The short answer is No. Below is the long-winded version. My reader was also curious as to how I maximize my credit card spending and what points I focus on most. Let’s start with addressing the first part:

So, if you currently have Chase Sapphire Reserve, there is absolutely no reason to keep Chase Sapphire Preferred open. Most of the benefits duplicate each other, so you will end up paying an extra $95 annual fee and will have nothing to show for it.

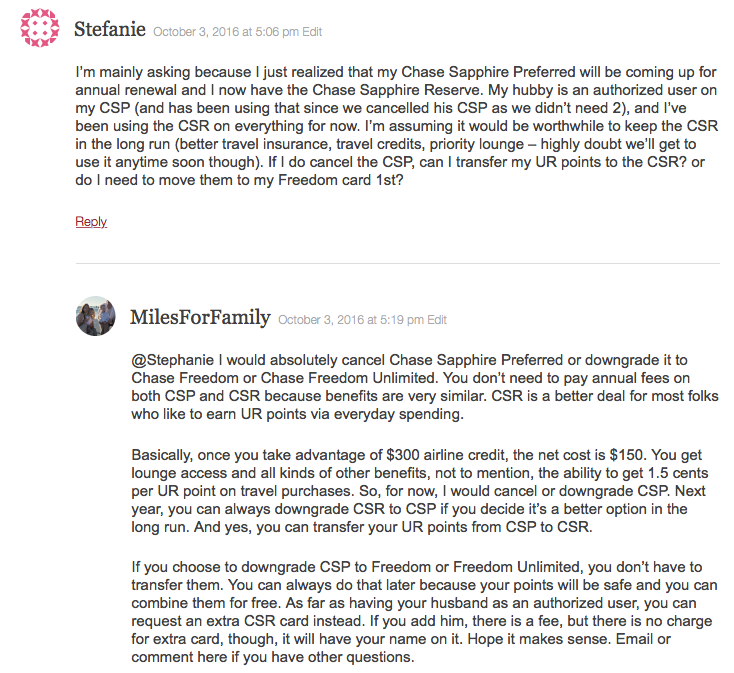

If you mostly accumulate rewards through everyday spending, a much better strategy would be to convert Chase Sapphire Preferred to Freedom or Freedom Unlimited. See my post on how to choose between those two cards. Of course, the biggest reason for conversion is the fact that you will save $95. As I’ve mentioned to my reader, you can always downgrade CSR to CSP later on, before the next annual fee is due.

You don’t really need more than one premium card in the family since spouses and domestic partners are allowed to transfer points back and forth at no charge. There is one concern when it comes to CSR. If you add an authorized user, you’ll end up paying an extra $75. The advantage is that if your spouse often travels without you, he/she will be able to access Priority Pass lounges. And apparently, you can bring an unlimited number of guests for free.

To me, this benefit is worthless because we always travel together, so I wouldn’t bother. Plus, my husband doesn’t like lounges. But your situation may be totally different. Another reason to add your spouse as an AU is to make sure they earn 3 points on dining and travel. Once again, it ain’t worth $75 to me, but YMMV

A simple workaround is to just request a duplicate CSR card in your name and give it to your spouse. Not everyone will be comfortable with it, but cashiers rarely ask for ID at restaurants. As far as the other charges go, all your spouse needs is Chase Freedom or Chase Freedom Unlimited, and those cards have no annual fees. The latter earns 1.5 UR points on everything, so it’s actually a better choice than CSR for majority of purchases.

To renew or not to renew?

In case you are curious, I don’t plan on renewing my CSR. I’m very cheap when it comes to paying annual fees and will do it only when I get something in return, as is the case with Chase IHG MasterCard. Even assuming I maximize $300 travel credit, pre-paying $150 for lounge access, insurance etc, is too rich for my blood.

That said, it could be totally worth it for many regular families, especially if you focus on earning Ultimate Rewards via everyday spending. I’ve said before that UR currency is my favorite, hands down. Especially after the recent debacle with Amex. If you fly a few times per year and love to chill out at an airport lounge (nothing wrong with that), this perk could be worthwhile.

Of course, the biggest advantage to having CSR is the ability to redeem UR points at 1.5 cents apiece on travel purchases. So, only you can decide if the juice is worth the squeeze.

But whatever you do, don’t blindly follow others who are shouting that renewing this card is a no-brainer. There is no such thing, everyone is different. Remember, even if you have no problem utilizing $300 annual travel credit, you’ll still be in $150 hole. For many families, the benefits will easily outweigh the cost. For others? Not so much.

If you spend a lot on travel, gas and dining, you may want to investigate Sam’s Club MasterCard, one of the most underrated and least talked about products out there. Yes, it earns cash back, but that’s NOT a bad thing. Speaking of, why is “cash” a four letter word in the miles and points hobby?

Remember, most people who say that renewing CSR is a no-brainer make six figures and travel quite often. There is nothing wrong with either of those things, but it doesn’t describe my family.

My miles and points strategy

It’s actually very simple. In short: I go after the most lucrative offers (for me), while simultaneously trying to avoid the hoarding trap. I don’t always get it right, of course, and make sure to record my mishaps on the blog so others can avoid making the same dumb mistakes. And there have been quite a few mishaps.

Basically, my goal is to accumulate miles and points at the lowest possible cost. Some of it is done via promos and everyday spending, but for the most part my strategy consists of applying for various lucrative credit card offers.

As I’ve mentioned earlier, I’m not against renewing credit cards, and do that on occasion myself. It just depends on the situation and my upcoming plans. See my post for more on this subject. In no way do I claim that you should follow my lead. Absolutely not! I encourage you to evaluate your own situation and decide accordingly.

When it comes to loyalty, I’m very much an opportunist. I do have certain standards, but my goal is to travel for as little out-of-pocket cost as possible. That means that one month we may stay at a Country Inn and Suites, and the next month at a Hyatt resort.

It doesn’t always work out, because some places turn out to be sub-par where my cheapness bites me in the behind. But I keep trying to find the right balance of quality vs. cost in points/effort to accumulate them. It’s a work in progress, just like this blog.

I’ve seen Drew from TIF once say something along these lines: “You can go broke while traveling for free.” I totally agree and I’ve always felt that this community glosses over the costs we incur while chasing miles and points. For some, it’s annual fees and opportunity cost of choosing less lucrative card for everyday spending, for others it’s MS-related expenses.

Of course, there are costs of time spent on trying to maximize every single opportunity and chasing every promotion under the sun, while neglecting your family. It’s important that our miles and points strategy is a small part of our overall life strategy, not the other way around.

Readers, what cards are on your renewal list?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

Going broke whilst traveling for free is a good point! The thought of paying $900 for two CSRs for the wife and I is something that would never pass muster for me years ago. Yet here I am halfway there!

@Cheapblackdad You and I fluently speak the language of “cheap”, my friend.

It’s incredibly important to take a look at all the costs we incur in this hobby. It’s not really free as long as we pay real $, whether it’s various promos or fees. That said, renewing CSR can make a lot of sense for many folks. I remember you’ve mentioned that you have CSP. In all likelihood, CSR is a better deal in its current form.

Sorry, somewhat off topic…I have a couple quick questions about referral links that I hope you can answer. When someone uses a blog’s referral link does the credit card company(or affiliate program) share information about the person signing up(such as name) with the referring website? Or does the person/blog referring just receive information such as the total number of sign ups so the person(s) signing up remain anonymous?

ABC, that’s a good question! No, affiliate company does not share any personal info with me. All I know is what cards people applied for and how many were approved. I have no clue who it is unless they actually tell me. Hope that answers your question.

Thanks for answering. That’s what I thought, but it is good to get a straight answer! When you say “I have no clue who it is unless they actually tell me.” by “they” you mean the people/readers who use the links, right? I had not used creditcards.com before but I clicked your link and then after selecting the card to apply for it transferred me directly to Chase. You should have a CSR referral show up as the app was instantly approved(was below 5/24)!

Thank you so much for using my link! I really appreciate it. As of now, it’s our main way of monetizing the site, so every click makes a huge difference. 🙂

And yes, by “they” I meant readers. I don’t think my affiliate company or bank are allowed to share any personal information as to who gets approved. Frankly, I think it’s better this way as everyone is entitled to privacy. But I’m happy when readers let me know because it gives me a chance to thank them.