As most of my readers know, last month I’ve signed up for 100K points’ offer on Amex Platinum card. It’s no longer available, but check my post for ways you might be able to get it to come up (no guarantees). It’s an all-around terrific offer, but the biggest issue is $450 annual fee, not waived. I’ve presented an argument on why this bonus is worth it even under the worst of circumstances. Some will agree with the post and some won’t.

But my point was, even if you have to cough up $450 for the annual fee and never take advantage of buying airline gift cards or any other shenanigans (cough, Amazon, cough), you’ll still come out ahead. And it looks like that’s exactly what I’ll be doing. That’s right, I don’t plan on milking this benefit or exploiting the loopholes like charging taxes on award tickets, buying gift cards etc.

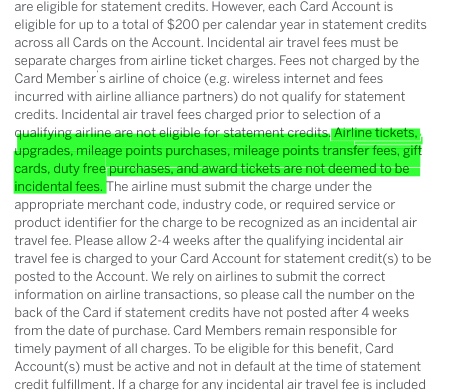

Let me be clear, I’m not passing any judgement on those who do. I know several readers who took advantage of it, so this isn’t some sort of a guilt trip. I’ve really struggled with this one because it means passing on potentially $800 in gift cards between two Amex Platinum cards (for both calendar years). Even if I decided to sell them, I could probably easily clear at least $600. And we can definitely use the money. So, why be so stupid, you may ask? Because it’s against the terms:

Sure, I could buy the gift cards and if Amex wanted to reimburse me, who am I to argue with them? The problem is, I wouldn’t feel right keeping the money and would feel compelled to call Amex. Then I would feel compelled to blog about it, and would be the most hated person in the hobby. So, I’ve decided to nip the problem in the bud, so nobody accuses me of being the butt.

I talked to my husband and he felt the same way. I’m the one in the relationship who loves to exploit the loopholes. He just pays for things, usually full price.

Additionally, it looks like I won’t even be able to take advantage of the pro-rated fee refund. Doctorofcredit reports that Amex will discontinue this practice as of September 1st. Sure, my sign-up bonus should post in August and technically, I could try to take advantage of this benefit in the eleventh hour. But I won’t be doing it.

First, at the moment I don’t have another MR-earning card and neither does my husband. I would hate to speculatively transfer MR currency to an airline program or cash it out on gift cards. Side note: See my post on how you can get the most value out of your Membership Rewards points.

Additionally, I believe it wouldn’t make us look very good as customers if we cancelled our cards right after receiving the bonus. Banks are not stupid, and I would hate to tick off Amex in any way. They have several bonuses I haven’t yet taken advantage of. It’s just not worth it to get a few hundred dollars back now and risk foregoing thousands of dollars in rewards later on.

While I don’t have a problem taking up banks on their offers, I also believe in playing by the rules. Which is why I don’t think it’s right to take advantage of this $200 airline credit.

Bring on the fees, Spirit!

Of course, it doesn’t mean I won’t try to legitimately avail myself of this awesome perk. As you may remember, I’ve booked a short anniversary getaway to Chicago in the fall using Spirit miles. That airline charges for everything other than using the bathroom. Not a problem anymore! I have $400 in incidental airline credits between our two cards.

You have to log in to your Amex profile on this page and select your choice of airline before the charge is billed. There is some uncertainty with our Chicago trip, so I won’t be making a selection till few days before the flight (don’t forget, Leana!!!) We won’t be flying again till next June, and by then Amex Platinum will be canceled.

You are allowed to change your airline selection to another carrier in January and from what I understand, the reimbursement credit covers checked luggage, food you purchase on the plane etc. Basically, things I normally avoid because I’m cheap.

Originally, I planned to just take a carry-on with us in order to save on luggage fees, but will now check the bag instead. Heck, I could even wait till I get to the airport. You want $100 to check my luggage? No problem, here is my Amex Platinum. I’m just kidding, I would never do that.

There is something strangely satisfying about selecting Spirit carrier for this perk. How many other Amex Platinum cardholders are doing it? It’s absurd, in a way this hobby is absurd.

While on a plane, I can order their finest cuisine and fanciest alcoholic drinks. The biggest can of Dom Perignon you have, please!

Image courtesy of Graphics Mouse at FreeDigitalPhotos.net

Say what? They don’t sell Dom Perignon on Spirit flights? That’s disappointing. What about Krug champagne?

Readers, sound off in the comments if you think I’m being ridiculous!

Click here to view various credit cards and available sign-up bonuses

Author: Leana

Leana is the founder of Miles For Family. She enjoys beach vacations and visiting her family in Europe. Originally from Belarus, Leana resides in central Florida with her husband and two children.

That also means u get ur 35% points refunded with spirit and I can’t seem to get spirit flights to show on Amex travel