically, there are refusing to cooperate. After 4 phone calls, I was told that someone from Amex would contact me within 10 days. Right. So, mediation is on hold for now till I get a name and a number. Fortunately, I’m a very persistent person. That’s why I’m still blogging!

Give them Amex’s general counsel, Laureen Seeger. Her email is probably laureen.e.seeger@aexp.com or laureen.seeger@aexp.com. I’m not sure how to find a number or extension, other than calling their main line and fishing for it (ask for her by name), but JAMS may find the email sufficient. Maybe you could give JAMS their main line?

@Leo Thanks for stopping by! Unfortunately, I’m not familiar with how Citi handles this sort of thing, but I imagine it’s similar to AMEX. I recommend you first file a CFPB complaint. It’s free and takes only a few minutes. I’ve seen numerous reports of success when others went this route with Citi, so I recommend you try it first before starting a time-consuming mediation process.

I like that you stand up for yourself and have a somewhat related question. Do you know if Citi also has a remediation process? I need to fight with them too for some lost points. Appreciate any advice.

And lets say you win and get the MR points back, then what? Amex can and probably will terminate your accounts permanently. I think what you’re doing is looking at this short term gain but not long term loses.

@Mountain Man I thought about it. If we get the points back (a big IF), I’ll probably immediately redeem them on gift cards or transfer them to miles. It’s entirely possible that we will get blacklisted as a result, but I’m OK with that. Well, obviously, I would rather preserve good relationship with Amex, but I think that ship has sailed.

Go to work. Get a job. Do “normal” spendings. QUIT gaming/cheating/MS/.

Youre taking it a bit far and making yiurself look ignorant. Youre talking to a woman with a family and small children. Show some damn manners stupidass.

It doesn’t matter if Amex institutes “once per life time bonus” or not. You have been gaming, and possibly cheating and stealing millions (points/miles/cash back/money) from Amex and other banks for years. And now you got caught for gaming/cheating/stealing/manipulating. Suck it up, shut up & Pay the price. I hope all banks -from Amex to Zions will black list/block/ban you for life. I hope they will claw back ALL of your points and take you to court. You’re a abuser, a scam artist, a con artist, a cheater, a manipulator, a whiner.

The judgement you’re getting is ridiculous. I’m glad you’re standing up for what is yours and am surprised Amex is taking things this far. Best of luck!

@Anonymous Thanks! Honestly, I understand why some people feel the way they feel. I’m not crazy about name-calling, but this is internet. I’ve always tried to adhere to principle of “don’t draw attention to yourself” when it comes to this hobby. Clearly, this was a huge misstep.

You’re not eligible for lost wages under any circumstances. If spending a lot of time on this cuts into your earned income, that’s simply an additional cost of pursuing the claim. As you said, it’s the principle you are fighting for, so don’t let the cost influence you. Even if you lose money on this, it’s worth it.

@LCMD Thanks for letting me know! Honestly, all I want is for the points to be reinstated. I even offered to pay the annual fee again or whatever it takes, but no dice. And yes, it’s now a matter of principle. Obviously, some feel I’m in the wrong, and that’s OK too. Diversity of opinions is what makes this community fun.

Hope you get your points back… but I agree with Tazz. My main reason for enjoying the hobby (I don’t MS) is that you get these benefits almost for free. It wouldn’t be worthwhile for me personally to fight for the 200K points, but if I felt I was being unfairly targeted I might fight it because of the principle. I still disagree that your relationship with Amex is worth less than 200k points. How many amex’s have you gone through? How many platinums have you gone through? People underestimate the value of future products!

@Joe Thanks for your comment and following my saga! I definitely hear what you are saying and debated on whether to pursue this or not. The tipping point was when Amex said that the rep was referring to earned points, not the bonus. This is such a ridiculous claim, so I decided to go after these guys. Maybe a mistake, but I think I will regret more NOT pursuing it.

As far as how many Amex bonuses I haven’t gotten so far, there are quite a few. I’m sure the value if more than $2000. But like I said, it’s now a matter of principle. Maybe I’m crazy, time will tell.

You sound like whining trump who didn’t get his way. That’s exactly what’s wrong with todays society is all about me me me, always feeling you are entitled to get your own way.

” I spent over $3,000 in 3 months, and after getting the bonus I felt Amex Platinum was not the right product for me (100% true). So, I have converted it to Green card.”

The above quote says really you need to know about you.. You got greedy, wanted to milk amex for another $300-$400 on both cards and you deserve 100% what you got.

You could have kept the amex card for a year, gotten $400 back thru airline credit and possibly another $100-$200 in amex offers.

@Mike I’m not sure it’s constructive to bring politics into this whole thing or call me names, but that’s fine. I can tell you feel strongly about this topic, which is why I’ll respond. I never said I was a victim, and I don’t want anyone to feel sorry for me.

In fact, there is a good chance I’ll end up losing this case. I’ll be sure to record it on the blog and you are welcome to stop by and comment how you were right all along (no sarcasm intended).

As I’ve said in my post, I didn’t feel right about taking advantage of airline credits or other perks, so I converted the card. Definition of Greed is open to interpretation, but I agree that I was unwise. That doesn’t, however, justify Amex actions. Just my opinion, and I’ll let court agree or disagree.

I feel strongly about it, because amex also clawed my points too in the latest platinum fiasco. I learned a good lesson in life (because i was wrong, and amex was right) and i am moving on with my life. I have a good relationship with amex and not going to mess that up. Amex has been great to over the years and have received numerous targeted offers even i had the bonus before.

I am not a person who plays the game ( i am right and you are wrong), i just treat this as a good life experience in the churning game Amex obviously want’s to put the stop to the abuse especially on the platinum card, hence the new rules.

You just wanted to take the short cut by going ONLY for the points and not paying the annual fee, and unfortunately you got caught, there is nothing more to it. The fact that you did the same with your husband card, made it very easy for amex.

I think you are being very dishonest with the whole story. You repeatedly mention all the ways you are in the right but don’t mention that you tried to avoid paying the annual fee for the points.

What you really did was tried to circumvent the $450 annual fee after being given the 100K. The original chat agent didn’t think about it. Now you hold that as your case.

But anyone who has played this game knows that you don’t try to get the fee back without risking your bonus. AMEX probably realized that and will likely point that out in any dispute or mediation. And the CFPB also probably recognized what you tried to do.

What annoys me with your actions/post is how you play this off as a victim. Don’t try to make yourself sound thoughtful about not taking advantage of the additional $200 for next year. At least you would have fulfilled your annual fee.

I’ve been churning for 11 years. I take advantage of opportunities but I certainly also work within the system. You should have just taken the $450 as part of the transaction cost. You got greedy and now have to pay for it.

Take responsibility for your actions and stop trying to get something you don’t deserve. You gave up that when you decided not to fulfill the annual fee.

@DSp166 I don’t dispute that I wanted to save money on the annual fee. I wasn’t using any of the perks and didn’t take advantage of the airline fee credit.

And to be fair, the bonus wasn’t attached to the annual fee itself, but rather to spending $3000 in 3 months. The bonus was already deposited into my MR account by the time I switched to Green card. And I repeat, the rep said we would keep the points after conversion. I don’t disagree with you that it was a foolish decision. But I take issue with you calling me dishonest. I did it openly and had Amex blessing on the whole thing. Then, just as it was too late to convert back to Platinum (after 30 days passed), Amex clawed back the points. To me, they are the ones who are being dishonest and sneaky. Regardless, thanks for your comment.

I call it dishonest based on 2 things:

1) You KNOW that the 100K bonus is tied to a $450 annual fee. Trying to justify not paying it because you don’t use all the benefits and that there was no “language prohibiting me from canceling and getting a pro-rated refund” is just an excuse. You entered into an agreement and AMEX has the right to expect that annual fee to be calculated as part of their revenue, just as they expected to give you 100K points once you made the spending requirement.

It is completely a straw man excuse stating the bonus isn’t attached to the annual fee, but to the spending of $3,000 in 3 months. Fact Check: the bonus is an INCENTIVE for getting the card; the $3,000 is a REQUIREMENT to QUALIFY for the bonus. The $450 annual fee is part of the requirement to have the card; which is why you got the bonus in the first place. Take away their $450, they have a right to take away the bonus.

You certainly would not have applied for the card if there wasn’t 100K signing bonus, so if you accepted that part of the terms, you should also accept the $450 fee as part of the terms.

You are trying to leverage a chat from an agent that gave you wrong information, despite the body of evidence on the internet saying that canceling within 6 months is not a good idea. Multiple data points from FlyerTalk and other bloggers have indicated that this is a risk. You got greedy, decided to gamble and lost. Chalk it up to life experience; don’t rely on just a chat session, especially if evidence around you indicates to the contrary.

2) If you were truly honest about your dealings with AMEX, you would have put in the first paragraph of all your posts very clearly WHY you switched over to the Green card: to NOT fully pay the $450 annual fee. You go into a lot of details on what they did wrong and why you deserve the points; but gloss over the fact you initiated the downgrade so you can AVOID PAYING the full $450 while still keeping the 100K points.

When I read the first few sentences of your post, I was sympathetic; until I realized the reason you lost the points was because you tried to get more than what was offered and now you are basing your entire defense on a chat session.

I get that you are frustrated with being told one thing, and have the opposite effect. I sympathize with that. However, saying you’ll go to the ends of the earth for an action they took on you that has been public knowledge (yet you CHOSE to discount) is your fault, not AMEX’s. Writing a blog post that describes you as the person fighting for everyone who has been wronged is disingenuous. Getting people to think you are defending yourself from a big bad corporation (when in reality you caused the whole mess), is dishonest. You dug your own hole and AMEX is certainly in their right to leave you in it.

There is a reason why AMEX is now no longer offering pro-rated refunds; people are taking advantage of the policy (getting bonus, then getting pro-rated refund) to the point that AMEX is just not going to do it anymore. Congratulations on taking part for that decision.

@Dsp166:

> It is completely a straw man excuse stating the bonus isn’t attached to the annual fee, but to the spending of $3,000 in 3 months. Fact Check: the bonus is an INCENTIVE for getting the card; the $3,000 is a REQUIREMENT to QUALIFY for the bonus. The $450 annual fee is part of the requirement to have the card; which is why you got the bonus in the first place. Take away their $450, they have a right to take away the bonus.

Here is the relevant part of the current (40,000 points) bonus terms:

“To be eligible to receive the 40,000 Membership Rewards points, you must be enrolled in the Membership Rewards Program at the time of purchase. 40,000 Membership Rewards points will be credited to your account after you charge a total of $3,000 (the “Threshold Amount”) or more of purchases on your Platinum Card® from American Express within the first three months of Platinum Card Membership starting from the date your account is approved. [snipped OT (for the purposes of this post) terms] Points will be credited to your Membership Rewards account within 6-8 weeks after charges appear on your monthly billing statement.”

I will assume that the terms of the 100k offer were identical, except with a different points value.

You are correct that the annual fee is part of the card terms. The refund clause is also part of the card terms. The bonus terms only require that $3,000 of qualifying purchases are made within three months of account approval. There is no requirement to pay, and not receive a refund of, an annual fee. There is no requirement to keep the account open for any period of time. Receiving a fee refund does not negate the bonus terms.

If you contend otherwise, could you point me to the exact language that you believe supports your position?

@MilesForFamily:

> I don’t disagree with you that it was a foolish decision.

There was nothing foolish about it.

@DSP166 I appreciate you stating your point again, but really don’t feel like getting into a debate. I’ve said that I take an issue with anyone calling me dishonest, and I stand by that. That said, I really don’t feel like proving my virtue to an internet stranger. If you feel I’m a dishonest person, that’s cool.

Obviously, I’m not going to change your mind and you won’t change mine. It was up to Amex to refund part of the fee when I converted the card. I didn’t force the issue, the rep said that’s their policy. Fine by me! As I’ve mentioned earlier, this hobby revolves around taking advantage of deals and credit card bonuses at the lowest possible cost. Isn’t it the whole point of this hobby? Would it be that much better if Amex got an extra $100 in fees from me in exchange for 100K points? I doubt it. Once again: I didn’t steal anything from Amex and followed the rules outlined in their own “T and C.” I witness many strategies that I feel are unethical, but it’s not my place to impose views on others.

Lastly, I’m not pretending to be some sort of a crusader on behalf of everyone who has been wronged by Amex. Bottom line: I’m simply exercising my rights, and if I end up losing the case, you won’t hear me crying that I’m a victim. Sorry the post came across that way, it wasn’t my intention.

I appreciate you taking the time to reply. As you noticed, I went into detail as to why I believe your posts were “dishonest”. I stand by my points and belief, and you stand by yours. Besides, it’s your blog after all.

If you had disclosed at the beginning that you were trying to get 100K and NOT pay the full $450, I would be less inclined to feel that way because at least it was clearly articulated. Instead it was crouched in the lack of benefits being utilized and questionable value of the benefits. When you cut through it, you just don’t want to pay $450 for 100K points.

But how it’s currently phrased makes you more a victim than the instigator. You can always edit your posts to clarify in the beginning, and I would certainly reconsider the bias you have made in your blog (because it currently sounds sensationalist and dare I say, clickbait worthy). Something that I didn’t expect your blog to be.

@DSP166 I honestly appreciate you taking the time to state your position. I hope I’m not coming across as defensive, that’s not my intention. Believe me, I didn’t write the post to garner sympathy or create a clickbait article. My goal is to record the process so others can learn from it. I already made up my mind as to what I’m going to do. Clearly, there has been a lot of negative reaction, which isn’t entirely surprising. I don’t really enjoy spending my day reading strangers say that I’m a liar and a fraud. I like having extra traffic, but not that kind.

I know I made a mistake. But here is the thing. As soon as I found out about the clawback, I called Amex and offered to pay the penalty and the annual fee in order to reinstate the points. No go, it was 32 days since conversion. I also don’t think it’s unreasonable to expect a large company to stand by their reps. In this case, Amex chose to twist the truth rather than say: you are a deadbeat customer, and we took points away because it’s clear we won’t be making a profit from you. I would rather them do the latter than employ sneaky tactics. A lot of what we do in this hobby is viewed as shady by outsiders. Where do you draw the line? For me, the line is breaking the rules and lying.

I don’t have a dog in this fight. I just want to say that in the MS game, sometimes you win, other times, you lose. I understand you’re fighting for your right to those MRs and amex as a company is also fighting for theirs. It’s really up to you on how much time, effort and money you want to spend on this battle; while others give up and move on to the next deal, a few will persist like you. Good luck!

@Tazz Appreciate your comment! I agree. If I end up losing this thing, I’ll move on. To clarify, I didn’t actually meet the spend via MS, it was done via organic transactions. This may end up being a waiste of time, but so be it.

Best of luck to you!! Amex was truly in the wrong here. I am glad that you are taking the time to pursue this. It will be instructive for many people who follow your blog. (Keep that in mind as you go through this time-consuming, frustrating process.) 🙂

@GCB Thanks! I guess who is in the wrong here is open to interpretation, eh? I’m going to let the court sort it out. That’s why we have legal system in place. I wouldn’t pursue it unless I felt that Amex took this thing too far. If it’s OK for them to claw back points for rule violations, it’s OK for me to ask for points back when I didn’t violate any rules. Unfortunately, I know it will be a time-consuming process. And time is a scarce commodity for me. But you are right, it might be helpful to my readers.

STOP whinnying. Warn you? Amex doesn’t need to warn you. When was the last time you ran the red light, speeding in the school zone, break the guidelines/laws and the cops just gave you a warning??? QUIT BEING STUPID. STOP PLAYING DUMB. YOU CHEATED AND ABUSED THE SYSTEM. YOU DESERVED IT. YOU ARE A CHEATER. YOU ARE A SCAM ARTIST. YOU ARE A CON ARTIST.

@Aaron Roberts Once again, I didn’t break any rules. Comparing it to running a red light and getting caught isn’t a fitting description of what happened. But regardless, you made your point and that’s fine. You don’t have to use caps, I understand what you are saying. There is no need to leave a third comment saying essentially the same thing. Have a nice day!

I hope AMEX would do this to all people who cancel/downgrade after just 3-4 months. People like this blogger are ruining fair games. And it is gonna eventually ruin it for everyone.

@Mark Thanks for commenting! I honestly doubt that my little blog would make an iota of difference as to how Amex handles sign-up bonuses. Besides, they already instituted one bonus/per lifetime rule. How can it get any worse?

And you’re a troll. Why do you need to post the same thing over and over again?

I’m glad Amex clawed back those points. You game, you cheated and you abused the system. Get over it. You are a scammer. You are a con artist.

@Aaron Roberts Thanks for stopping by! I certainly appreciate your perspective. Bottom line is: I took Amex up on their offer and they decided to weasel out of it after I’ve fulfilled the terms. I didn’t scam anyone and certainly didn’t cheat. That being said, you are entitled to your opinion and I’m not going to try to convince you otherwise. Thanks again for your comment.

Anything you write here can be used by AMEX to establish intent, and so on.

@rrgg True! But I haven’t said anything in the post that I haven’t told Amex already. Regardless of how Amex feels about the conversion, the rep should have warned us. I didn’t break any rules and have nothing to hide. If Amex doesn’t want people to get the bonus and convert the card shortly after, they should put it in the terms. But they didn’t.

A strict reading of the T&C make this quite surprising that they haven’t acquiesced to your demands yet. However, I imagine that once someone in legal gets their hands on this, it will be resolved quickly.

Lastly, the arbitration provisions require your claim to be individual – You will not be able to file one claim for both of your cards.

@Jake I hope you are right. I just filed mediation claims, so

I’m waiting for someone to contact us. I wasn’t sure if the rules are the same when it comes to small claims court. I’m guessing they are?

Could you explain why the author’s intent matters? Even if the author’s intent from the start was to get the bonus and downgrade/cancel for an AF refund (not saying it was), those actions do not appear to violate the T&Cs or law, so I’m not seeing your point.

Please don’t say “fraud,” because fraud would involve deceit. That element doesn’t look to be present here.

Because I think she did MS and gift cards and the lke are against the rules.

@Rich: In another comment, she said she did not MS.

I hope you win!

@Bear Thanks a lot! I’m sorry, for some reason your comments keep going to SPAM. My apologies!

awesome, keep the fight and give it back to ’em. Let us know. If you decide to file class action lawsuit, lots of us will join to bring the cheating giant down.

@rahul4u Thanks for stopping by! I’m going to try, but it may lead me nowhere and end up costing me more money. Oh well. I thought about letting it go, but it just bugs me too much. On class action lawsuit: unfortunately, there is a provision in terms for Platinum card that prohibits it. It looks like Amex has conveniently added it recently, so the only option is small claims court. Well, aside from mediation and arbitration.

All cards have this clause fyi.

You’d think they’d rather just give the points back than go through this process. Good luck!

@Cristi That’s what I’m hoping for! I would like to get the points back, and will be happy to let this thing drop. If they refuse, I will file a claim, which will end up costing them more if they lose.

They may not give in because rhey know you are a Blogger and can affect what others do.

@Rich Thanks for all of your comments! I did consider this because I’m writing about the whole thing in the open. It may end up backfiring, though mine is a fairly small blog. Either way, like I told another commenter, I have nothing to hide. I took Amex up on their offer and didn’t violate any rules. Some may feel differently, but according to terms, it’s clear that Amex is in the wrong. At least, based on my interpretation of it.

Also, to address your other comment: I didn’t do any MS with Platinum and didn’t buy any Visa gift cards. It was strictly organic spend.

What state do you live in? Check your state’s consumer protection laws as they usually provide adding attorney’s fees, and up to triple damages as well as costs if you are sucessful.

@Stephanie Thanks for the tip! I will look into it once I decide to file a small claim. I think the case is pretty straight forward, but I’m not positive on that one. I just started mediation process, so we’ll see what happens. I’m hoping Amex will reinstate the points, which is all I want. If they don’t, I’m taking them to court, and it may end up costing them a lot more $.

Good luck!!!!

@Lindy Thanks!

They may give in. They probably assume most people won’t take it to mediation or arbitration and will give up. But I bet if you do take those steps, they will just give up. Hopefully, I’m right. 🙂

@Jennifer I hope you are right! I don’t know what will come of this, but I’m willing to give it a shot.

Amex did the right thing. You game you cheat and abused the system. You deserved it.