Like many of you, few months ago I got Amex Platinum when the bonus was 100K Membership Rewards. No 5/24 rule to worry about, so thank you American Express! I got my points without any issues, and still have them in my account (I hope). Apparently, Amex decided to claw back MR points from some people. The reason is unclear, but in all likelihood, manufactured spending had something to do with it. You can follow this Reddit thread for all the latest developments.

Unfortunately, transferring them to an airline partner or redeeming them on gift cards is unlikely to help. Amex will show a negative MR balance and will probably charge you for those points. Yes, it sounds crazy, but it’s true. Clearly, folks at American Express aren’t too happy about so many people getting in on what was supposed to be a targeted offer. So, it looks like they are enforcing the terms that cash equivalents (like Visa/Mastercard gift cards) don’t count toward minimum spending requirements.

I’m not saying this to scare you. In fact, if you still have your points, you’ll probably be fine. But this is something you should be aware of. There is another negative development on the horizon. You may or may not remember, but as of September 1st, Amex will no longer prorate annual fees on credit cards.

For most who got in on this 100K deal it’s not really an issue because they are waiting to double-dip on $200 airline credit. As I’ve mentioned in this post, I made the decision not to take advantage of this loophole for ethical reasons. I’m definitely not passing judgement on those who choose to avail themselves of this perk, I just don’t feel comfortable doing it.

One of the benefits of Amex Platinum is free TSA pre-check or Global Entry. If you are not familiar with these benefits, I recommend you read this post on Dannydealguru. Both my husband and I had this perk via Citi Prestige, but we never took advantage of it. We live more than an hour from the nearest TSA pre-check center, and 1.5 hours from places where you can get Global Entry. It just didn’t make sense to spend 3 to 4 hours of our time in order to skip lines at the airport once or twice per year.

A funny story

My husband works with a guy whose name is Hussein. Here is the deal: his mom was born in Honduras and his dad is Puerto Rican. Apparently, when mom was pregnant, she read a story about a Middle Eastern prince by the name of Hussein. She liked it so much, she decided to give it to her son. Oops!

This guy told my husband that this name gave him nothing but trouble ever since. In fact, when he proposed to his wife he told her that she better be ready to wait a long time at the airport while he is questioned about terrorist activity. And he wasn’t kidding. My husband said that the guys at work jokingly call him Josein as an homage to his hispanic origins.

OK, I guess we’ll get TSA pre-check for free

Anyway, my sister-in-law said we should definitely get TSA pre-check and shockingly, my husband agreed. Fortunately, at the time we had our Amex Platinum cards. So, I made an appointment to get TSA pre-check and the earliest available time was on August 30th. Hmm, OK.

That meant that if I canceled the cards, there would be no pro-rated annual fee refund since it would take some time for TSA pre-check reimbursement of $85 to show up on the statement. Of course, according to this post on DoC, consumers should still be able to convert Amex Platinum to Amex Green card and get prorated refund that way. At least, that’s what American Express told us.

Unfortunately, my husband’s work demands got in the way and I was forced to cancel our TSA appointment. The earliest time we could go was now in October. And of course, the longer I would hold on to Amex Platinum cards, the bigger chunk of prorated fee refund I would end up losing. Additionally, what if Amex will change their mind and not give the refund when you do a product conversion?

Goodbye, Amex Platinum and thanks for the points

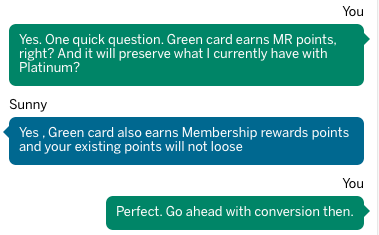

I’ve decided to convert both of our Platinum cards to Green version via Amex chat. I did the chat two separate times and was told that we would receive a prorated refund of $450 fee and would be charged a prorated $95 fee on the Green card. Of course, the paranoid person that I am, I wanted to confirm that my points would be safe.

The guy said my MR points are winners! I haven’t received the credit yet, but don’t foresee any problems. Since we only had Amex Platinum for a little over 3 months, we should get most of the fee back. If my math is correct, I’ll receive $338 refund and have a charge of $71 (new pro-rated fee on Green card).

This will leave us with net of $267 per card, not too shabby. Plus, we’ll have till next August to decide on what to do with out MR stash. I’m quite happy with this outcome because it means I bought 100K MR points for $183 total.

If we had an MR-earning card like Amex Everyday, I could have canceled Amex Platinum and keep our points intact. Alas, that’s not the case. And honestly, it’s probably for the best since I’ve read that it might be another possible reason for recent points’ clawback.

What’s the plan?

Well, assuming Amex lets me keep my points, I plan to eventually apply for Amex Everyday. It has no annual fee, so I can keep my MR currency till I need to transfer it to miles. Then I’ll cancel Amex Green card since no way (Jose) will I be paying $95 each year just so I can keep my points.

Hopefully, I can get a sign-up bonus of 25,000 points on Amex Everyday, but will settle for less if necessary. You can check CardMatch tool and see if you can get an offer of 25,000 points or more. Otherwise, read this post on how you can make sure that you get best Amex offers each and every time.

Bottom line

Amex rules on prorated annual fee refund will change on September 1st. If you’ve been thinking about canceling one of their cards for that reason, now is the time. Oh, and don’t be like me and procrastinate. Just get that TSA Pre-Check or Global Entry if you can get them for free.

Readers, who else is planning to convert Amex Platinum?

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

I was confused by your post but then realized that you had tried to go for Pre-Check and not Global Entry. Apparently the Pre-Check payment process is different. For future reference – when you apply for Global Entry (which includes TSA Pre-Check), the $100 fee is collected at the time of application. You have to first complete an online application and pay the $100 fee to submit it for pre-screening. The charge will post to your account quickly within a day or two. US CBP will then complete the prescreen check and notify you of the results. If successful, they will ask you to schedule an interview for the next step in the enrollment process. In Florida, you can do the interview at both Orlando airports, Tampa, Ft. Lauderdale, West Palm Beach, and Miami.

@Erik Thanks for suggestions! I’m debating on this whole Global Entry thing. I just got CSR, so it would be free. The problem is, my husband would still have to pay $100. Plus, we live 1.5 hours from Tampa and going there would require him to take a day off work. He really doesn’t like the idea! That’s why we never took advantage of this perk when we both had Citi Prestige. Now I kind of wish we did. Oh well. I know we would benefit from it, for sure. I’m just trying to determine if the juice is worth the squeeze.

I am one of those unlucky people who had their points withdrawn because of manufactured spending to meet the minimum spend requirement. I did benefit the $200 airline incidental fee and $100 global entry. So the question is should I downgrade to no fee amex everyday spend or to something else. Any suggestions

@Caveman Oh no! That really stinks. So sorry to hear about it. Well, if you want to cut your losses, you should probably downgrade to Amex Green card like I did. I don’t believe it’s possible to downgrade Platinum to Amex Everyday, but of course, it doesn’t hurt to try. Do a chat and ask what your options are.

Green card is probably your best bet if you don’t want to apply for Everyday card right now. It will buy you some time (for around $75 via new prorated annual fee on Green card). If you DO want to apply for Amex Everyday, check Cardmatch tool I’ve mentioned in the post or pull up the link in different browsers. There has been an online offer of 25,000 points, but I’m not sure if it still shows up for folks. If you can pull it up and can handle minimum spending, it would probably make sense to go for it. But no M/S this time! The decision is yours. Let me know how it goes.